- ETH retreated below $2,600 after encountering strong resistance above $2,700.

- The pullback could be a trap that could set ETH up for a potential short squeeze as leverage rises.

Ethereum [ETH] was on the third day of a bearish retracement after encountering resistance above $2700. However, there is speculation that the downturn could be short-lived.

A recent one CryptoQuant Analysis suggested that ETH short positions have risen above the $2,700 price level.

This confirmed that many were expecting a retracement due to previous resistance at this price level. Currently, selling pressure has overtaken demand, pushing the price to $2584 at the time of writing.

The analysis warned that the rise in shorts and demand for leverage could expose ETH to a short-squeeze scenario.

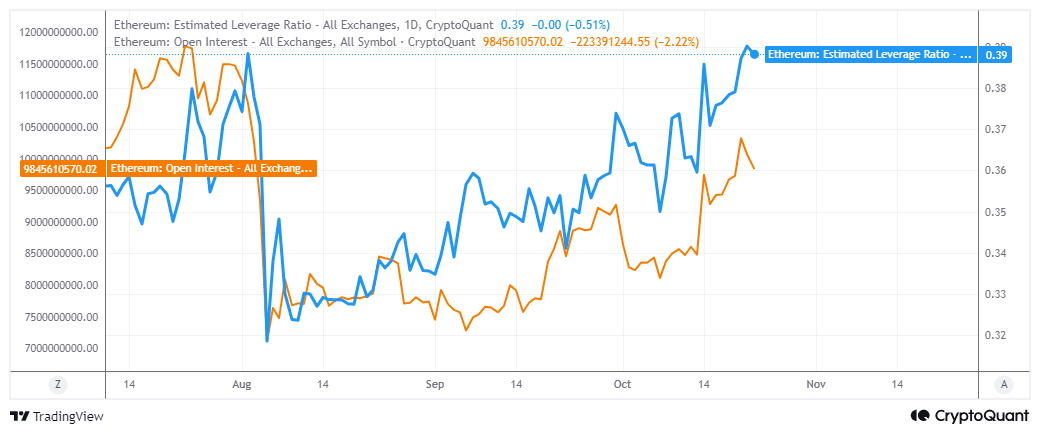

Ethereum’s open interest has increased since September 6. This indicated a renewed interest in the derivatives segment.

More importantly, ETH’s estimated leverage ratio has recently risen to levels last seen in early July.

Source CryptoQuant

A rise in over-indebted short positions could underline fertile ground for whales to shake things up by driving up prices. But what are the chances of this happening?

Assessing ETH Demand to Establish a Short Squeeze

The biggest sign that a short squeeze could be coming was if the whales started to rally aggressively.

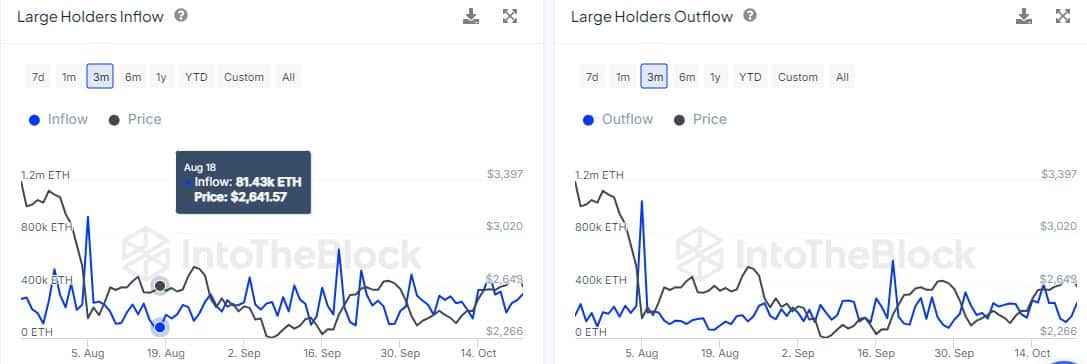

According to statistics from IntoTheBlock, ETH flow to major holder addresses grew from 194,280 coins on October 19 to 335,870 coins on October 22.

This confirmed that large holders have accumulated more ETH as prices fell.

Source: IntoTheBlock

On the other hand, large holder outflows grew from 122,380 ETH on October 20 to 267,180 ETH on October 22.

This meant that the amount of Ethereum sold was slightly higher than the net purchases, which is in line with the bearish price action during the same period.

Even though bears dominated, large holders bought more coins than they sold. In the last 24 hours, they purchased 68,690 ETH, worth over $177 million.

The data suggests that an attempt by the whales to push the price back up may already be in play.

Read Ethereum’s [ETH] Price forecast 2024-25

This means the coin could be poised for an interesting second half of the week, possibly marked by another rally and an attempt to break past the latest resistance zone.

Ethereum has been prone to volatile conditions, and the level of Open Interest and need for leverage have increased.

Credit : ambcrypto.com

Leave a Reply