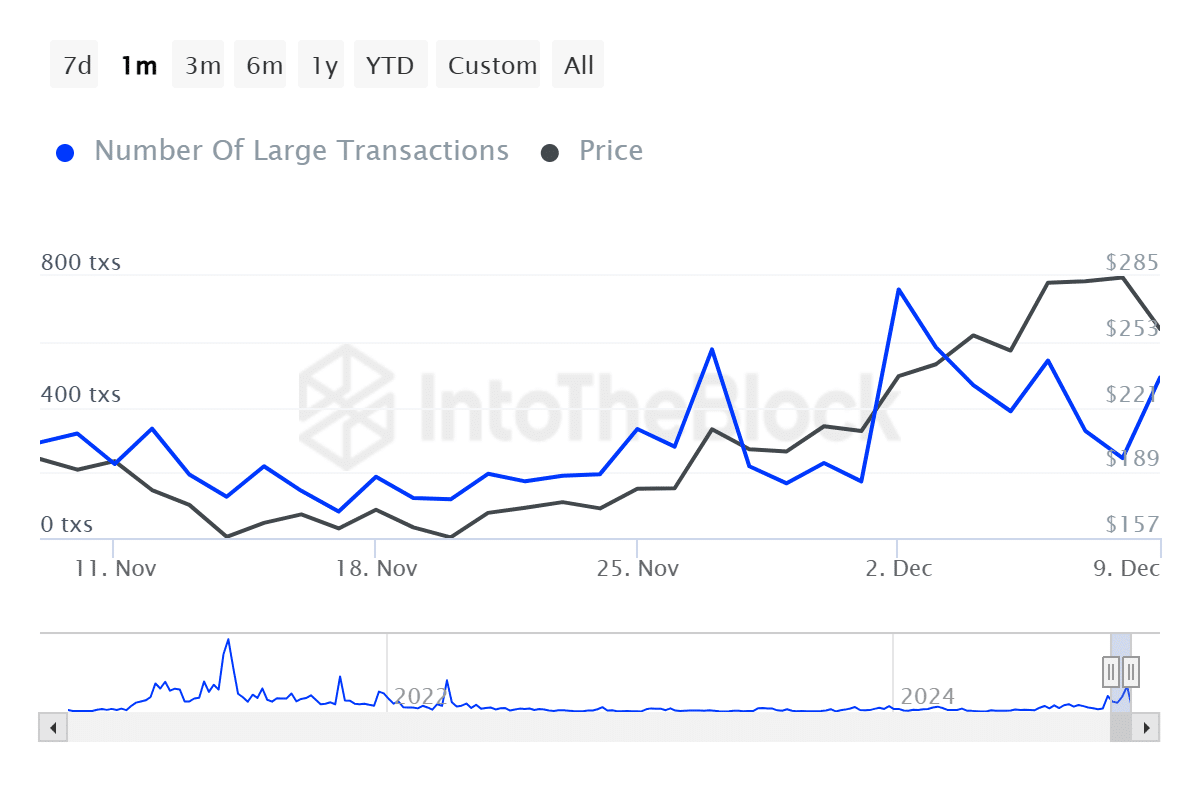

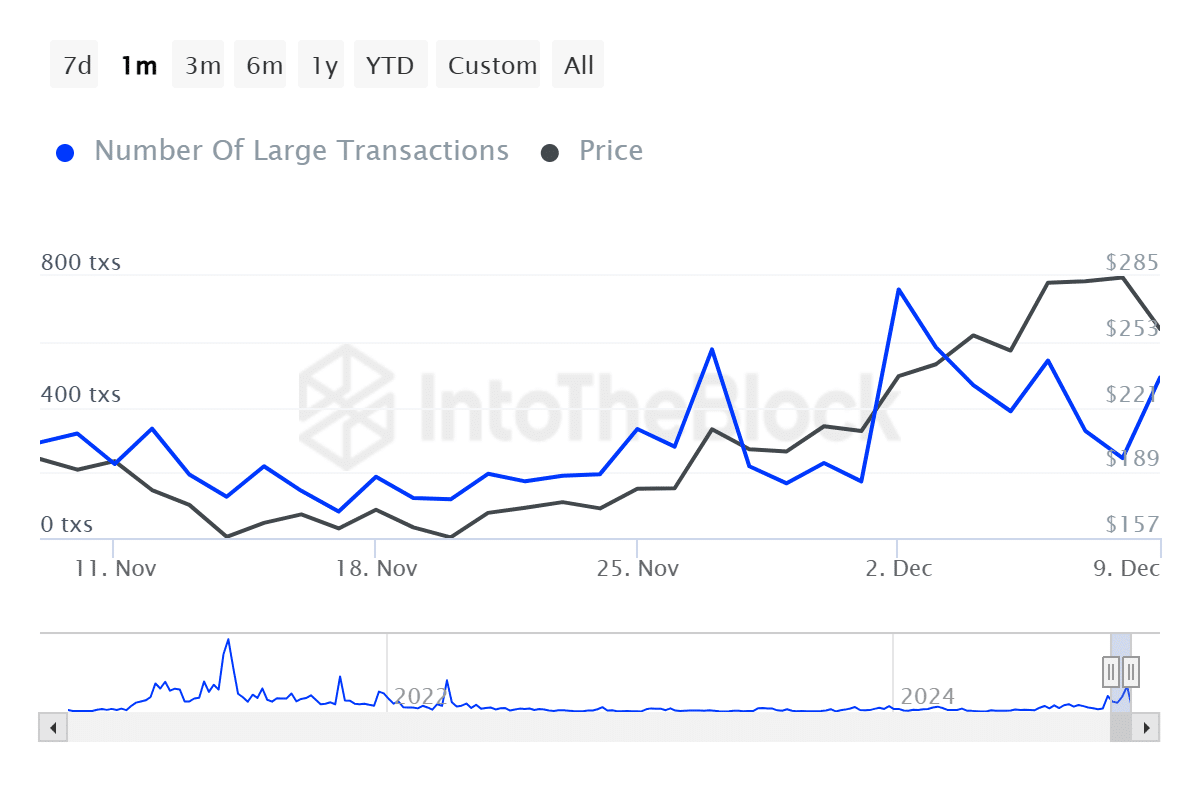

- AAVE’s major trades are up more than 150% in the last 24 hours

- AAVE inflows into the exchanges have increased over the past three days, indicating potential volatility ahead

Whales have taken notice of AAVE’s recent price action, with the altcoin’s large transactions surging 150% in a single 24-hour period, according to IntoTheBlock data.

This increase in whale activity indicated that major players may be becoming interested again, perhaps due to the recent decline in AAVE’s price. Whales tend to move the market, and their more active participation is often a sign of a possible trend reversal or acceleration.

