- An increase in Ethereum Layer 2 solutions has discharged some transactions.

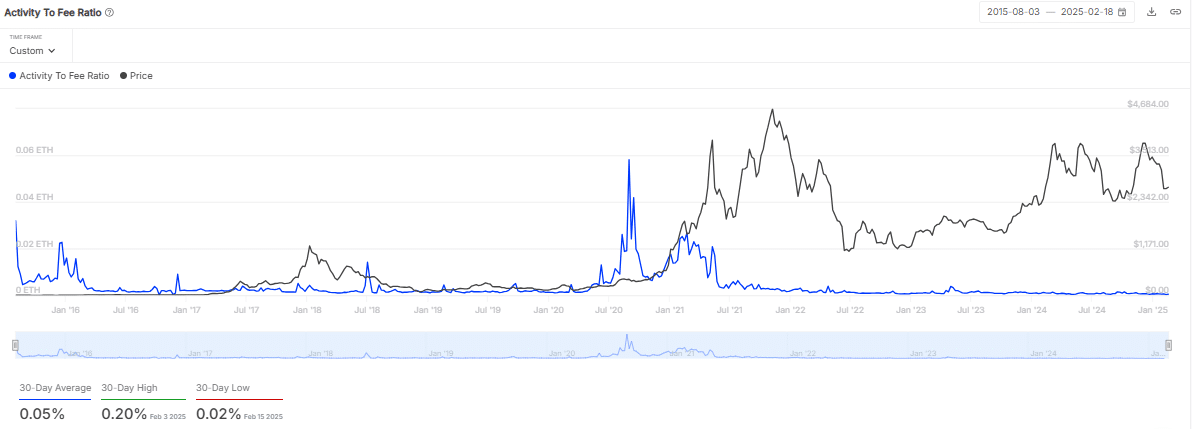

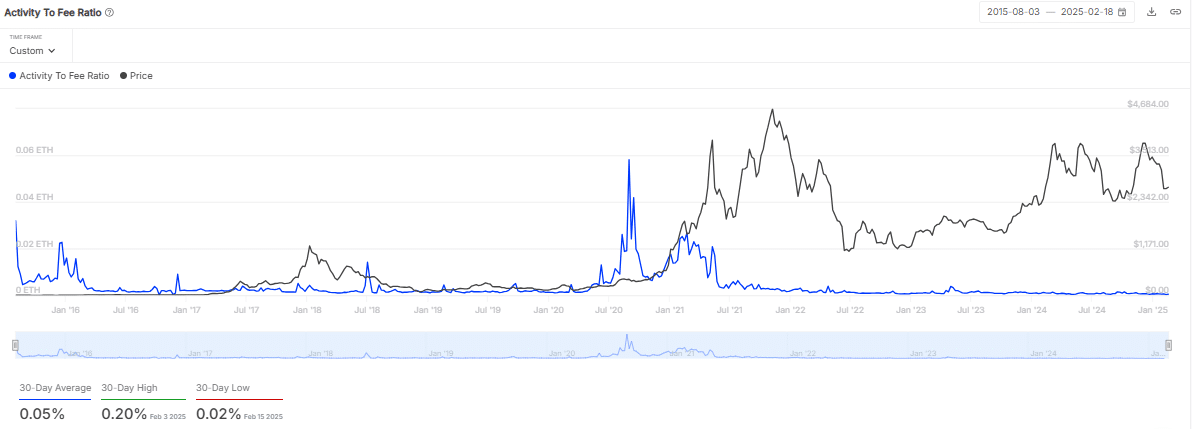

- Reduction of network activity as an activity to reimbursement that reflects the ratio can have a hand in this decline.

Ethereum’s [ETH] Blockchain, which stands in the center to feed many projects in the crypto ecosystem, including Defi and NFTs, witnessed a stunning crash of 70% in gas costs, making a low of four years from 20 February.

The daily costs fell from $ 23 million to $ 7.5 million.

According to data from Intotheblock, the average gas price has plummeted to around 5 Gwei, which translates to around $ 0.80 per transaction-a sharp decrease in the $ 20-plus costs that were seen during peak activity in 2024.

Source: Intotheblock

As a result, analysts and users have thought behind the forces behind this drop. Two primary drivers were increasing in Ethereum L2S that carried out transactions and a decrease in the activity of the Mainstet Network activity.

