- After the market had fallen, 7 brothers and sisters issued 28.75 million DAI to buy 12,070 ETH for $ 2,382 again.

- Eric Trump tweeted “buy the dips”, this means that it is now the right time to buy ETH?

While the cryptomarkt was confronted with decline, the wallet continued to invest ‘7 brothers and sisters’ strategically heavily in Ethereum [ETH] who showed their remarkable market optimism.

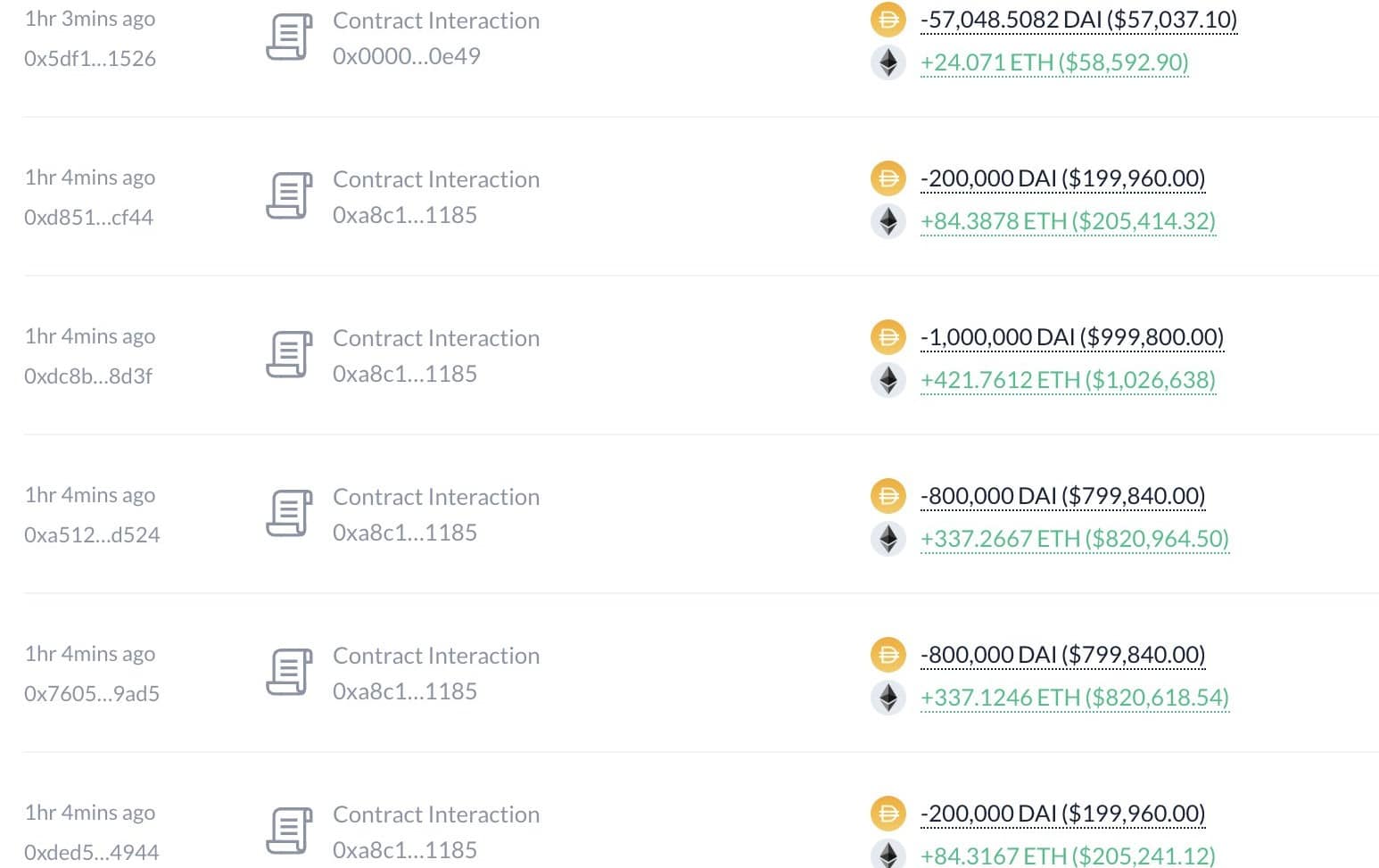

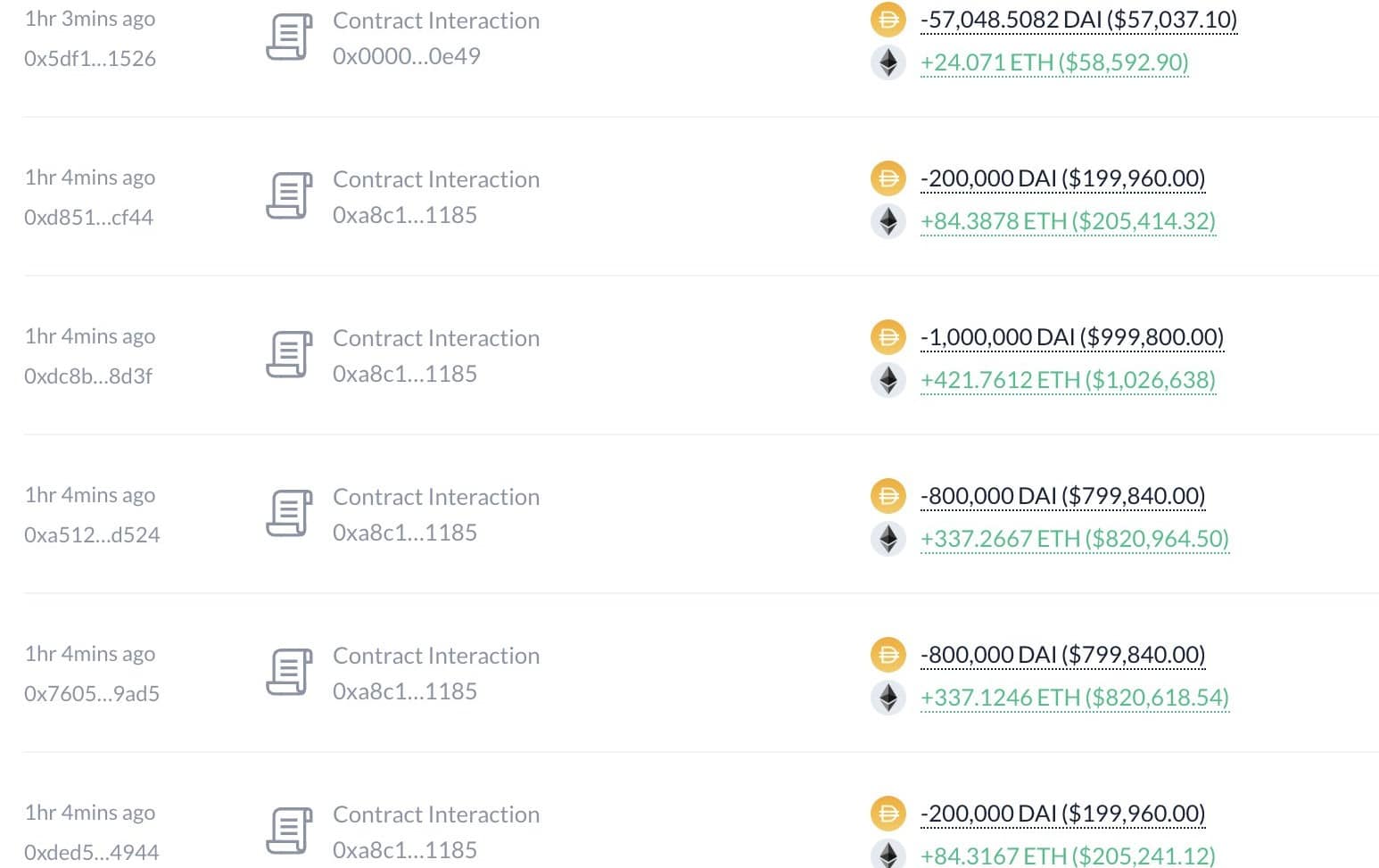

Recent transaction data showed that ‘7 brothers and sisters’ exchanged a stunning DAI of 28.75 million within a short window to acquire 12,070 ETH, with each unit at around $ 2,382 prices.

This repeated their last purchase when ETH fell at similar levels.

This purchase was part of a broader strategy that was clear by their company of 1.15 million ETH, with a value of around $ 2.8 billion, in just two portfolios.

By observing their investment pattern, it can confirm that the ‘7 brothers and sisters’ have bought any important dip on Ethereum.

Source: Lookonchain

This aggressive acquisition took place in the midst of wider market discomfort, which suggests a strong belief in the long -term value of Ethereum.

Their actions were tailored to public sentiments repeated the son of President Donald Trump, Eric Trump, whose recent tweet reflected the timing of the purchases of 7 brothers and sisters. Trump wrote on X;

“₿uy the dips !!!”

Such notes often catalyze broader investor’s interests. If the trend persists and more large holders increase their participations during dips, ETH could strengthen the market position.

Conversely, if the wider market does not stabilize, even substantial purchases might not prevent a potential decline.

What is the next step as an ETH price campaign on the sold -off territory?

The Ethereum’s price points for potential purchases when the sold -off territory arrived, according to the latest RSI lecture. This marks a potential turning point for investors. ETH won more than 6% at the time of a sharp drop in the last 24 hours after the sharp drop.

The RSI, which recently fallen below 30, began to vary positively, which indicates the reduction of downward momentum, even if prices continue to fall. This suggests that although sellers have been aggressive, sales pressure can tire itself.

ETH prices have fallen consistently since the beginning of the year, but are now approaching a critical level of around $ 2,480.

If this level applies, this can indicate a reversing point for the market, whereby a purchase option is offered for those who view these technical indicators.

Source: TradingView

Historically, such RSI abnormalities have often preceded remarkable recovery in the price of Ethereum.

If the sentiment shifts, reinforced by macro -economic factors and the activity of large holders, ETH could recover higher resistance levels that are seen in December 2024.

Conversely, if the support fails under continuous sales pressure, prices can fall further, which means that lower thresholds are lower than $ 2,000.

This scenario would require greater caution because it could indicate a more extensive Bearish phase before a recovery holds.

Credit : ambcrypto.com

Leave a Reply