- Technical issues soured the excitement behind the GRASS launch

- A rejection as low as $2 could mean a sharp pullback

GRASS started trading on October 28, but many issues hampered trading token’s air drop. During the long-awaited event, technical problems arose, problems that prevented it from happening Phantom wallet users cannot access their tokens.

The rush to claim GRASS tokens caused a three-hour outage on Phantom. Some users also saw transactions marked as unsafe. Users were critical online after they were deemed ineligible for the airdrop even though they had practiced agriculture.

Of the total 1 billion GRASS supply, 10% was allocated to contributors and early backers, but this was marred by problems. Will these setbacks dampen the bullishness behind the token, or will the project prove that it is ready for the market?

GRASS gains 132% from recent lows

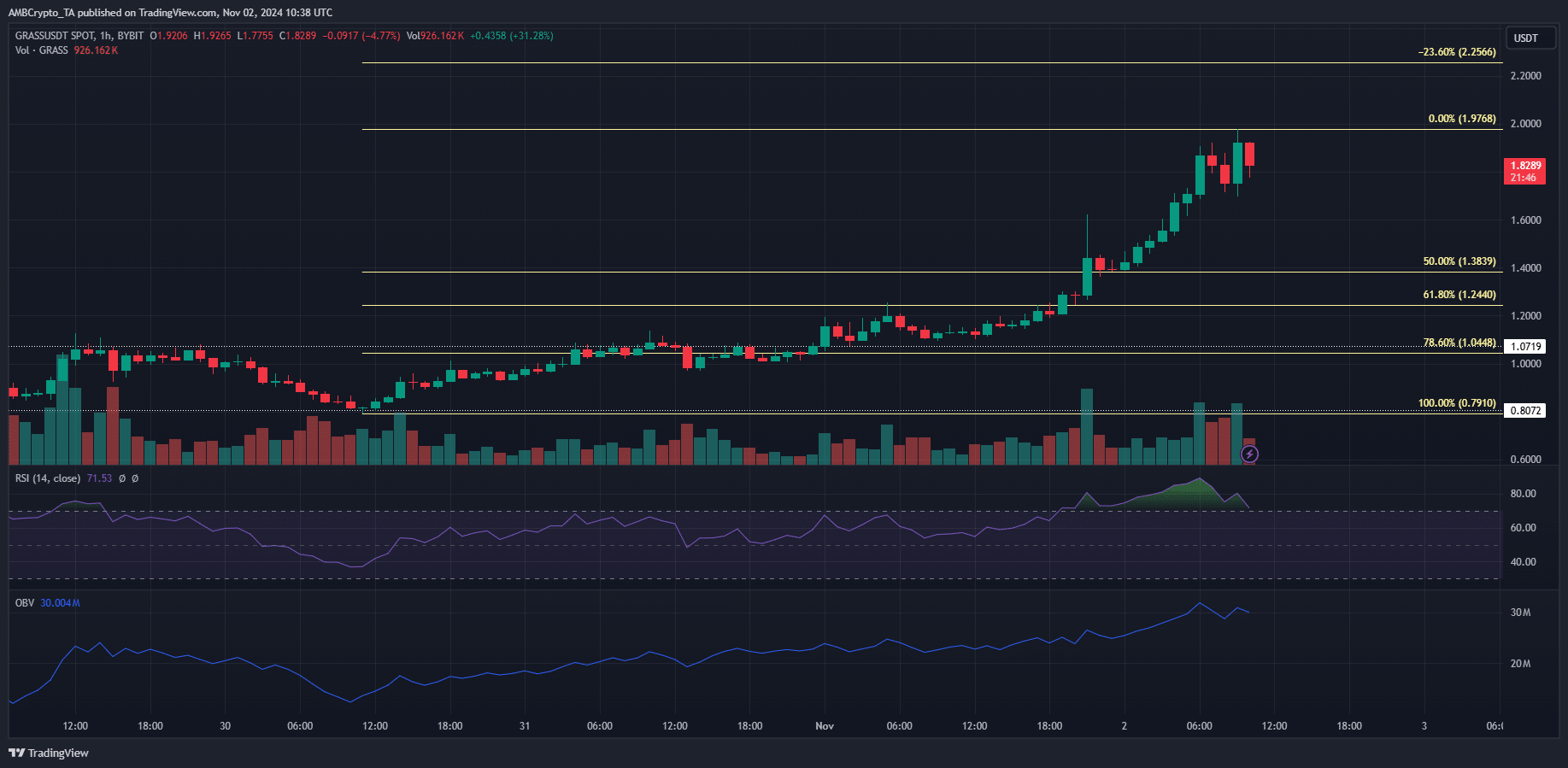

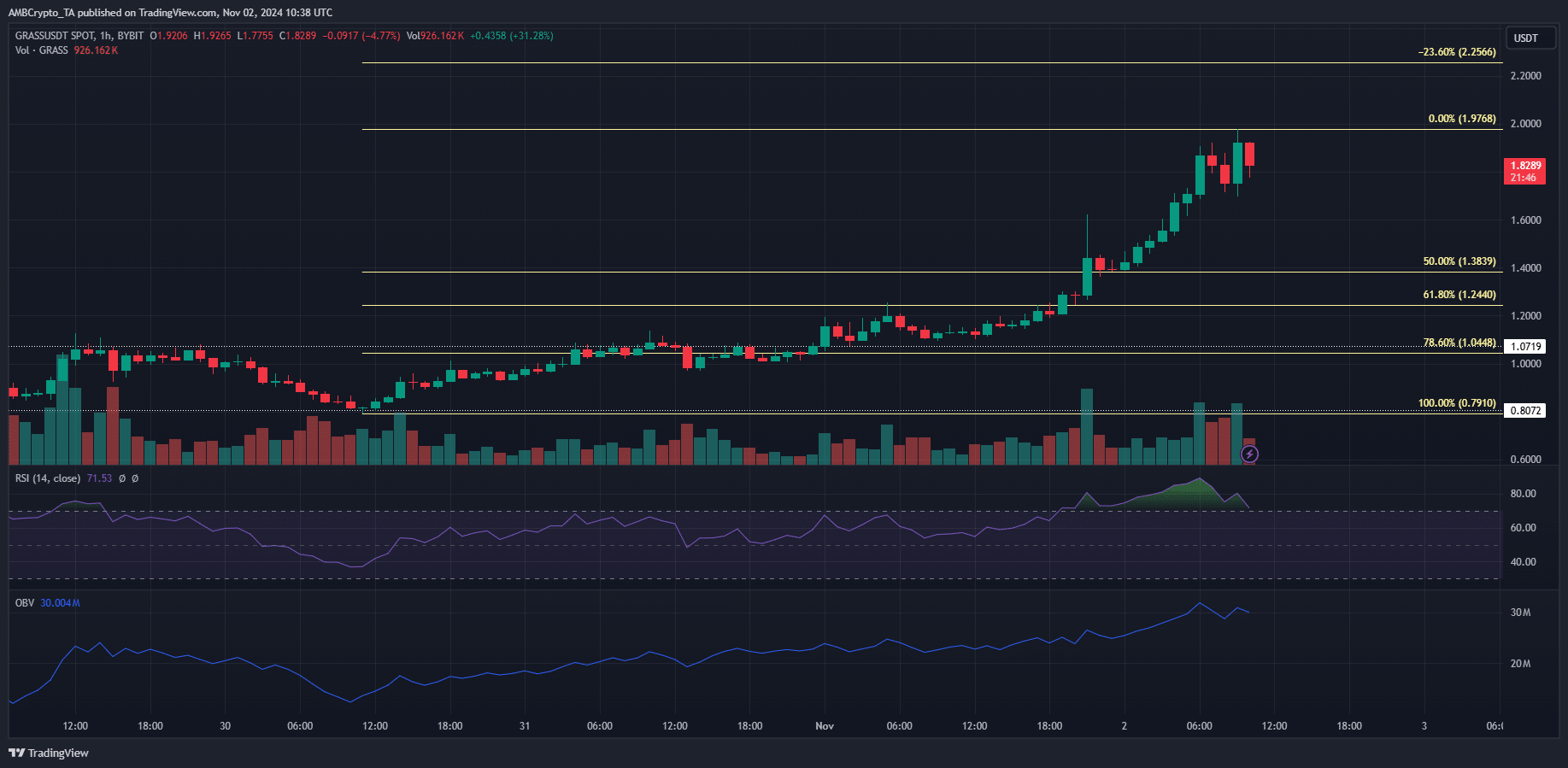

Source: GRASS/USDT on TradingView

Since the token has only been trading for a few days, price action data is limited. And yet the bullish intent was clear on the lower futures. The token has seen above-average trading volume over the past 24 hours.

The OBV has been steadily moving higher since October 30, alongside the price. This highlighted the buying pressure behind GRASS and implied that there could likely be more gains soon.

