- Dogecoin’s falling wedge pattern indicated a bullish breakout, but $0.39 remained critical resistance.

- Weak transaction volumes and declining MVRV ratios cast doubt on Dogecoin’s breakout potential.

Dogecoin [DOGE] was trading at $0.3542 at the time of writing, down 3.33%, showing potential signs of a bullish breakout. Analysts point to a falling wedge pattern, a classic chart setup that often signals an impending price rise.

The breakout target is $0.39, a level that could attract renewed market interest. Will this pattern remain true and drive the price of Dogecoin higher?

Does Dogecoin’s Price Action Indicate a Breakout?

The falling wedge pattern on Dogecoin’s daily chart highlights bullish potential, with the critical resistance level at $0.39.

If DOGE manages to break above this point, the next upside target is $0.50, which could mark a significant move for the cryptocurrency.

However, the current consolidation around $0.3542 reflects the indecisiveness in the market, leaving traders on edge.

A decisive breakout above the wedge would confirm bullish momentum, but failure to do so could lead to further sideways moves or a retracement.

Source: TradingView

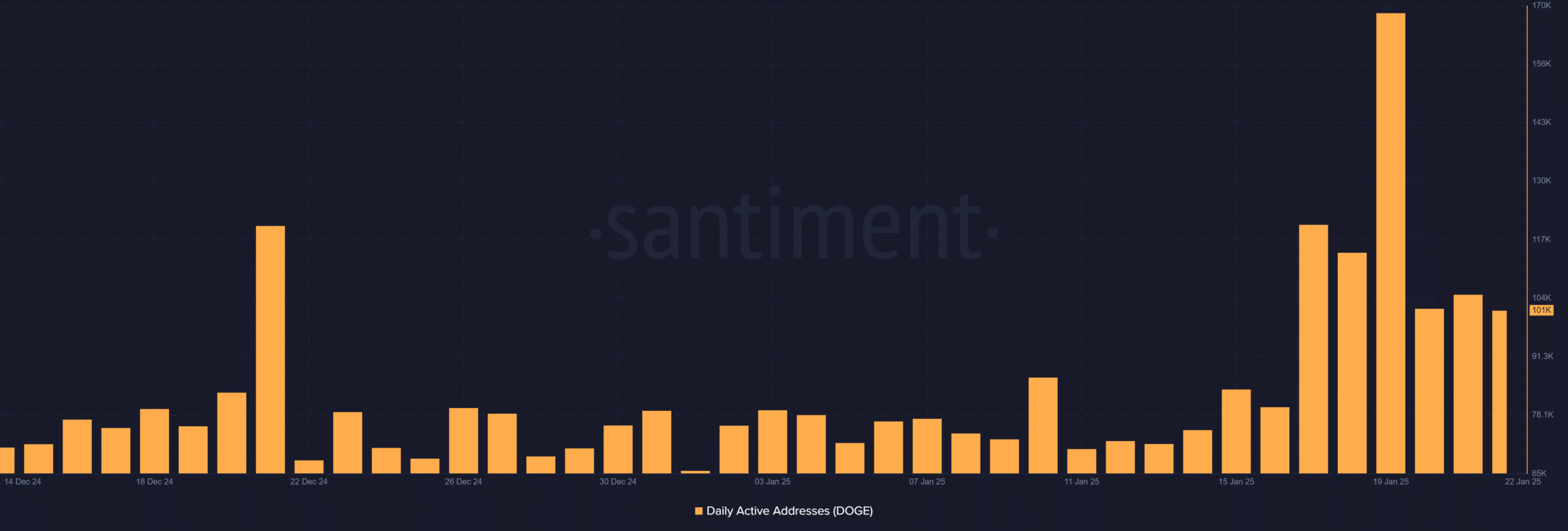

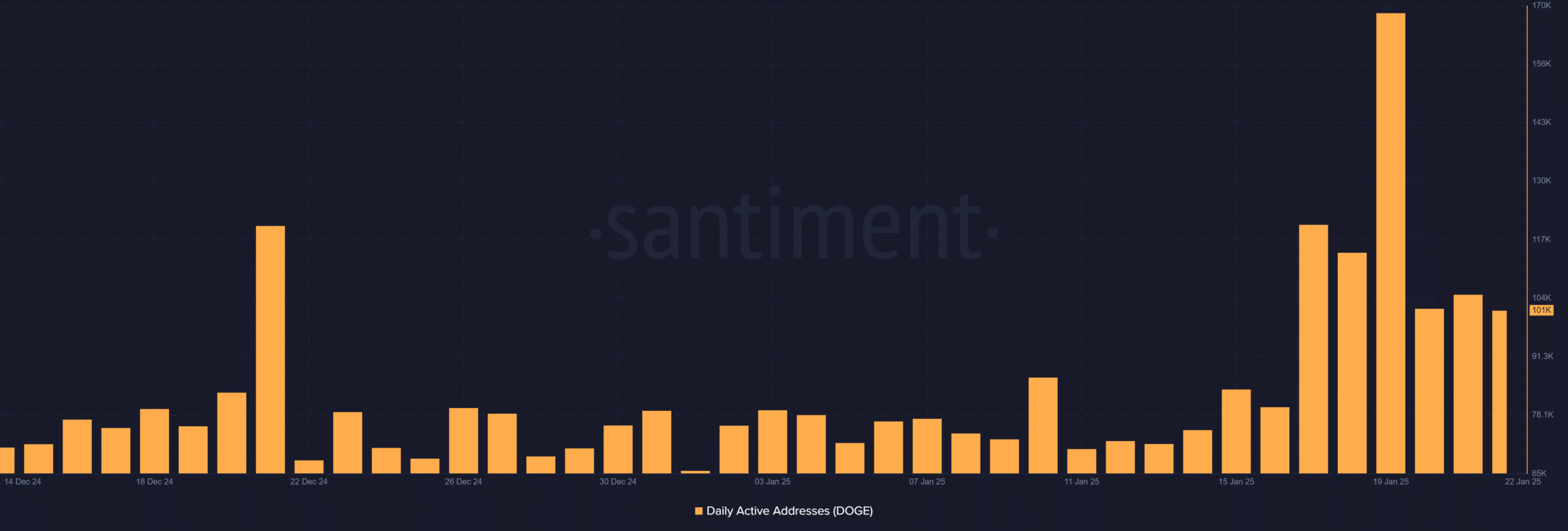

DOGE’s daily active addresses remain stable, but is this enough?

Dogecoin’s daily active addresses reached 101,000 as of January 23, reflecting moderate user engagement. This steady activity indicated consistent community interest – essential for price stability.

However, it lacks the sharp growth typically seen during major price increases.

While daily active addresses indicate a loyal user base, a significant increase in activity is necessary to reinforce bullish momentum.

