- Pepe Bulls continued to defend the 78.6% retracement level.

- Due to the lack of high buying volume, momentum was neutral and a strong rally was not yet in sight.

Pepe [PEPE] saw on-chain metrics weaken but posted short-term gains in recent days. Active addresses were down and trading volume wasn’t high either, with whales also showing signs of moving to the sidelines.

The price action chart showed that the crucial Fibonacci retracement level was still a support. As long as it remains standing, the Pepe bulls retain their hope.

Pepe’s volatility can jeopardize swing positions

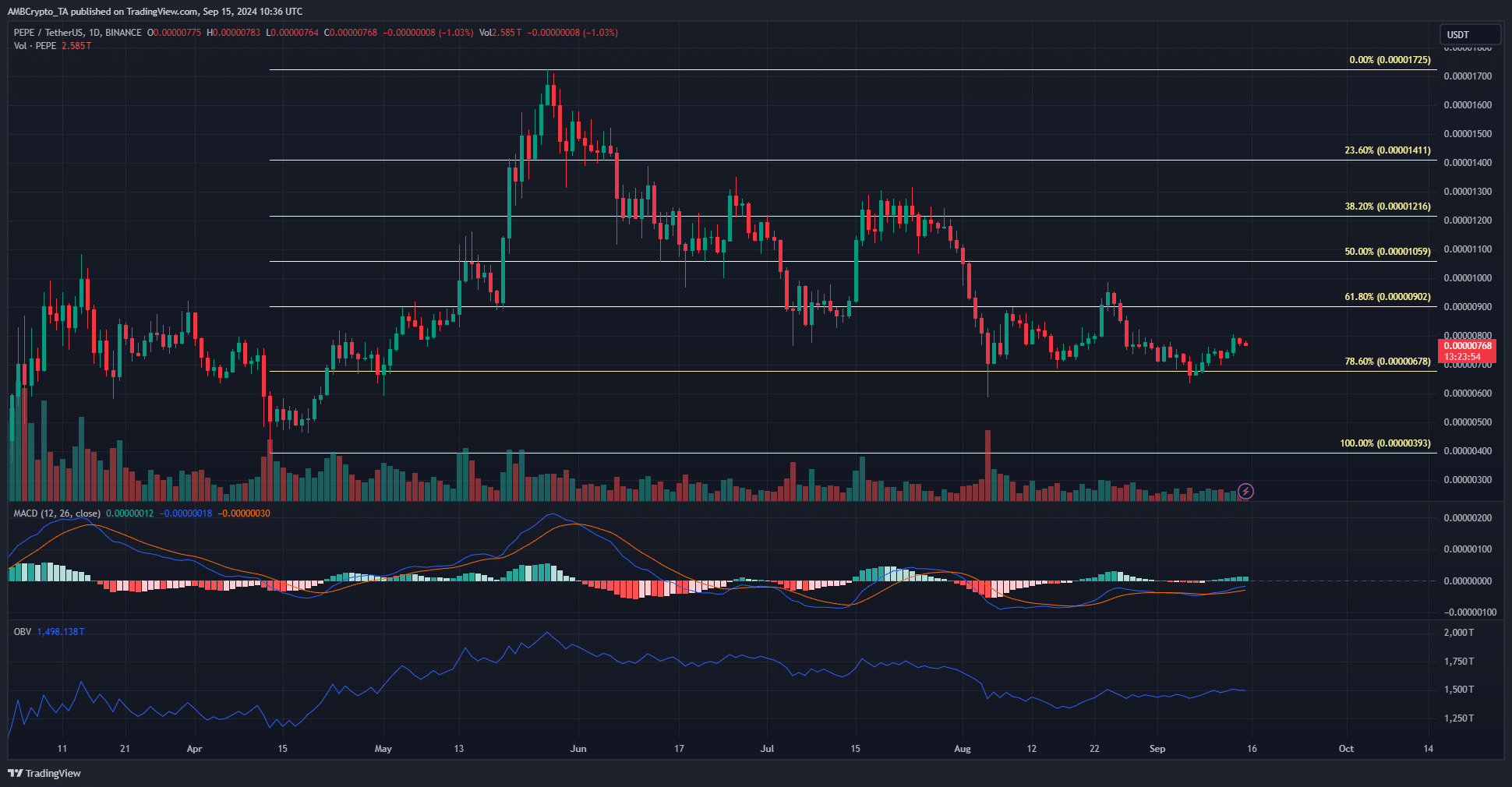

Source: PEPE/USDT on TradingView

The Fibonacci levels plotted using the April-May rally were still relevant. The 78.6% retracement level was still respected as support, although some short-term deviations were observed.

