Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Ethereum has finally broken a key resistance level and acts above $ 1,900 after being pushed past the long -existing $ 1,850 barrier. This movement marks the start of an outbreak that many hoped for – but few expected to arrive so quickly. After weeks of hesitation, bearish pressure and uncertain momentum, ETH shows renewed strength, just as the wider market sentiment starts to shift.

Related lecture

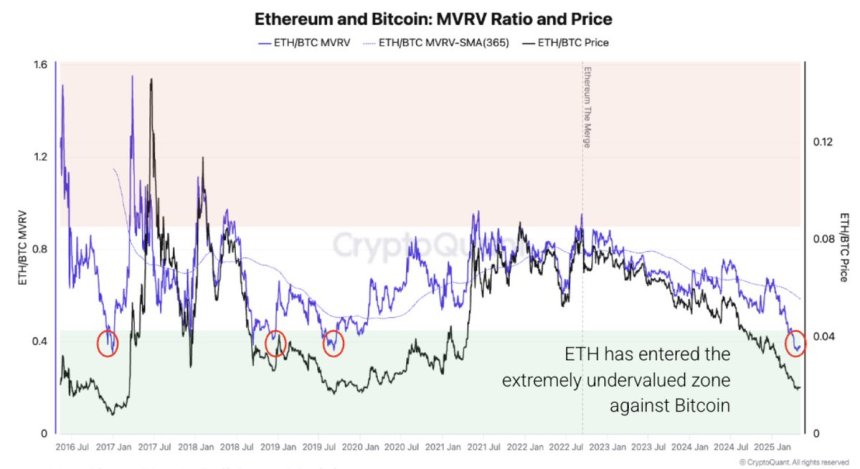

By adding weight to the outbreak, new insights from cryptoquant reveal that Ethereum is now extremely undervalued compared to Bitcoin, the first time this has taken place since 2019. Historically, such levels of ETH/BTC preceded periods of strong Ethereum -outformance. Although price promotion is at the forefront, on-chain data reinforce the bullish case, indicating that ETH can introduce a favorable phase in its cycle.

This renewed benefit comes in the midst of low expectations and wide skepticism, making it all the impact. Since ETH acts above $ 1,900, traders and investors are closely watching for follow-through and potential continuation to $ 2,000 and then. If history is a guide, the recent step of Ethereum may not be just a peak in the short term it can be the start of a larger trend removal, especially if the ETH/BTC valuation gap starts to close.

Ethereum flirts with $ 2,000 as undervaluation arouses bullish hope

Ethereum is now approaching the critical goal of $ 2,000, a level that, if recovered and retained, would confirm a technical outbreak and possibly herald a wider bullish phase. After weeks of slow movement and bearish pressure, ETH gains strength and shows signs of strength over both price action and on-chain statistics. A near $ 2,000 would mark a major shift in sentiment, which indicates renewed trust for both investors and traders.

However, risks remain. The constant tensions between the US and China continue to inject uncertainty in the worldwide markets, and the American Federal Reserve has shown no signs of pivot point. Because the interest rates are expected to remain increased and still quantitative tightening (QT) will remain in force, the macro -economic background remains a headwind. If these geopolitical and monetary factors relieve it, the outbreak of Ethereum could get persistent traction.

According to cryptoquantThe Ethereum-to-bitcoin MVRV (market value and realized value) Ratio emphasizes that ETH is now extremely undervalued compared to BTC-De first time that this has taken place since 2019. Historically, such conditions have led to strong periods of Ethereum Outperance.

Nevertheless, the bullish setup is confronted with some internal friction. Delivery pressure, weak demand on chains and flat network activity can block the momentum if the market sentiment does not improve any further. Although the current push of Ethereum is encouraging, the confirmation only comes with continuing movement over resistance and stronger Fundamentals. Until then, ETH will continue to slip at a critical moment, with the potential to lead the next part of the Crypto rally – or to slip back in consolidation as external and internal pressure.

Related lecture

ETH -Price analysis: Technical details

Ethereum is traded at $ 1,933 after a strong outbreak above the $ 1,900 resistance zone, which marks the highest level since the beginning of April. At the 4 -hour graph, ETH rose with an increased volume of approximately $ 1,850, with a consolidation range of several weeks breaking. This movement confirms Bullish Momentum and clearly brings the psychological level of $ 2,000 into sight.

The outbreak is further supported by the price that is now far above the EMA of 200 periods ($ 1,791) and the 200-Period SMA ($ 1,700) is supported. These long -term advanced averages had previously acted as a resistance, but have now been reversed in potential dynamic support. The strength of this rally indicates renewed purchase interest and a possible shift in market sentiment.

However, the next challenge lies in maintaining this upward momentum. Ethereum has to hold above the level of $ 1,900 – $ 1,920 to prevent a fake out and to confirm this outbreak as sustainable. A clean push by $ 2,000 would further validate the bullish structure and open the door for higher goals.

Related lecture

In general, the graph reflects a decisive technical outbreak, supported by volume and structure. If bulls remain under control and macro conditions remain stable, ETH could prepare for a stronger trend in the coming days.

Featured image of Dall-E, graph of TradingView

Credit : www.newsbtc.com

Leave a Reply