- Metaplanet increased Bitcoin accumulation with the last purchase of $ 53.4 million.

- Plans to expand to the US with a $ 10 million Treasury Corp in Miami.

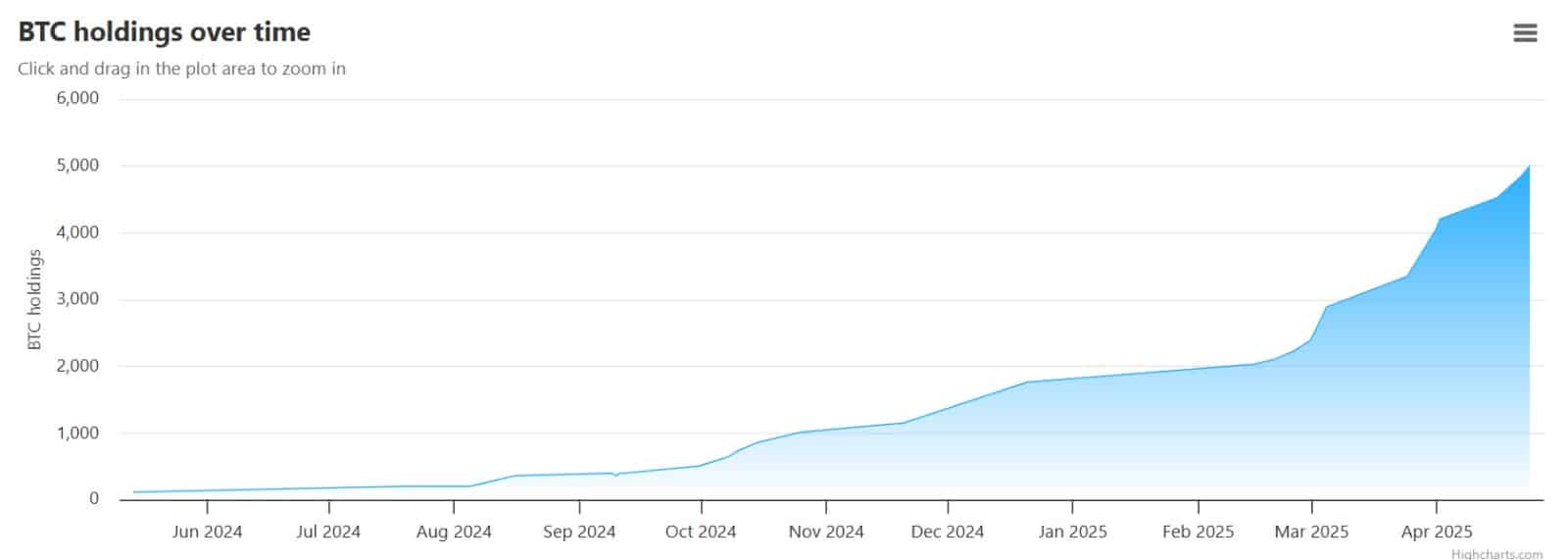

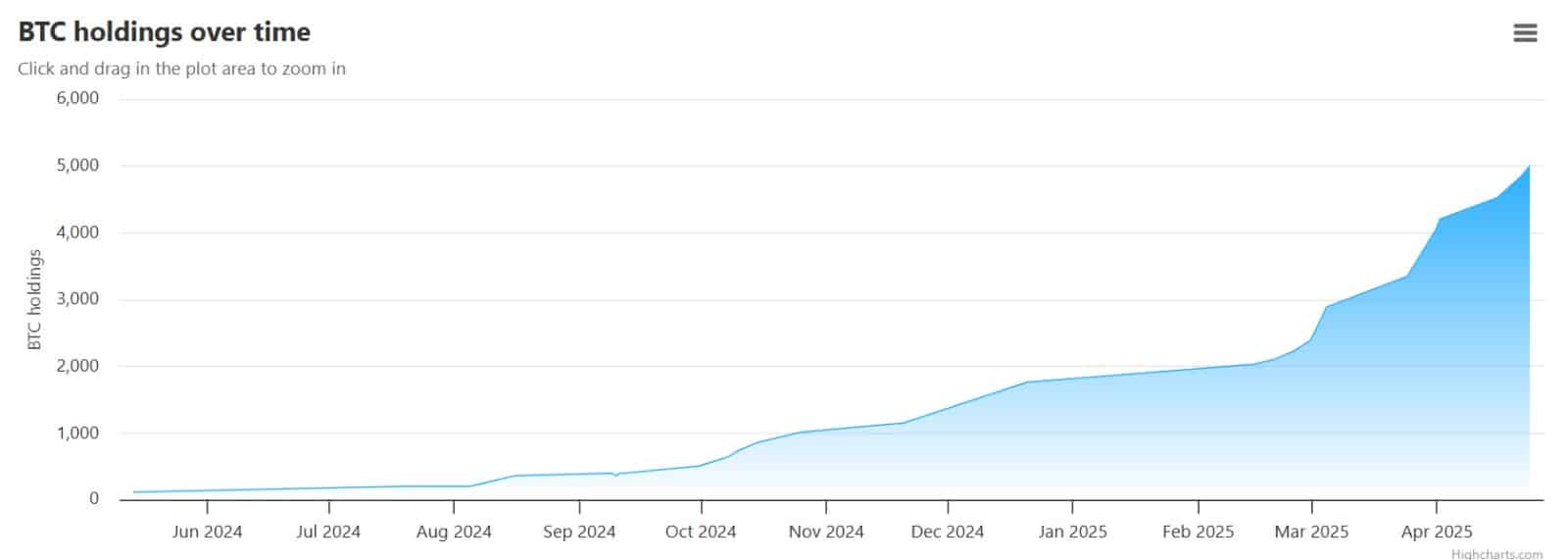

In the past five months, institutional appetite for Bitcoin [BTC] has become visibly stronger. A company that leads this accumulation is the Metaplanet of Japan and is actively expanding its BTC companies.

In the latest Koop Spree, The Tokyo Listed firm announced The purchase of 555 BTC at an average price of $ 96,134, worth $ 53.4 million.

This fresh addition pushed its total Bitcoin holdings to 5,555 BTC, with a value of approximately ¥ 71.76 billion (or $ 465 million), with an average access of $ 86,672 per coin.

Since April 2024, when Metaplanet revealed its crypto strategy, the company has collected Bitcoin aggressively. As part of the company’s strategy, it wants to increase its participations to 10k BTC by the end of 2025.

So far, it has 4445 BTC more to achieve its annual goal.

Source: Bitbo

Of course the company did not stop when buying. It financed the acquisition by issuing a new series of ordinary shares at $ 25 million, which marked his 13th round of fundraising since 2024.

These stock and bonds have become a consistent part of the “Bitcoin Financial Strategy” of Metaplanet, rolled out in April 2024.

In addition to the Koopspree, Metaplanet plan To enter the United States and to expand its presence. It aims to open a branch in Miami and to set up a Treasury Corp in Florida, sown with $ 10 million in capital and wants to scale to $ 250 million.

Metaplanet is currently the largest public company that Bitcoin holds in Asia.

Institutional interest in Bitcoin has been warmed up

The continuous acquisition of Bitcoin from Metaplanet is not only Bullish, but also a good indicator for the growing institutional demand. It means that institutions now regard BTC as a lucrative and safe long -term investment.

That is why Metaplanet -acquisition is not an insulated matter, because institutions have returned to the market and now buy BTC. This market behavior is proven by a positive Coinbase Premium Index.

A shift to positive here suggests that as the world markets cool down rates, Bitcoin becomes the first stop.

Source: Cryptuquant

That said, the aggressive strategy of metaplanet has had wrinkle effects. The stock has risen by 11.45% at the time of writing and underlines the trust of investors in its BTC-oriented approach.

Source: Google Finance

The growing stock of Metaplanet is no longer just a balance sheet item – it is a value of a value. And his bullish attitude feeds broader confidence across the board.

Credit : ambcrypto.com

Leave a Reply