- Whale Wallets raised holdings to 16.793 million ETH because Exchange Netflows showed a strong increase in the outflows.

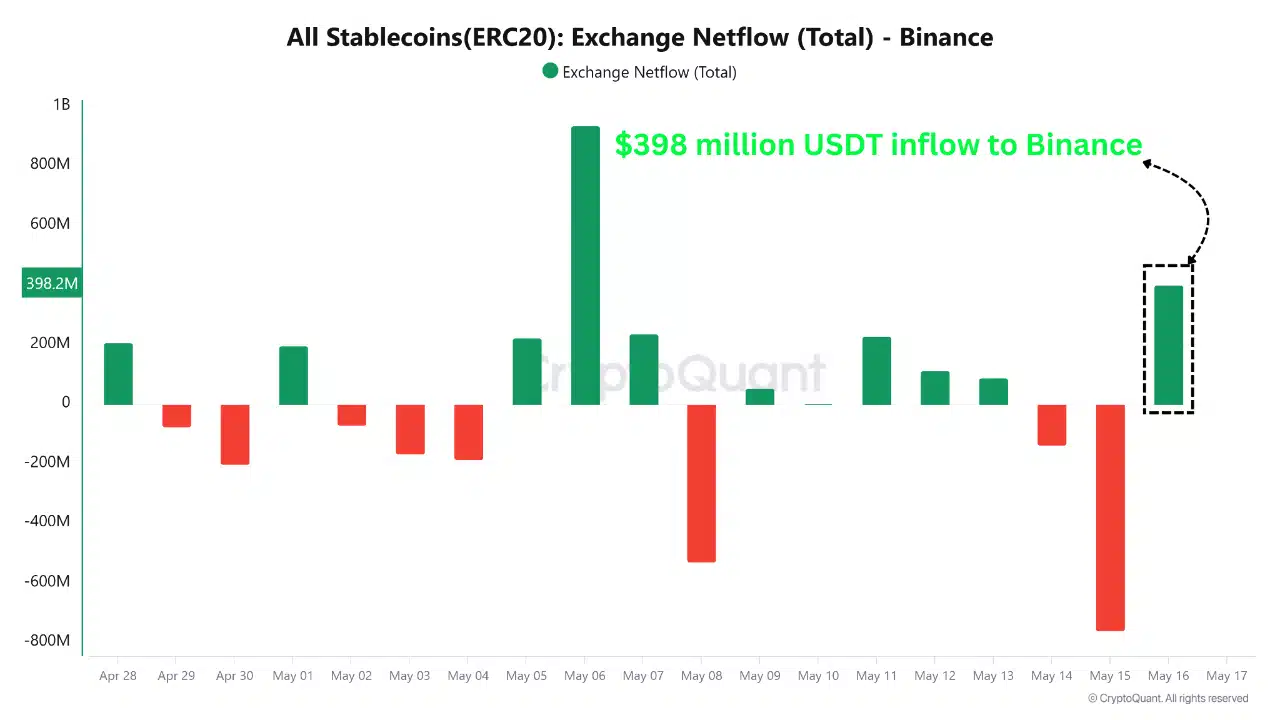

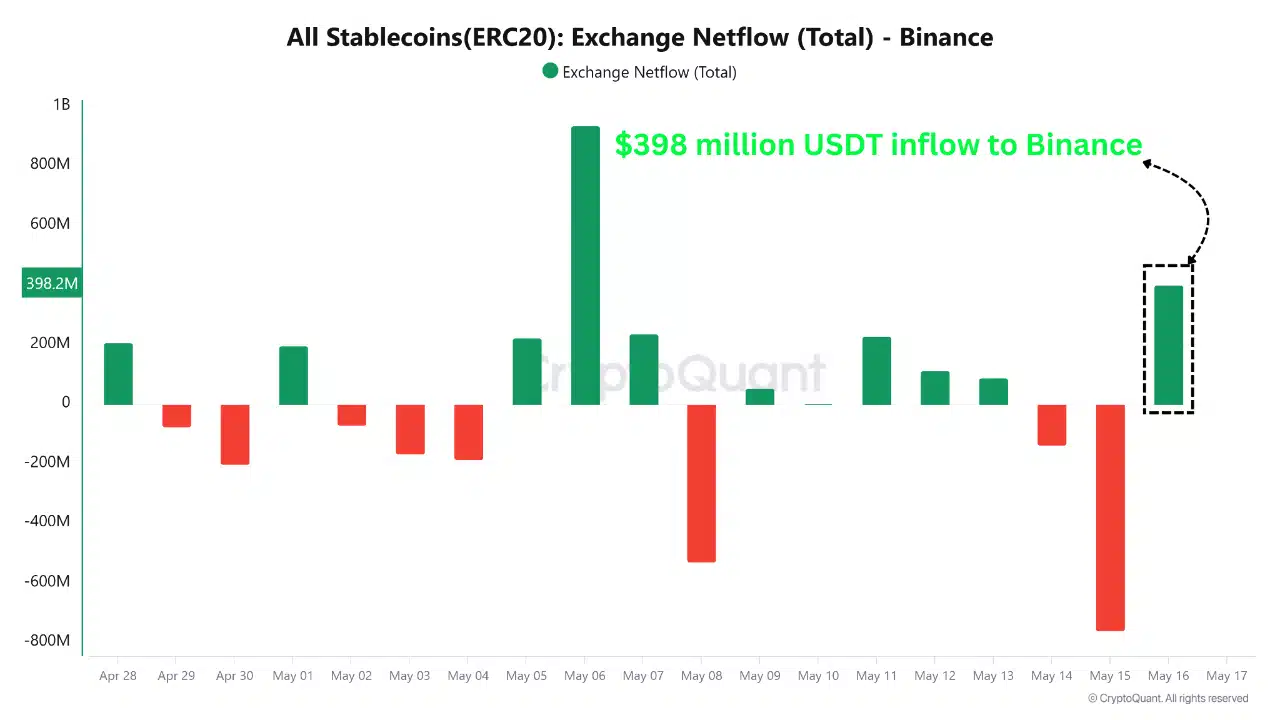

- A USDT inflow of $ 398 million and $ 540 million ETH outflow on the same day signal aggressive repositioning by large investors.

Ethereum [ETH] Did to $ 2,492 and lost 3.73% in 24 hours, after a rejection near the $ 2,800.

This pullback even unfolded when Walvisportfeuilles stepped on accumulation and Stablecoin inflow increase, pointing to strategic repositioning behind the scenes.

However, sentiment in the short term remains fragile.

While some traders seem to leave with losses, activity on chains shows strategic structure. This divergence creates uncertainty around the next movement of ETH, because important technical levels come into play.

Doubling down or signaling LUTION?

Walvisportfeuilles with 10k-100k ETH have increased their participations to 16.793 million ETH, which suggests a strong accumulation.

At the same time, Exchange Netflows showed a sharp weekly peak of 84.22% in ETH outflows, which strengthened a bullish long-term image.

However, one whale recently sold 10,543 ETH at $ 2,476, with a loss of $ 2 million in just two days.

This lonely dump, although striking, does not necessarily undermine the wider accumulation trend. That said, it reflects the constant discomfort on a volatile market.

Source: Cryptuquant

What does $ 398 million do in USDT and $ 540 million in ETH signal?

Data on chains revealed an important shift: $ 398 million in Tether (USDT) flowing In Binance, while $ 540 million in ETH was withdrawn from centralized fairs on the same day.

This marks the largest ETH-Netto withdrawal of one day since the beginning of April, indicating that large holders will probably move assets to cold storage or deployment environments.

In the meantime, the enormous USDT inflow suggests that whales arm with dry powder to collect more ETH as it acts within an observed accumulation range.