The token met resistance at the psychological round resistance of $2. A decline to $1.75 could be possible, especially as the RSI formed a bearish divergence.

Chance of a deeper relapse

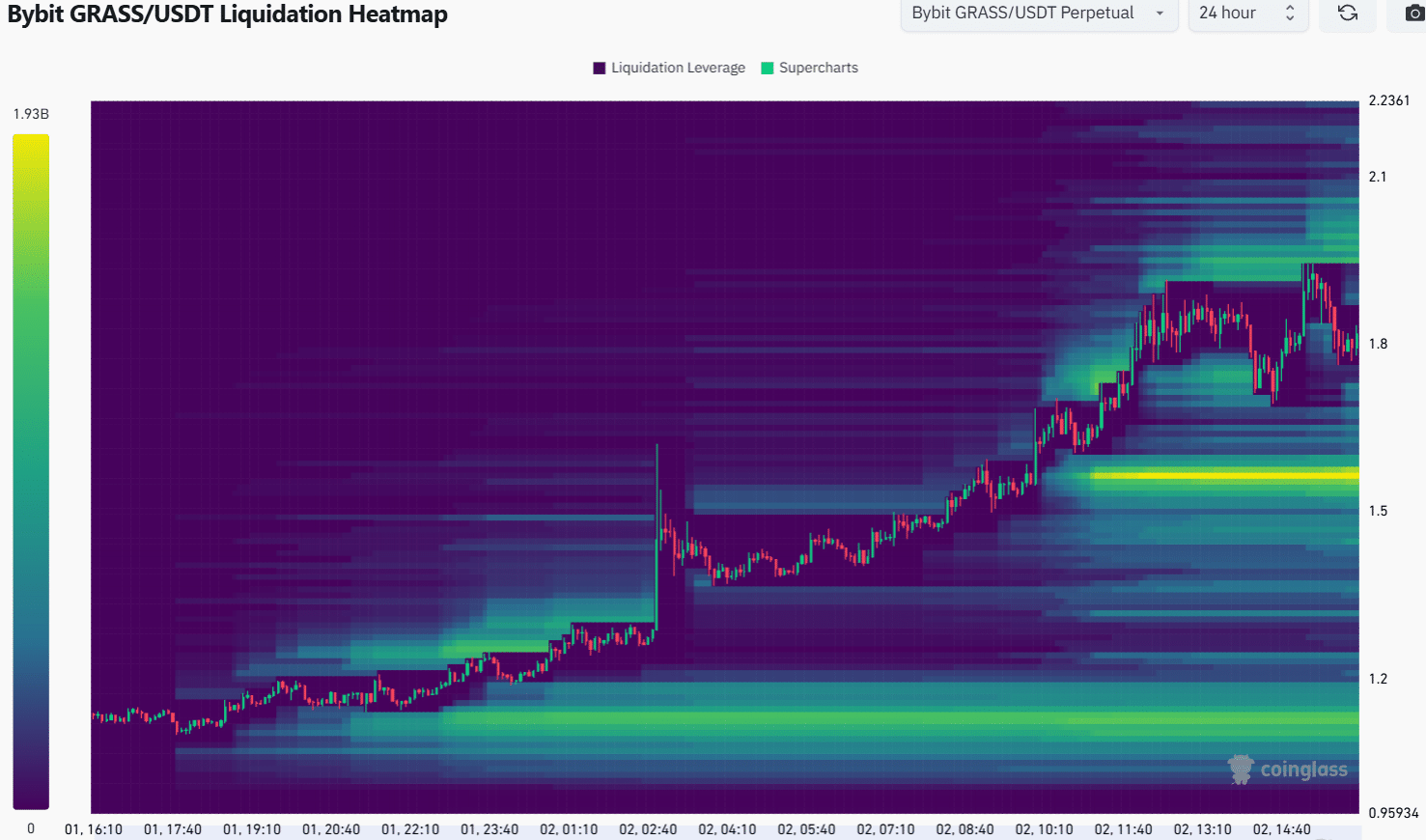

There were two main liquidity pools around the price of $1.96 and $1.56. The former appeared to be closer to press time price, while the latter was a stronger magnetic zone.

Realistic or not, here is the market cap of GRASS in terms of BTC

The bearish momentum divergence and the $1.56 liquidity pool meant a drop below $1.75 would be possible. Traders should be prepared for this possibility.

A retest of $1.56 and $1.4 could provide a buying opportunity for swing traders.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer

Credit : ambcrypto.com

Leave a Reply