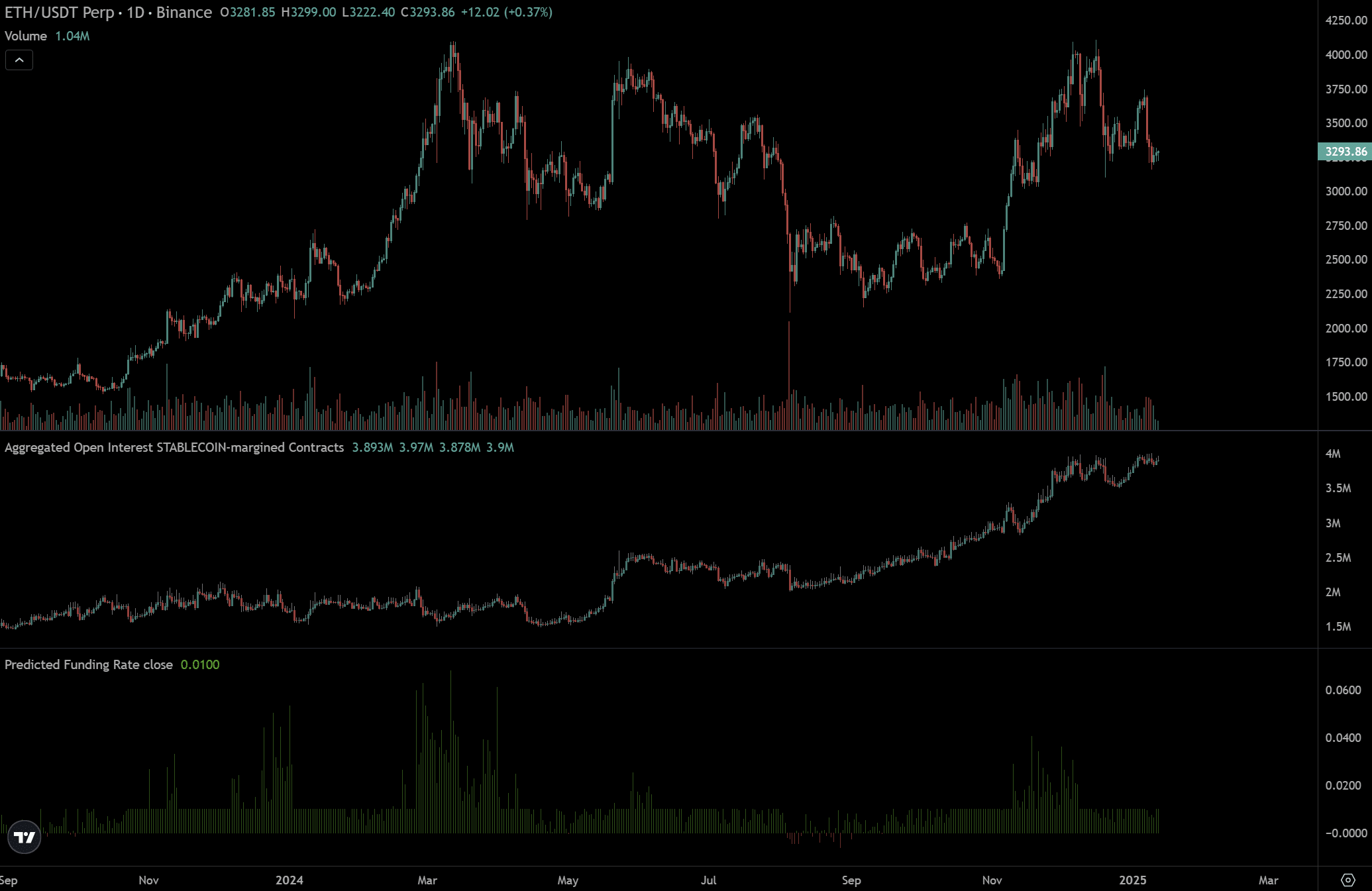

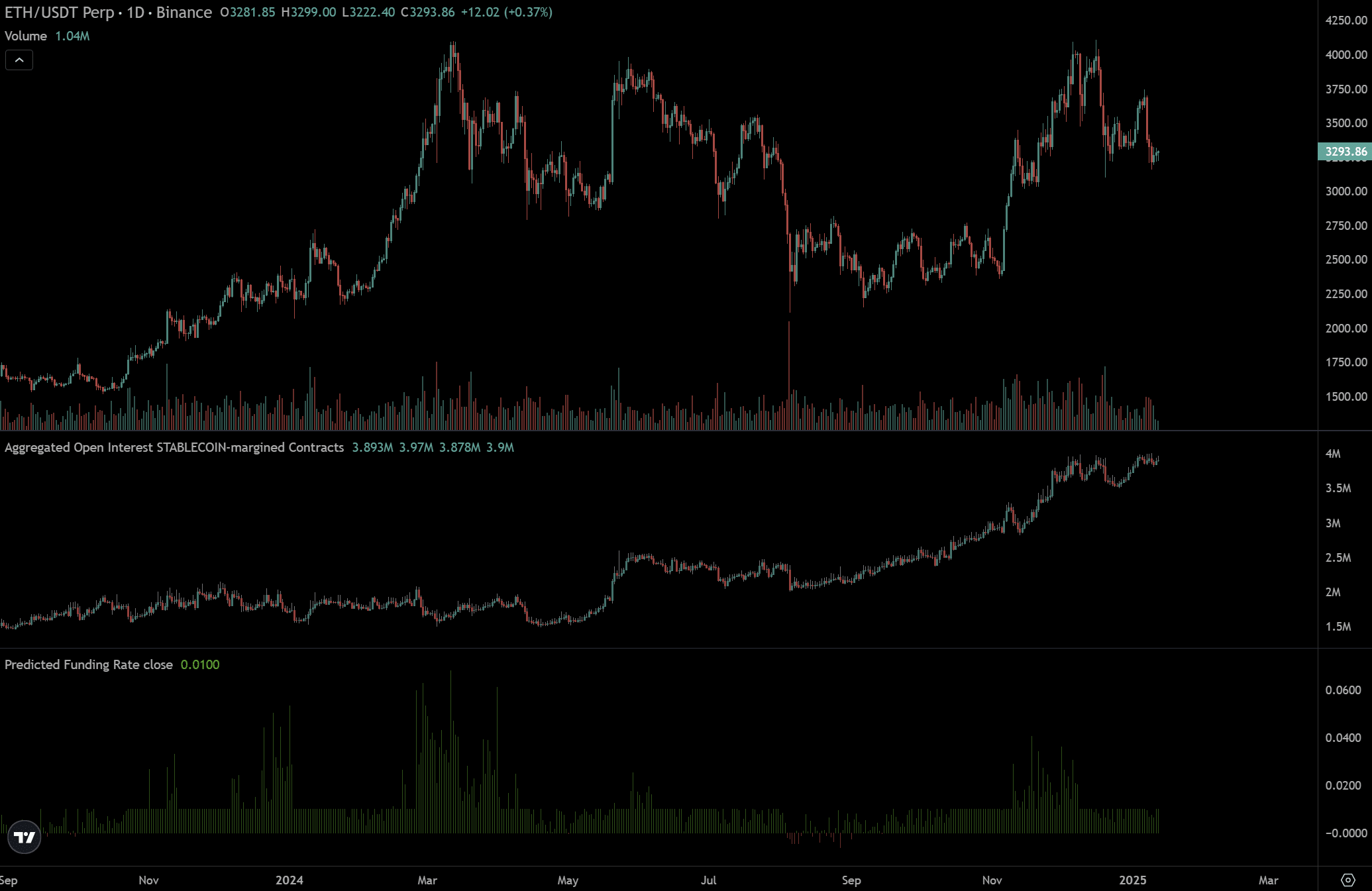

- ETH’s leverage has increased to $10 billion in two months.

- Historical trends indicated that high leverage could negatively impact the value of ETH.

Despite the first quarter being historically bullish Ethereum [ETH]The altcoin’s massive $10 billion leverage could expose it to liquidation risks and limit its upside potential.

Andrew Kang, co-founder of crypto VC firm Mechanism Capital, predicted that ETH could remain tied ($2K-$4K) due to this leverage risk. He declared,

“$ETH has added more than $10 billion in leverage since the election. This settlement will be painful, but $ETH will not go to zero. It will easily range from $2,000 to $4,000 for a very long time.”