This meant that swing traders could take long positions during a retest of this retracement.

Their stop-loss orders must take into account the short-term volatility around this level. Furthermore, neither momentum nor buying volume has been strong over the past month, indicating that PEPE is in an accumulation phase.

A daily session close below the $0.000006 level would indicate that the bears were in control. Until then, buyers can scoop up more PEPE and wait for a recovery.

The OBV has been rising slowly since August, increasing the chances of a Pepe rally.

Will smart money try to shake people out of their position?

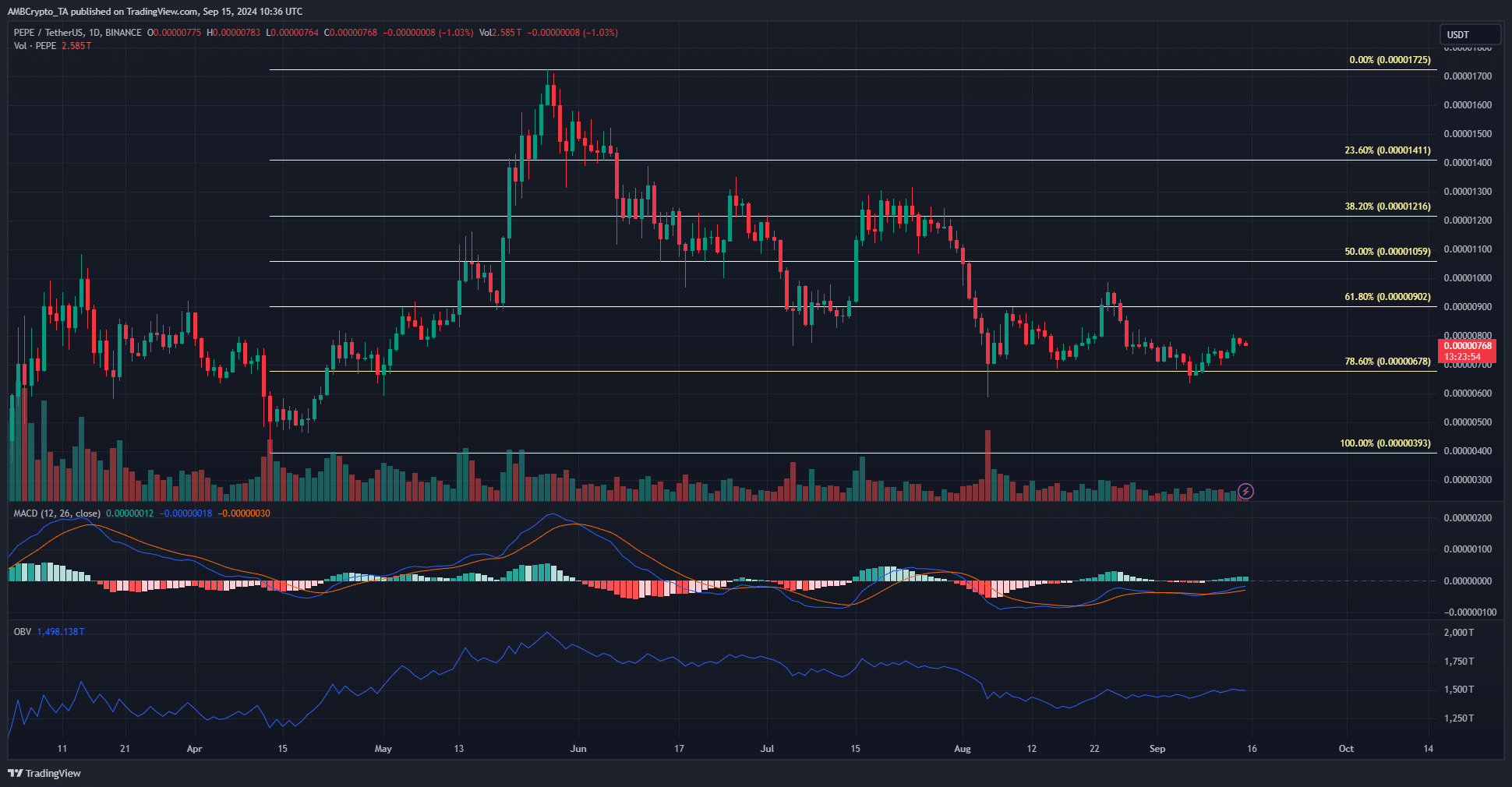

Prices are attracted to clusters of liquidity, and AMBCrypto noticed such a pocket in the $0.000006 zone. This also marked the low point at which the meme coin fell on August 5.

