Big reverse mortgage companies love it Finance of America (FOA) and Ellington financial — the parent company of the reverse lender Longbridge financial – recently announced their Q3 2024 earnings results, with FOA in particular posting strong numbers, while Ellington continues to tout Longbridge’s versatility across its overall portfolio.

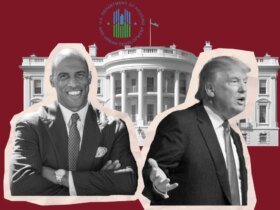

Recently, HousingWire‘s Reverse Mortgage Daily (RMD) sat down with us UBS analyst Douglas Harter to take a closer look at investor attitudes toward these companies in the here and now.

Looking to the future, there are some unanswered questions about the prospects of certain details within the Home Equity Conversion Mortgage (HECM) program, as well as other recent priorities in both the public and private sectors.

Past problems determine future responses

When asked about the collapse of the top five reverse mortgage lenders in 2022 Reverse Mortgage Financing (RMF) and the resulting liquidity crisis, Harter was asked whether something like this could create pessimism among investors that it happened, or inspire confidence given the government’s response to it.

Ultimately, it depends, he explained.

“I think initially it leans towards concerns about the short-term impact on liquidity and possible contagion to other areas,” he said. “There is also the question of how existing players will be affected. But if these issues are addressed and potential government actions such as HMBS 2.0 improve the dynamics of the sector, it could create new opportunities.”

That’s because an event like this can indicate what an entity looks like Ginny Mae could approach collaboration with other liquidity providers, which could be a source of optimism. But investors need time to absorb and assess the consequences.

“These types of questions usually arise after the initial aftermath, once the market starts to see how stakeholders and investors are reacting,” he said.

But it’s also likely that investors can see what the companies see, and that is additional product viability for the lenders’ own reverse mortgage offerings. Both FOA and Ellington emphasized the strength of their own products in recent earnings calls.

“Looking at the proprietary side, there is clear potential for growth and efficiencies, especially in jumbo loans,” Harter said. “If you can reduce origination costs through economies of scale, that can be beneficial. This fits well with Ellington’s strategy as they are a balance sheet-heavy company focused on creating long-term investments to support their dividend.”

There is more potential volatility at FOA as that company aims to be “less capital intensive than Longbridge or Ellington,” Harter said. “This has historically led to more fluctuations in their financial reports, with market adjustments playing a significant role – positive this quarter, but negative in the previous ones.”

But as FOA’s manufacturing operations expand, that volatility could diminish, he said. The key will be in the company’s ability to find long-term investors.

Impending changes

Because much of the reverse mortgage industry is intertwined with the Federal Housing Administration (FHA)’s HECM program, the upcoming transition of power in the federal government has some implications for the viability of space, depending on what type of policies the next HUD secretary, Ginnie Mae president, or FHA commissioner will choose.

As of now, Ginnie Mae is pursuing a final term sheet for HMBS 2.0, a complementary reverse mortgage securities program first telegraphed by Ginnie Mae early this year. An initial term sheet was released by Ginnie Mae this summer, and a final term sheet is expected sometime in the near future according to a timeline offered by acting Ginnie Mae President Sam Valverde in an interview with RMD.

But with the impending change in administration and the push from some allies in Congress of newly elected President Donald Trump to halt policymaking until the transition of power takes place, it remains to be seen how things will play out. For investors, the performance of HMBS 2.0 and proprietary products could play a role in their view of the reverse mortgage industry.

“I think the resolution of HMBS 2.0, and assessing the potential ongoing balance sheet or liquidity benefits that could come from that, is certainly something that people are looking at,” he said. “As we have previously discussed, the success of proprietary products or the HomeSafe Second are other key areas of focus. People are looking for indications of whether the market can grow. Of course, interest rates will fluctuate, over which no one has any influence.”

As for whether or not investors have an interest in the details of the actual transfer of power, it doesn’t take up much time in Harter’s conversations with investors, he said.

“It doesn’t seem like people have a clear picture yet of what could actually change,” he explained. “On the forward side, there is more focus on considering the potential impact of ending the conservatorship Fannie Mae And Freddie Mac. That seems to be where the current conversations are focused.

“No one really knows yet what that would mean, or how much could be accomplished with or without Congress, and what could get through Congress. It’s certainly on people’s minds, but there’s no clear picture yet of what it would look like.

Leave a Reply