- Musk supports Trump’s push for presidential control over Federal Reserve policy.

- Bitcoin is gaining momentum as a hedge against inflation amid rising US government debt.

Elon Musk, the influential CEO of Tesla and SpaceX, has long been an outspoken supporter of current President Donald Trump, especially during his 2024 election campaign.

After Trump’s victory to become the 47th president of the United States, Musk openly supported the idea of having the president play a more direct role in shaping Federal Reserve policy.

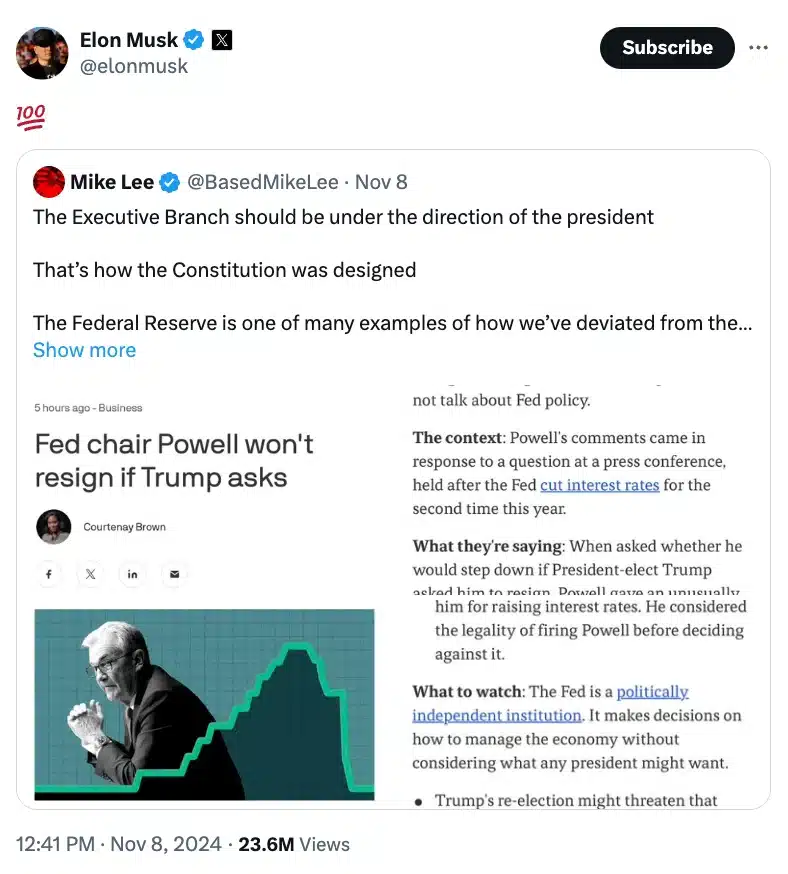

Senator Mike Lee on ending the power of the Federal Reserve

This emerged in response to a recent message from Sen. Mike Lee, R-Utah, in which he advocated for the Federal Reserve to operate under the direct control of the president.

To complement this, Musk showed his support the next day with a simple “100” emoji, which is often used to express full agreement.

Source: Elon Musk/X

For those who didn’t know, Senator Lee did packed his tweet with the hashtag #EndtheFed, calling for a radical change in US monetary policy.

He said,

“The executive branch must be headed by the president. That’s how the Constitution was designed. The Federal Reserve is one of many examples of how we have departed from the Constitution in that regard. Another reason we need to end the Fed.”

How did this start?

For context, Lee’s post was sparked by Federal Reserve Chairman Jerome Powell’s refusal to resign even if asked to do so by new President Trump, a move Lee saw as emblematic of a system gone wrong. As expected, Musk’s endorsement of Lee’s stance on social media sparked further discussion about the Federal Reserve’s role in US economic governance.

Responding to the situation in which the community responded, as highlighted by an Truth Justice who said,

“The End of Government Corruption.”

The issue flared up when Fed Chairman Jerome Powell reaffirmed that he would not resign at the request of President-elect Trump. This indicated renewed friction between the central bank and the White House.

What’s more?

Historically, the Federal Reserve operated independently and made decisions based solely on economic conditions, but during his first term Trump frequently criticized Powell’s policies.

For example, during the 2024 election campaign, Trump showed interest in exerting more influence over the Fed’s actions if he were to return to power. While saying the same thing, Trump claimed in August at a press conference at his Mar-a-Lago club in Florida:

“I think the president should have at least done that [a] say in there.”

As expected, so does Musk shared expressed a similar sentiment in a recent tweet when he argued:

“The unelected and unconstitutional federal bureaucracy currently has more power than the presidency, the legislature, or the judiciary! This has to change.”

How is Bitcoin the savior?

With the US national debt surpassing $35 trillion, Bitcoin [BTC] is emerging as a potential hedge against inflation driven by years of money printing. Figures like Florida CFO Jimmy Patronis and Senator Cynthia Lummis are pushing for BTC investments to protect purchasing power.

In addition, Trump has also proposed using Bitcoin to manage the national debt, highlighting its growing role in US economic strategy. As the debate over Bitcoin’s financial impact heats up, its potential as an inflation hedge is gaining attention.

In fact, one X user said it best when he said:

Source: Voltaire’s Looking Glass/X

Credit : ambcrypto.com

Leave a Reply