Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Ethereum is at a critical moment after breaking from above the most important resistance, but fails to maintain the momentum in the direction of the psychological level of $ 3,000. The recent increase brought optimism to the market, but ETH has now withdrawn something and struggled to expand the profit as global uncertainty weighs on sentiment. With macro pressure on assembly and negotiations between the US and China about a potential trade agreement in Focus, the wider market seems to wait for clarity before taking his next decisive step.

Related lecture

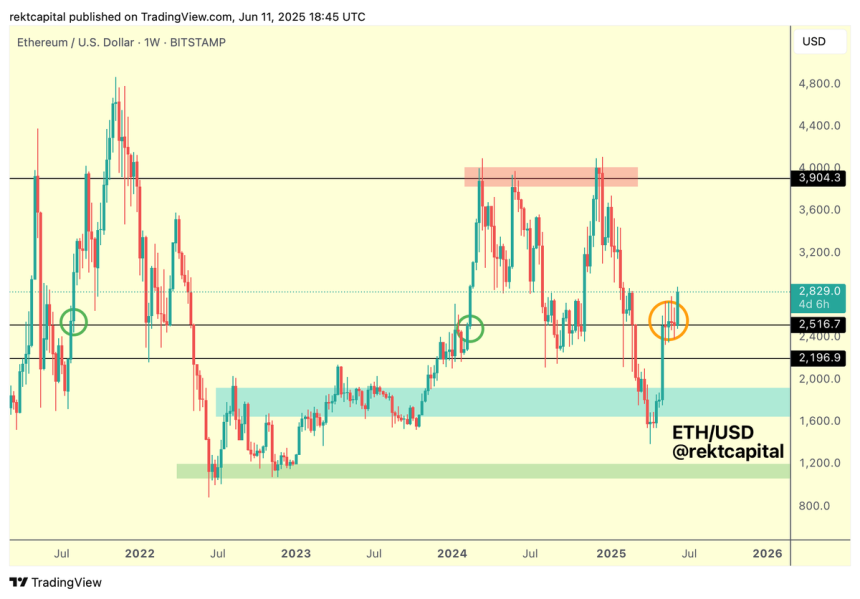

Top Analyst stretches Capital stretching historical context at the current Ethereum set -up, pointing to two earlier cycles where ETH successfully tested the $ 2,500 level before launching to $ 4,000. In August 2021 and again at the start of 2024, EH $ 2,500 held strong support (green circles), as the basis for a large breakout rally. This repeating pattern now allows investors to look at the same level with growing interest.

Because Ethereum acts in the vicinity of $ 2,750 – $ 2,800, in the coming days it could determine whether this current setup will be mirrored beyond Bullish Cycli – or whether the momentum fades again. With strong support below and a clear historical route map above, the ability of ETH to regain strength can activate the next leg in what many believe that the beginning of the altealth season can be.

Ethereum reflects past patterns prior to potential outbreak

Since the LOTTEPPEN OF ATTRACTION, Ethereum has more than 100% realized, with a powerful momentum and increased activity at current levels. After having briefly made a local high in the vicinity of $ 2,830, ETH has been withdrawn somewhat, but remains strong above the $ 2,750 figure-an important area that now acts as a short-term support. The strength of this rebound feeds the growing speculation that Ethereum may not only prepare itself on another leg, but also sets the tone for a wider altea season.

Analysts across the board keep a close eye on the current consolidation of ETH, in which many historical patterns quote as a reason for optimism. Remarkable, Stretches capital emphasized A recurring pattern that previously led to important meetings. In August 2021, Ethereum successfully tested the $ 2,500 level as support before he rose to around $ 4,000. The same happened at the beginning of 2024, when Eth again bounced from $ 2,500 and came to the same zone.

Now, the past five weeks, Ethereum has repeatedly confirmed the level of $ 2,500 as solid support, which seems to be a basic book of a textbook for another important step. This battery phase – the past Cycli – has convinced that many traders are convinced that ETH could soon reclaim $ 3,000 and lead Altcoins higher.

With macro conditions still uncertain and market participants who are looking for signals in force, the behavior of Ethereum has extra meaning at these levels. If ETH can maintain its position above $ 2,750 and construct Momentum up to $ 2,830, the market could see an explosive shift in sentiment, which may activate the next phase of the bull’s cycle. For now, all eyes stay on Ethereum while it is the top of his multi-week range with bullish conviction.

Related lecture

ETH applies above the breakout zone after $ 2,830 rejection

Ethereum is currently trading at $ 2,749 on the 4-hour graph, with an important breakout zone between $ 2,700 and $ 2,740 after a brief rejection at $ 2,830. After he broke above this resistance of several weeks last week, ETH rose to higher territory before he withdrew into the last few sessions. Despite this renewal, the price has so far maintained support over the previous resistance area and now acts as a strong demand zone.

This range – heyed by the yellow box on the graph – served almost a month like a ceiling before it was supported during the outbreak. Ethereum now consolidates directly above this area and as long as it remains above 50 and 100 simple advancing averages (SMAs), the bullish structure is intact. The volume has started to cool somewhat, which suggests that traders are waiting for a decisive movement – either a struiting to $ 2,800 – $ 2,900 or a demolition below $ 2,700.

Related lecture

A successful grasp of this support zone could confirm the retest and build Momentum for a new attempt. However, not holding $ 2,700 ETH could view the 200 SMA around $ 2,570. For the time being, Ethereum remains technically strong, but traders are closely monitoring for confirmation.

Featured image of Dall-E, graph of TradingView

Credit : www.newsbtc.com

Leave a Reply