Amid a general price decline in the crypto market over the past week, Ethereum (ETH) recorded a price correction of over 19.5% and found support at a local bottom of $3,100. Since then, the prominent altcoin has shown only slight bounce in the past two days, rising more than 5%. However, recent data on wallet activity provides a lot of reason to be optimistic about Ethereum’s long-term future.

Ethereum HODL Addresses Increase Supply Dominance to 16%

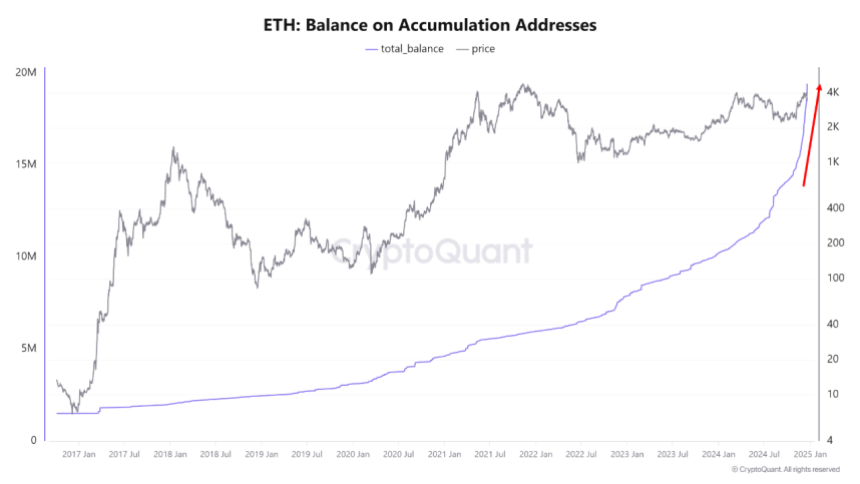

In a recent one QuickTake postCryptoQuant analyst MAC_D shared some positive insights about the Ethereum market.

The crypto market expert reports that the balance of Ethereum accumulation addresses increased by as much as 60% between August and December. During this time, these HODL wallets increased their share of the ETH supply from 10% to 16%, or 19.4 million ETH from 120 million ETH.

To explain, the accumulation addresses are wallets that hold Ethereum but rarely move or sell their assets. They are considered a benchmark for long-term investment and trust.

According to MAC_D, the rapid increase in ownership of these Ethereum HODL wallets is a new development absent in previous bull cycles. The analyst attributed this huge accumulation rate to investors’ optimistic expectations about the incoming administration of Donald Trump in the US.

These expectations include more favorable regulations for the DeFi industry, which represents a key sector of the Ethereum ecosystem. Therefore, regardless of Ethereum’s current price movement, these long-holding wallets will likely continue to increase their holdings in anticipation of future price growth.

Furthermore, MAC_D emphasizes the importance of these accumulation addresses, as Ethereum’s price has never fallen below the realized price. Therefore, continued purchasing through these wallets offers great potential for long-term price gains.

What’s next for ETH?

Regarding Ethereum’s immediate move, MAC_D warns that macroeconomic factors are likely to exert a stronger influence on ETH’s price in the short term, as illustrated by the recent price crash caused by possible reduced interest rate cuts in 2025.

At the time of writing, the altcoin is trading at $3,352, having dropped 3.07% in the past 24 hours. At the same time, ETH’s daily trading volume has fallen by 53.25% and is valued at $31.15 billion.

After the recent price drops, Ethereum is also performing negatively on the larger charts, with losses of 14.74% and 1.05% in the last seven and thirty days respectively. On the plus side, the asset’s price is still well above its initial price level ($2,397) at the start of the post-US election price rally, indicating that longer-term sentiment remains positive.

With a market cap of $401 billion, Ethereum remains the second largest cryptocurrency and largest altcoin in the digital asset market.

Credit : www.newsbtc.com

Leave a Reply