- Trump-backed World Liberty Financials was bullish on ENA.

- Should you also follow ENA and jump on it?

Donald Trump-backed DeFi project, World Liberty Financials (WLF), added Ethena [ENA] to his portfolio. According to the blockchain analytics company SpotOnChainpurchased the ENA project for $500,000.

WLF recently won the top DeFi tokens including Ethereum [ETH], Aaf [AAVE]And Chain link [LINK]. In fact, AAVE and LINK pumped almost 30% each after the bids.

ENA also rose after the WLF move, posting a gain of over 13%. But what is ENA’s valuation status and can short-term players jump on the trend?

The upside potential of ENA

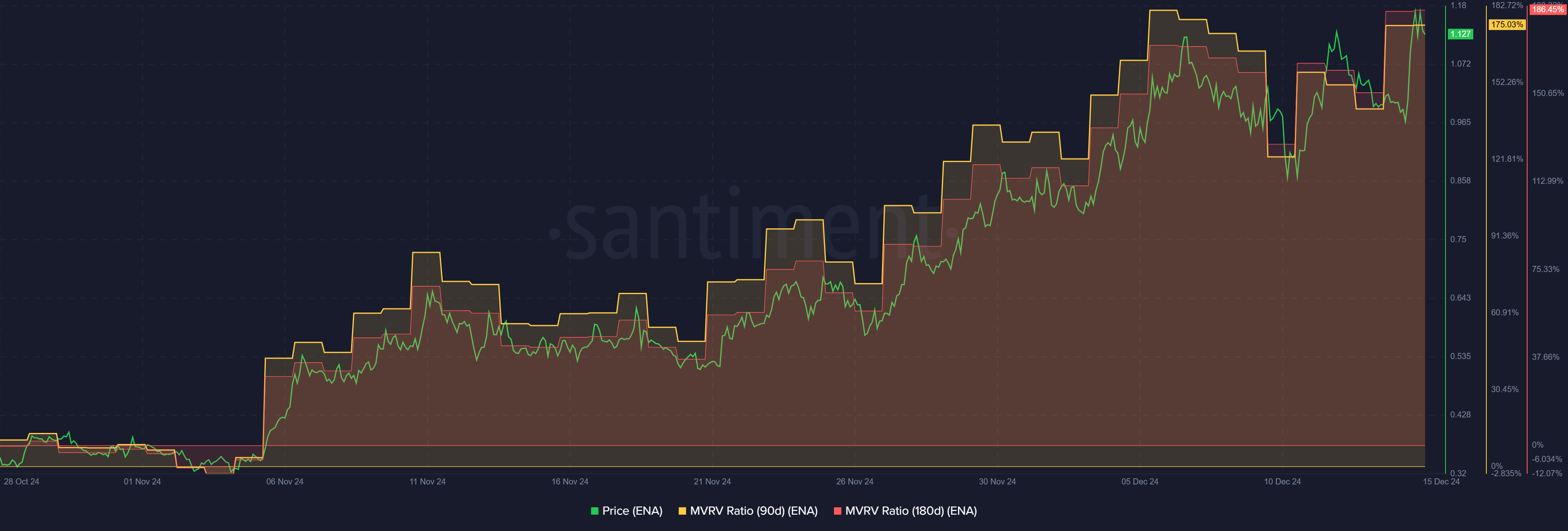

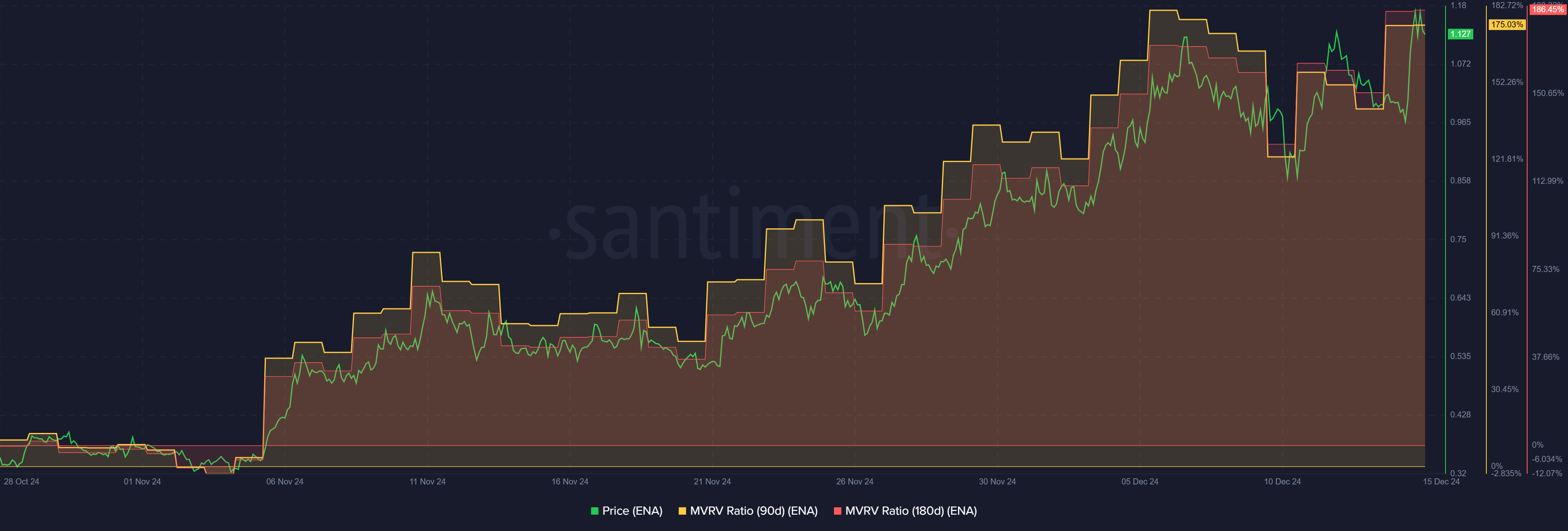

Source: Santiment

At the time of writing, ENA holders had huge, triple-digit unrealized gains in the short and medium term. This was illustrated by the 186% gain for the 180-day MVRV and the 175% gain for the 90-day MVRV.

This meant that those who had held ENA for the past six or three months had huge unrealized gains and could book profits. According to MVRV, ENA was therefore relatively overvalued.

However, another crypto investor, Byzantine General, argued that ENA could still have huge upside potential, citing the better-performing stablecoin yield, USDe. He said,

“ENA with its stablecoin that gets returns from positive funding rates (and staking) should perform very well as long as we are in a bull market. I think this will only continue to drag on.”

