Andrei Grachev, a top manager at DWF Labs, has challenged the core developers in almost protocol (near) to reduce the inflation of token from 5 percent to 2.5 percent. In an X -post on Wednesday, Grachev asked the core developers of Near Protocol to consider the transition to stimulate the long -term perspectives of the project.

Grachev reminded De Core founders that DWF Labs currently owns 5 million in the vicinity of Tokens and has used another 6 million tokens. To resolve the proposal, Grachev told the core developers that DWF labs would buy another 10 million extra near tokens.

In the meantime, Bowen Wang, a developer at almost protocol, welcomed the idea of reducing the inflation of the token, but emphasized that the final step is to the community. Moreover, the current inflation is part of the stimulation plan to attract more holders to stop to the tokens and secure the protocol.

Furthermore, look at almost price promotion

In the midst of the long -awaited Altealth season 2025, catalyzed by the rising institutional demand and the impending reversal of the Bitcoin -Dominance, almost Price has indicated a bullish sentiment. The Mid-Cap Altcoin, with a completely diluted appreciation of around $ 3.2 billion and a 24-hour average trade volume of around $ 186 million, won more than 5 percent in the last seven days to trade around $ 2.57 at the time of this letter.

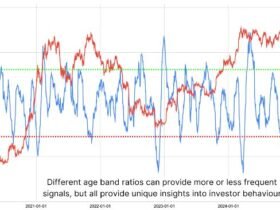

From the point of view of technical analysis, the almost price is about a large stir when it consistently closes above the established falling logarithmic trend. In the daily age of time, Near Price has formed a potentially reverse head and shoulder pattern, which indicates bullish sentiment in the short term.

The bullish sentiment is also reinforced by the weekly MacD line that recently exceeded the signal line in the middle of growing bullish histograms.

Credit : coinpedia.org

Leave a Reply