- Hype set up 14.72% in 24 hours and jumped from $ 26.13 to $ 30.45 in the middle of strong market correlation with Bitcoin.

- Hyperliquid led all chains in daily costs of $ 3.2 million, while annual reimbursements amounted to $ 639 million for the month.

Hyperliquid [HYPE] has remained one of the best performing assets in the last 24 hours, after a profit of 14.72%.

Market analysis suggested that it can maintain this process because the recent movement is in accordance with the Bitcoin rally.

Further insight shows that both trade and on-chain activities are heavy crooked in favor of hype.

Hype can correlate with Bitcoin

Following Bitcoin’s of all time, only a few tokens have reflected this upward trend, among them.

The analysis of Ambcrypto links the recent switch of Hype to whale activity, in particular among those who have considerable liquidity and hyperliquid – are native platform – for large futures transactions.

Whale action led the leadership.

The most impactful trigger seemed to be a $ 1.07 billion long position, now $ 28 million in non -realized PNL.

Source: Coinglass

Large transactions such as these often cause trust among retail investors, who see a strong potential in hype. As a result, the Altcoin rose on 20 May from a low of $ 26.13 to a current price of $ 30.45.

Moreover, the Bullish market feeling leaned. Longs formed 51.17% of the positions, which eliminated the shorts at 48.83%.

Does trading activity correspond to the bullish sentiment?

Trading activity shows a positive correlation that could further stimulate the growth of hype. According to Artemis, Hyperliquid has generated the highest trading costs in the last 24 hours, with a conclusion of $ 3.2 million.

Source: Artemis

This trading activity reflects the rising interest rate in its ecosystem. In the last 30 days, the reimbursements of annual $ 639 million exceeded, which represents a price increase of 37.24%.

In the meantime, the vast hype rose to 423.4 million, reducing the available circulating supply, just like demand.

Source: Artemis

This dynamic could cause supply because the circulating diet does not keep track of increasing demand.

