- BTC’s STH MVRV seemed to be at an inflection point that could fuel or dump BTC

- Options traders stepped up their hedging activity in the run-up to Trump’s inauguration

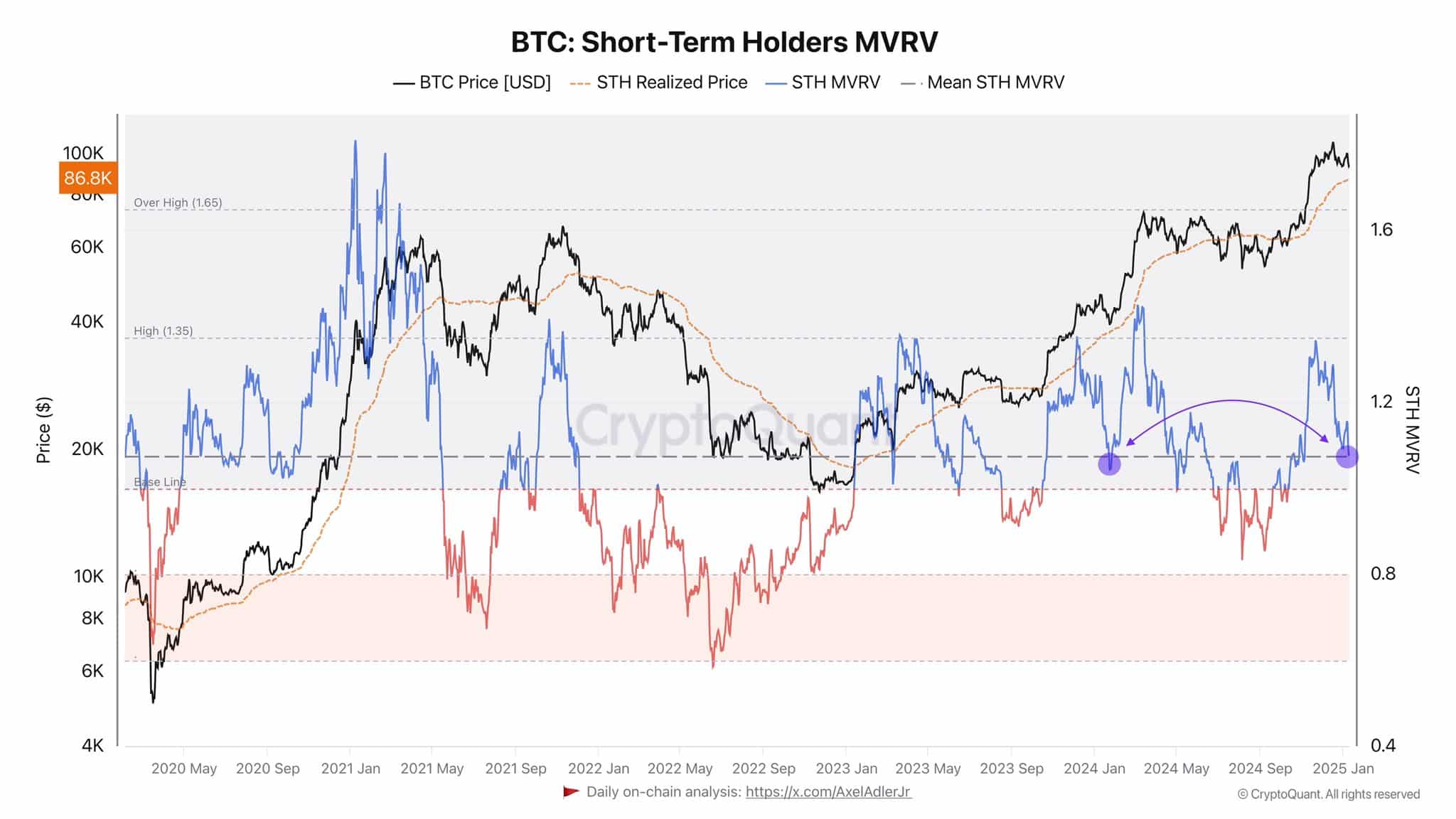

Bitcoin [BTC] is at a crossroads ahead of Donald Trump’s presidential inauguration on January 20. But that’s not all: a key valuation indicator, the STH (short-term holders) MVRV, has also retreated at a crucial point.

Is a new ‘Trump pump’ likely?

At the time of writing, the STH’s realized price was valued at $86,000. Taking the STH MVRV level into account, this could be a bullish trigger for BTC, according to CryptoQuant analyst Axel Adler. Adler noted,

“Currently, the price realized by STH is $86.8K. If demand continues until Trump’s inauguration, the STH RP could rise to $90,000. Should the president fulfill even some of the promises he made to voters in the early days of his term, this could be a strong bullish trigger.”

