- Bitcoin gains the grip as the American economic uncertainty affects record heights, increasing the appeal of Safe Haven.

- Falling BTC inflow to Binance signal reduced sales pressure and growing long-term investor confidence.

As US economic instability gets deeper, Bitcoin [BTC] attracts attention again as a potential global safe haven.

With the trust of investors in traditional markets that hesitate, the flagship active of the crypto market shows signs of resilience.

In particular, BTC inflow to Binance has fallen considerably, which indicates reduced pressure on the sales side and a shift to long-term possession.

These silent but meaningful signals suggest that Bitcoin may be aware of the next major outbreak, which quietly positions itself, not only as a hedge, but as a competition in the flight to safety story.

Bitcoin rises in the midst of record -breaking economic turbulence

The US economic policy security index increased to a record high in 2025.

The graph shown That every peak in uncertainty historically coincided with Bullish Momentum for Bitcoin – and the newest Golf is the most extreme so far.

Source: Alfractaal

The tariff increases of the second Trump administration, a recovered debt ceiling, the tied FED policy and a credibility crisis for the US dollar have all fed investor fear.

Add the geopolitical risks and legal whiplash, the result is a very volatile environment for traditional markets.

Bitcoin, on the other hand, seems structural immune to such chaos.

With confidence in Fiat -taking, BTC is increasingly not considered speculative, but as a strategic hedge – one that can quietly introduce his next battery phase prior to a large outbreak.