Source: Santiment

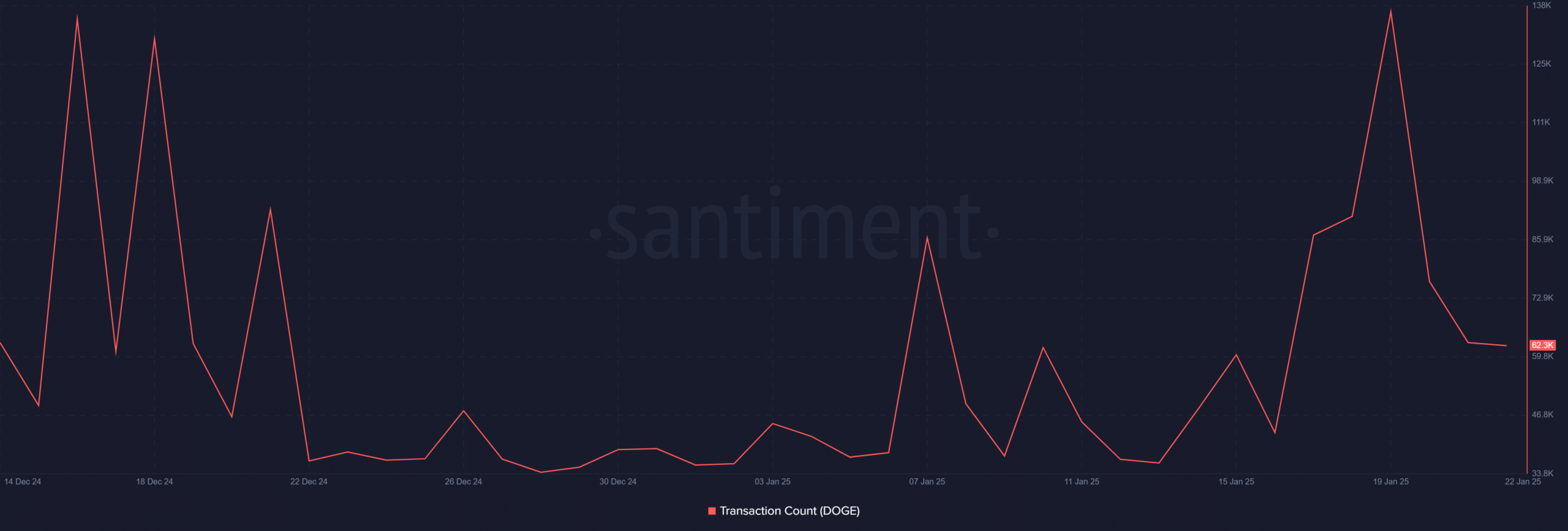

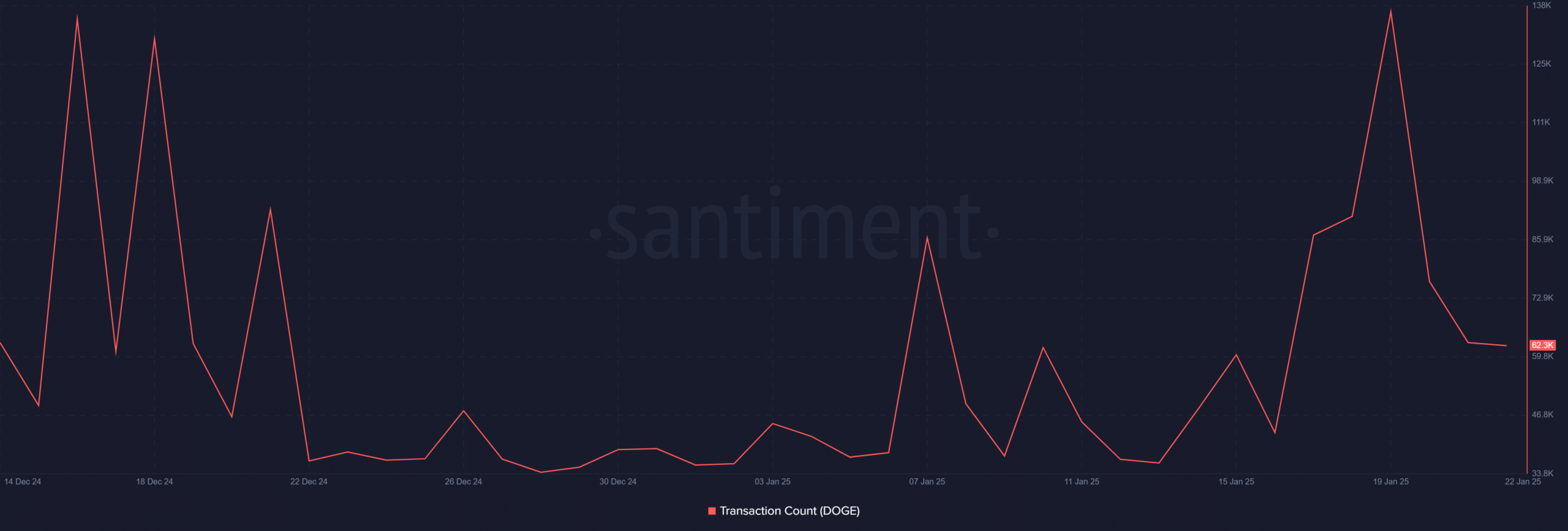

The declining number of transactions is a cause for concern

However, the number of transactions is declining, falling to just 62,355 on January 23. This reduction indicates lower activity on the network, indicating a potential loss of momentum.

Fewer transactions could lead to reduced market confidence, potentially delaying the expected outbreak. Reversing this trend will be crucial for DOGE to build upside momentum and attract more attention from traders.

