Nissan is struggling financially, and the brand could soon take another hit when President-elect Donald Trump takes office in January next year.

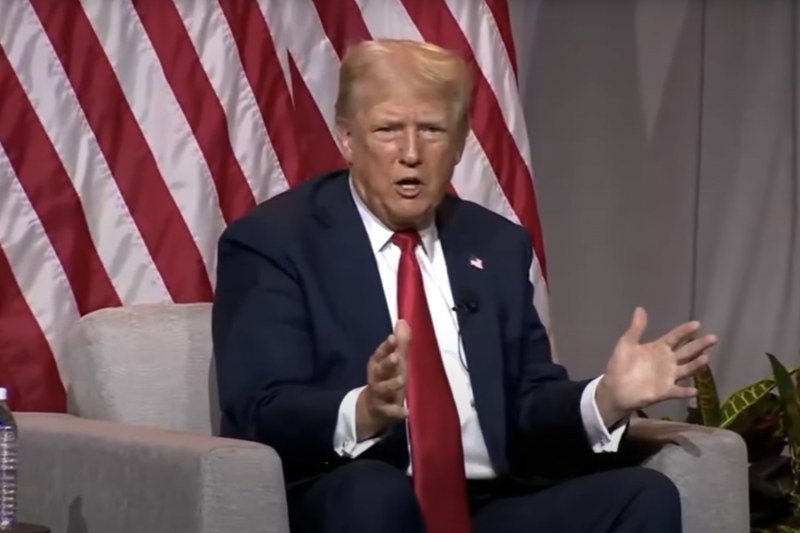

The new president said this week he would impose a 25 percent tariff on imports from Canada and Mexico, arguing that the countries must crack down on drugs and migrants crossing the border into the United States.

While that doesn’t necessarily include vehicle imports, it’s enough to raise eyebrows at Nissan. Mexico is home to several of the Japanese brand’s factories, with more than 300,000 vehicles exported from Mexico to the US so far this year.

In fact, Mexico was the only country where Nissan’s year-on-year production rose in October, with output falling 15 percent in both the US and China, while Britain and Japan each saw smaller declines.

Looking at the figures from January to October, production in Mexico increased by 9.8 percent, again the only market to see an increase.

There are hundreds of new car deals available through AutoExpert now. Get the experts on your side and score a good deal. Browse now.

Nissan produces a handful of models in Mexico for the U.S. market: the Versa, Kicks and Sentra, the latter of which is a compact sedan and Nissan’s strongest seller in the U.S.

The three vehicles are Nissan’s most affordable in the US market.

Plants in Cuernavaca and Aguascalientes produce these models, while there is an additional factory inside Aguascalientes produces engines.

In October, Nissan sold 13.4 percent more cars in the US, the first year-on-year growth since July. Sales also rose in Mexico and Canada, but significant declines in China and Europe contributed to an overall global decline of three percent.

From January to October, US sales rose 1.8 percent compared to the same period this year, although this was offset by a 10 percent slump in China.

In any case, Reuters reports that the US accounted for more than 83 percent of Mexican exports in 2023.

At the time of the initial tariff announcement, Reuters quoted Mr. Trump as saying he would impose such restrictions as one of his first steps as president.

“On January 20, as one of my many first executive orders, I will sign all the necessary documents to charge Mexico and Canada a 25 percent tariff on all products entering the United States, and the ridiculous open borders,” he said .

His intentions come despite the fact that in 2018 he was one of three leaders who signed the United States-Mexico-Canada Free Trade Agreement between the Nations. Such rates appear to conflict with that agreement.

If Mexico’s tariffs materialize, it would make it significantly more difficult for Nissan to bring some of its most popular overseas models to the US.

Although Nissan produces several models in the US, such as the Altima, Rogue (X-Trail in Australia) and Frontier pickup, the results there are noticeably lower than those from Mexico.

Nissan has produced 460,338 units in the US so far through the end of October this year, compared to 575,366 in Mexico. Furthermore, more Nissans were produced in Mexico than in China, the UK or Japan.

Some of Mexico’s production is destined for the domestic market, but so far this year it is an increase of 9.8 percent compared to the same period last year. By comparison, U.S. production is down 10.6 percent through the end of October this year compared to this time last year.

However, the tariffs may not ultimately be implemented. Mr. Trump threatened tariffs of up to 25 percent on Mexican vehicles during his first administration, but these never materialized.

Regardless, Nissan CEO Makoto Uchida reportedly said his company would keep a close eye on pricing plans shortly after Trump’s re-election.

This week, Nissan’s financial situation appeared to deteriorate as it reportedly began an urgent search for a stable long-term shareholder, while alliance partner Renault looks to reduce its stake.

At the same time, Nissan reportedly said it would be open to Honda buying some of its shares – a company it partnered with in August this year.

Renault last year cut its stake in Nissan from 43.4 percent to less than 36 percent, split between itself and a trust, while retaining a 15 percent voting stake. It also confirmed plans to gradually reduce its stake in the company.

In addition, Nissan was given voting rights for its 15 percent stake in Renault, while it confirmed it would reduce its stake in fellow alliance brand Mitsubishi from 34 percent to 24 percent.

Nissan announced earlier this month that it plans to cut global production capacity by 20 percent and cut 9,000 jobs to “stabilize and right-scale” the company, after Japan’s first-half consolidated operating profit fiscal year 2024 by 303.8 billion yen (~A$3 billion) to 32.9 billion yen (~A$334 million).

Nissan thus achieved an operating profit margin of only 0.5 percent.

MORE: Nissan has ’12 or 14 months to survive’ if financial situation gets tough – report

MORE: Donald Trump doubles tariffs on Mexican cars

MORE: Renault agrees to limit influence at Nissan, details on new joint projects

MORE: Honda, Nissan and Mitsubishi join forces on electrification

Leave a Reply