Source: CryptoQuant

The attached chart shows that the STH MVRV bounced around the average level in January 2024. After that, BTC saw an 88% increase to $72,000. This also coincided with the approval of the US Spot BTC ETFs, suggesting a repeat could be likely if Trump makes bullish announcements for the sector.

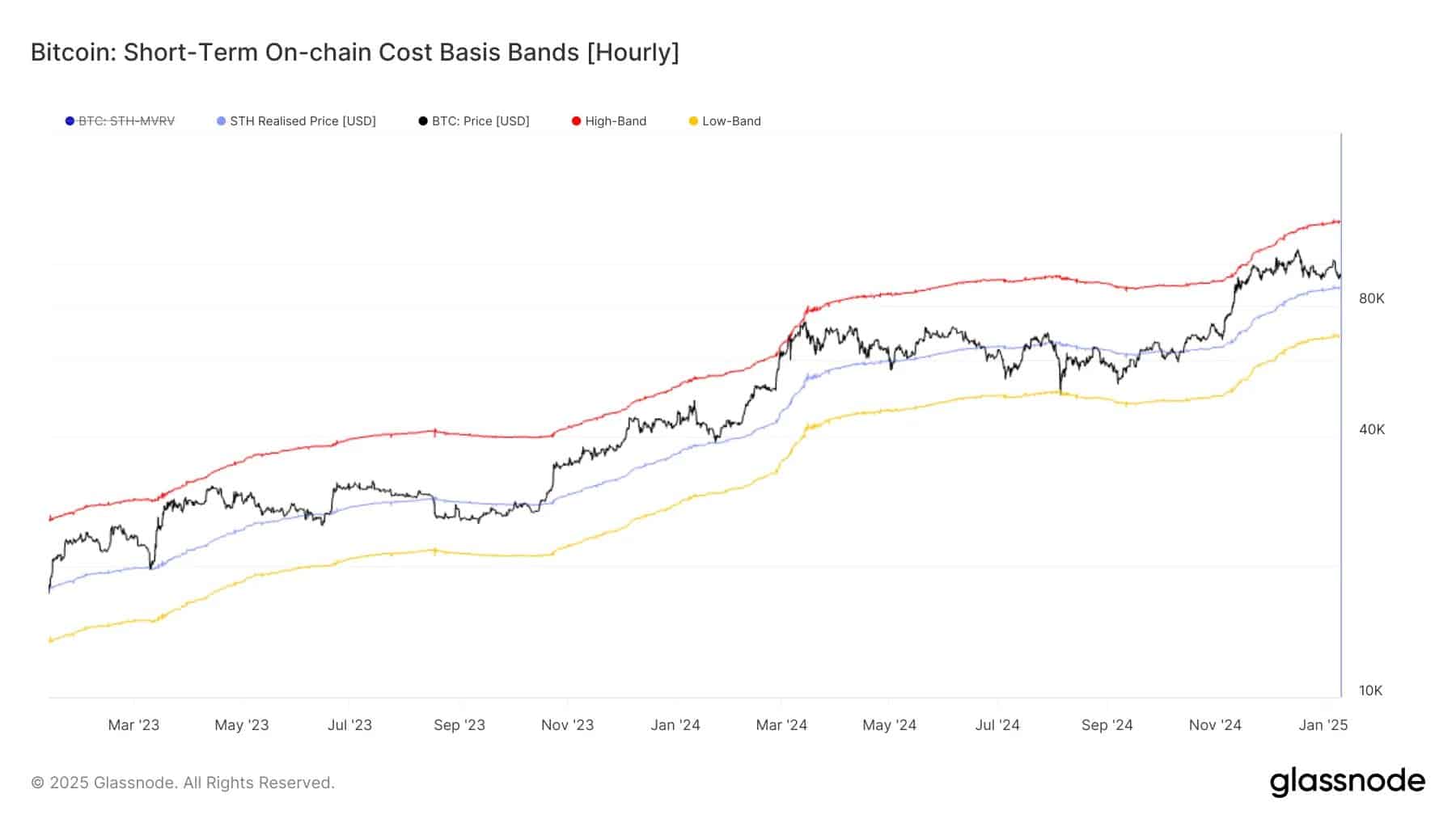

On the contrary, a drop below the average level for STH MVRV historically indicates a long-term downtrend or price consolidation for BTC. This could happen if the price of BTC falls below the STH cost basis, which according to Glassnode was $88,000 at the time of writing.

The analytics company declared,

“The price of $BTC is now about 7% above the STH cost basis of $88,135. If the price stabilizes below this level, it could be a sign of declining sentiment among new investors – which is often a turning point in market trends.”

