Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Dogecoin (DOGE) closed a bullish note last week after testing critical technical levels that can define the next directional movement. The weekly graph on Binance (Doge/USDT) reveals that DOGE is currently just above the significant 0.786 Fibonacci retracement level traded at $ 0.167. This retracement comes from the all time from $ 0.0805 to the peak of $ 0.4844.

Dogecoin reversal confirmed?

A remarkable technical development is the interaction with a prolonged falling trendline, which extends from the all time of May 2021. Doge recently tested this trendline as support after he broke above it in November 2024.

Last week’s candle printed a hammer -like formation, characterized by a small real body at the top of the range and a considerably longer shade. While the candle also shows a modest upper loss, signals from the dominance of the lower shade that buyers have absorbed aggressive sales pressure under the trendline and the price again pushed over the 0.786 Fibonacci level – a strong bullish signal.

Related lecture

However, this week can be just as important as last week. A weekly close to above $ 0.167 seems essential to confirm the momentum. Otherwise another test of the multi-year trendline could be a make-or-break moment for the Dogecoin price.

Momentum indicators in particular remain neutral to Bearish. The weekly relative strength index (RSI) closed around 39, reflection, which reflects a subdued purchase strength and emphasizes that Doge still works under the neutral 50 mark.

The exponential advancing averages (EMAs) offer layered resistance above the current price.

The EMA of 100 weeks is $ 0.17284, just above the current range of Doge, while the EMA of 50 weeks is at $ 0.21427. The EMA of 20 weeks, the more direct resistance during previous rallies, is now at $ 0.24805. Support is reinforced with the EMA of 200 weeks around $ 0.13621, a level that would probably serve as a final line of defense like Doge would crash under the multi -year trendline.

Related lecture

Price promotion in recent weeks also shows that DOGE is breaking off from a bearish flag or channel formation, whereby the breakdown accelerates to the confluence of the 0.786 Fibonacci level and the falling trendline -Hertest. Nevertheless, the market reacted with a strong purchase interest in the marked Red Support Zone.

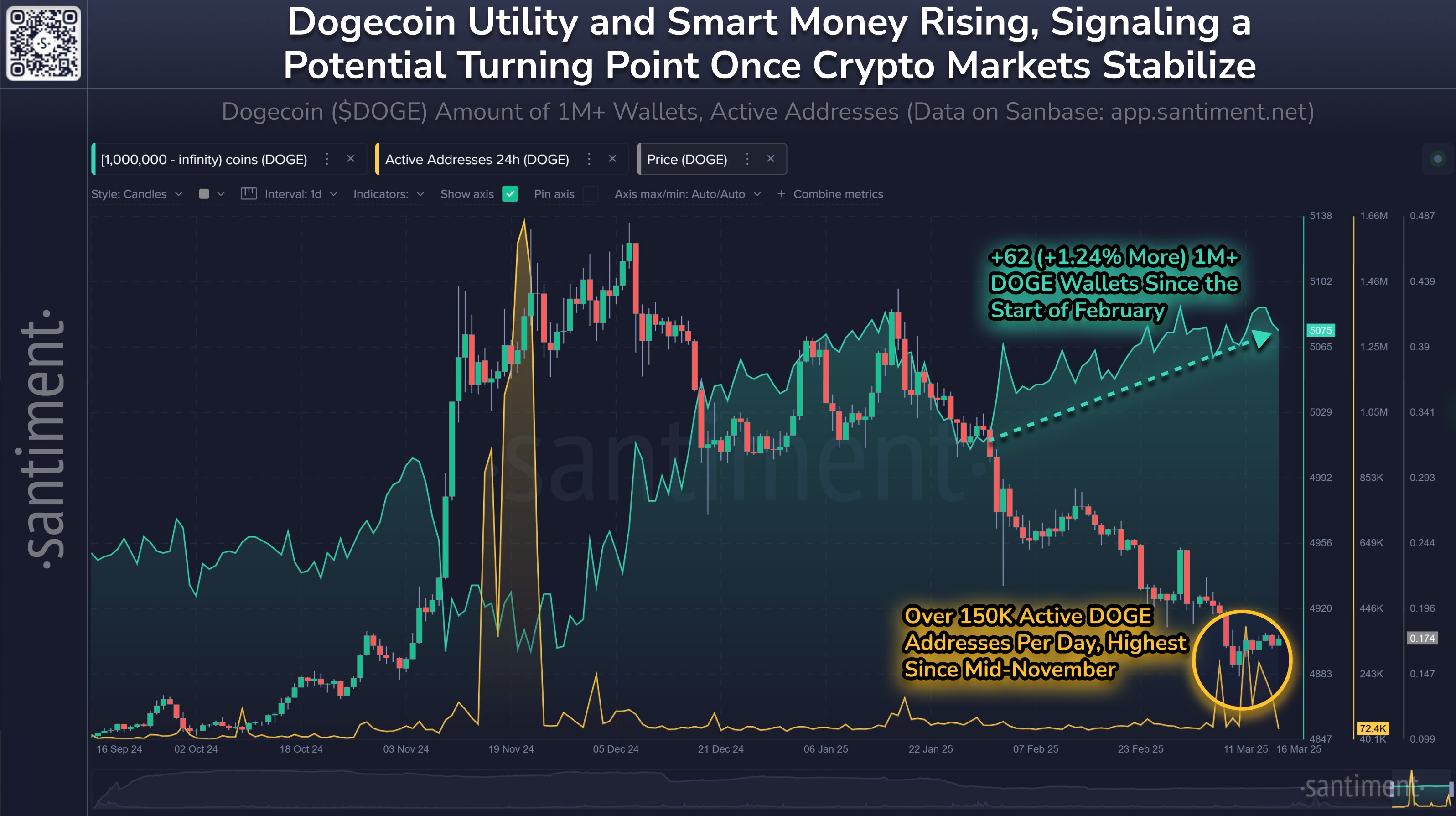

Data on-chain also contextualizes the recent price promotion. Analytics company Santiment reported today via X that Dogecoin, like most meme coins, was heavily influenced during the current market-wide racement of two months. Santiment, however, pointed to a bullish divergence on the network side.

The company states: “Dogecoin, like most meme coins, is hammered during the 2-month crypto-wide retrace. However, we recommend that you monitor the rising level of portfolios with at least 1 m $ doge, which has been restored during the price pour.

Add to this sentiment, crypto analyst Daan Crypto Trades commentary Via X: “DOG similar to Pepe, but has already taken the election level back after sweeping. I think these are important levels to continue to look at many of these alts. A sweep & recurrence signals somewhat short -term lighting and these levels can then offer a clean invaluation level.”

This is in line with the technical observation that the recent price action of doge can be a sweeping of liquidity below an important level, followed by a recovery above the support-a typical bullish reversing pattern in the short term in crypto-markets.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply