- After a sharp weekly increase, DOGE’s daily chart turned red.

- The fear and greed index indicated a possible sell-off.

After a huge weekly rally, Dogecoin [DOGE] disappointed investors as the price fell over the past 24 hours. Nevertheless, the memecoin was still on track to test its all-time high.

Will DOGE set a new record, or will investors expect more?

Dogecoin to test its ATH?

According to CoinMarketCapDOGE’s price rose more than 20% last week. The uptrend came to an end in the last 24 hours as the memecoin witnessed a 5% price correction.

At the time of writing, the memecoin was trading at $0.4373, making it the seventh largest cryptocurrency.

While that was happening, MilkyBull Crypto, a popular crypto analyst, posted tweet showing that DOGE was close to its all-time high.

Interestingly enough, an In response, MilkyBull Crypto said this was unlikely, but the comment also stated that anything could happen.

DOGE’s next move

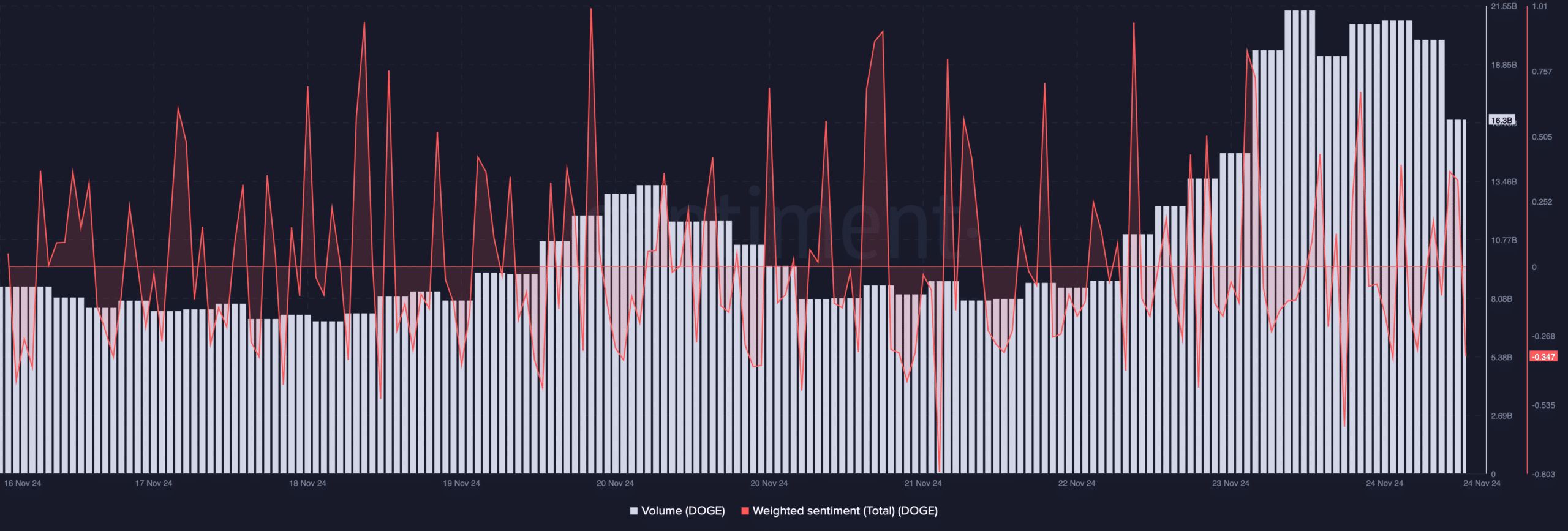

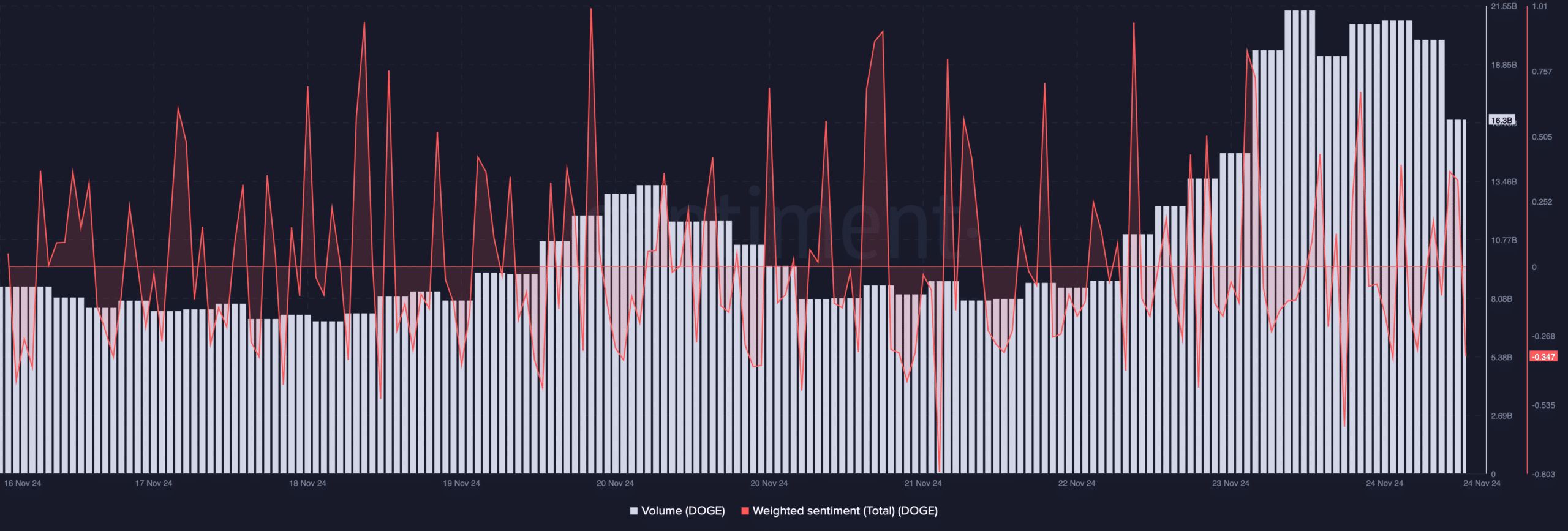

Meanwhile, DOGE’s triage volume dropped by 15%. This was good news, as a drop in volume amid a price drop usually signals a bullish trend reversal.

But weighted sentiment fell – a sign of rising bearish sentiment around Dogecoin.

Source: Santiment

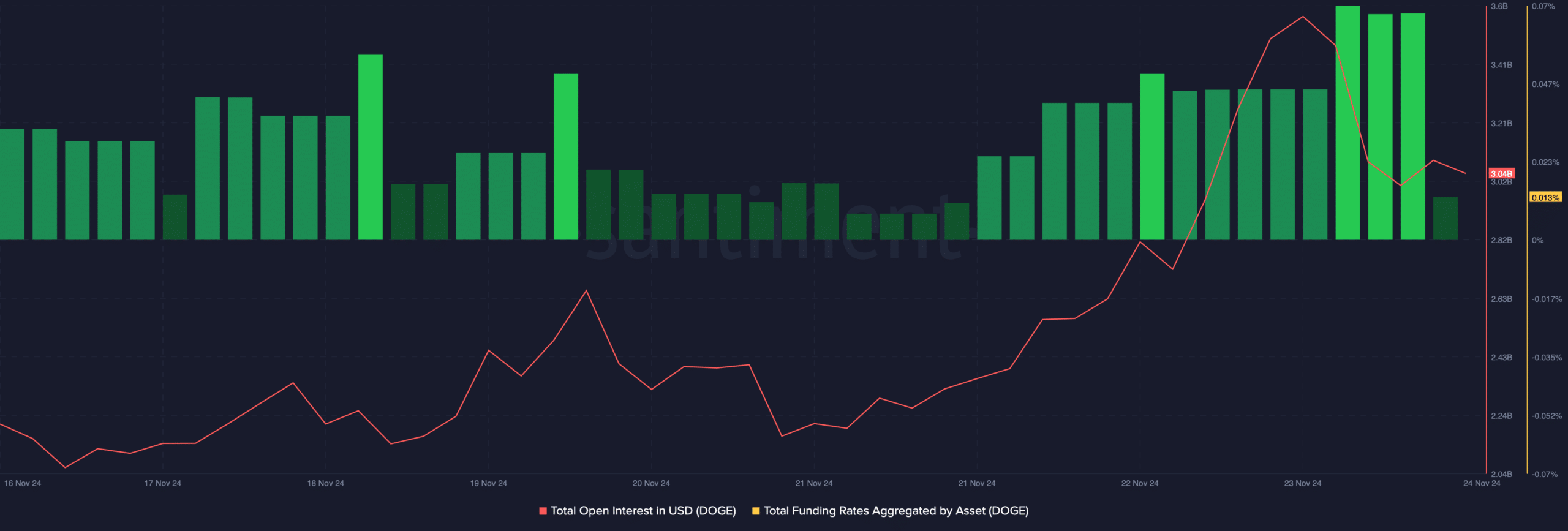

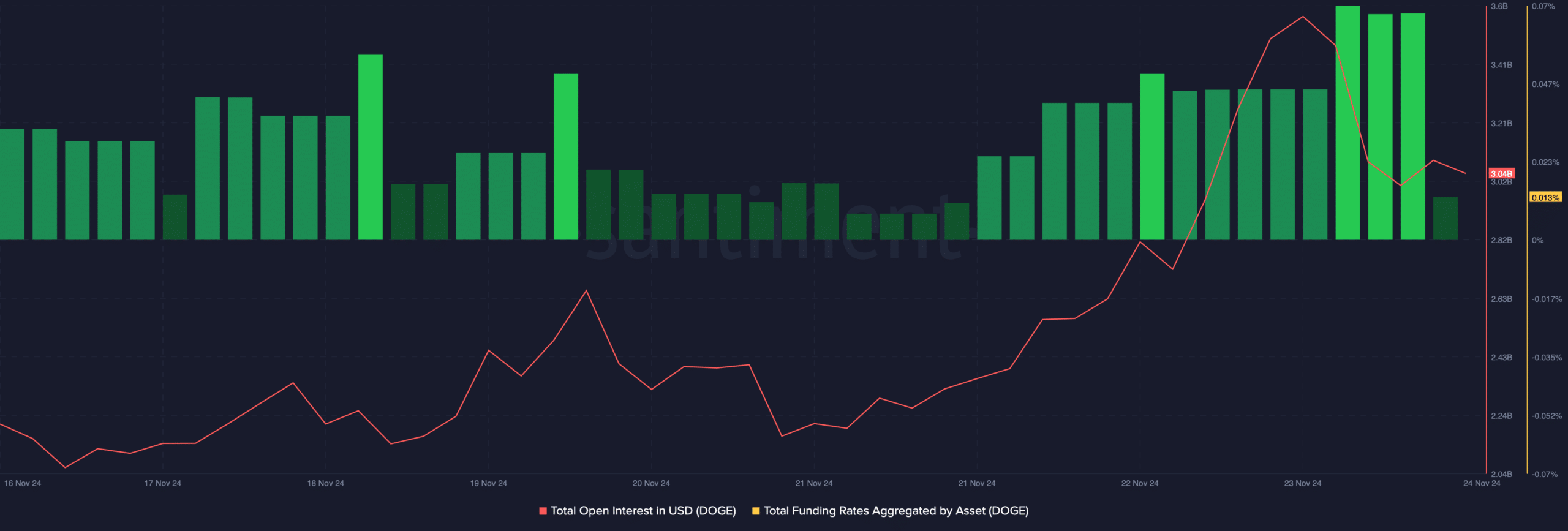

Another bullish measure was the Open Interest, which fell along with the price, indicating a soon trend reversal.

However, DOGE’s funding rate rose, indicating that derivatives investors were actively purchasing the memecoin at the discounted price.

Source: Santiment

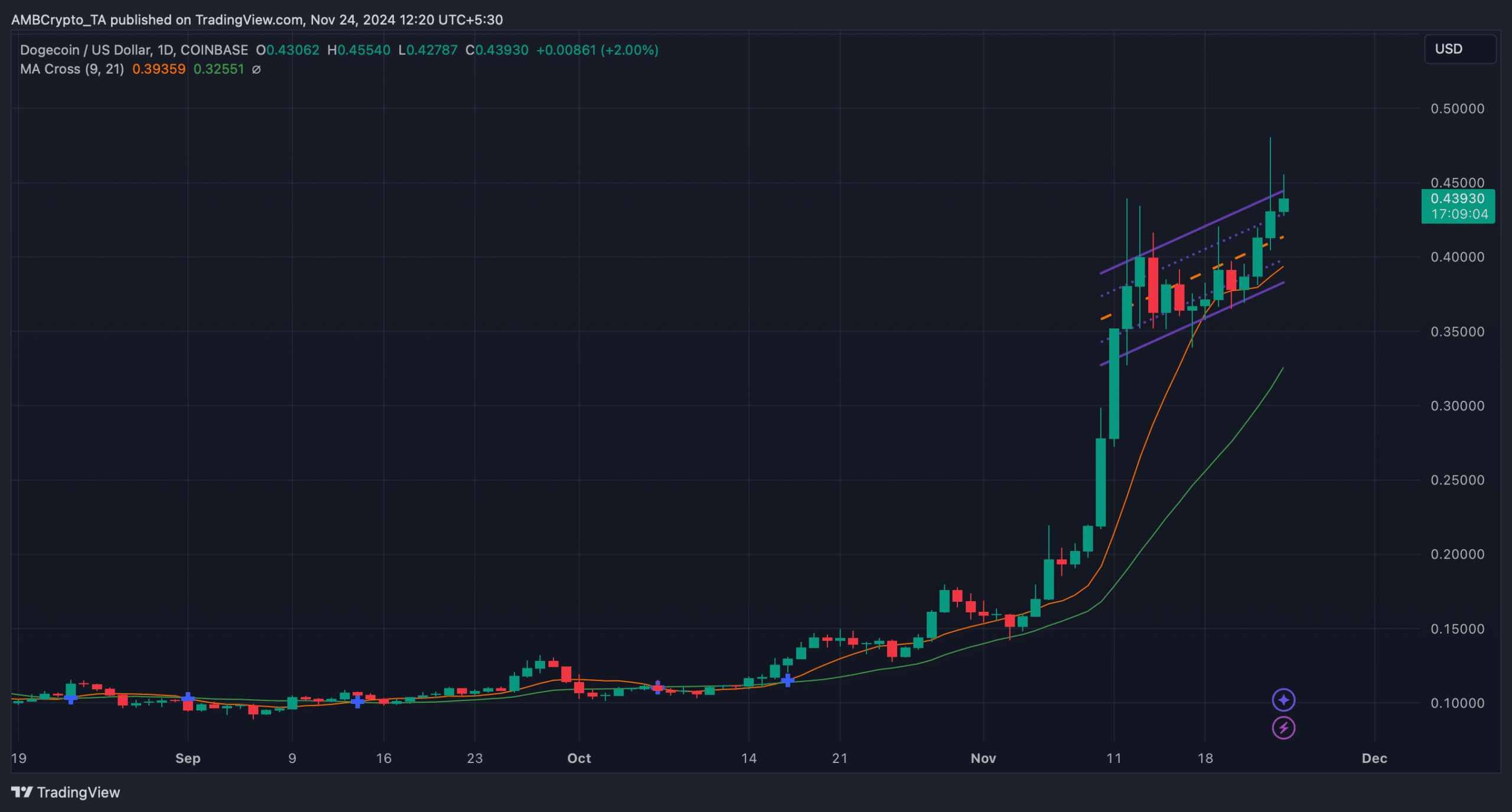

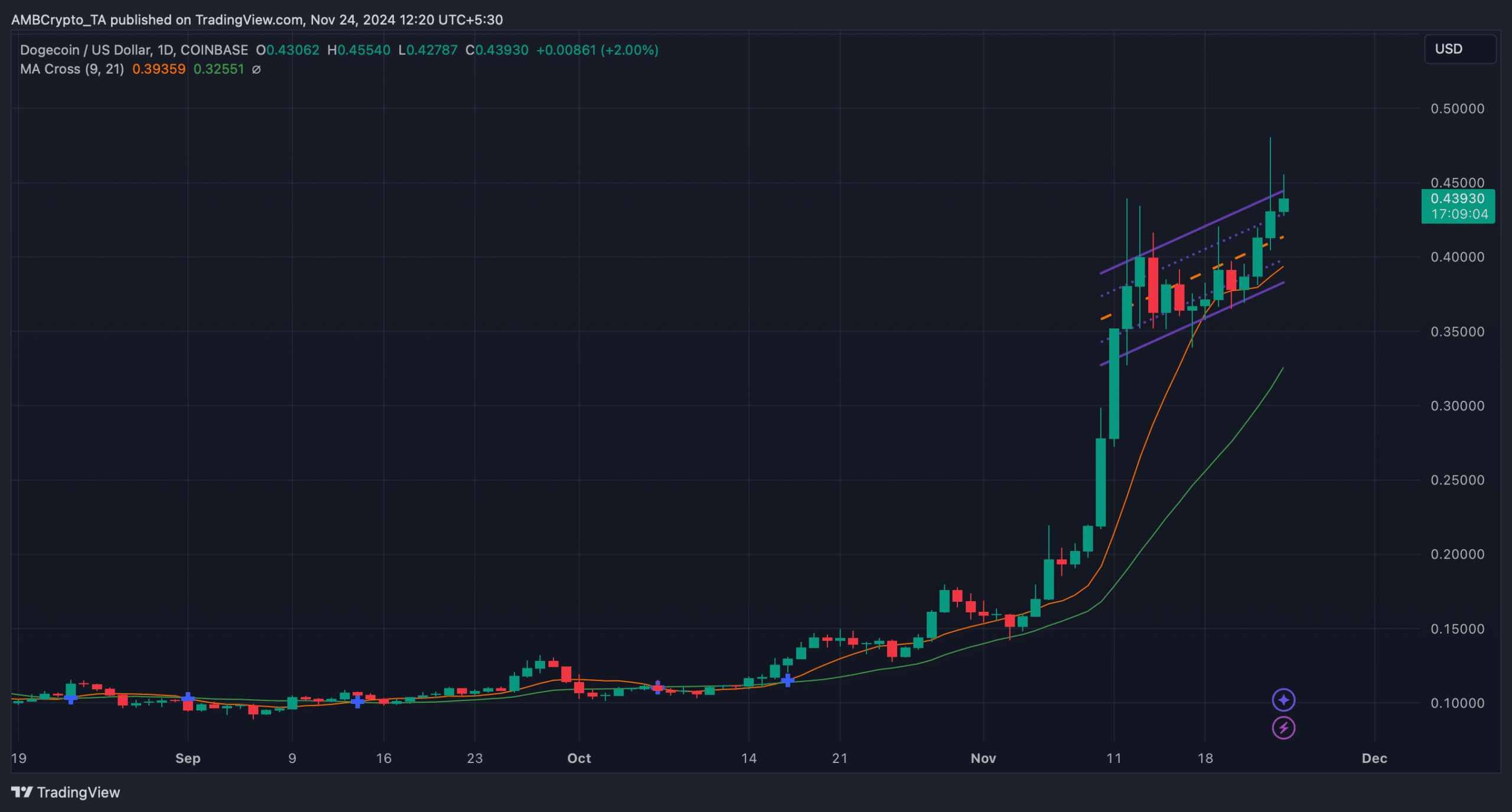

AMBCrypto’s look at Dogecoin’s daily chart revealed that the price was moving within an upward channel and at the time of writing it was testing the pattern’s resistance.

The MA Cross indicator revealed a clear bullish advantage in the market, indicating a successful breakout. If that happens, testing DOGE’s ATH could soon become a reality.

Source: TradingView

Nevertheless, even if the memecoin moves beyond its ATH, the chance of a correction afterwards remains.

In the event of a price discovery, investors could once again witness DOGE drop to $0.367 after it sets a new ATH.

