Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

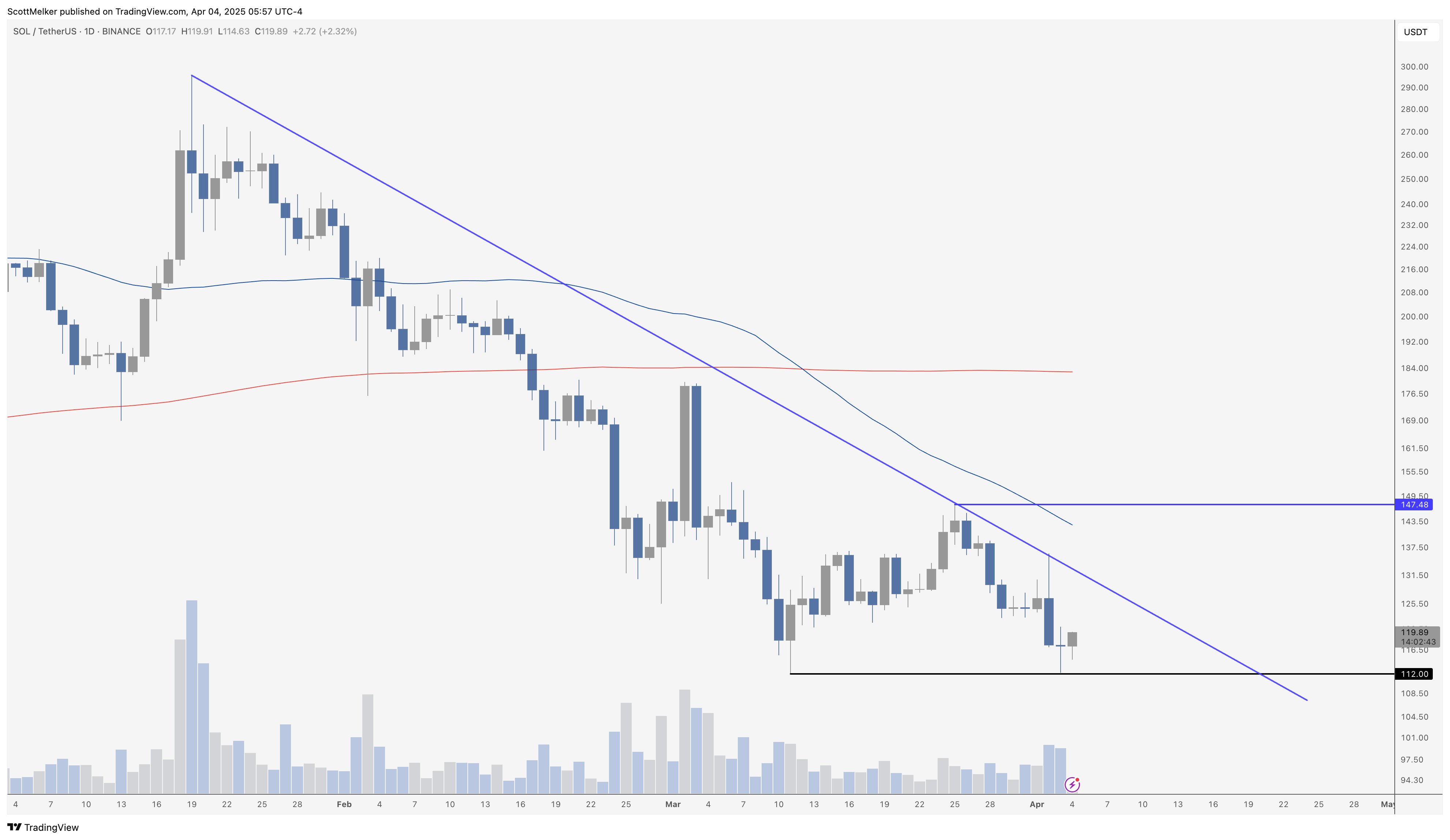

In a new technical analysis shared via X, crypto analyst Scott Melker Aka de Wolf emphasized all streets (@scott melker) a critical support setup for Solana (Sol), and emphasized what he sees as a textbook that bounces an important technical level. “Perfect perfect tuition of $ 112 support. Double soil would attach with a break above $ 147, the swing high between the two soils. Let anyone call it a double bottom until that happens. Nice strout of support with defined resistance to look,” Melker, “Melker,” Melker, ” stated.

The graph of the analyst shows that SO is back from almost $ 112, which strengthens that zone as considerable support in the short term. For a bullish pattern with double bottom to validate, Melker points to an outbreak above the falling line (currently around $ 130). If Sol breaks this resistance, $ 147 is the critical level that should be violated. Until then, he advises caution on the premature labeling of the formation as a confirmed double bottom.

Solana Bottom in?

These comments in particular are on the heels of unlocking. By one after By Unclassified Intelligence Company Arkham on Thursday: “$ 200 million of SOL-Development Tomorrow. Tomorrow (April 4) marks the largest one-day unlocking of Stusted Sol until 2028. These 4 accounts set a total of $ 37.7 million Sol in April 2021 and are 5.5x against the current prices.” The scale of these unlocks has yielded a substantial discussion about social media.

Related lecture

Another trader, Noone0x, took a more optimistic attitude and noted: “Sol unlocks. Looking at the clear side, the unlock of today was the last big block. Today alone, no less than 40% of everything is left. It is 78% done, May, June and

Historically, large token – discharge events – either for Solana or other projects – are often expected well in advance by traders and investors. Markets “price in” that large holders sell their old tokens, sometimes the prices stimulate lower prior to actual unlocking. As soon as the release date has arrived, if the expected sale does not come as seriously as feared as feared (or if much of the unlocked ring of the market remains), the prices tend to stabilize and often recover in the days or weeks that follow.

Related lecture

This pattern comes to the fore because many holders, especially larger or early investors, can choose to let their tokens rest or hold if they retain strong fundamental prospects. In the meantime, short -term traders who had gambled on unlock -related volatility can close positions as soon as the event passes. This “Buy the rumor, sell the news” (or vice versa) Dynamic can lead to basic issues regarding unlocking periods, but no outcome is guaranteed; Much depends on how much actual sales pressure surfaces and a wider market sentiment at the time.

Meanwhile, Awawwat, a trader and angel investor at APG Capital, warned That Solana could be in a precarious position, despite the fact that it is above $ 100. “Sol Absolutely Shrekt-Brak 170 range low, bounced a few times at 120-NU holding above 100, but the ice is thin-lasting big unlocking morning-okay Sub-100 offering as given, but this looks rough considering the condition of the trenches,” he wrote.

Sol traded at $ 115 at the time of the press.

Featured image of Shutterstock, Graph of TradingView.com

Credit : www.newsbtc.com

Leave a Reply