Rise of Ethereum L2 Solutions

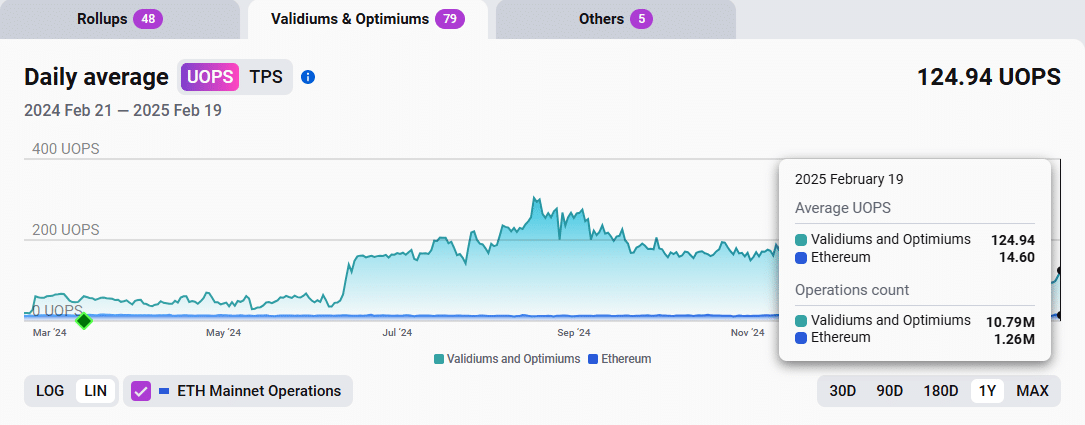

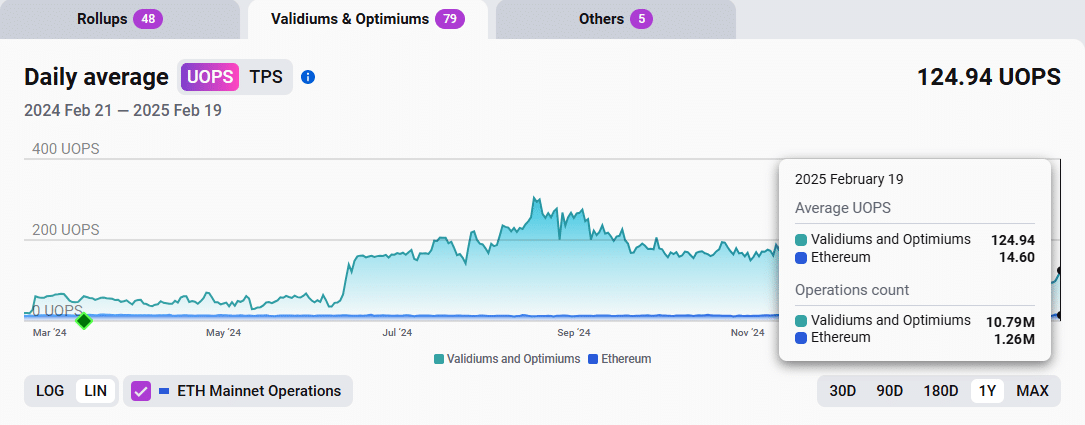

The rise of L2 solutions such as Arbitrum [ARB]Optimism [OP]and basis, which transactions off-chain process while using Ethereum’s protection has been one of the factors that contributes to the low cost values.

L2 networks now deal with more than 1.5 million daily transactions combined, an increase of 800,000 a year ago.

After the Dencun -Upgrade that introduced “Blobs” to lower L2 data costs, the gas costs on these networks fell by no less than 90%, with a few costs purely money.

For example, the average reimbursement of arbitrum is now $ 0.15 compared to $ 2 before the upgrade. This cost efficiency has transferred the activity of the mainnet, which makes the congestion and oblique costs facilitated.

Source: L2Beat

For rollups, data is posted, but still reducing the activity on the Miret.

Validations and optimixs, similar to rollups, also post periodic state obligations of transactions that are validated by Ethereum, but data is not placed on the minstet.

Falling network activity

In the meantime, Eth’s Maveti saw a delay with a decrease in daily transactions of 1.2 million in January 2024 to just over 900,000 in February 2025.

This dip voted in accordance with volumes on Dex’s who fall to $ 2.62 billion daily, against a peak of 2024 of $ 5 billion.

The decreasing hype around memecoins and speculative NFT drops has further soften the demand for block space.

Since the Dencun upgrade, ETH issue has surpassed Burns with 197,000 ETH, or $ 500 million, which indicates a reduced pressure in reimbursement.

Source: Intotheblock

Cheaper transactions can stimulate acceptance, but there is potential for challenges because L2 fragmentation could dilute liquidity.

Since L2s such as base – continuing to flower with $ 8 billion in TVL – can evolve the Mainnet from Ethereum to a securityback bone instead of a transaction interest.

Credit : ambcrypto.com

Leave a Reply