Read Dogecoins [DOGE] Price prediction 2024–2025

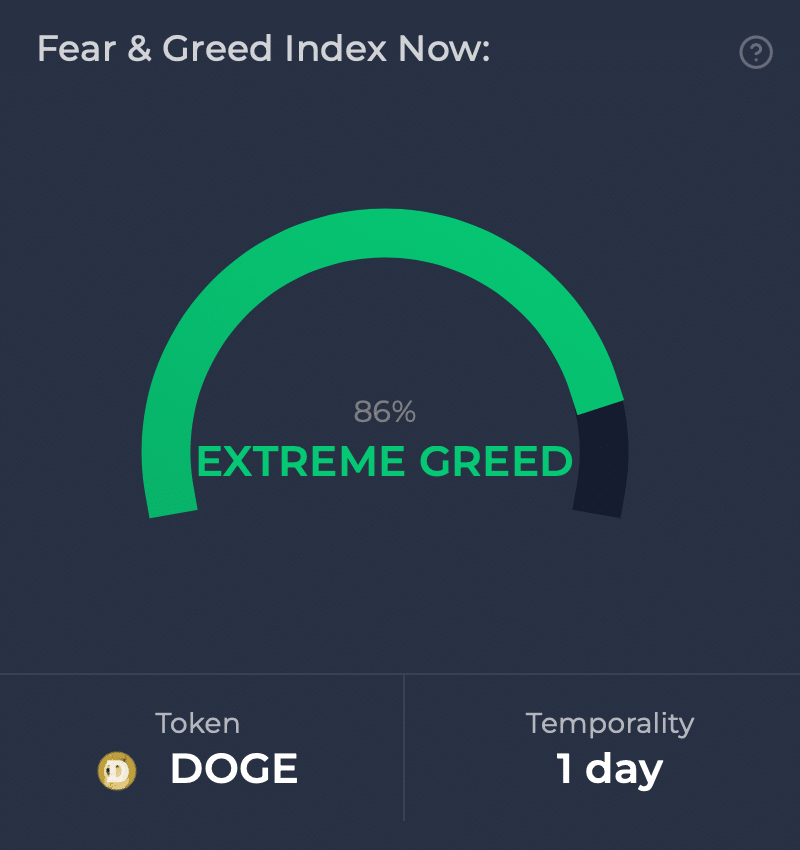

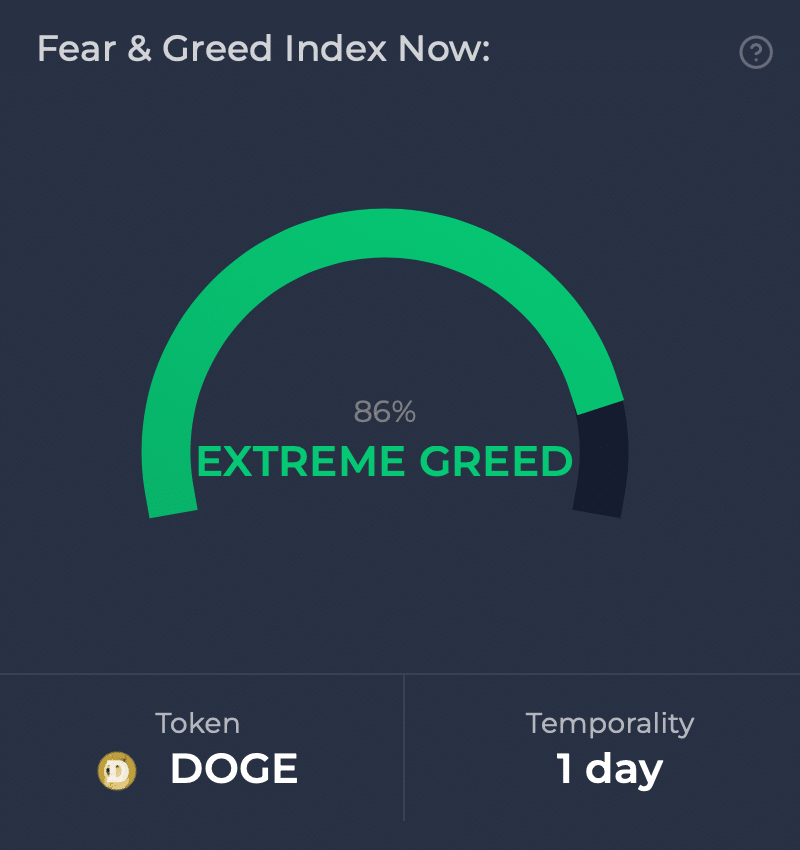

Notably, DOGE may not test its ATH very well anytime soon. This seemed to be the case when the fear and greed index entered the ‘extreme greed’ phase.

When that happens, it indicates that the likelihood of a price correction is high.

Source: CFGI.io

Credit : ambcrypto.com

Leave a Reply