Source: IntoTheBlock

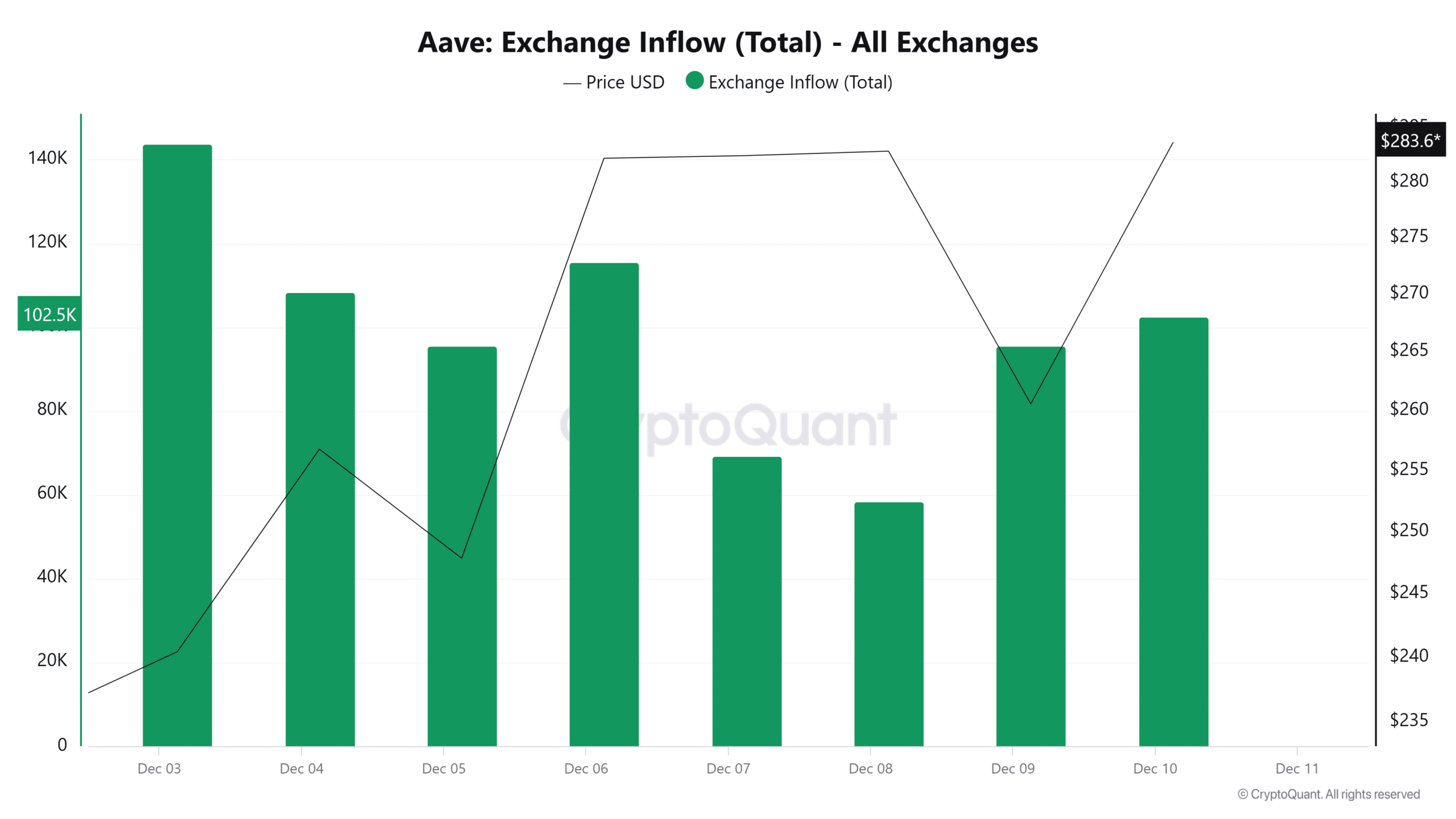

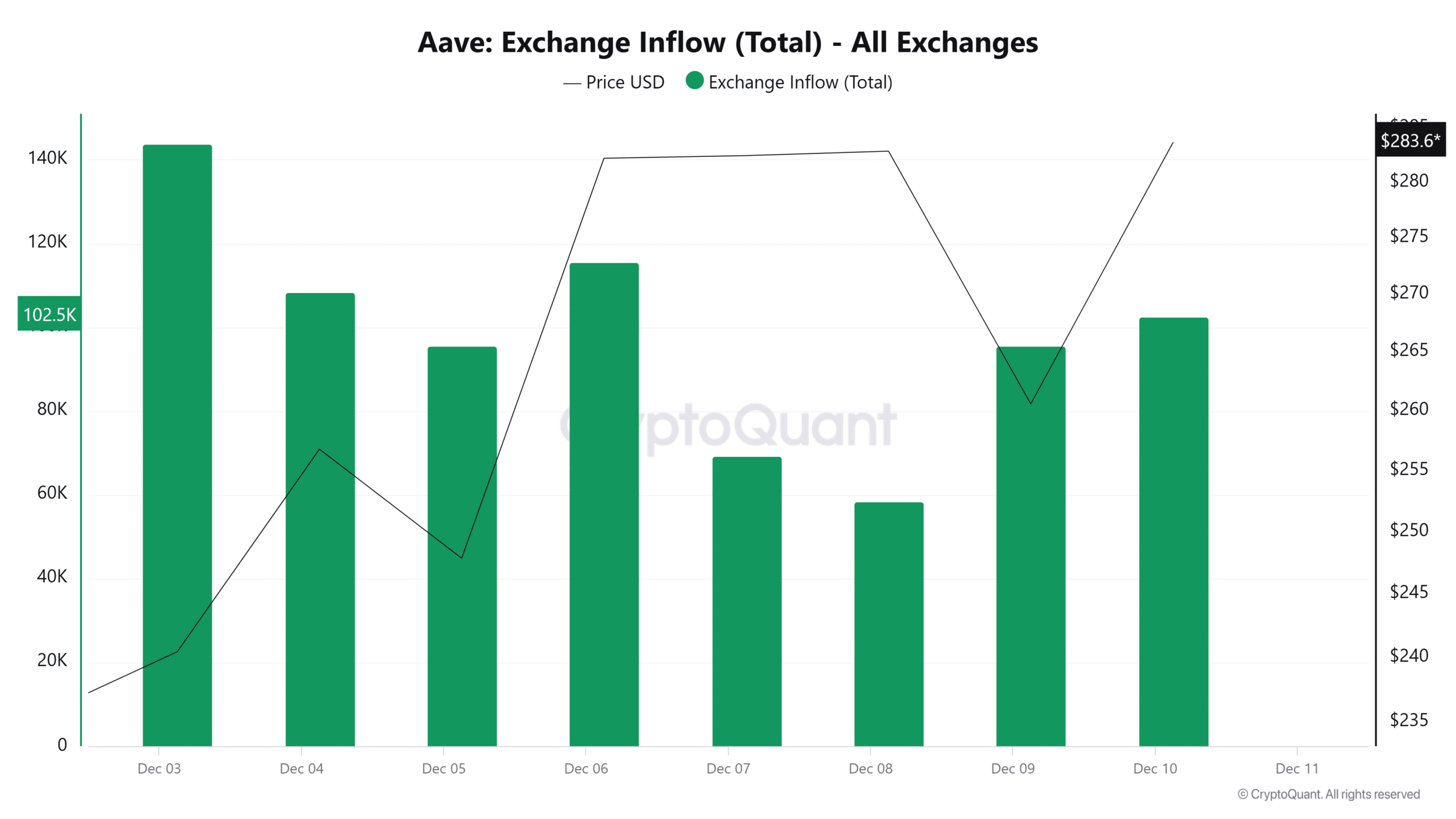

AAVE’s currency inflows are increasing

This spike in whale activity coincided with an increase in AAVE inflows to exchanges. In fact, currency inflows have been rising steadily over the past three days, which could indicate that some traders are preparing to liquidate or reposition their holdings.

Such moves usually come before a period of high price volatility and can signal a potentially major chart move.

