- SAND could fall 15% to reach the $0.231 level unless it breaks above the $0.29 level.

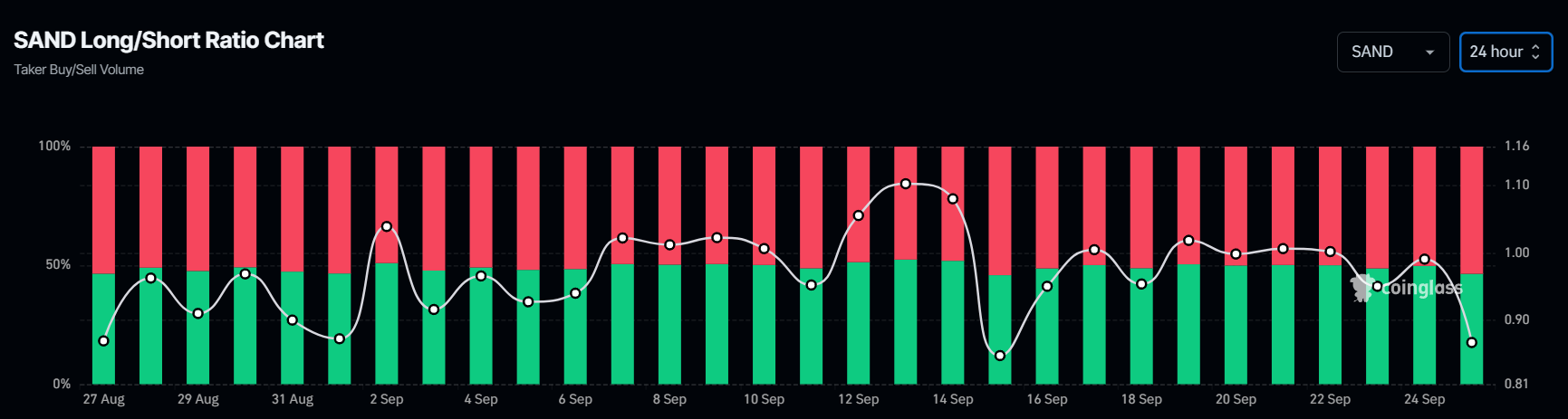

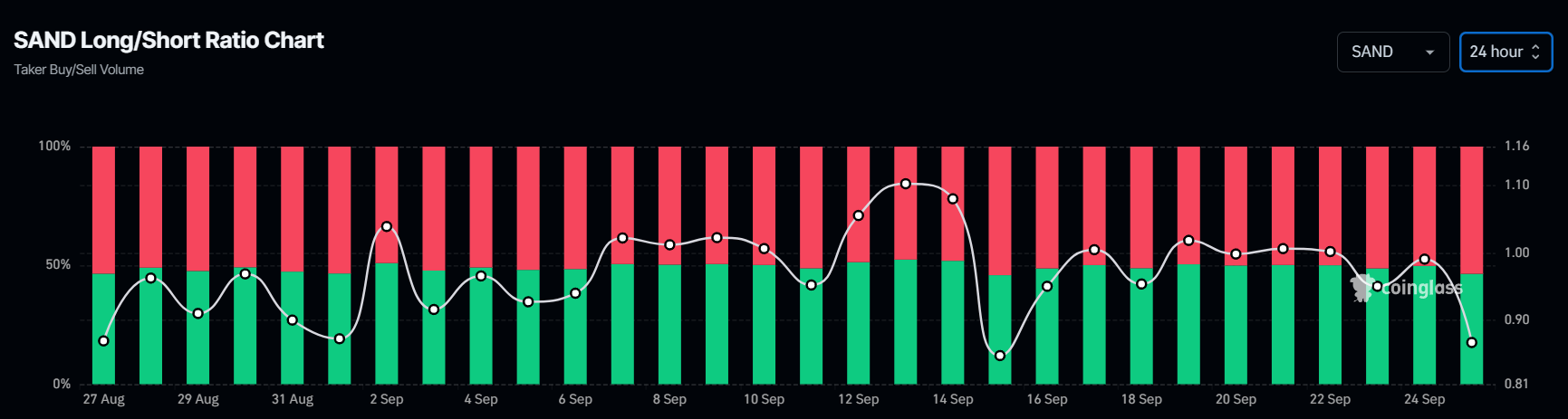

- The token’s Long/Short ratio at the time of writing was 0.84, indicating bearish market sentiment.

