Mike McGlone, senior macrostate of Bloomberg Intelligence, warns that the strong performance of gold in 2024 can be a bearish signal for Bitcoin (BTC) and other risky assets.

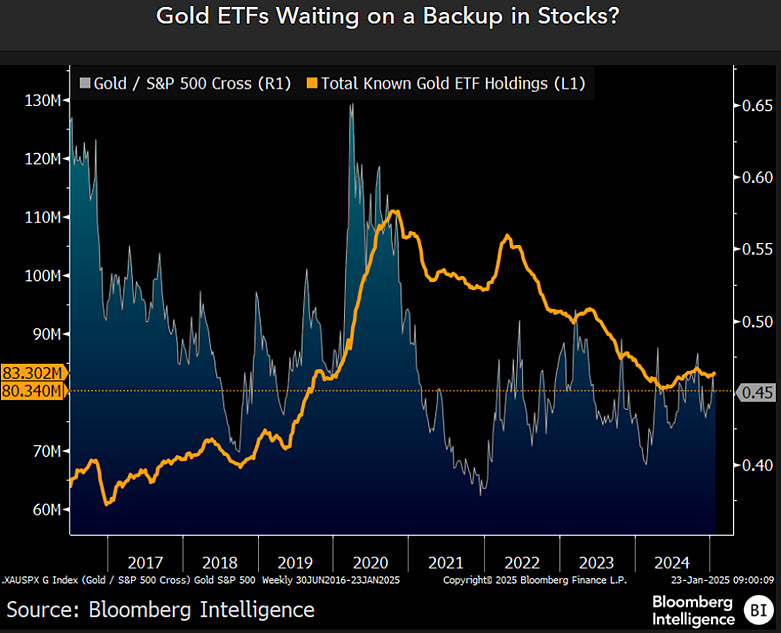

Mcglone say That gold has performed better than the markets, which indicates that investors are moving their wealth to the precious metal as a safe haven par excellence, amid worsting about deteriorating macroeconomic conditions.

“The number must be raised” risks: the problem of Bitcoin and beta versus gold: it may not be a good sign for risky assets that gold, despite the considerable competition from Bitcoin, beats the record -breaking stock market in 2024. Does the metal get too hot? Or tell us something? My prejudice is the latter, especially because of [US President Donald] Uncertainty and promotion with the Trump government, and the risks of highly speculative digital assets. ”

McGlone too believes Whether Bitcoin can hold $ 100,000 as support can be the decisive factor or the flagship crypto-assets will remain in an upward trend.

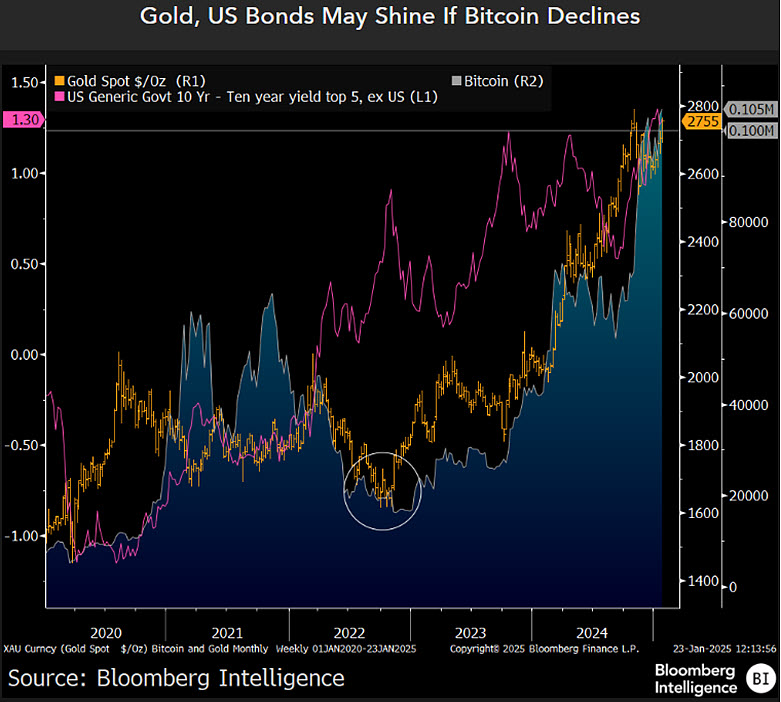

“Bitcoin may have to stay above $ 100,000 or otherwise. In similar upward processes from the 2022 low point, gold and Bitcoin could come across resistance thresholds, and what perhaps matters the most is the crypto versus $ 100,000. If Bitcoin withdraws, this would suggest the same for the stock market, with consequences for deflation, lower bonds and rugwind for gold. ”

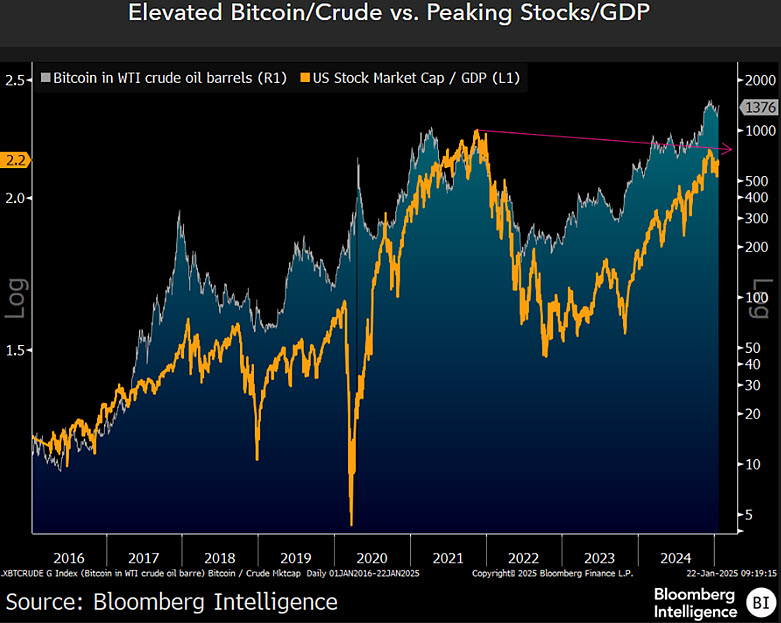

Finally McGlone notes How the value of the US stock market capitalization and bitcoin compared to the gross domestic product (GDP) of the US is much higher than when Trump took on for the first time in 2017, which indicates that market peaks can be near.

“Sell if they call ‘risk’: the combination of increased US shares and Bitcoin versus crude oil at the beginning of 2025 compared to 2017 can emphasize the risks of excessive enthusiasm. When President Trump took on for the first time eight years ago, the capitalization of the US stock market was closer to 1.2x in relation to GDP, and the crypto amounted to around $ 1,000. Fast forward to 2025 and the stock prices are approximately 2.2x the GDP, and Bitcoin has risen 100x to $ 100,000. ”

Bitcoin is traded for $ 106,274 at the time of writing.

Don’t miss any beat-subscribe to receive e-mail warnings directly in your inbox

Check price promotion

Follow us further X,, ” Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney

Credit : dailyhodl.com

Leave a Reply