- Dogecoin saw a very strong peak in address activity because its price remained below $ 0.20.

- Doge print a bullish dragonfly doji on the weekly – which indicates a potential reversal.

Dogecoin’s [DOGE] The price fell from $ 0.431 to $ 0.171, but the address activity rose from the end of February to the beginning of March to 395K.

This combination of rising active addresses with falling prices showed special market behavior in motion.

Such an increase showed that investors built their positions at cheap prices to anticipate the coming recovery.

Network traffic increased remarkably when active addresses reached 395K while they start at 97K. Secondly, social connections within communities have contributed to the peak.

Source: Santiment

Regular buzz and events on social media have driven transaction activities within the Dogecoin network. Moreover, fund movements probably increased the activity levels of the address by large holders, but they had no influence on the price of Doge.

The disconnection between network activity and price suggests that network use is not always linked to market value. On March 14, 2025, for example, active addresses fell to 55k, while the price was $ 0.171.

In general, cumulative activity, community support and whale fund movements seem to be the primary factors behind the increase in activity, even if prices fell.

What the weekly price promotion of Doge suggests …

Analysis of the price action of Doge, an upward trending doagly doji pattern appeared on the weekly period of time, such as in 2017.

The price percentage of $ 0.0006 before 2017 became the starting point for a price strike up to $ 0.01 with high profit.

At the time of writing, the price level showed $ 0.171 potential for a reversal that can encourage to reach $ 0.431 or to exceed it, such as the Market Momentum 2017.

Source: Trade reproduction

However, the opposite is possible. The price increase of 2017 took place compared to extensive accumulative phases, while the current decrease has not reached comparable depths since $ 0.431.

Extra sales can lead to the Dogecoin price $ 0.1. Although a rebound seems possible, this does not reduce the existing threat of further price reduction.

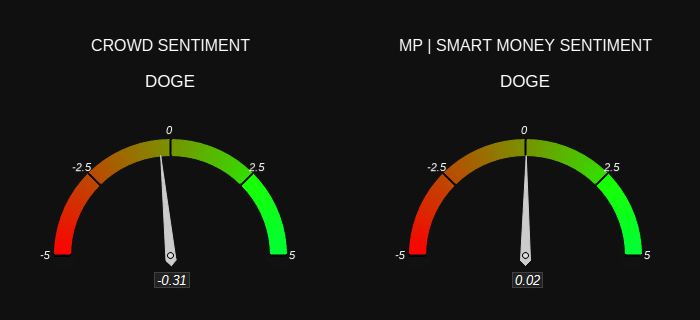

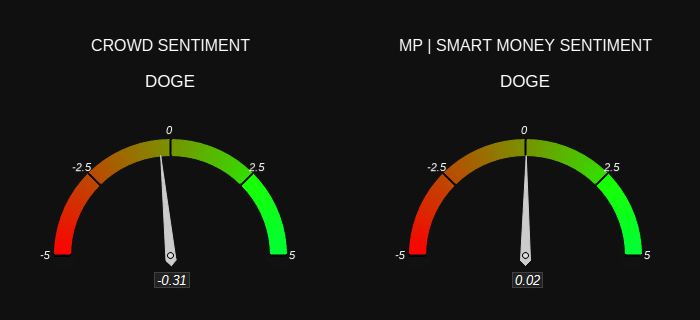

Market sentiment

Moreover, the current sentiment of Doge Crowd was on -0.31, which indicates a somewhat bearish mood that was almost neutral. The smart money had a narrow positive reading of 0.02, which indicates mixed feelings.

Healthy negative sentiment of the crowd base indicated the current undervaluation of the market and pointed to a possible market shift.

Source: Market Prophit

The neutral attitude of Smart Money did not show a strong sales pressure. A reversal can start from $ 0.171 with the appearance of a Dragonfly Doji and lead to $ 0.431 price.

The current low sentiment values ensure caution, because extra bearish trends can push the price to $ 0.1.

Credit : ambcrypto.com

Leave a Reply