After a remarkable rally in recent days, The Sandbox [SAND] seemed poised for a price drop as millions of tokens are dumped onto centralized exchanges.

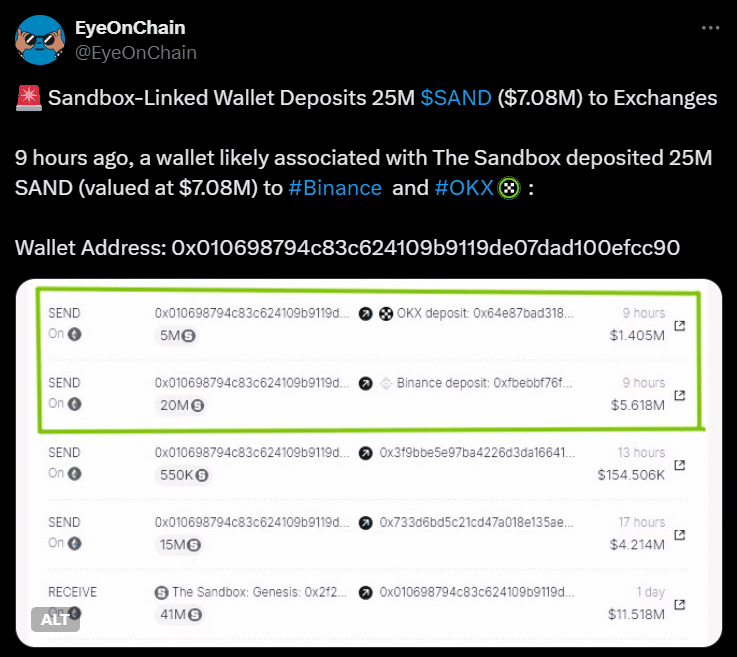

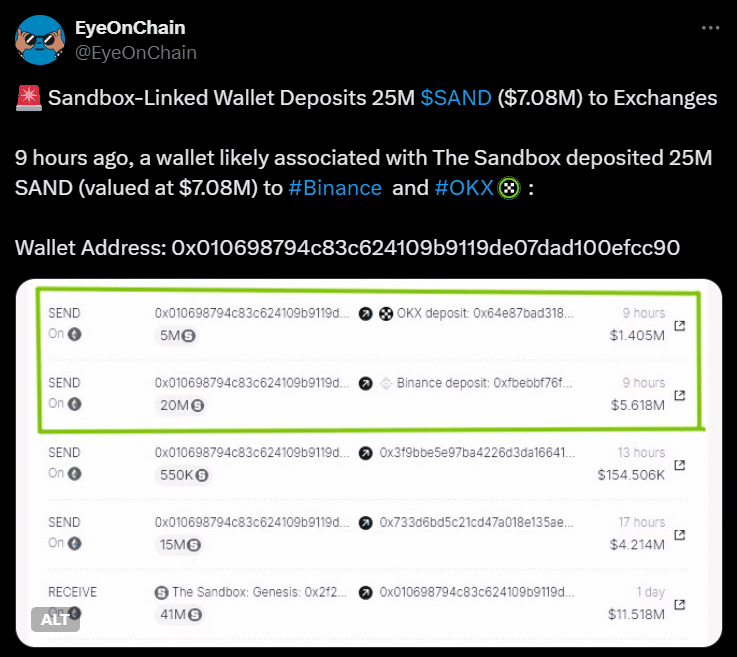

Wallet dumps 25M SAND

On September 25, analysis company on the chain Eye chain posted on

Source:

The post also noted that this wallet received 41 million SAND worth $11.32 million from The Sandbox. Moreover, a significant portion of these tokens have already moved to the CEXs, indicating a possible sell-off.

The Sandbox: price momentum

Despite this significant dump, SAND has not seen any major price changes in recent hours. At the time of writing, SAND was trading around $0.281 and has experienced a modest 1% increase in price over the past 24 hours.