Therefore, traders and investors should be prepared for a rapid downturn.

Such a decline is not a guarantee at this stage, but rather likely, as not every liquidity pool is tested successfully.

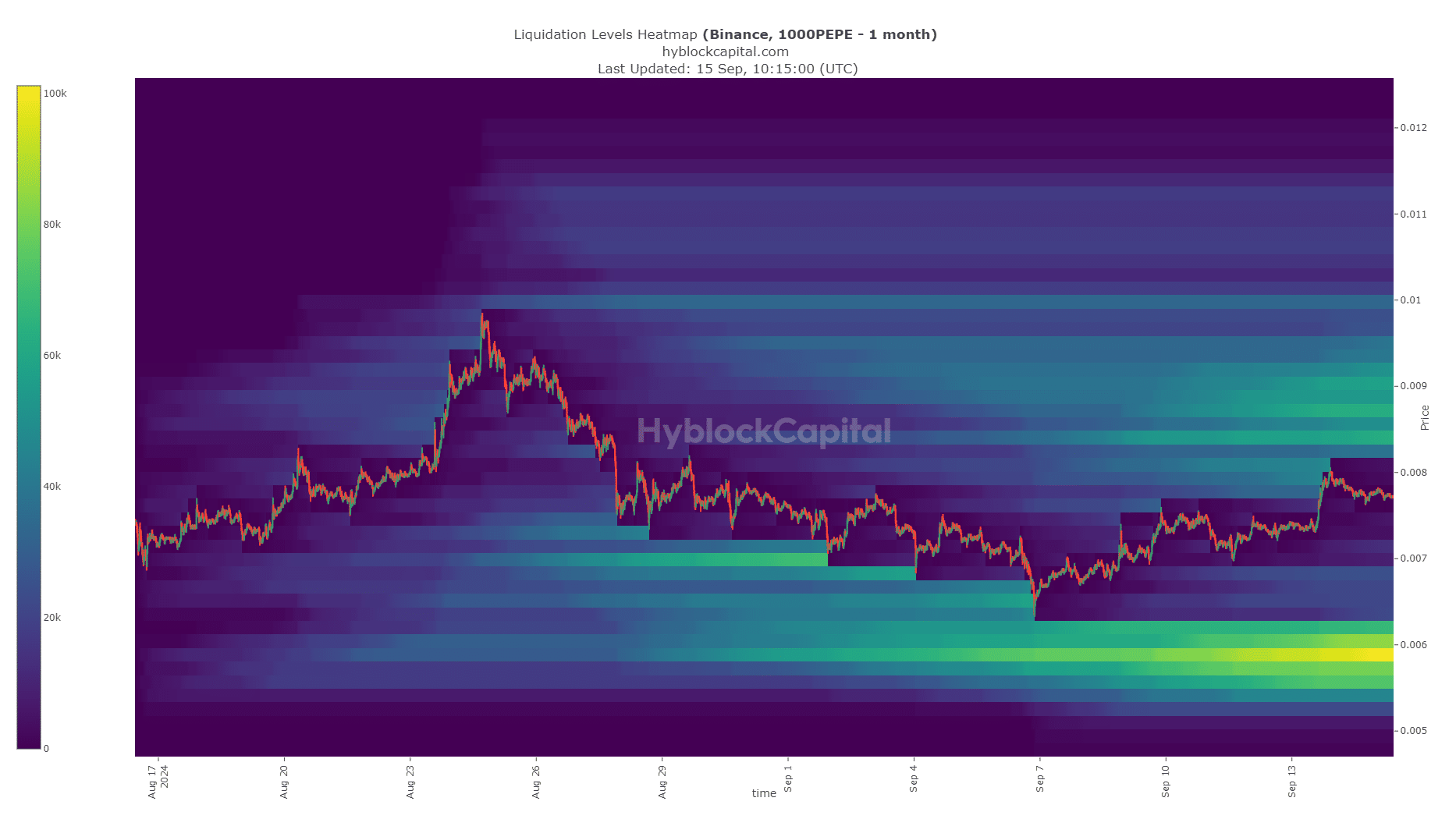

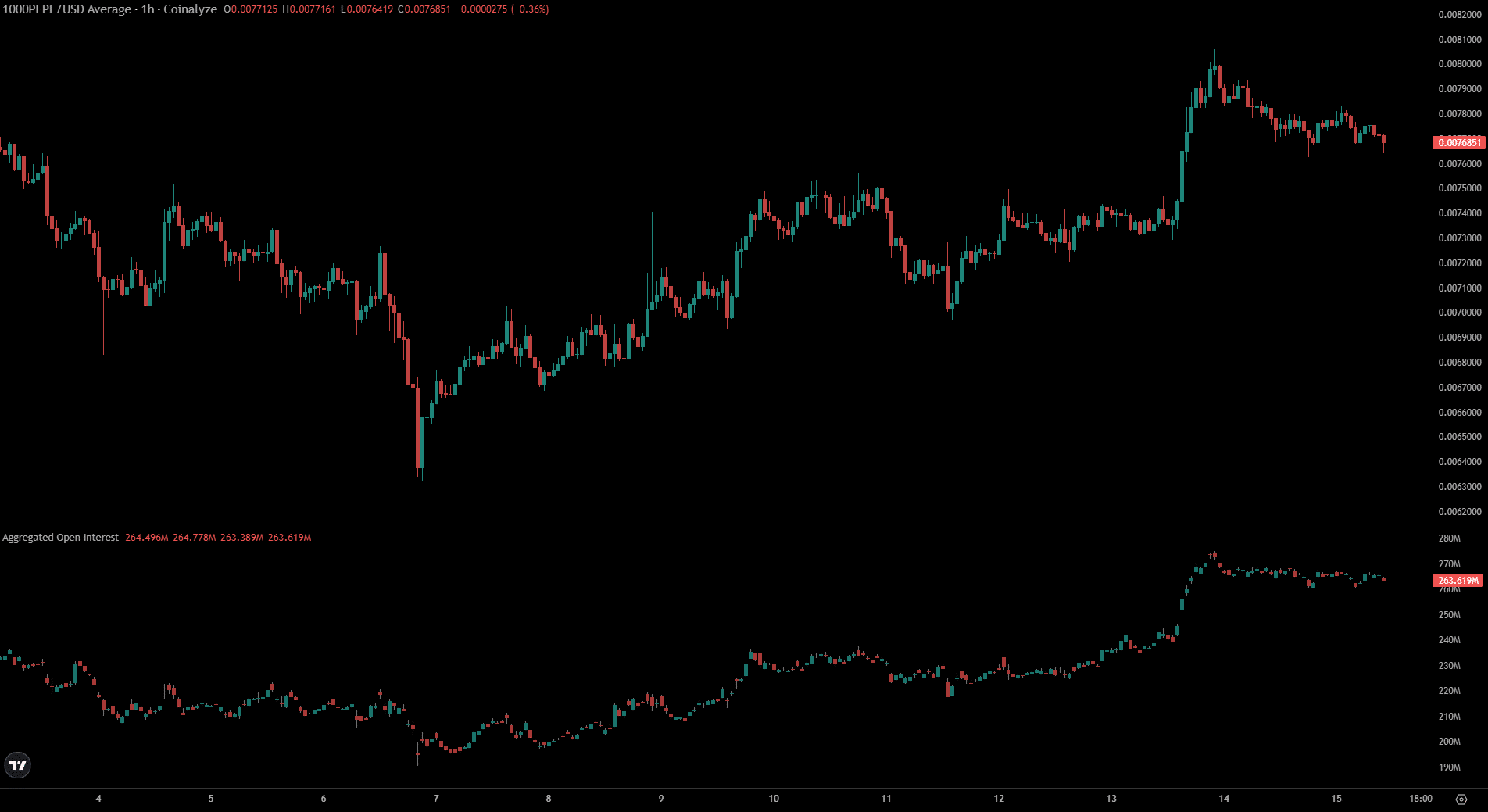

Market sentiment appeared bullish in the short term. Following the September 13 earnings, Open Interest rose from $235 million to $273 million.

Is your portfolio green? View the Pepe Profit Calculator

Speculators were eager to go long, looking to profit from the PEPE movement and showing bullish sentiment. The small drop in price since then has not seen the OI drop significantly, meaning long positions continued to believe in further gains.

This could hurt them in the coming days in the event of a sharp Bitcoin [BTC] correction.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer

Credit : ambcrypto.com

Leave a Reply