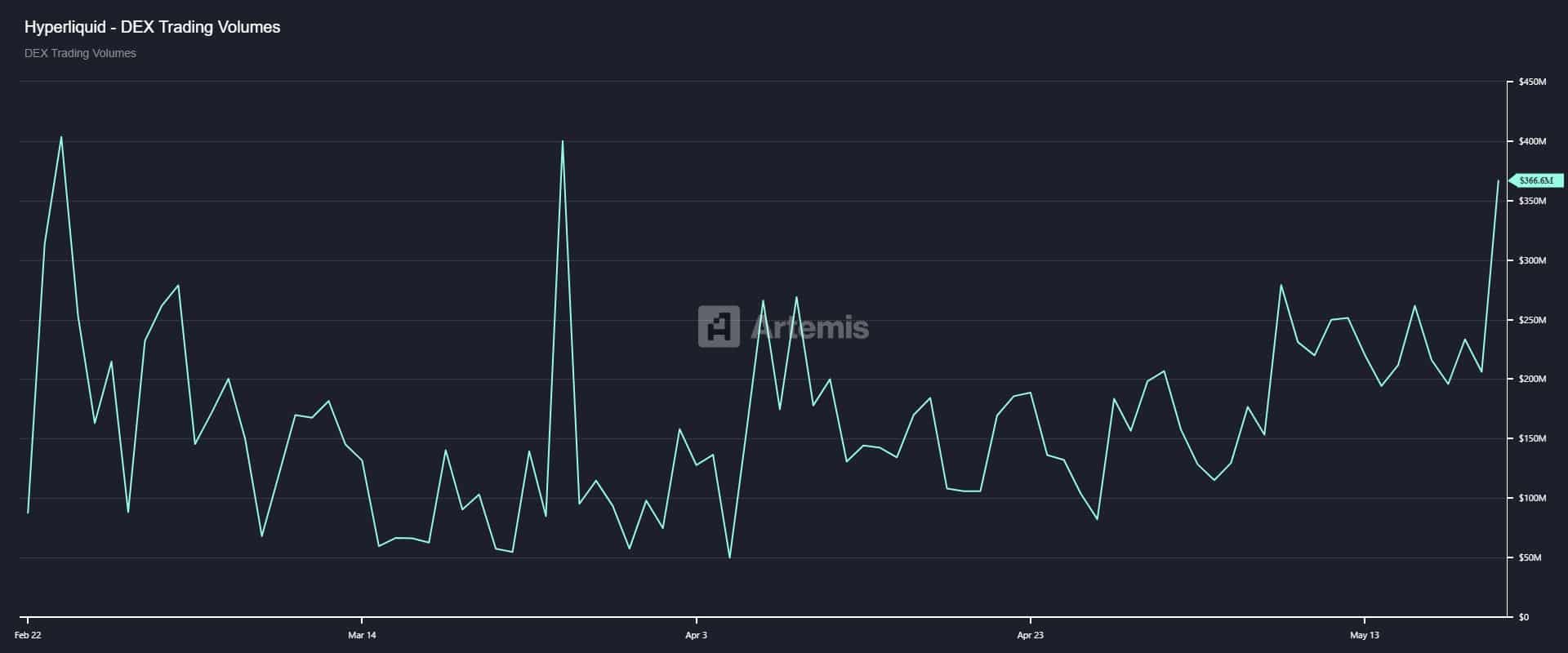

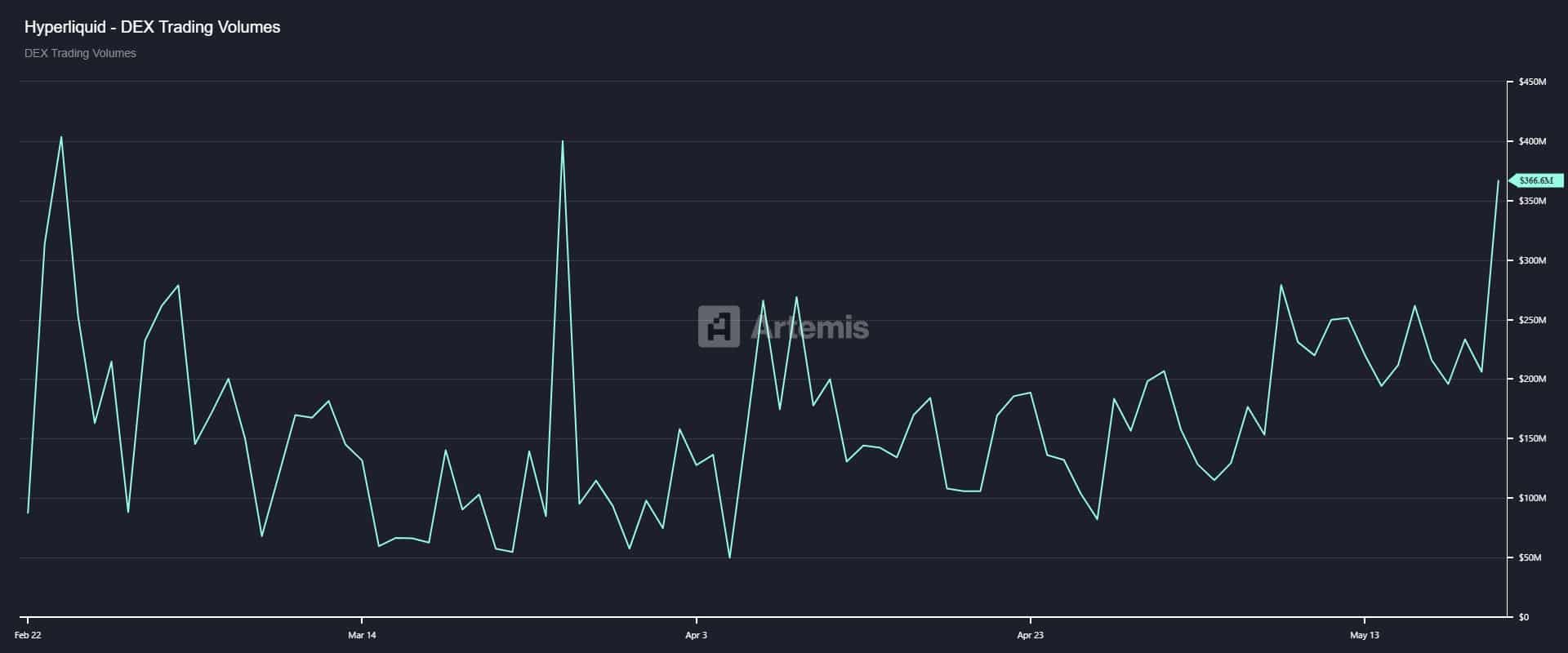

The trading activity of hype has grown considerably on decentralized stock exchanges (Dexes). Volume has reached a new milestone of $ 366.6 million in the last 24 hours.

Source: Artemis

This marks a significant interest, because these Dex -Handelsvolumes were last reached on March 26. A 30 -day outlook shows that the current trade volume has risen by 97.46% compared to the earlier basic value.

Credit : ambcrypto.com

Leave a Reply