Source:

Before the US election, ETH (borrowed assets for speculative trading) leverage was $9 billion. In December, it shot up to more than $19 billion.

Afterwards, the sharp price drop liquidated several positions and dragged ETH to around $3.1K.

Will Leverage Derail ETH’s Advantage?

Kang added that the ETH basis trading powered by CME Futures had little impact on the massive leverage as it was “delta neutral”: any ETH bought on the spot market has been shorted on the Futures market. Instead, he blamed speculative traders for the excessive leverage.

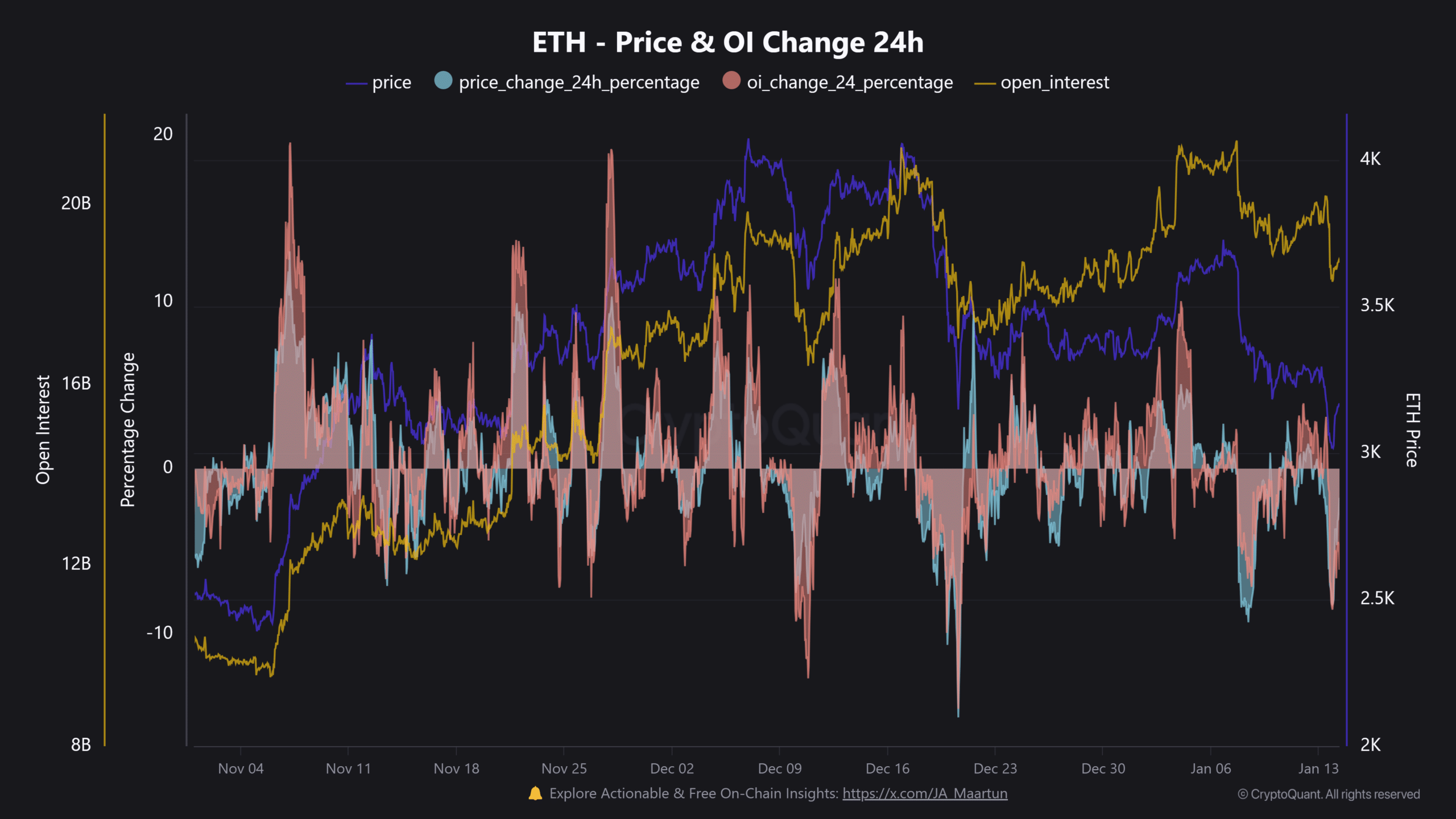

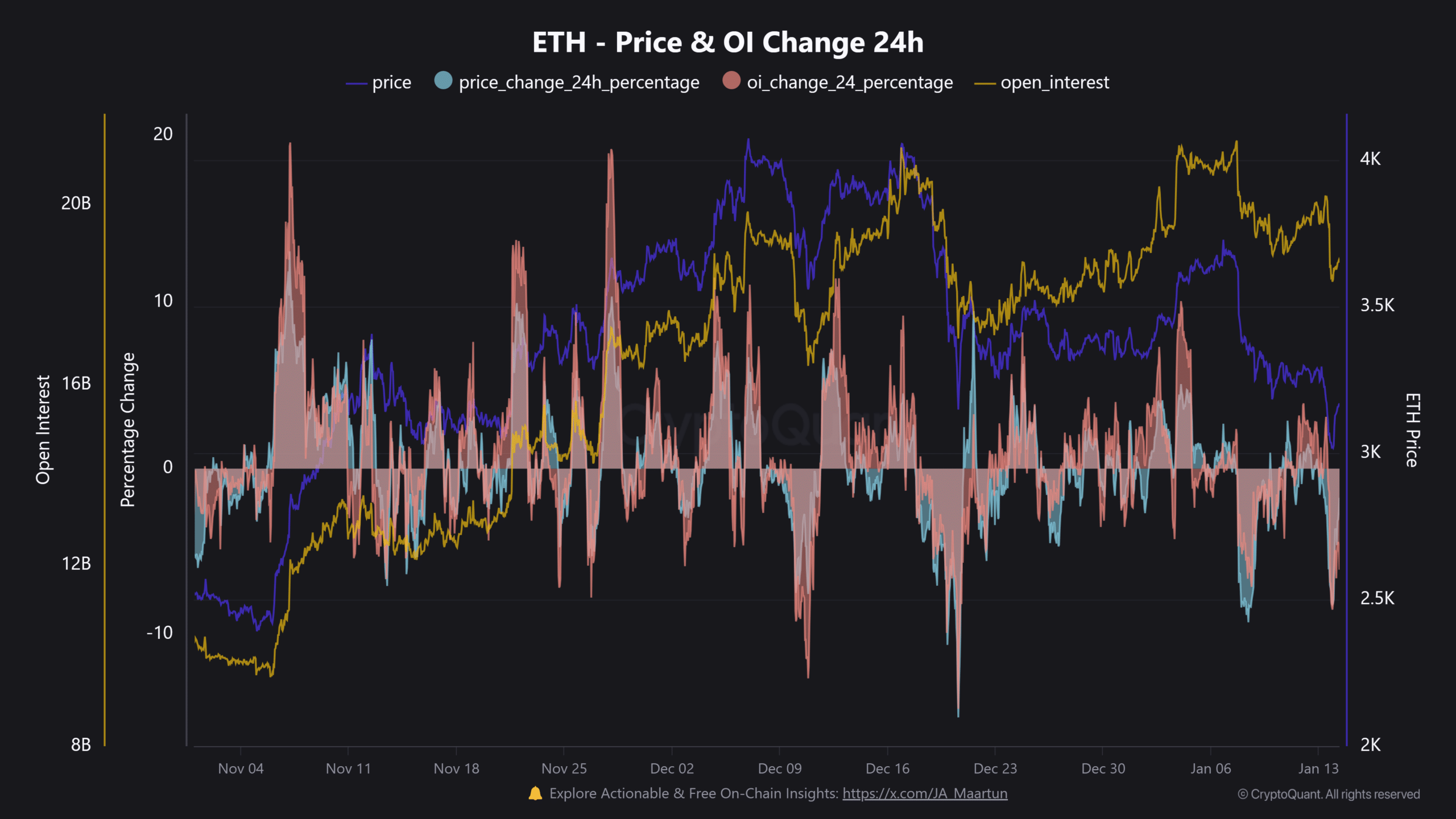

The historic ETH leveraged pump confirmed Kang’s concerns. When the leverage Open Interest rose more than the price during the rally, in most cases a pullback and a local top followed.