Source: CryptoQuant

Bullish bias is emerging at key levels

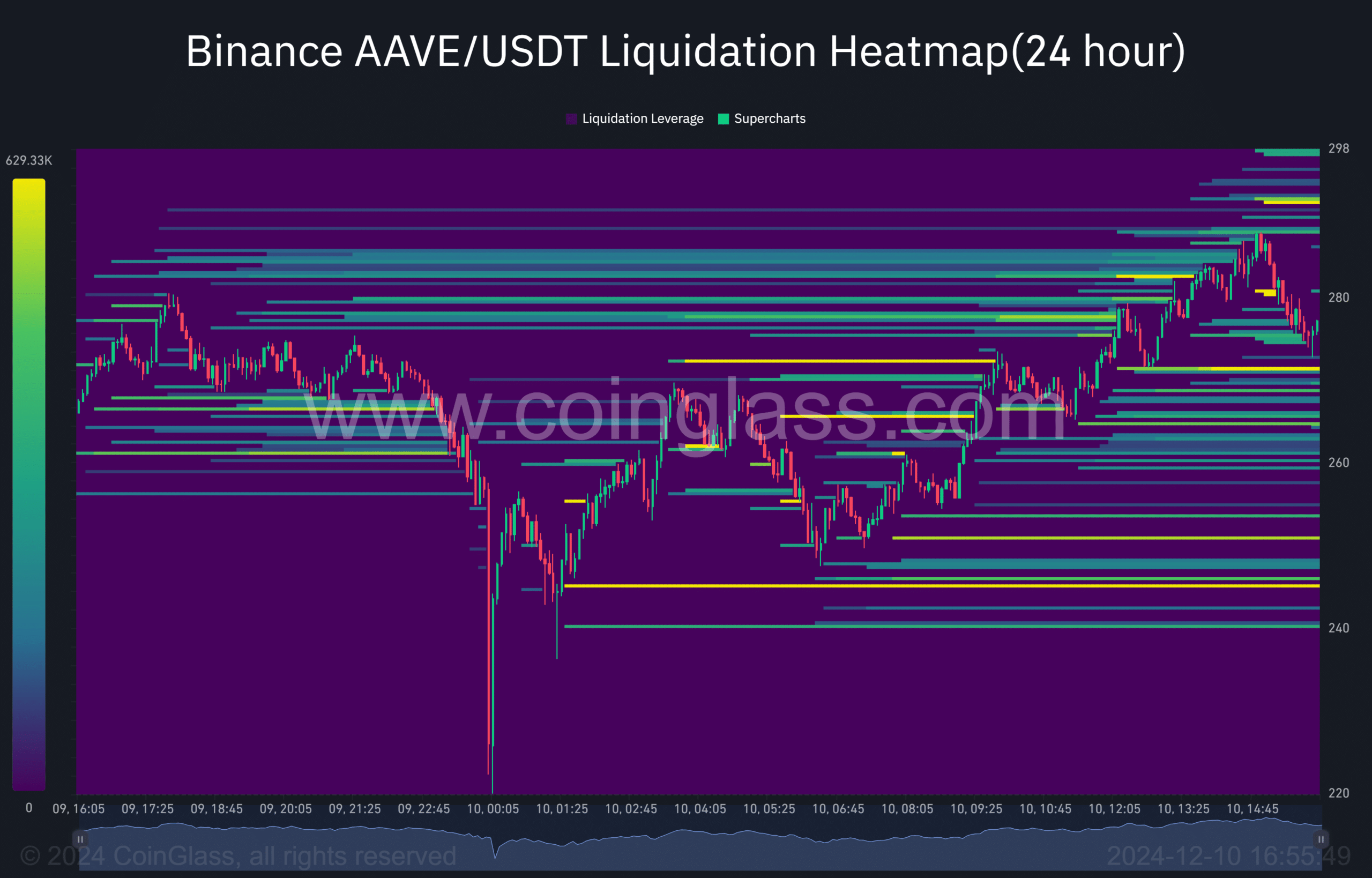

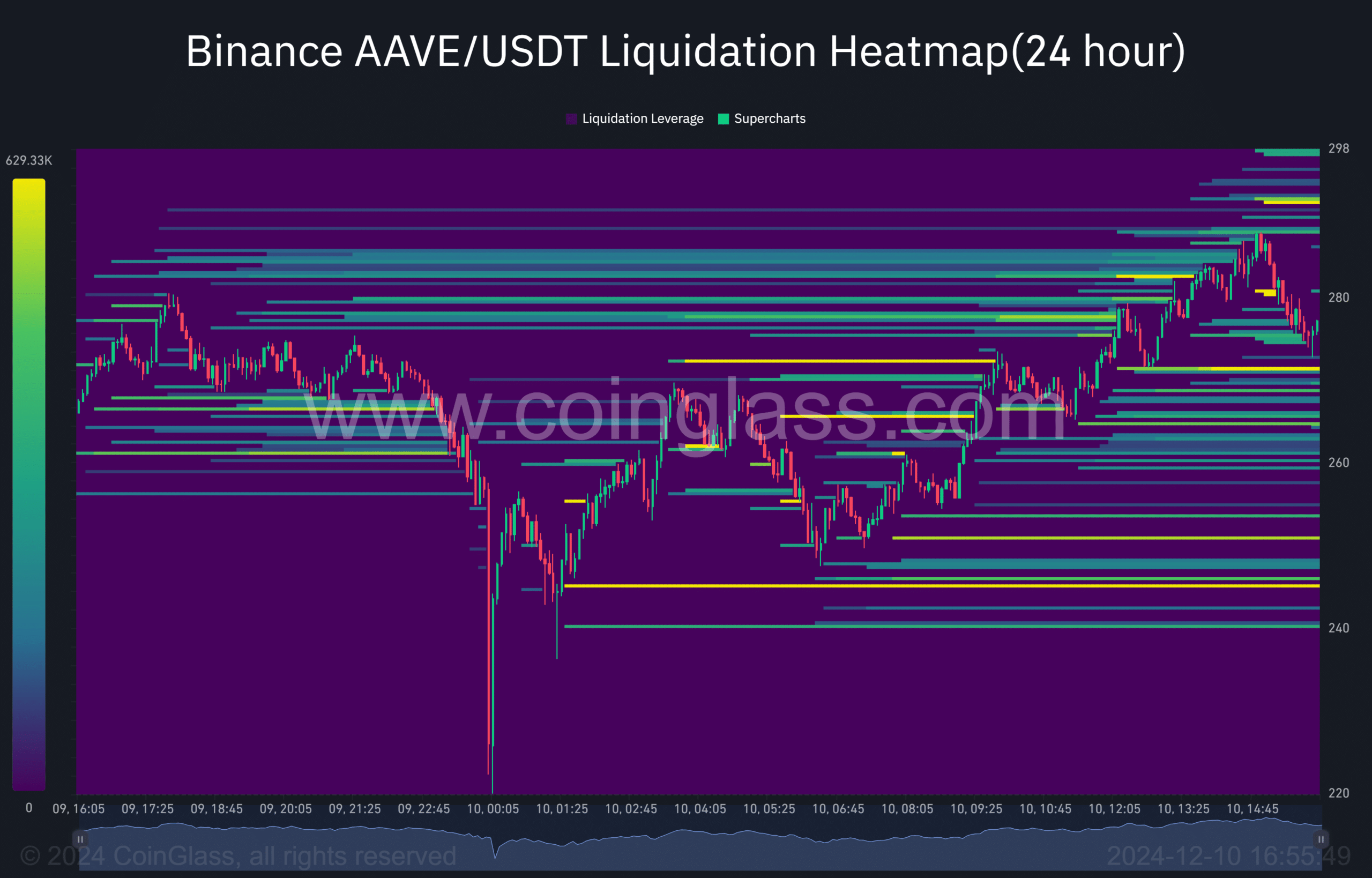

In addition to the magnitude of such increased activity, AAVE is also showing signs of a bullish bias. At the time of writing, the altcoin had a liquidation pool worth $583,000 at the $291 price level, a critical threshold for market participants.