Source: Glassnode

In short, if BTC defends $88,000 before or after Trump’s inauguration, a strong recovery could be imminent. However, a drop below $88,000 could trigger a panic sell-off by the STH cohort, which could drag the cryptocurrency down even further.

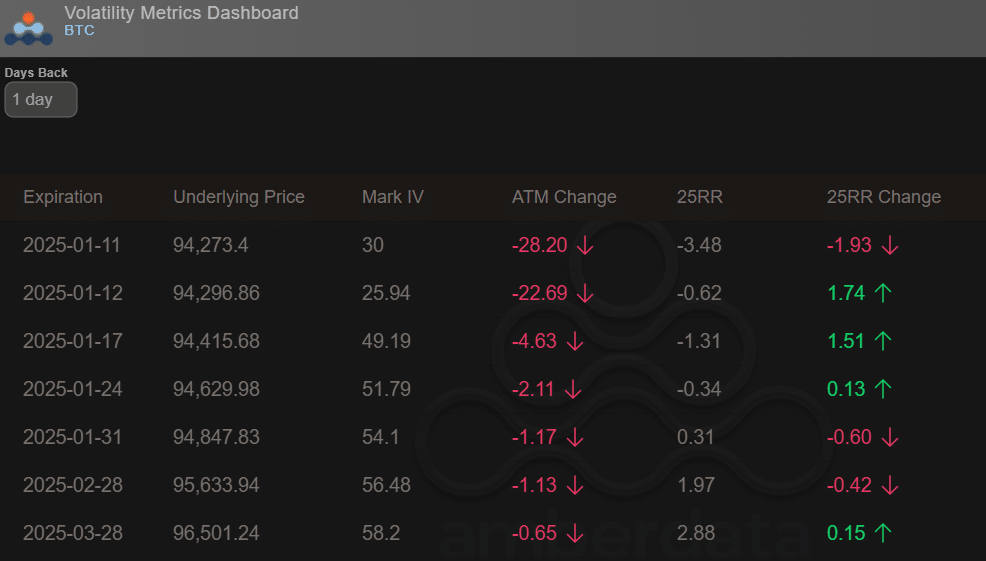

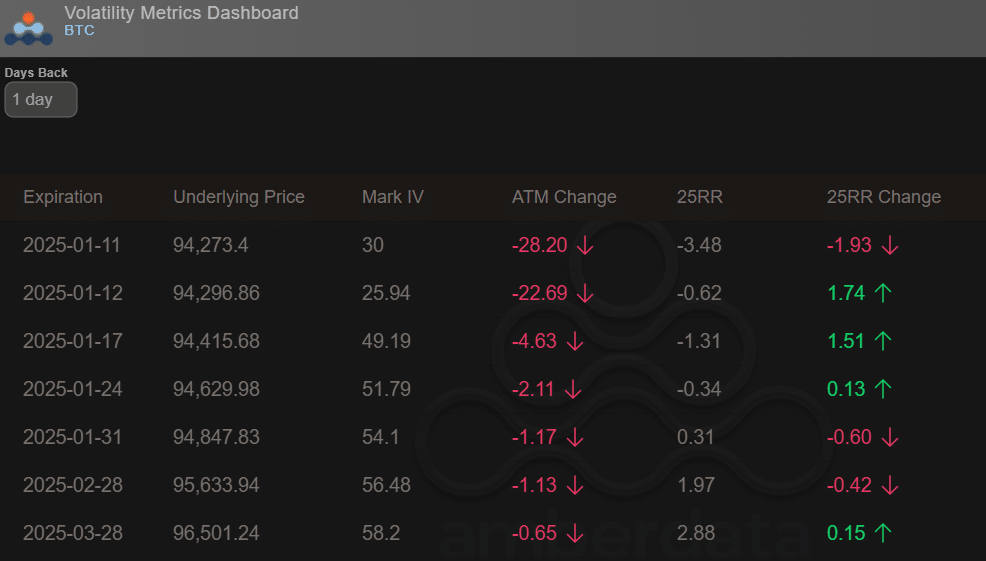

In the options market, traders have priced in negative to slightly bullish prospects before and after the inauguration. This was illustrated by the 24-hour change in the 25RR (25-Delta Risk Reversal).

The indicator was negative for option expirations on January 17 and 24, highlighting increasing hedging activity or a premium for put options (bearish bets to cover downside risks).

Source: Amberdata

Before expiration on January 31, the 25RR was slightly positive at 0.31, indicating a slight premium for calls (bullish bets). Simply put, options traders expect wild swings and potential declines before the event, and some stabilization afterward.

Credit : ambcrypto.com

Leave a Reply