Source: Cryptuquant

Of course this double movement refers to more than coincidence. It suggests that whales circling with precision.

More users come to a member of Ethereum, existing users stop

Interestingly, the Ethereum network saw an increase in new addresses of 18.73% last week. Nevertheless, active addresses fell by 3.18%, suggesting that existing users have withdrawn.

This divergence suggests that although the long -term interest in Ethereum is growing, the commitment in the short term cools down.

Therefore, although new users participate, existing existing may wait on the sidelines. This behavior is often seen during transition market stages when investors hesitate before the next big move.

Source: Intotheblock

Ethereum’s open interest drop With 3.29% to $ 16.02 billion, which emphasizes a reduction in speculative positions.

Traders seem to make Leveraged bets after the recent price rejection at $ 2,800. This decline reflects the risk-off sentiment as volatility peaks.

However, it can also indicate that the market is reset, so that weak hands are deleted before the next leg.

Is ETH Finding Support or Storage at important FIB levels?

Ethereum recently became $ 2,629, tailored to the 2,618 Fibonacci extension before he withdrew.

The current price is floating near $ 2,492, sitting between critical support and resistance zones. Stochastic RSI shows neutral momentum with values on 61.31 and 51.47.

That is why ETH can consolidate before a directional outbreak.

Price promotion around this FIB level must be closely viewed. If bulls above $ 2,292 (FIB 1,618) retain, the upward continuation remains possible.

Source: TradingView

Despite today’s decrease, Ethereum shows strong whale support and rising stablecoin inflow. Although the short -term volatility has caused insulated outputs, broader statistics indicate accumulation.

If buyers defend the current levels, a rebound to $ 2,800 remains possible.

Credit : ambcrypto.com

Leave a Reply