Ford Says that the buyers of fleet are receptive to large electric vehicles (EVs), but for vehicles aimed at private buyers – at least in the US – the business case is a lot harder to make.

“… For larger electric utilities, the economy has not been resolved,” said Ford CEO Jim Farley in a profit call in the fourth quarter.

“These customers have very demanding use cases for an electric vehicle. They drag, they leave the road, they make long road trips.

“These vehicles have poorer aerodynamics and they are very heavy, which means very large and expensive batteries.

“Retail customers have shown that they will not pay a premium for these large EVs, making them a really difficult business case given the costs in the batteries.”

Hundreds of new cars are available via Carexper now. Get the experts by your side and score a lot. Browse now.

A Ford spokesperson has clarified Insideevs That the Blue Oval CEO referred to large SUVs.

The company had already canceled plans in August 2024 to build upcoming SUVs with three rows, which were previously delayed.

It announced that it was planning to use “hybrid technologies instead for its next SUVs with three rows”.

It also delayed a new electric pick-up until 2027 and recently confirmed that it was looking at the use of extended-range electric vehicle (honorary) powertrains in larger vehicles such as pickups.

Honors have an internal combustion engine (ICE), but this is used to charge the battery instead of feeding the wheels directly. Rival Ram will soon launch his 1500 Ramcharger who uses this technology.

“People love hybrids for more than just fuel consumption. And I think we see this in more degrees of hybrid and PHEVs as a solution for customers, honor for certain types of vehicles, heavy vehicles that do not drag and that pure EV for commercial are very affordable, ”said Mr Farley.

“I don’t know if that makes sense to you, but that’s what I hear from the customers why they love these vehicles.”

There are a handful of large SUVs for electric off-road on the market, including the GMC Hummer EV and Rivian R1s. These will be accompanied in the coming years by models such as the Jeep Recon and Scout Traveler.

But Ford seems to concentrate his efforts in the large EV room on vehicles aimed at commercial buyers. It already has the F-150 Lightning-pick-up and the e-transit full-sized van to address these buyers.

“For Ford, our commercial customers show potential for large EVs,” said Mr Farley.

“They are willing to pay a premium over ice because they really [total cost of ownership] Advantages of EV and they can live by charging depot. They don’t have the same series of fear that retail customers have. “

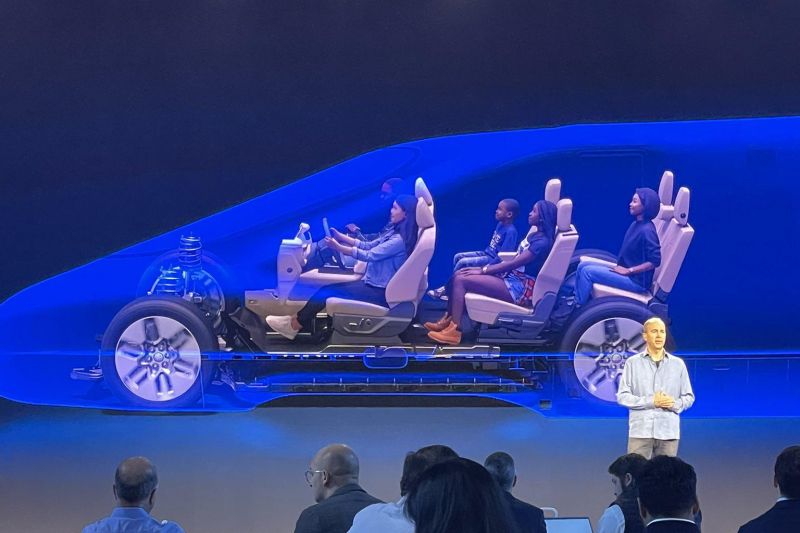

Just like companies such as Stellantis and BMW, Ford invests in platforms that can support multiple types of power lines. This includes both body-on-frame platforms, for vehicles such as pickups, as well as more auto-like Unibody platforms.

For private buyers, Ford says that it is “deep in development” of new “affordable, high-volume” EVs.

“On the American retail side, the Sweet Spot that has emerged is small and medium -sized trucks and utilities,” said Mr Farley.

“The use case of these vehicles fits perfectly for EVs, daily commuters, well suited as a second vehicle in the household.

“They require smaller, much cheaper batteries. These vehicles can be offered at lower prices to help the acceptance of EVs for the customers who really appreciate their lower operating costs. “

The first thing that such a vehicle was developed by a team “Sinkworks” in California and is a Ranger-Sized Ute in 2027.

In the meantime, the more red ink expects from its model E EV division. After losing US $ 4.7 billion (~ a $ 7.5 billion) in 2023, the US $ 5.1 billion (~ a $ 8.1 billion) lost in 2024 and Ford expects a loss of US this year $ 5.5 billion (~ a $ 8.75 billion).

More: Ford to invest in reach-extender EVs in the midst of pure-electric vehicle demand

Leave a Reply