- The reimbursement of Ethereum and the growing accumulation can indicate the start of a marketbound

- Decrease in ETH Exchange Reserves on a potential supply squeeze and coming price rally

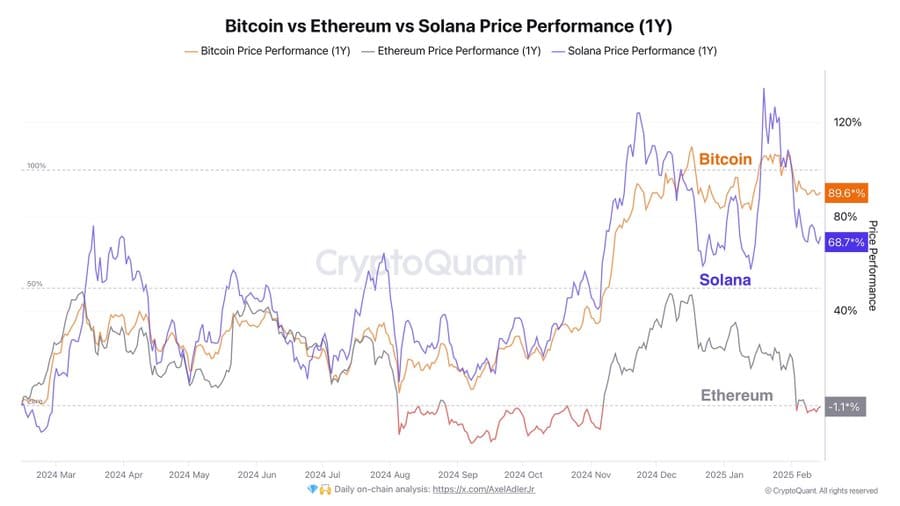

Ethereum [ETH] Has suppressed less than a year compared to his colleagues. However, new data on chains may indicate a possible shift. While ETH has fallen 1.1% on an annual basis, Bitcoin [BTC] and Solana [SOL] have made an enormous profit.

Now two important developments – the fall of transaction costs and accumulating accumulation – can be drawing of the growing trust of investors.

Can this indicate the start of a revival of Ethereum?

The lower reimbursements influence network activity and acceptance

The transaction costs of Ethereum have This week fell by more than 70%With total daily costs now at $ 7.5 million, a decrease of $ 23 million just a few weeks earlier. This decrease follows a recent increase in gas limit, which effectively expands the block capacity and reduces congestion.

Historically, lower costs are correlated with a higher network use. During earlier reimbursement, in 2021 and mid -2023, for example, daily active addresses and transaction officers will rise.

If this pattern applies, Ethereum could see a renewed increase in activities in the chain. However, what is crucial is whether this increase in the activity translates into persistent demand instead of speculative broadcasts in the short term.

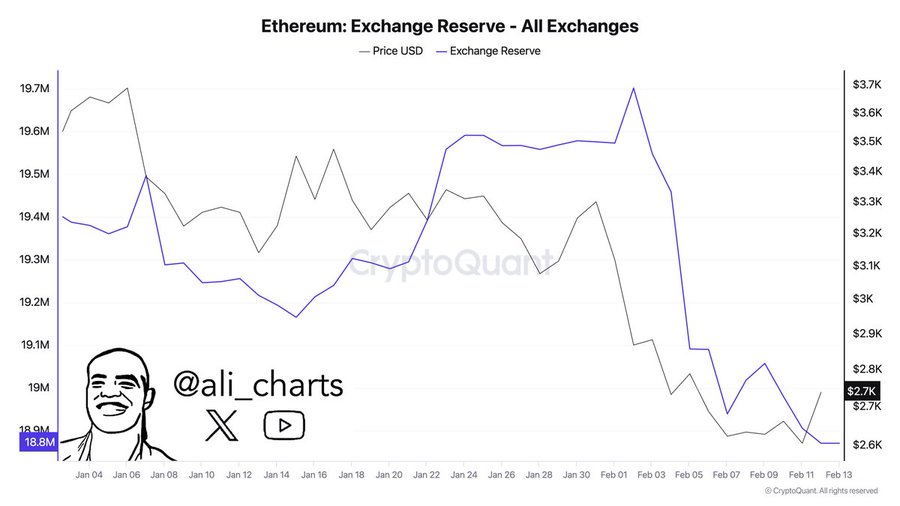

Signalert the sharp fall in ETH exchange reserves A supply?