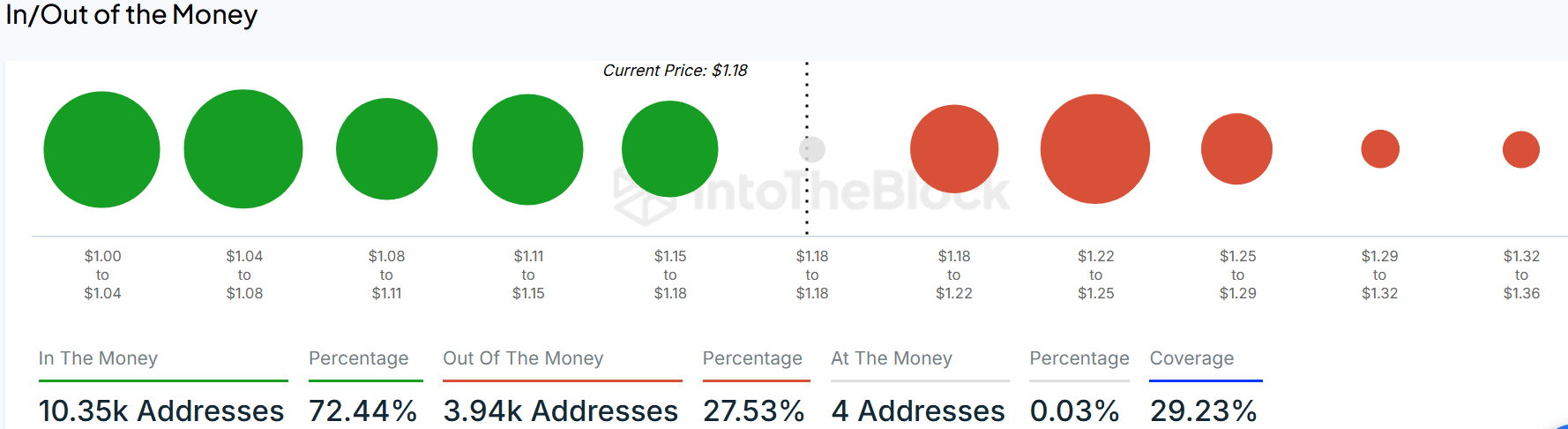

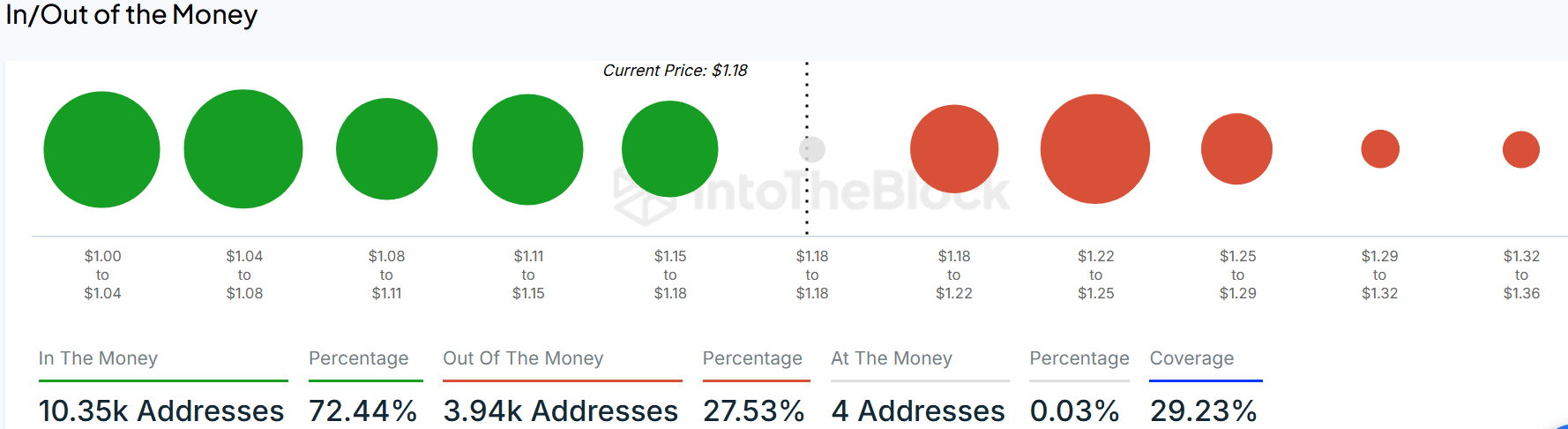

With ENA valued at $1, only 5% of total ENA holders were at a loss, according to IntoTheBlock data. This could quickly convert late buyers into exit liquidity, making it relatively expensive for investors to jump into the altcoin.

However, should they hold, the immediate roadblock was at $1.22-$1.25 as over 850,000 ENA (red bubble) were bought at this level.

