- The newest bullish divergence of Ethereum hinted at the end of Beerarish Trend and the start of a bullish trend

- CVD revealed that many DEX traders take a profit or close their positions

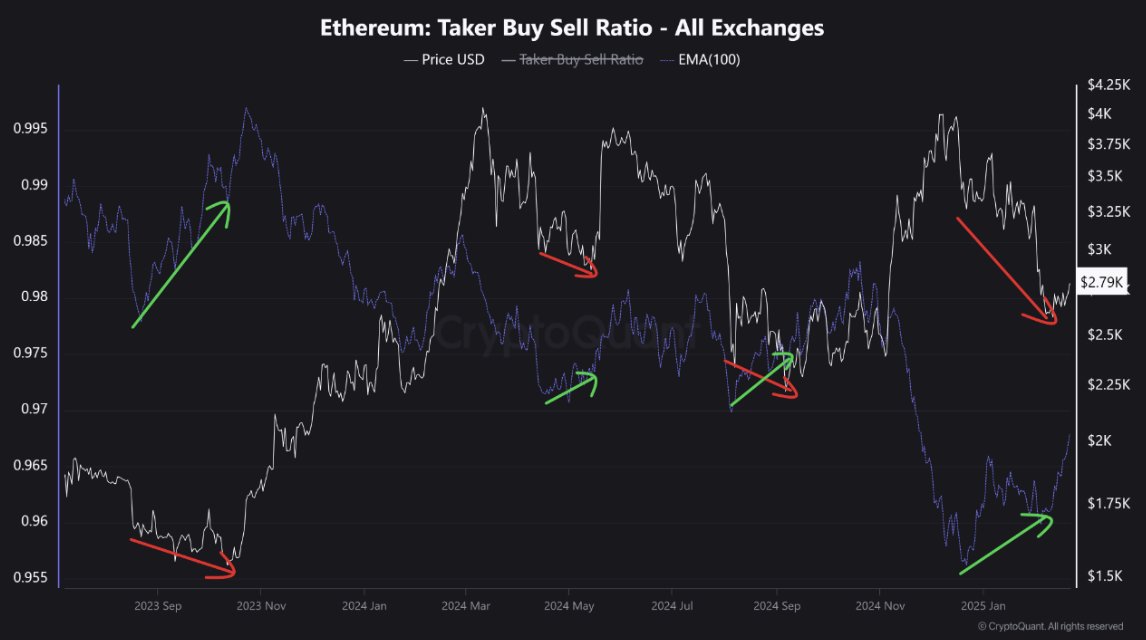

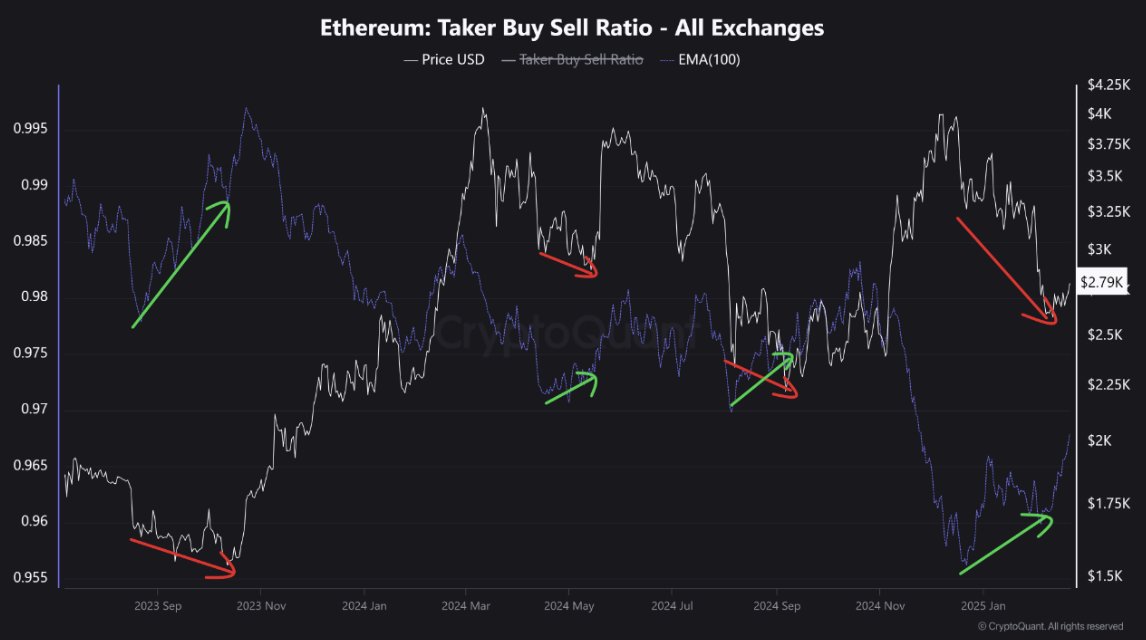

The Ethereum (ETH) market, at the time of the press, projected a large bullish divergence, one that was identified by the Taker Buy-Sell-Ratio at the price trend. Such a divergence often precedes a market recovery in the charts.

For example, in September 2023, despite the price that dropped to nearly $ 1500, the Taker Buy-Sell ratio began to rise-one sign of building pressure build-up. This quickly resulted in repairing ETH to the $ 2,000 level.

From November 2024 to January 2025, the price of Ethereum also fell to around $ 2,700. The Buy-Sell ratio of Taker, however, once again flashed an upward trend and emphasized the potential purchase interest despite the decrease in the price of the Altcoin.

Source: Cryptuquant

Historically, such patterns point at the end of Bearish phases and initiate new bullish trends.

The newest teamwork suggested that despite the time price of the $ 2,800 press, a emergence could be imminent. This could mirror in previous patterns where the rising Taker -Koop activity correlated with price repair.

Whales versus smart DEX traders

In addition, recent activities in the Ethereum ecosystem presented a striking contrast between large-scale buyers and active traders at decentralized fairs. This was in the midst of rising prices, before the sharp fall due to the Bybithack where $ 1.4 billion ETH was lost.

It is remarkable that whale accounts have performed their participations by collecting an additional 140,000 ETH-what a bullish position or a long-term handle indicates. This massive acquisition seemed to be in accordance with an upward trend in the ETH price, and points to strong confidence in large holders.

Source: ICRYPTOAI/X

However, the cumulative volume delta (CVD) indicated a trend in which Smart DEX traders have increasingly taken a profit or have closed their positions. This refers to a possible sentiment shift or risk aversion at price levels of the press.

This sales activity can cause the short -term price volatility or pressure if the profit is guaranteed, in contrast to the accumulation behavior of the whales. The complex interplay can lead to a variety of short -term versus long -term effects on the Ethereum route.

Ethereum’s Log Curves

Ethereum, at the time of writing, acted in the brought zone. This means historically a potential reversal on the charts. The ETH prize seemed to act under this critical threshold in the logcurve zones – which increases the chance of a price bounce.

Historically, such a positioning has issued large rebounds, such as mid -2017 and at the end of 2020. During this period, ETH navigated from the over -sold region to higher zones, which reflects a strong purchase interest rate on observed levels of values.

Source: Coinvo/X

Conversely, although over -sold circumstances often recover Herald, external market shocks or broader arary sentiment can destroy this potential, and push ETH further down before a great recovery takes place.

The prevailing over -sold status can catalyze a bullish reversal or cause a longer downward trend.

Credit : ambcrypto.com

Leave a Reply