Source: CryptoQuant

This was clearly visible in early November and late December. They both escalated ETH liquidations.

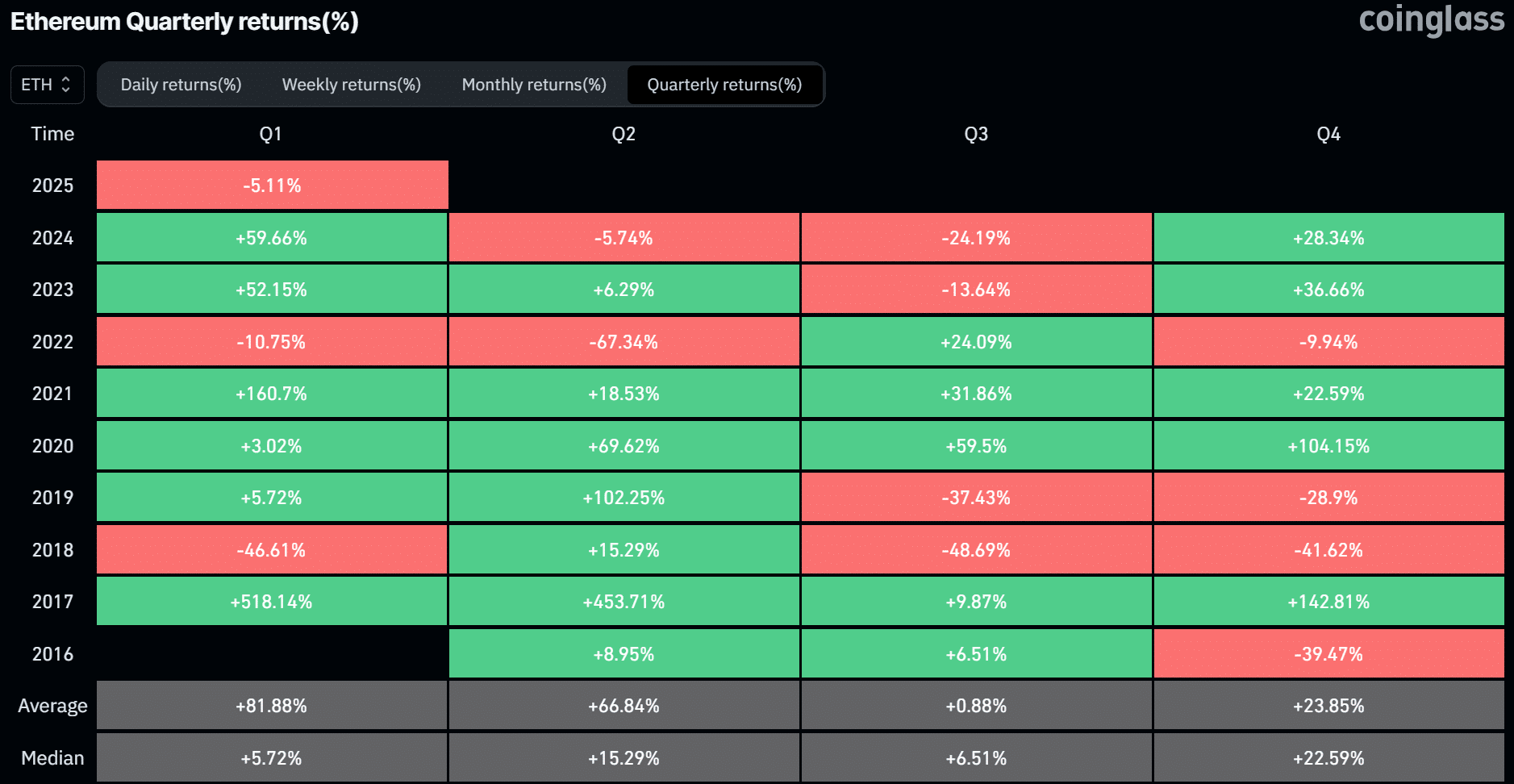

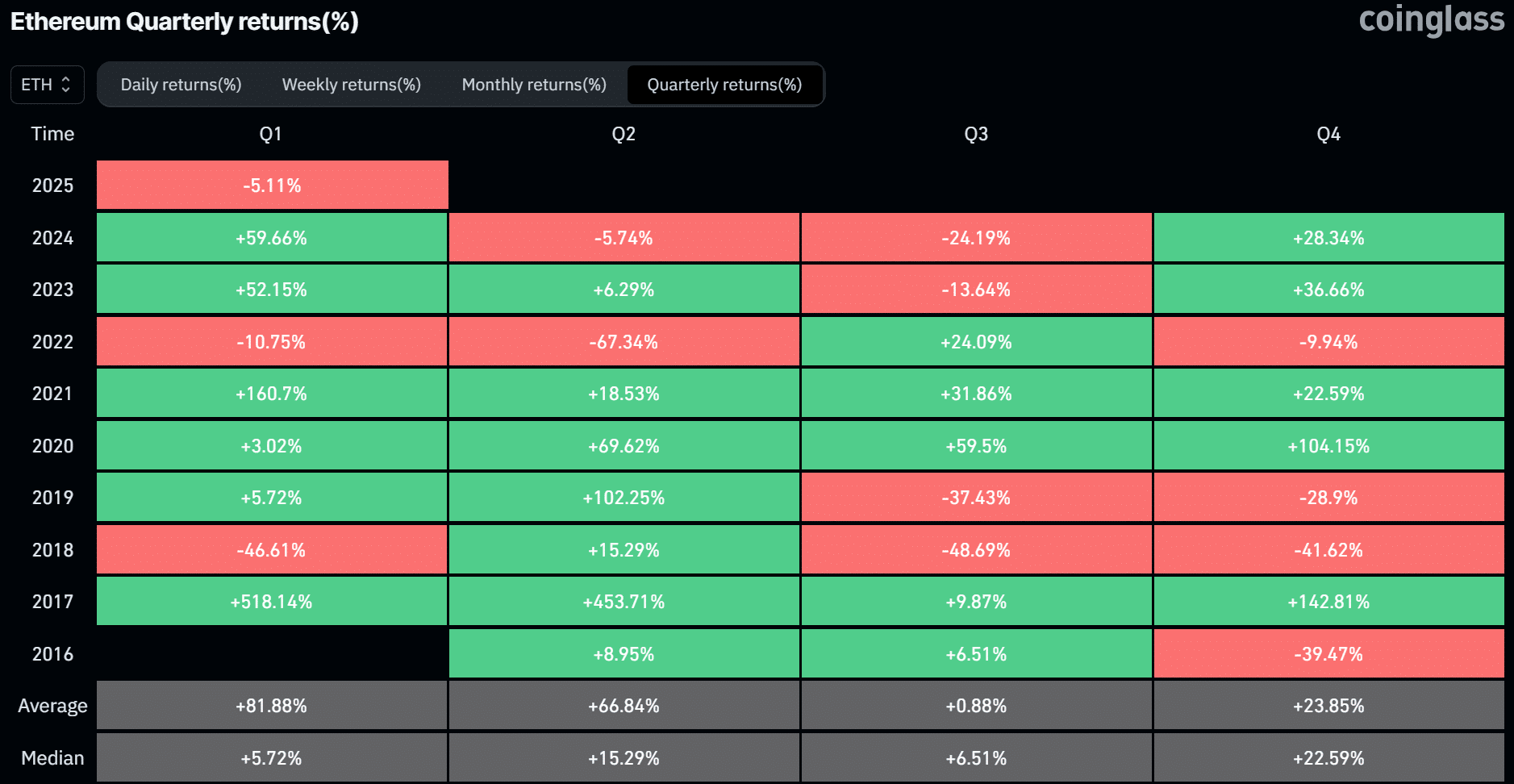

In fact, on December 20, ETH recorded more than $300 million in liquidations, with long positions dominating the losses. That said, Coinglass’ data showed that the first quarter has consistently been ETH’s strongest performance, with an average gain of 81%.

Out of the last seven years, ETH closed only two quarters (Q1s) in the red. Simply put, if historical trends repeat, ETH could post significant gains in the first quarter of 2025.

Source: Mint glass

However, the looming liquidation risk could limit the price upward expectation. At the time of writing, ETH was back above $3K, having fallen sharply to $2.9K following Monday’s bearish move.

Credit : ambcrypto.com

Leave a Reply