Source: IntoTheBlock

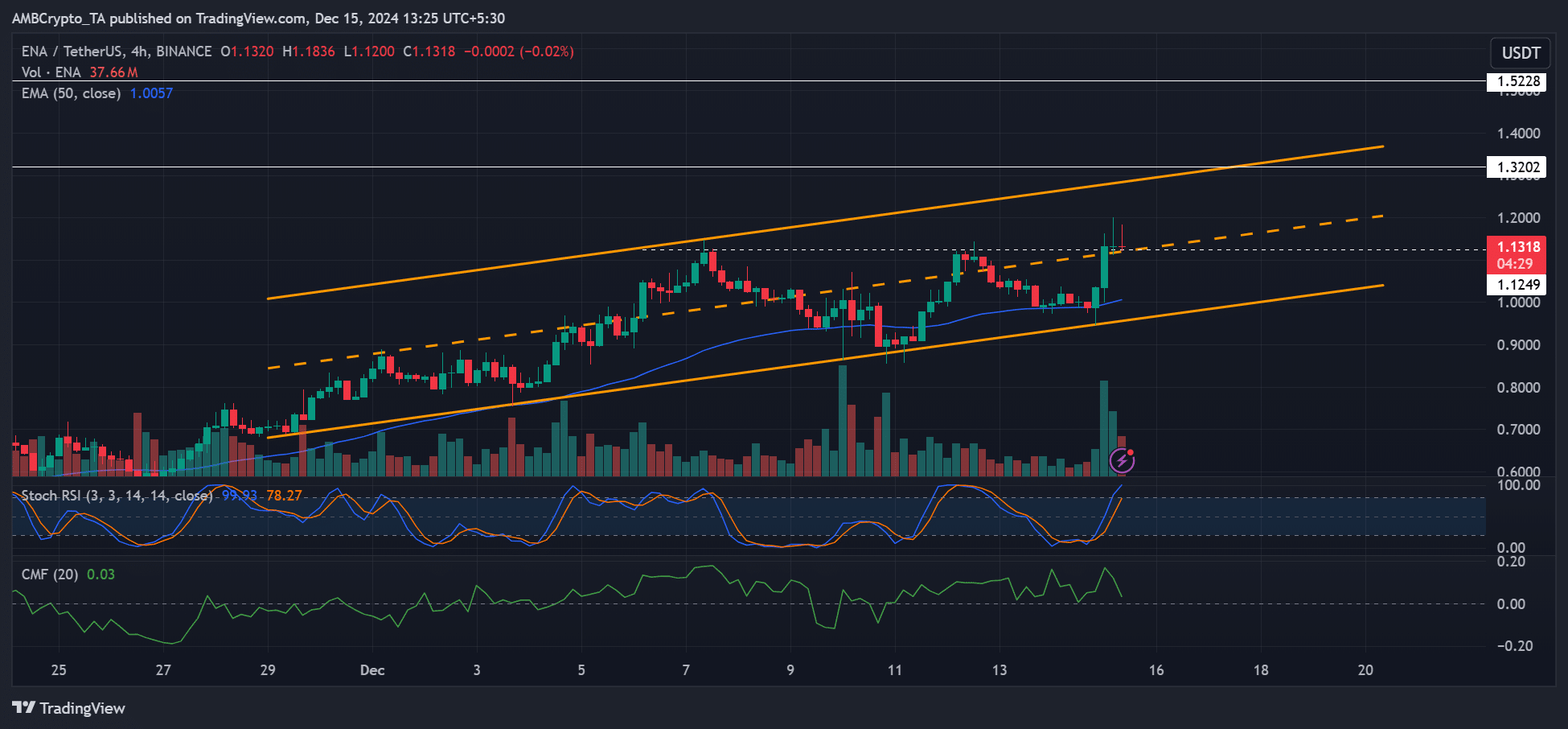

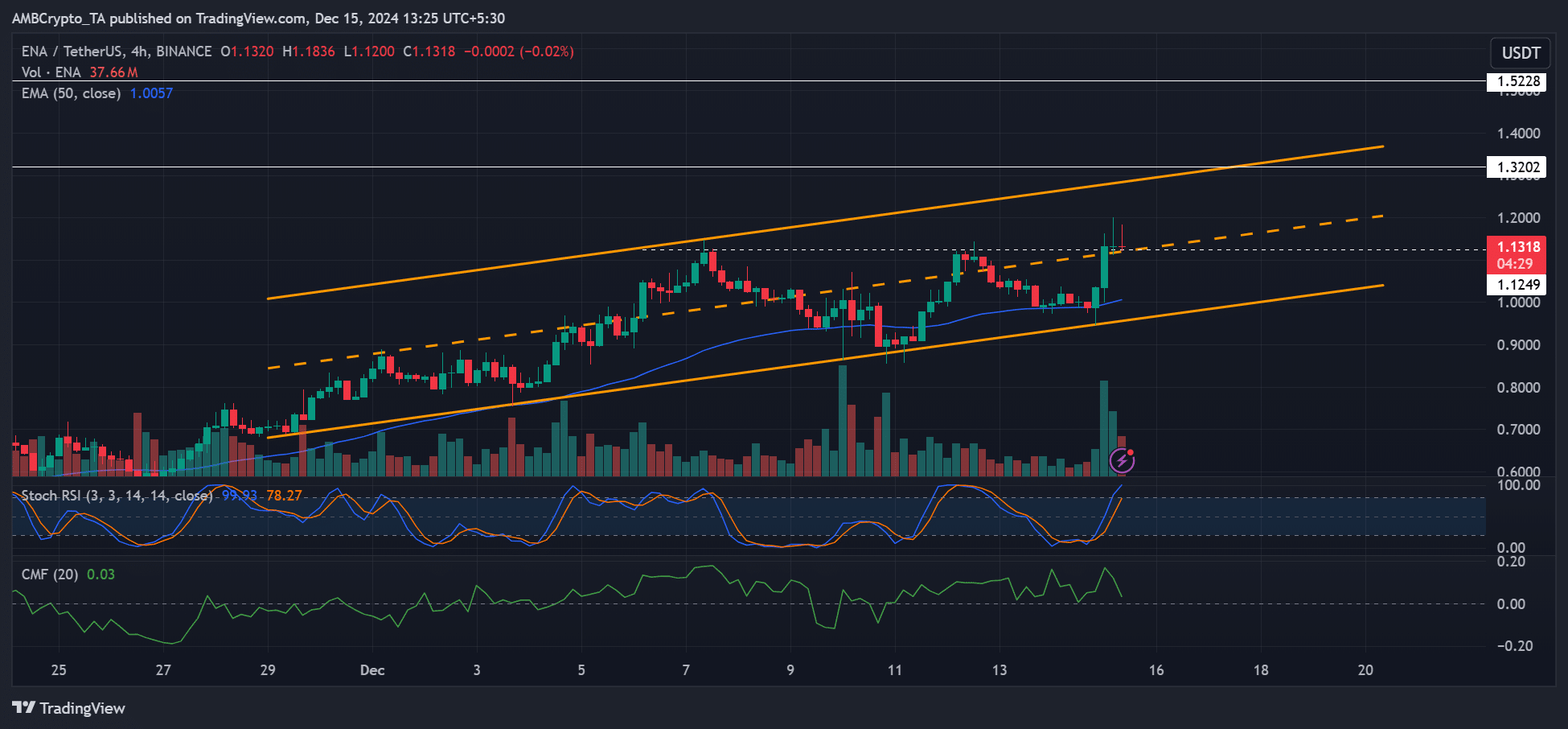

However, traders could still have that potential possibilities. On the price charts, ENA was rejected at $1.2, but defended $1.12 and the mid-range.

This could set the stage for targeting the $1.23 high. If so, a potential gain of 15% could be achievable.

Source: ENA/USDT, TradingView

On the contrary, a break below the mid-range could drag ENA to the lower range or the 50-day EMA (Moving Average) on the 4-hour chart.

Credit : ambcrypto.com

Leave a Reply