The global macro director of Fidelity Investments, Jurrien Timmer, believes that the S&P 500 is now able to see a market recovery after falling around 20% compared to his all time this year.

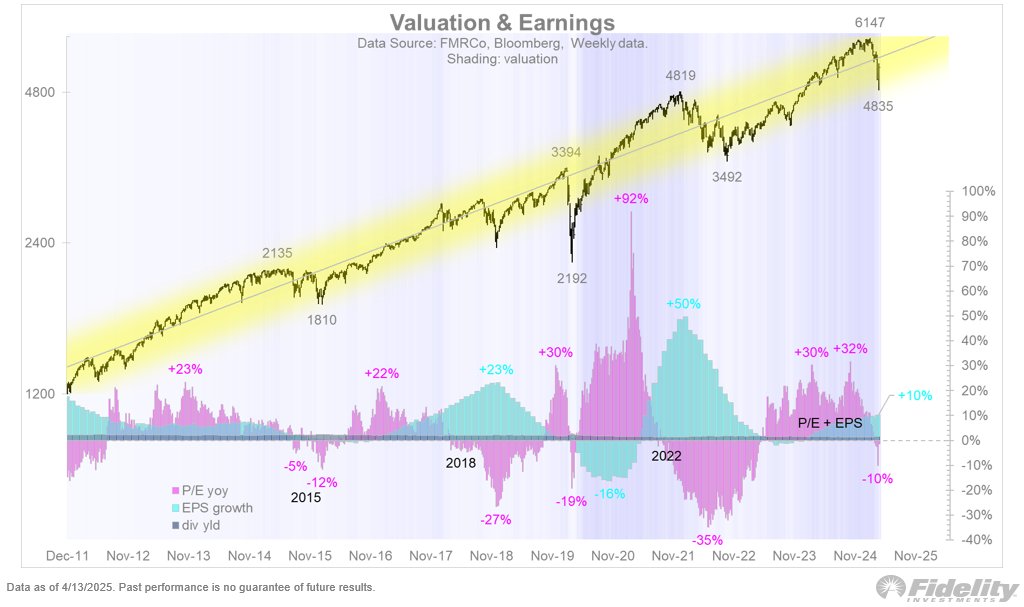

In a new thread on the social media platform X, Timmer out That the S&P 500 was swayed upstairs and below a rising trendline in December 2011.

According to the analyst, the newest correction has driven the stock market well below the rising trendline, and it is now at a point where it could organize a comeback.

“If the S&P 500 index catches up that degradation point, it would happen after the index was completely waved from one extreme to the other.

The graph below shows the index with its rising trendline (exponential regression). Just like a pendulum, the market always goes from one end to the other, and in this case it went far above the line to far below. That suggests that investors have priced enough pain to make it worthwhile to take the other side. “

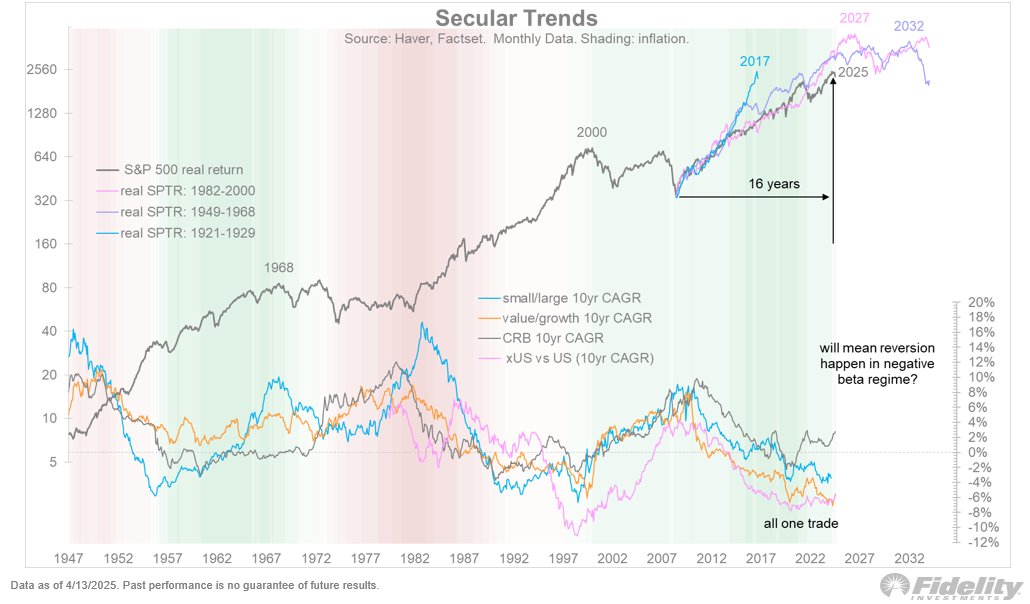

Although Timmer believes that shares are prepared for a revival, he warns that the long-term upward trend of the S&P 500-one that started in 2009 will go into the house. According to Timmer, investors will probably re -assess their positions on the US stock market in the midst of a changing global order.

Carpenter believe That investors will now look at fundamental healthy and undervalued shares, even if those names are outside the American markets.

“It is not to question the bullish secular regime in which we have ended since the financial crisis ended in 2009. The timing of the cyclical departure raises questions about the state of the secular bull, which in my opinion is in recent years. If a new world order of de-globalization and the dollarization could change and that could change.

This is an existential question, not only in terms of the type of return that we can expect in the coming years, but also leadership within the markets. With the MAG 7 -Dominance now more than 10 years old and fraying, a rotation to value and international will probably take place in a reduced secular beta regime. ”

From the end of Friday, the S&P 500 acts at 5,282 points.

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Generated image: midjourney

Credit : dailyhodl.com

Leave a Reply