Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

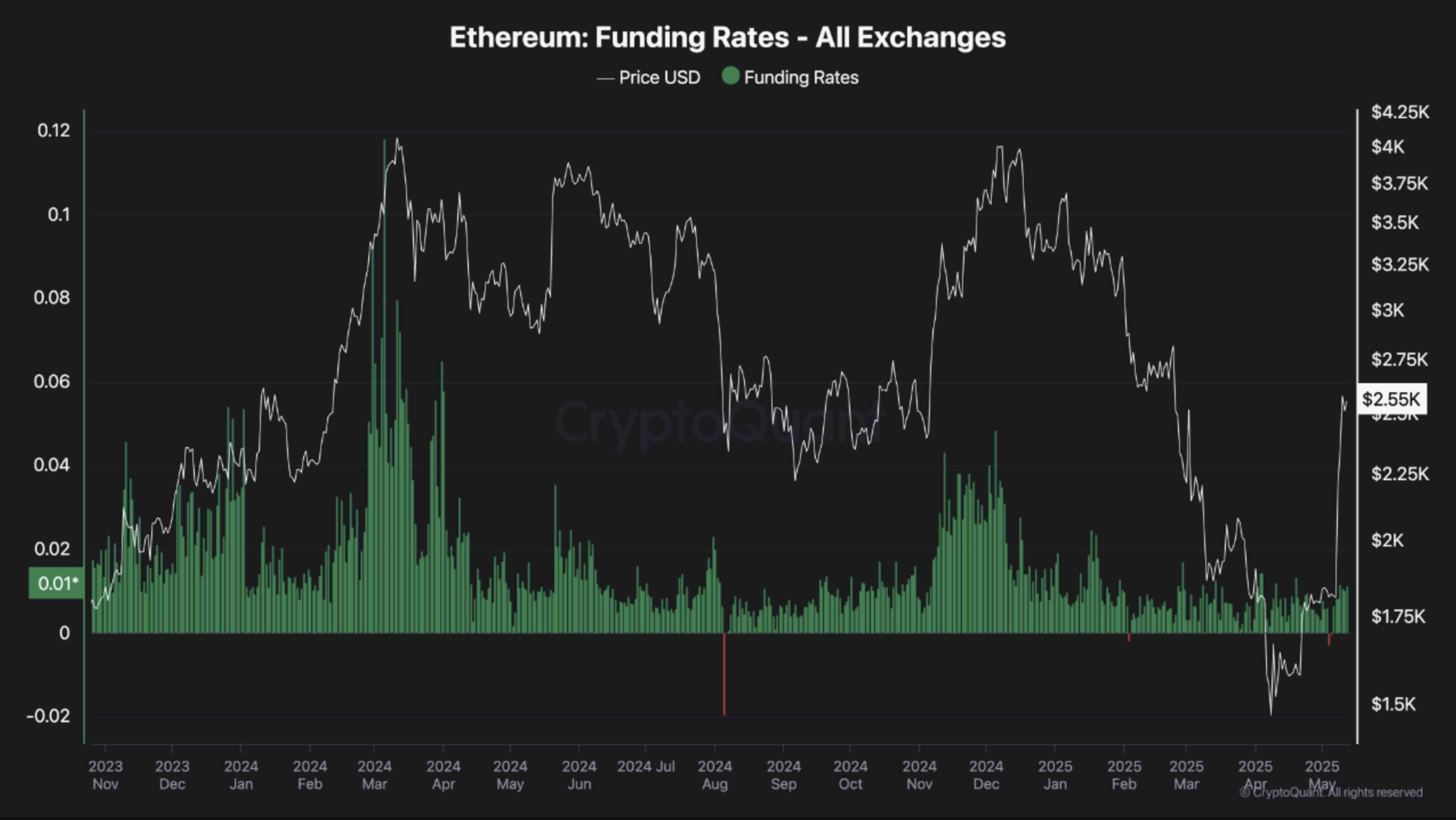

Ethereum (ETH) has risen by more than 40% over the past two weeks and traded in the middle of $ 2,000 at the time of writing. It is remarkable that several important indicators suggest that the current ETH rally is more powered by the demand for spot market than the lever trade – an encouraging sign of a potentially sustainable Bull Run.

Ethereum rally powered by the spot demand

After the majority of the past year stay behind with other large cryptocurrencies such as Bitcoin (BTC), Solana (SOL) and XRP, ETH now shows signs of an organic upward trend. According to cryptoquant analyst Shayanmarkets, the present momentum seems to be primarily spot-powered, rather than fueled by speculative futures trade.

Related lecture

In a recent cryptoquant Quicktake post, Shayanmarkets emphasized that ETH financing percentages have remained ‘relatively flat’ despite the price buttons. This is important because the financing percentages are usually a reflection of sentiment in the Perpetual Futures market.

To explain it, the financing rates are periodic payments exchanged between traders in eternal futures contracts to coordinate the contract price to the spot price of the active. Positive financing figures indicate that long positions pay shorts, usually signaling for bullish market sentiment, while negative rates suggest a bearish sentiment.

In the case of Ethereum, fixed financing percentages during this recent rally indicate that the upward price promotion is powered by real buying on the spot market, no speculative leverage. This makes the upward trend less susceptible to sudden reversations caused by mass liquidations. As Shayanmarkets noted:

Nevertheless, the financing percentages must start to rise to maintain and validated the bullish momentum, which reflects greater trust and more aggressive positioning by futures traders.

Meanwhile other analysts to predict Further upside down for ETH. For example, noted Crypto analyst Ali Martinez recently noted that if ETH decisively can break the resistance level of $ 2,380, it could then enter a new bull rally.

In his last X -post, Martinez emphasized that the new critical support range of ETH is between $ 2,060 and $ 2,420. The analyst noted that nearly 10 million portfolios have more than 69 million ETH between these levels.

New ETH Ath on the horizon?

Although Ethereum was reached far below its all-time High (ATH) of $ 4,878 in November 2021, many market guards believe that a new ATH can be for the second largest cryptocurrency per market capitalization on the horizon.

Related lecture

In the same spirit, crypto analyst Titan from Crypto recently noticed that ETH is following a V-shaped recovery. The analyst shared the next weekly graph that compares BTC and ETH price action, and predicts that ETH is probably to follow BTC’s process.

Meanwhile, analyst Ted -pillows sketched Five Bullish Factors that can push ETH to $ 12,000 in 2025 to $ 12,000-inclusive legal developments and strong inflow into spot-exchange-related funds (ETF). At the time of the press, ETH acts at $ 2,555, an increase of 3% in the last 24 hours.

Featured image made with Unsplash, graphs of cryptoquant, X and TradingView.com

Credit : www.newsbtc.com

Leave a Reply