Source: Santiment

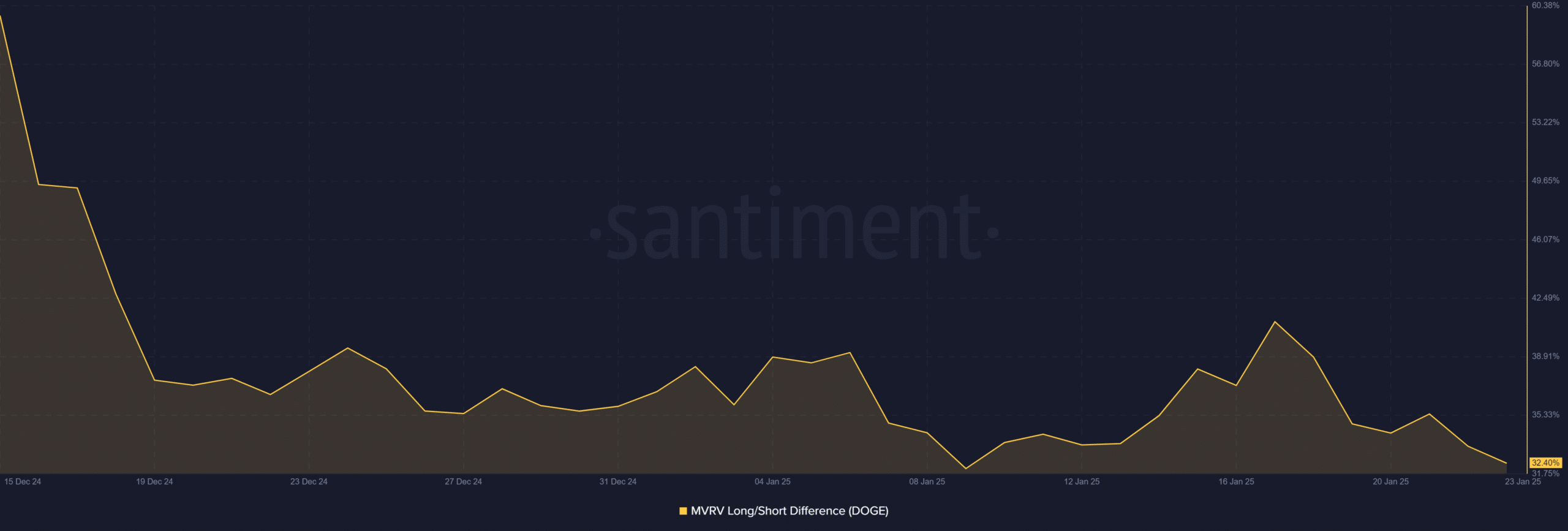

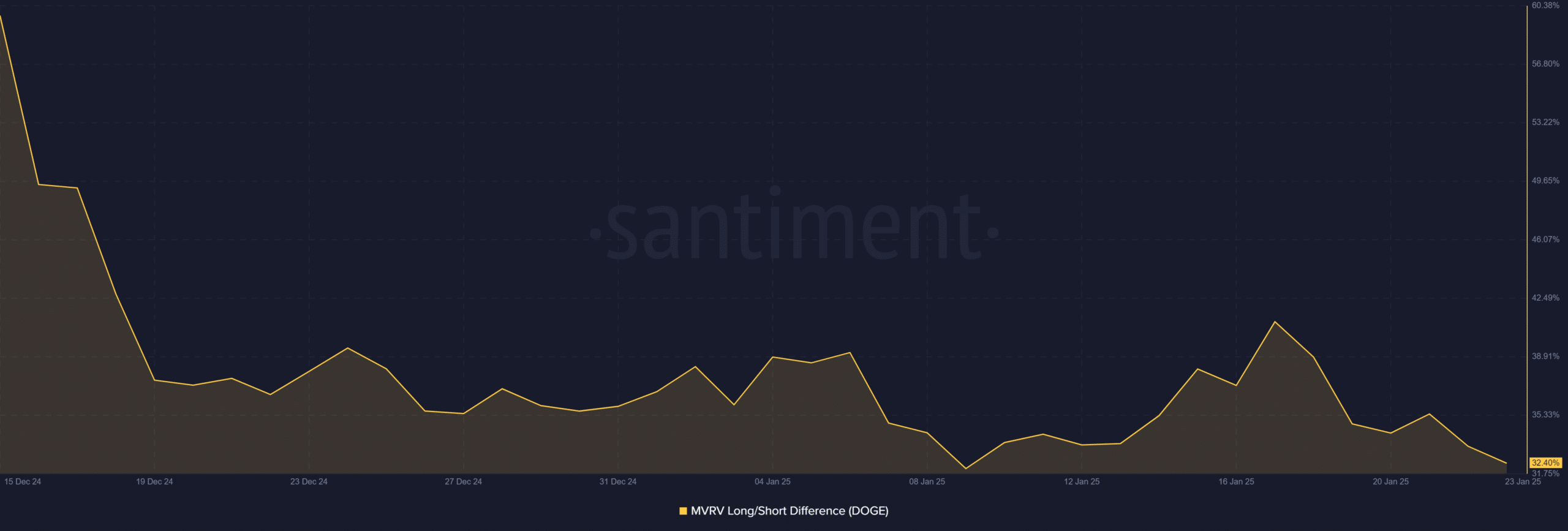

The MVRV ratio highlights bearish pressure

The MVRV long/short difference has fallen to 32.4%, a clear warning sign for both short and long term holders. This declining profitability could discourage new investments and increase selling pressure.

Furthermore, this downtrend suggested that traders were losing confidence, which could undermine DOGE’s bullish potential. Therefore, improving this metric is essential for any significant upward movement.

Source: Santiment

Conclusion: can Dogecoin break through to $0.50?

Dogecoin’s bearish wedge pattern offers hope for a breakout, with $0.39 as the key resistance level and $0.50 as the potential target.

Realistic or not, here is DOGE’s market cap in BTC terms

However, weak transaction volumes and declining profitability pose significant obstacles.

While stable daily active addresses indicate continued interest, more robust on-chain activity is needed to confirm a bullish reversal.

Credit : ambcrypto.com

Leave a Reply