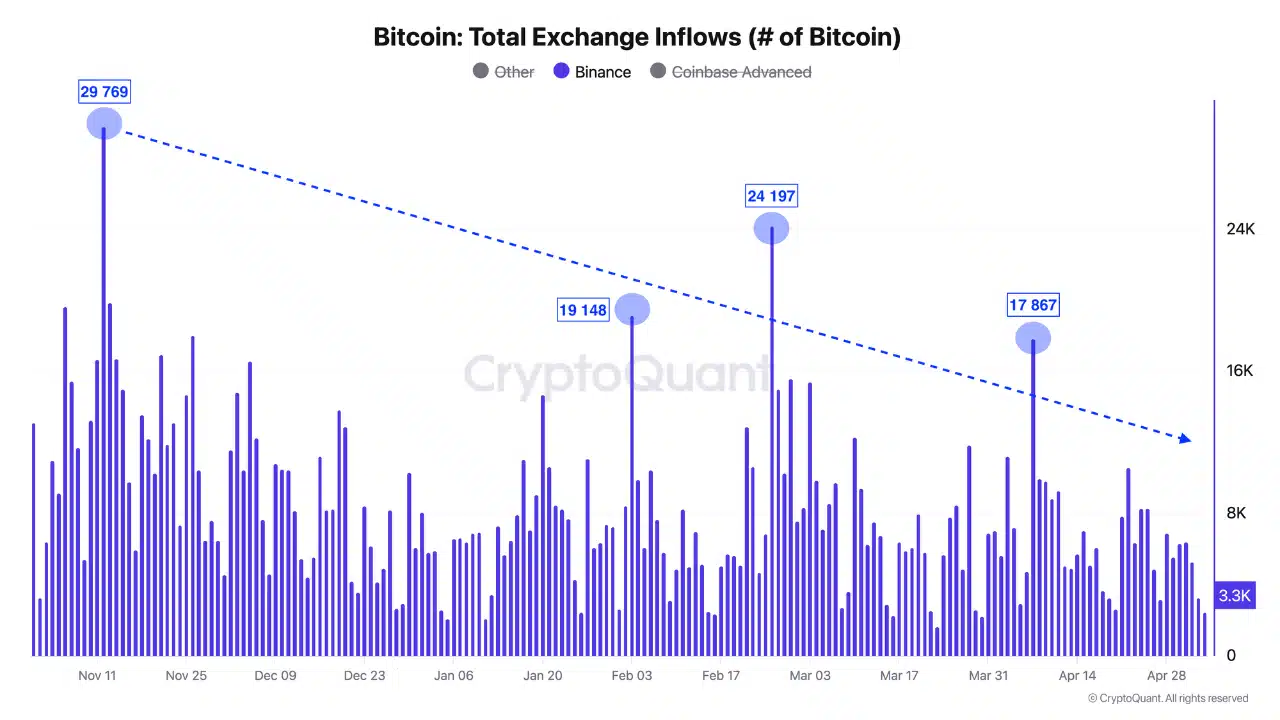

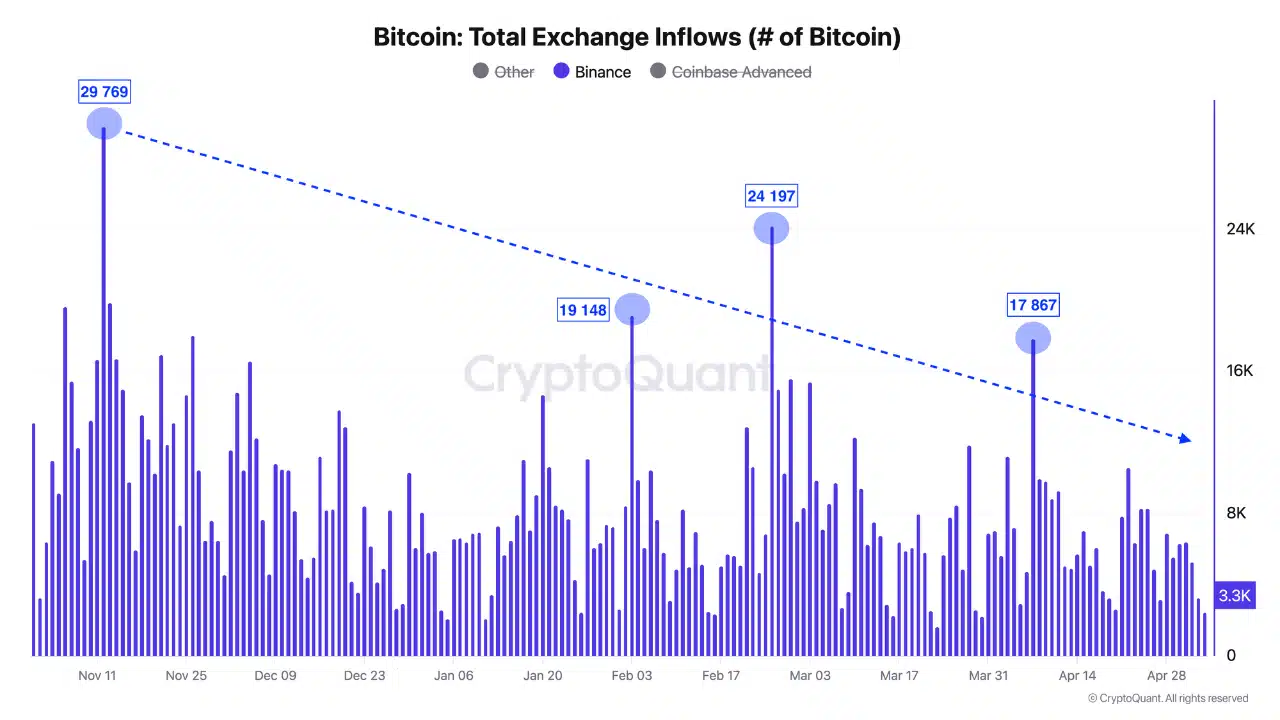

BTC: Sales pressure relaxing

Bitcoin -Inflow to Binance has been fixed Since the end of 2024, pointing to a reduction of immediate sales pressure.

Although there were a few remarkable peaks above 17,000 BTC, the trend is clear: fewer coins are being moved to the exchange for liquidation.

Source: Cryptuquant

With macro risks rising and investor confidence in Fiat systems that are faltering, this can be a reflection of the growing conviction in the long-term role of Bitcoin as hedge.

Bitcoin’s price forecast

At the time of the press, BTC traded nearly $ 94,000 and placed a small withdrawal after testing the $ 96,000. The RSI is slipped from Overbought Territorium to around 58, indicating a cooling momentum without pointing to overselling.

Source: TradingView

In the meantime, the MACD was close to a bearish crossover; Potential consolidation or weakness in the short term. However, the price structure remained intact above earlier resistance levels and now acted as support.

If the dip feet find above $ 91,000 $ 92,000, Bulls could quickly regain control.

Credit : ambcrypto.com

Leave a Reply