- HEGE may retreat towards $0.02 due to the bearish momentum divergence on the lower timeframes

- In the absence of a strong OBV movement, demand was weak

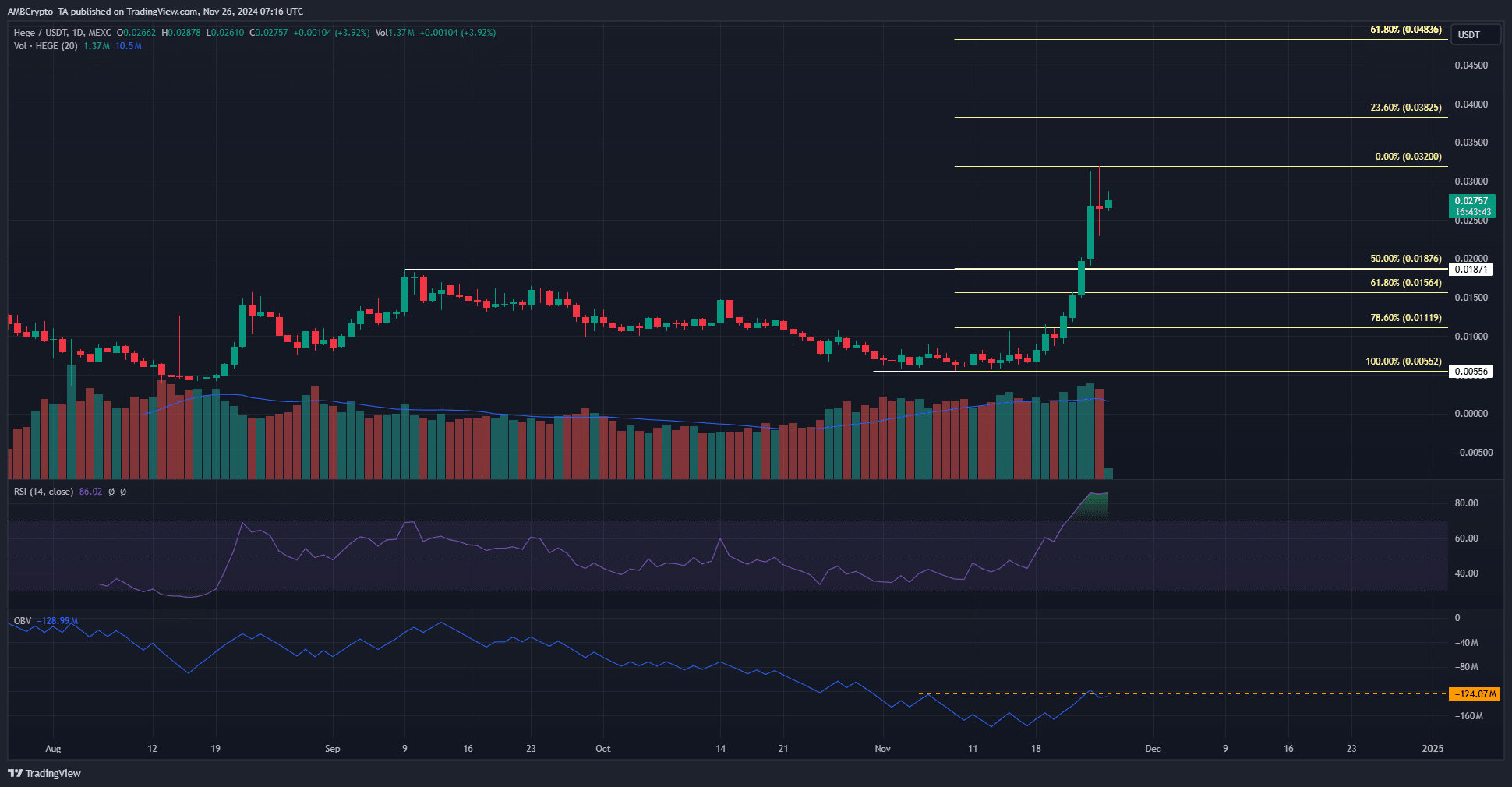

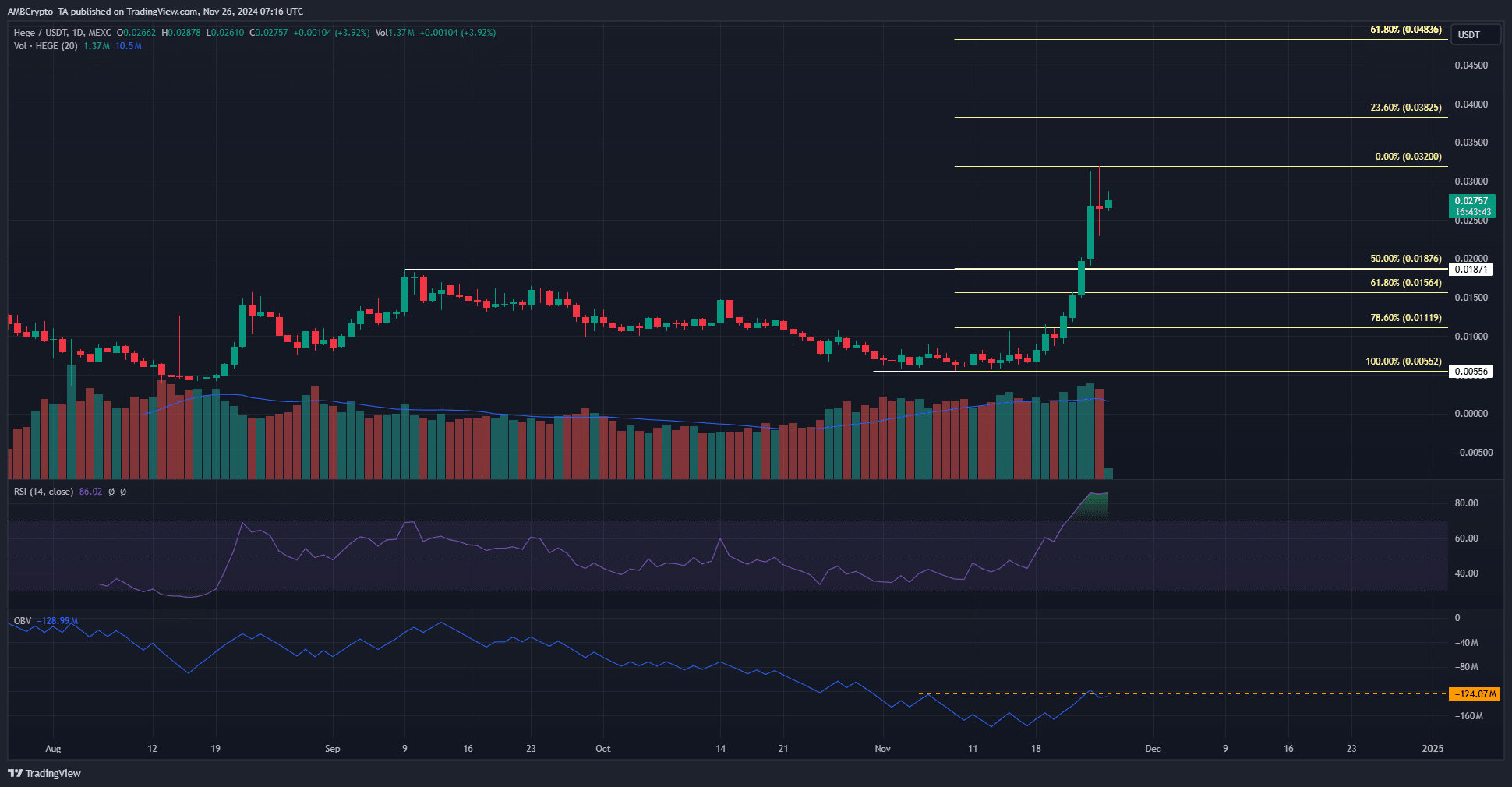

Hege [HEGE] had a strong bullish trend this past week. Since November 19, the memecoin has risen 234% up to the time of writing. Technical analysis suggested that a price drop towards $0.02 was coming.

Hege rises past the psychological $0.025

Source: HEGE/USDT on TradingView

The daily chart showed that a strong bullish structure has emerged. The first sign of a trend change came on November 19, when Hege tested the $0.0107 resistance zone.

This resistance had been in play since October 27.

Trading volume has slowly picked up steam over the past three weeks. Interest rates were above the 20-period moving average for almost the entire month of November.

Still, the OBV showed it was barely able to climb past a local high.

Like the price, the OBV has also been in a downward trend since September. But unlike the price, the OBV failed to identify a clear upward trend.

This was worrying because it showed that the remarkable gains HEGE recently made were not backed by real demand.

Realistic or not, here is HEGE’s market cap in BTC terms

The daily RSI stood at 86, showing strong bullish momentum. No bearish divergence has occurred yet in this time frame. The lower time frames, such as the 4-hour, have developed a bearish divergence.

The next support level was the 50% Fibonacci retracement level at $0.0187. The region of $0.0208-$0.0236 was also a short-term demand zone.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer

Credit : ambcrypto.com

Leave a Reply