- Notcoin’s price fell by 3.02% over the past 24 hours, trading at $0.005802.

- One analyst highlighted a falling wedge pattern for a potential rally.

Non-coin [NOT] The price saw a decline of 3.02% over the past 24 hours, with the token trading at $0.005802. The market capitalization rose to $594.42 million, a positive shift from the previous day.

Despite the price drop, the market showed resilience, although trading volume fell 9.08% to $86.19 million.

This trading activity indicated moderate market interest, with a volume to market capitalization ratio of 14.49%. NOT’s fully diluted valuation (FDV) remained at $594.38 million, indicating confidence in the coin’s long-term potential.

With a total supply of 102.46 billion tokens, NOT was positioned for potential moves, albeit with careful market monitoring.

Notcoin poised for a possible breakout amid low volatility

Notcoin’s price has been on a consolidating trend, trading around $0.005807 at the time of writing, which may be poised for a breakout. Analysts noted that the Bollinger Bands narrowed, with the upper and lower bands at $0.0071 and $0.0054, respectively.

This contraction often indicates low volatility, which could precede a significant price shift, signaling a potential breakout.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator reflected bearish sentiment. The MACD line was below the signal line, while the negative histogram indicated continued downward momentum.

The MACD line should break above the signal line for a bullish reversal, with a positive histogram shift towards the $0.0071 resistance level.

Source: TradingView

The Chaikin Money Flow (CMF) stood at -0.06, indicating mild selling pressure within the market. With a CMF value below zero, sellers appear to have greater influence than buyers.

If the CMF breaks above zero, it would indicate greater buying momentum, which could support a move towards the resistance level.

