This article is available in Spanish.

Recent analysis suggests so the Ethereum price It may operate on an eight-year cycle, which is different from Bitcoin’s established four-year cycle. This would be the pure underperformance of the Ethereum price relative to the Bitcoin price since the beginning of the year. Keeping this in mind, technical analysis suggests that Ethereum price still has a long way to go in this cycle, especially if Bitcoin price starts to undergo a major correction.

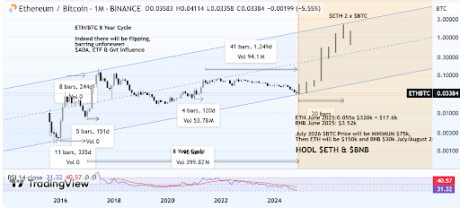

Understanding the 8-year cycle of ETH/BTC

Technical analysis of the ETH/BTC chart has pointed out an interesting cycle between both crypto heavyweights. Notably, the chart shows that Ethereum’s price has largely underperformed Bitcoin’s price in recent years, a trend that worsened even further since July this year.

Related reading

Unlike the Bitcoin price, which follows a well-documented four-year cycle in line with the halving events, the Ethereum price appears to be taking a different path. Over the years, data suggests that Ethereum is targeting an eight-year cycle. This distinction explains why Ethereum and its ecosystem often lag behind Bitcoin during bull runs and bear markets. Interestingly enough, this distinction has become very apparent in the current bull cycle, which has seen Bitcoin price reach multiple new all-time highs while Ethereum continues to struggle below $4,000.

Ethereum’s eight-year cycle indicates that when the Bitcoin price begins to peak within its own cycle, Ethereum could offset these movements. This plays into the idea of an altcoin season where investors start making profits on the Bitcoin price and start investing in the altcoin market.

According to an analysis on the TradingView platformBitcoin price’s four-year cycle suggests that the leading cryptocurrency could dive to the depths of its sinusodial path by 2026, according to its Power Law corridor by 2026. On the other hand, this predicted Bitcoin price decline will be countered by a simultaneous price increase of Ethereum that would push it to an eight-year cycle high in 2026.

Expected peak for Ethereum price in mid-2026

Based on the eight-year cycle theory, Ethereum’s price is expected to reach its peak in mid-2026. This peak is expected to align with the trough of Bitcoin’s four-year cycle, creating a counterbalance between the two leading cryptocurrencies. During this period, the price of Ethereum is expected to rise to the highest level Bitcoin is entering a price correction phase. Moreover, BNB is expected to act as a stabilizing asset alongside Ethereum as the Bitcoin price declines.

Related reading

Price predictions indicate that Ethereum’s price could reach $17,600 by June 2025, while BNB would simultaneously rise to $3,520. Ethereum is expected to reach $150,000 in July or August 2026, while BNB could rise to $30,000.

At the time of writing, Ethereum and BNB are trading at $3,385 and $660 respectively. Bitcoin is trading at $98,150.

Featured image created with Dall.E, chart from Tradingview.com

Credit : www.newsbtc.com

Leave a Reply