Ethereum Exchange reserves have fallen sharplyFrom 19.7 million ETH in early January to 18.8 million ETH in just 10 days.

Such a sharp decline is a sign that investors move assets to self -coasts, making the immediate stock available for selling.

Source: X

Historically, such sharp drawings have often preceded price rallies. The last comparable decrease in the exchange reserve took place in Q4 2023, which was followed by a price die of 35% during the next two months.

If this price trend continues, Ethereum can be confronted with an offer. Especially when the demand returns together with lower reimbursements.

Technical indicators show a lack of bullish momentum

Source: X

Despite the improvement of on-chain statistics, however, at the time of the press, Ethereum was still down 1.1% yoj. It was left with Bitcoin (+89.6%) and Solana (+68.7%).

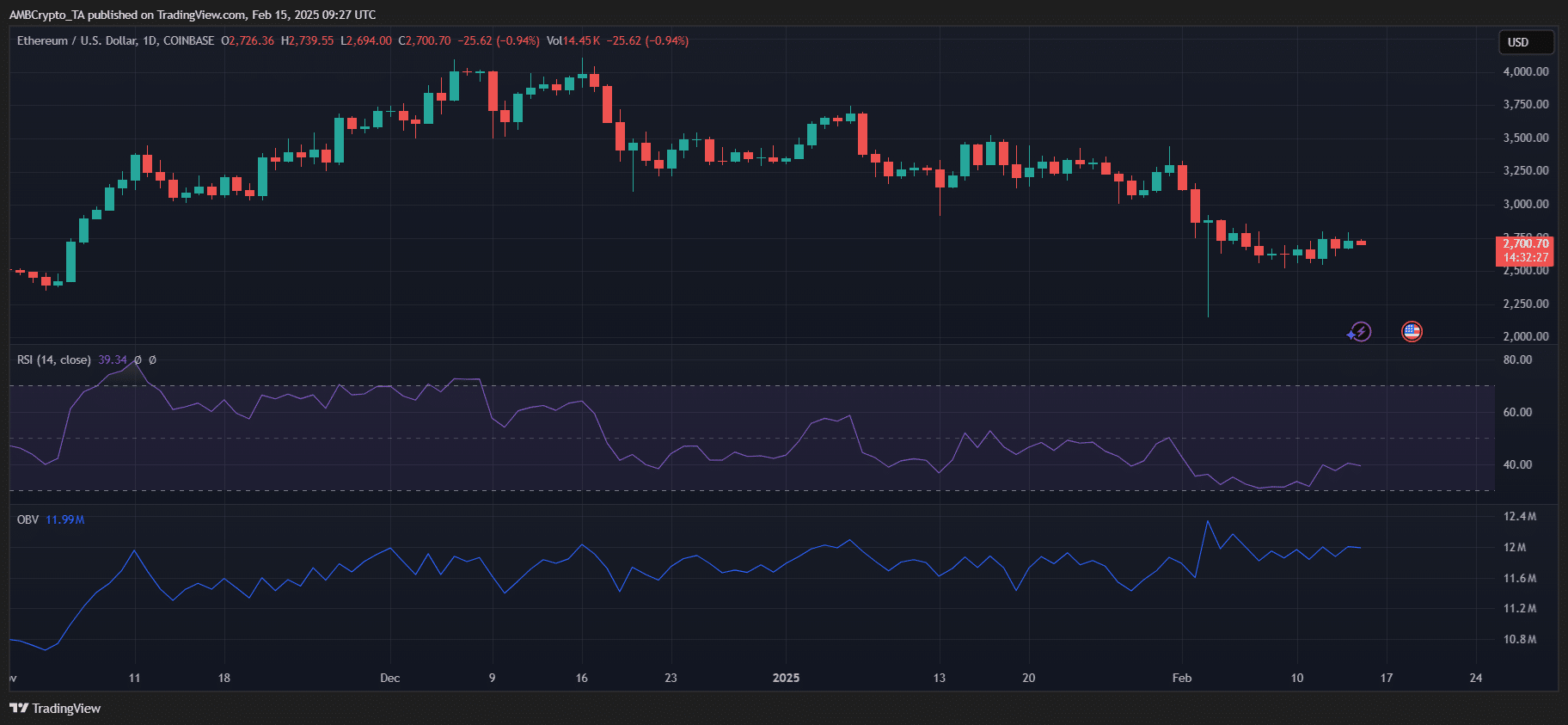

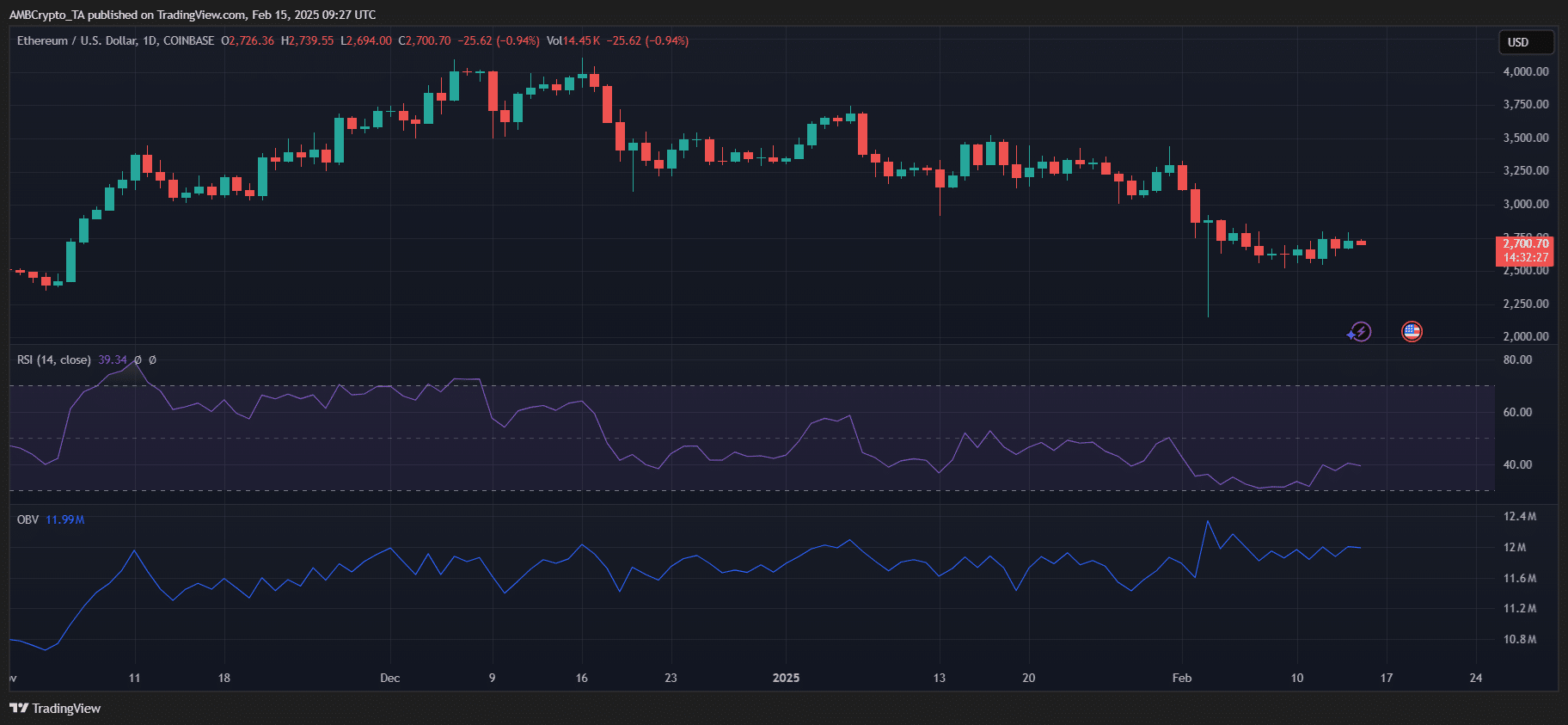

Source: TradingView

Recent data also emphasized a strong resistance around $ 2,800, with ETH struggling to break above it despite increasing accumulation. The RSI was at 39.34, indicating that although Ethereum can be almost over -sold circumstances, it should not get a bullish momentum yet.

Moreover, the OBV showed a lack of strong purchasing pressure – a sign that although the supply has been tightened, demand has to rise.

To break out ETH, it needs a decisive push beyond the range of $ 2,800- $ 2,900 supported by an increasing volume. If this fails, a retest of $ 2,500 remains a possibility for a long -term advantage.

Credit : ambcrypto.com

Leave a Reply