Selling pressure is high as holders lose profits

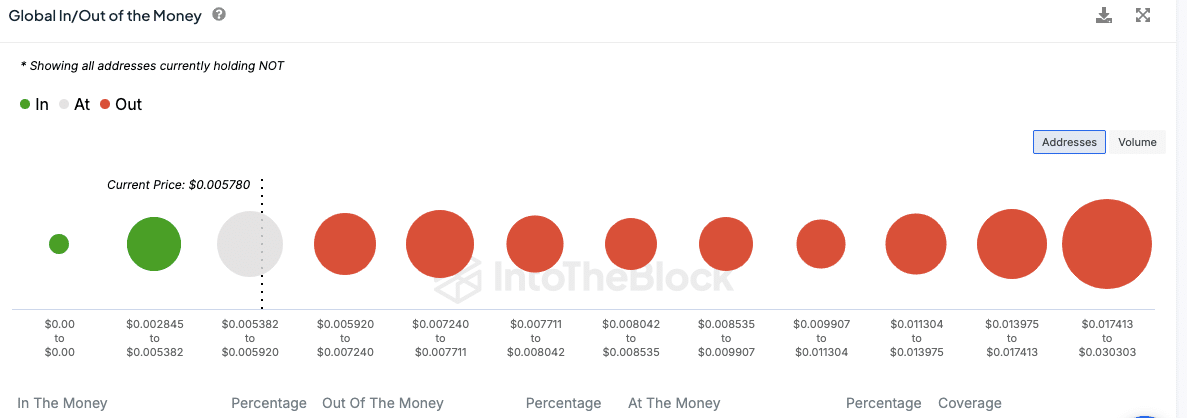

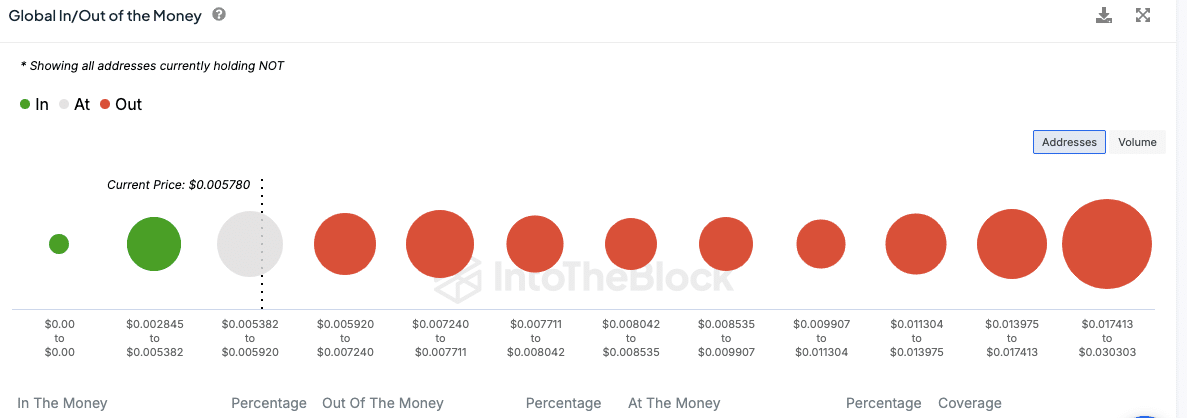

The global ‘In/Out of the Money’ graph showed that most NOT holders were ‘Out of the Money’. Most addresses are NOT held at higher price ranges, mainly between $0.005920 and $0.017413, indicating that many holders are facing unrealized losses.

Only a small portion of addresses were in the money, especially those buying between $0.002845 and $0.005382, indicating limited profitability at current levels.

Source: IntoTheBlock

The long/short ratio chart has shown fluctuating buying and selling interest, with recent sales volume spikes above 50%. The ratio showed that at times there are more sellers than buyers, leading to alternating control within the market, indicating balanced sentiment, with sellers occasionally dominating but not having sustainable momentum.

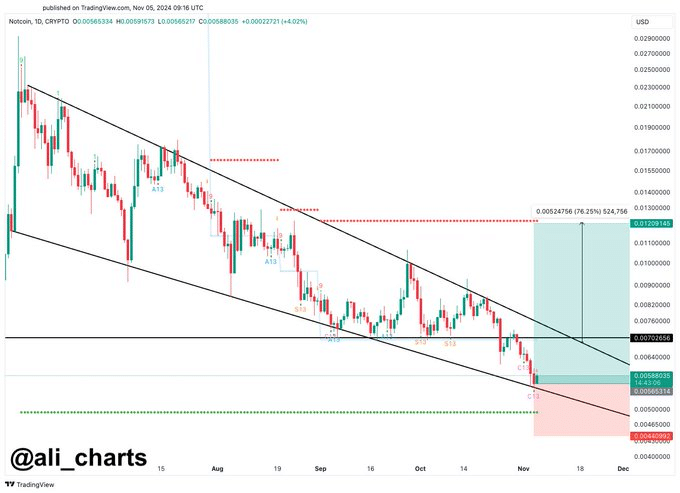

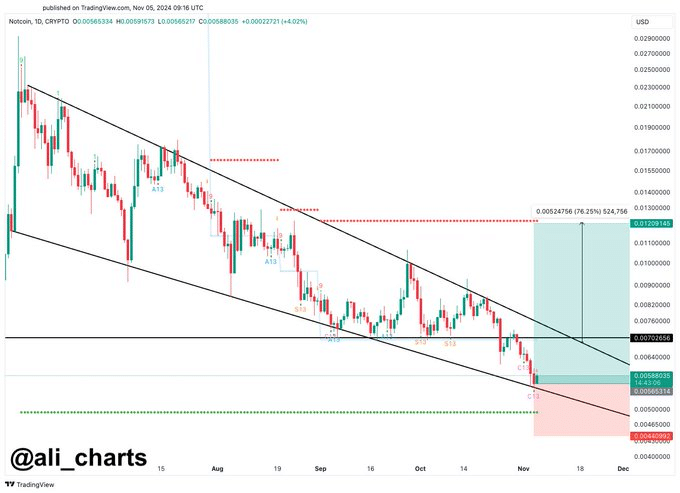

Falling wedge pattern signals rise for Bitcoin

Crypto analyst Ali Martinez has highlighted a bullish falling wedge pattern on NOT’s chart. This pattern could lead to a breakout with a price target around $0.012, although confirmation is still pending.

Traders and investors should keep a close eye on technical indicators as increased buying pressure could support significant price appreciation.

Source:

Read Notcoin’s [NOT] Price forecast 2024–2025

If buying pressure increases and technical indicators turn bullish, NOT could test its upper resistance levels. However, if selling pressure prevails, the token could revisit its lower support at $0.0054.

Credit : ambcrypto.com

Leave a Reply