This pool represented leveraged positions that could culminate in a rally if broken, potentially pushing AAVE closer to the psychological $300 level. The concentration of liquidity at this level highlighted investor optimism. If the prevailing market momentum holds, $291 could provide the springboard for further gains.

On the contrary, if this resistance is not broken, it could lead to a pullback in the short term as traders reassess their positions.

Source: Coinglass

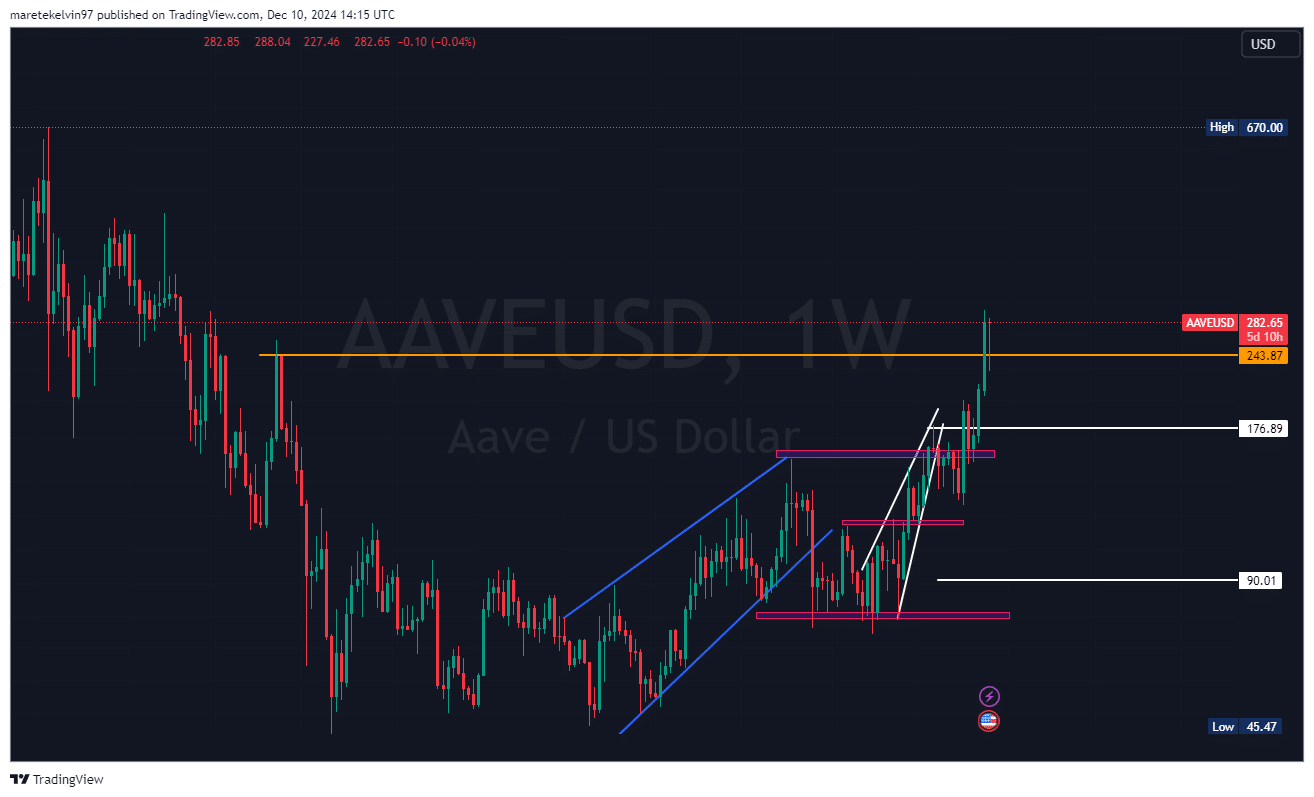

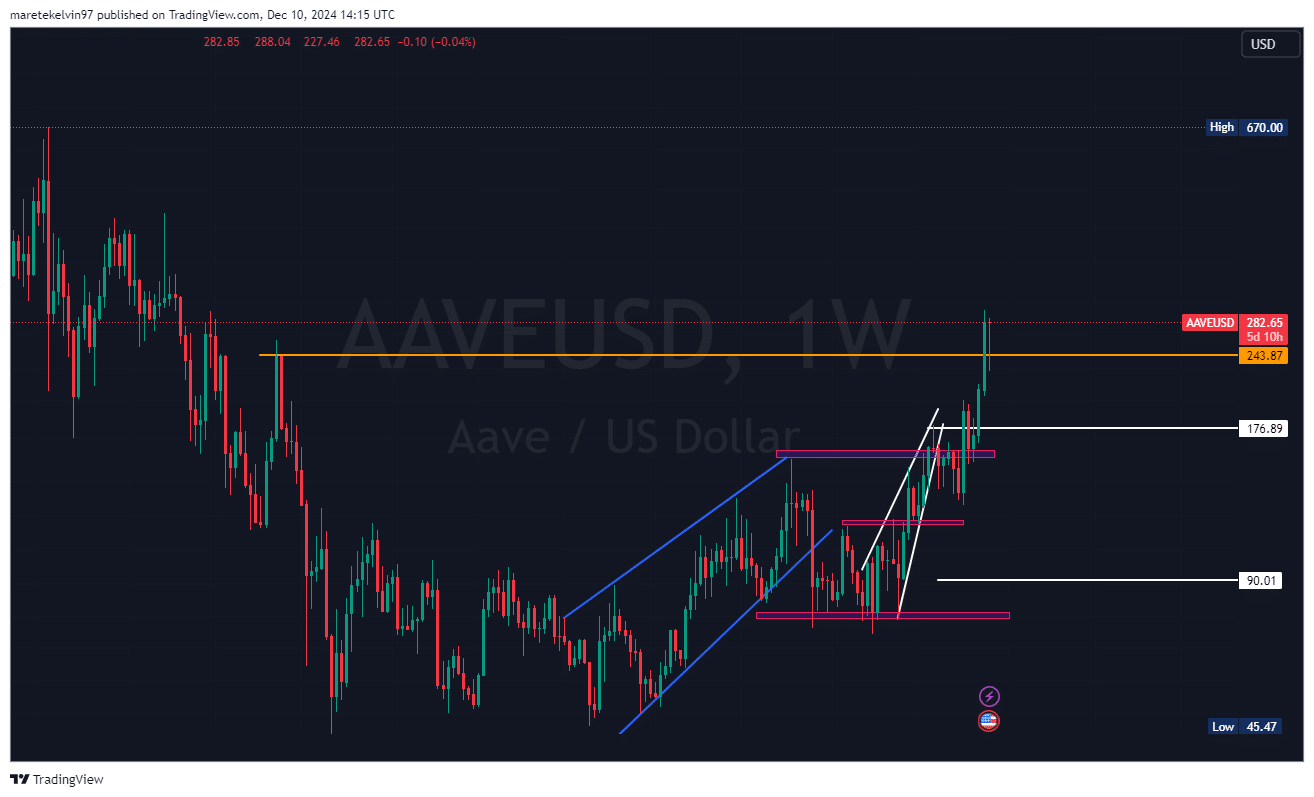

Technically, AAVE’s price registered a milestone by rising above the weekly resistance level at $243, before the recent short correction – likely from the profit-taking phase of the already 72% of investors who were already taking profits.

Needless to say, FOMO has encouraged many major players to invest in the dip. As it stands now, the next major resistance target is at the $300 price level.

Source: TradingView

The convergence of greater whale activity and inflows pointed to a potentially explosive move for the popular altcoin. If whales continue to buy and the retail industry follows suit, AAVE’s price could test the aforementioned resistance level in the coming days.

Credit : ambcrypto.com

Leave a Reply