- Brandt expected Sol ETH to surpass with an extra 30-140% in the long term.

- Galaxy Digital reportedly exchanged an ETH of $ 105 million to Sol.

Solana [SOL] Claimed $ 150, which produces its recovery profit to 58% of a low of $ 95 hit three weeks ago.

For Ethereum [ETH] Investors, they rose 30% in the same period, giving Sol opposite hangers a strong lead.

Sol to surpass ETH?

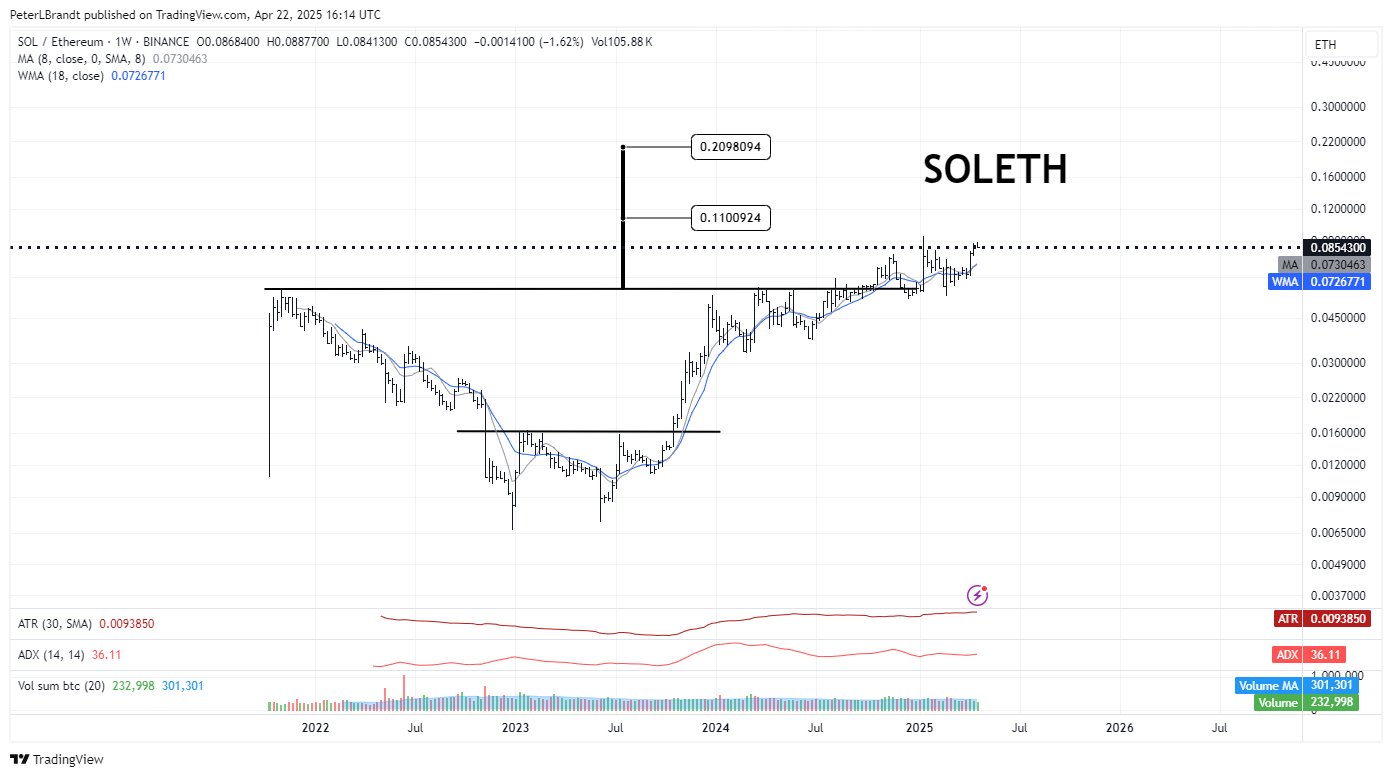

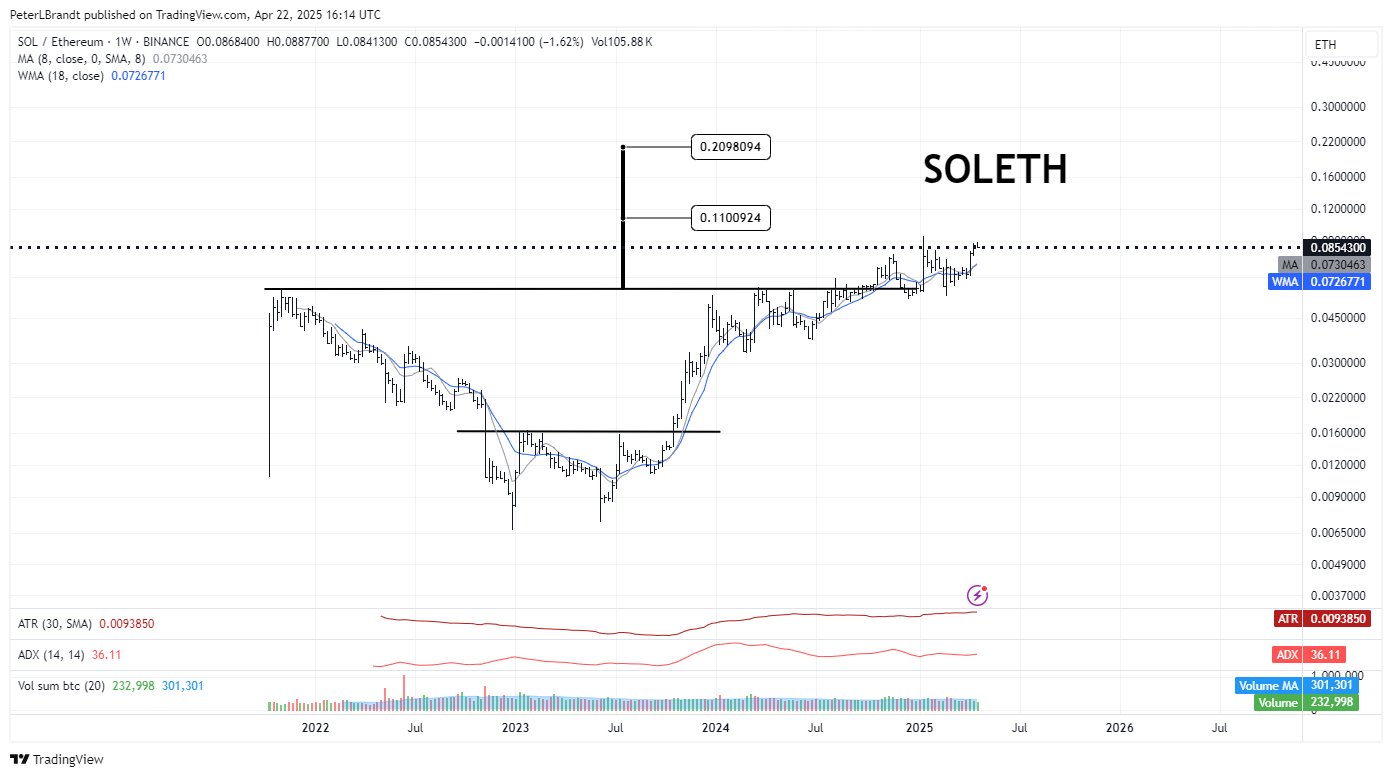

According to the renowned trader Peter Brandt, the aforementioned SOL Relative Outperformance against ETH can be calculated to 90%in the middle of or long term.

He called the cup and handle (C&H) pattern, usually considered bullish for his projection.

“This C&H is still playing. Sol has a lot of room to win on his invalid cousin, $ ETH.”

Source: X

The Graph of Brandt showed that, if validated, the SOL/ETH ratio, which follows relative SOL price performance at ETH, could hit 0.11 or 0.20. This suggested a potential rally of 90% or 245% of the breakout level of 0.05.

The SOL/ETH ratio was valued at 0.08. This meant that SOL/ETH had an extra growing space to collect 33% and 140% respectively if the goals of Brandt were hit.

Simply put, Sol could surpass with ETH with 30-140%in the long term.

Galaxy Dumps ETH for SOL

Interestingly, the likely investor seemed to play a shift from ETH to Sol with major players.

According to Wu Blockchain, reference Arkham Intelligence Data, Galaxy Digital exchanged $ 105 million ETH for Sol on Binance.

“In the past two weeks, Galaxy Digital has transferred 65,600 ETH (around $ 105 million) to Binance, while he has included 752,240 Sol (approximately $ 98.37 million) from the stock market, suggesting a possible ETH-to-Sol swap.”

Brandt’s projection could be validated faster if the trend would continue and more players follow the example.

Source: Coinalyze

SOL’s Market recovery reflects the demand for organic spots, emphasized by the uptick of the cumulative volume delta (CVD) spot indicator.

The rally shows signs of sustainability, fed by both the spot and derivative demand, clearly in the open interest.

On the 3-day price diagram is the following key level $ 160 and serves both a overhead hindernis and a progressive average.

To continue the upward trend, SOL must decide above the RSI -neutral level. Not doing this can lead to a retest of $ 136, so that traders are careful.

Source: SOL/USDT, TradingView

Credit : ambcrypto.com

Leave a Reply