During the same period, trading volume increased by 21%, indicating greater participation from traders and investors.

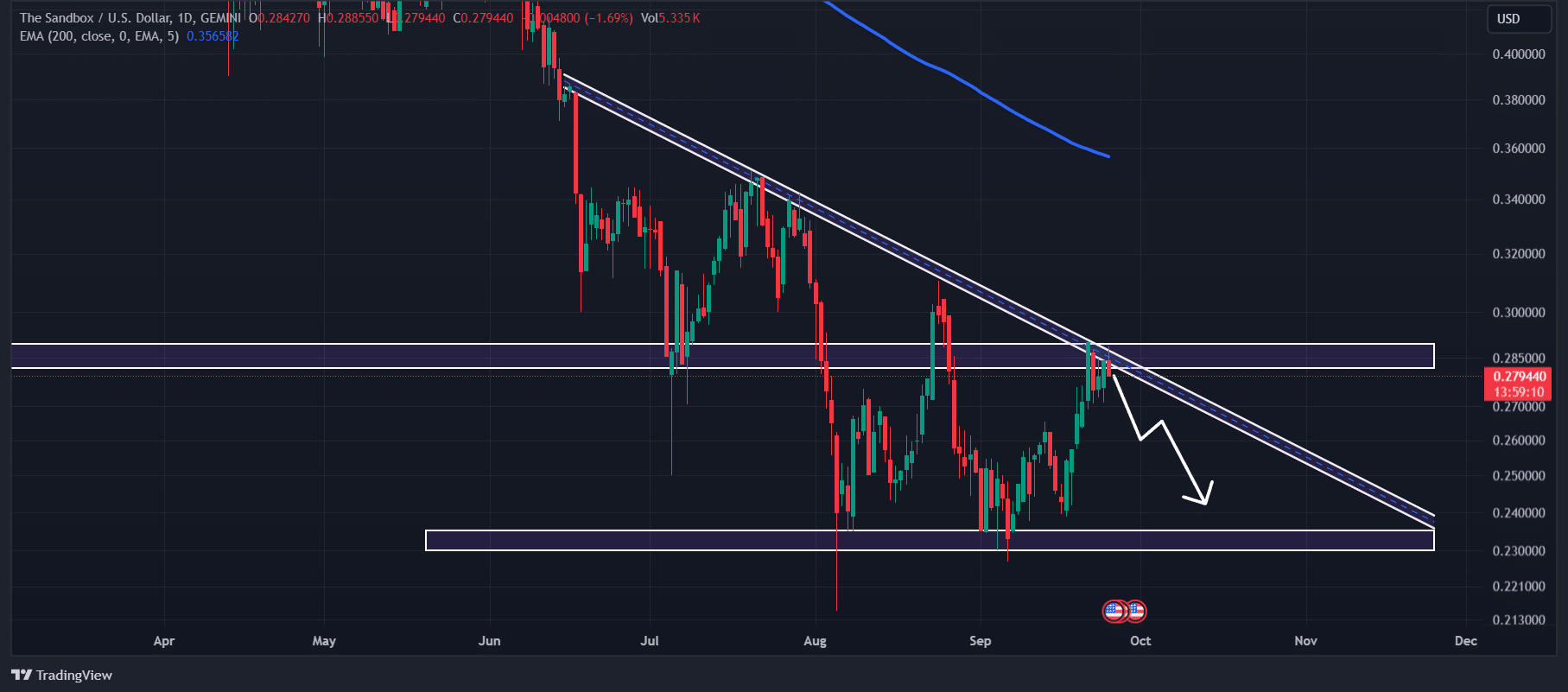

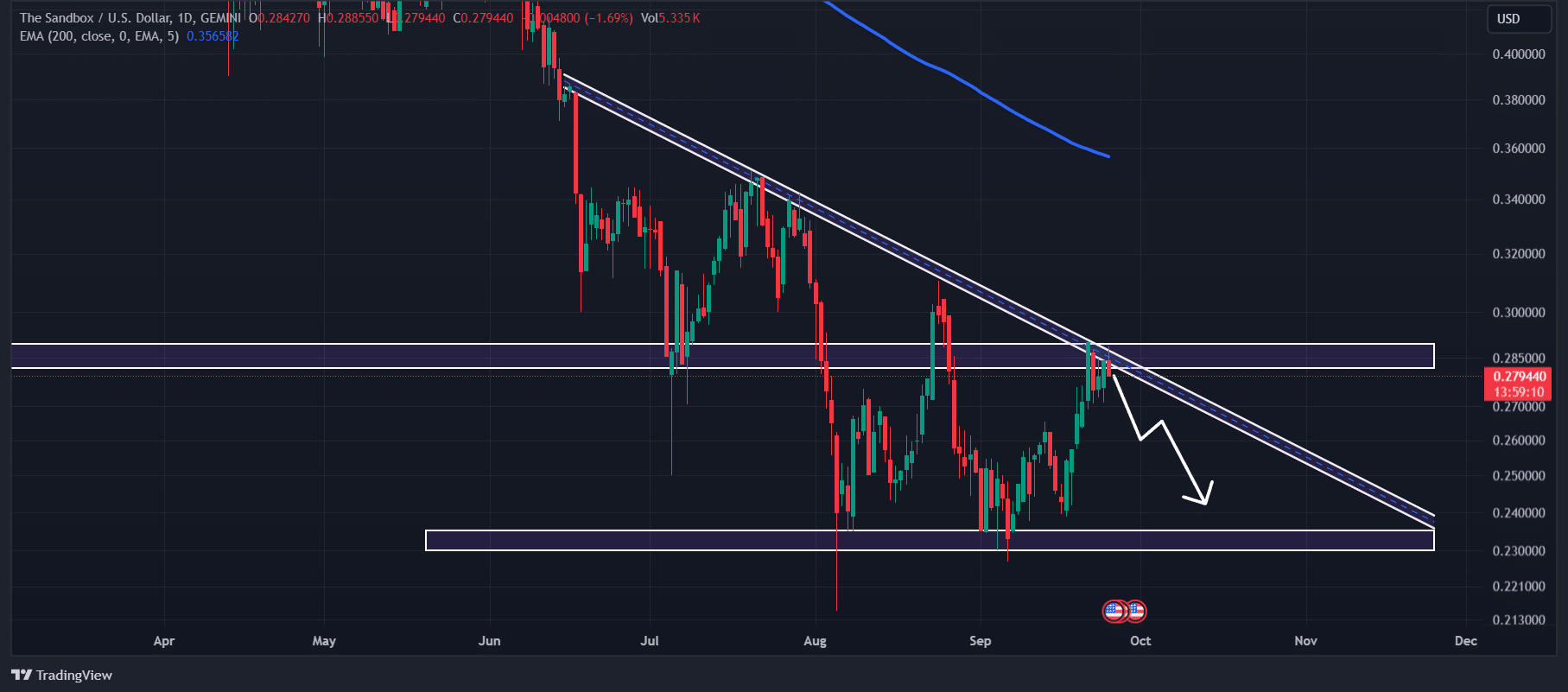

According to AMBCrypto’s technical analysis, at the time of writing, SAND appeared bearish and was trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend.

The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an up or down trend.

Source: TradingView

Moreover, the asset was facing a price reversal from a crucial resistance level of $0.288 at the time of writing.

Based on the historical price momentum and the recent token dump, there is a high possibility that SAND could fall by 15% in the coming days to reach the $0.231 level.

The bearish outlook for The Sandbox will only hold if SAND stays below the $0.29 level, otherwise it could fail.

Bearish data on the chain

This negative outlook was further supported by on-chain metrics. SAND’s Long/Short ratio stood at 0.84 at the time of writing, indicating bearish market sentiment among traders.

Source: Coinglass

Read The Sandbox [SAND] Price forecast 2024–2025

Furthermore, Futures Open Interest is up 4.2% over the past 24 hours, indicating that bears were betting more on short positions than on long positions.

At the time of writing, 54.14% of top traders had short positions, while 45.86% had long positions. So the bears dominated the assets and may have created selling pressure in the coming days.

Credit : ambcrypto.com

Leave a Reply