- Layerai rose by 81.92%, supported by strong technicians and rising open interest

- Activity at the chain and short liquidations have referred about the growing market confidence in Layerai’s Momentum

The Cryptocurrency market has recently seen its fairly volatility share, but Layerai [LAI] makes a statement. The Token rose in just one day with an impressive 81.92% and traded at $ 0.007600 at the time of the press.

This sudden rise in the price has attracted the attention of both investors and analysts. So what does this upward momentum drift and can Layerai support its growth?

Can Lai hold his profit?

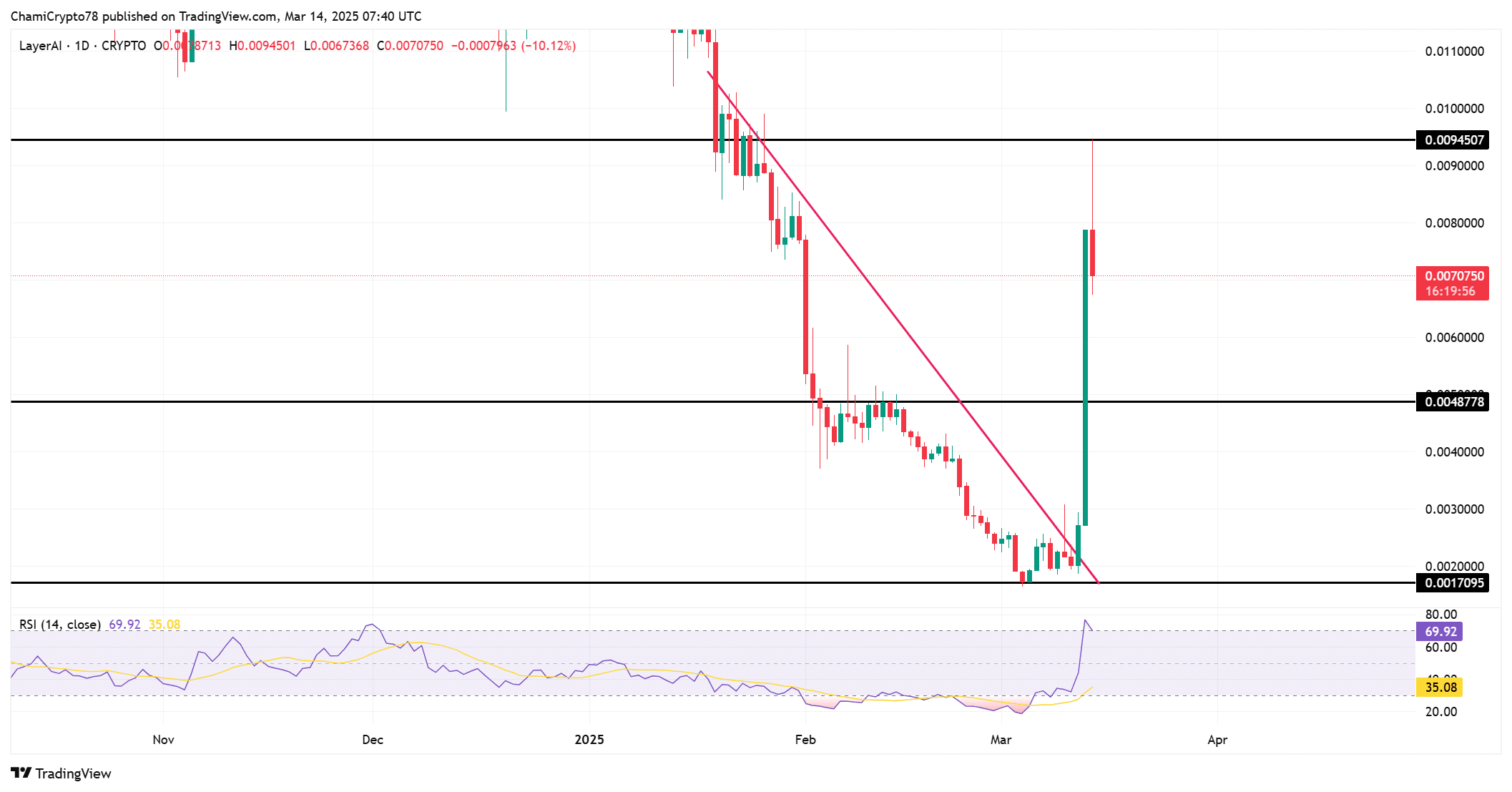

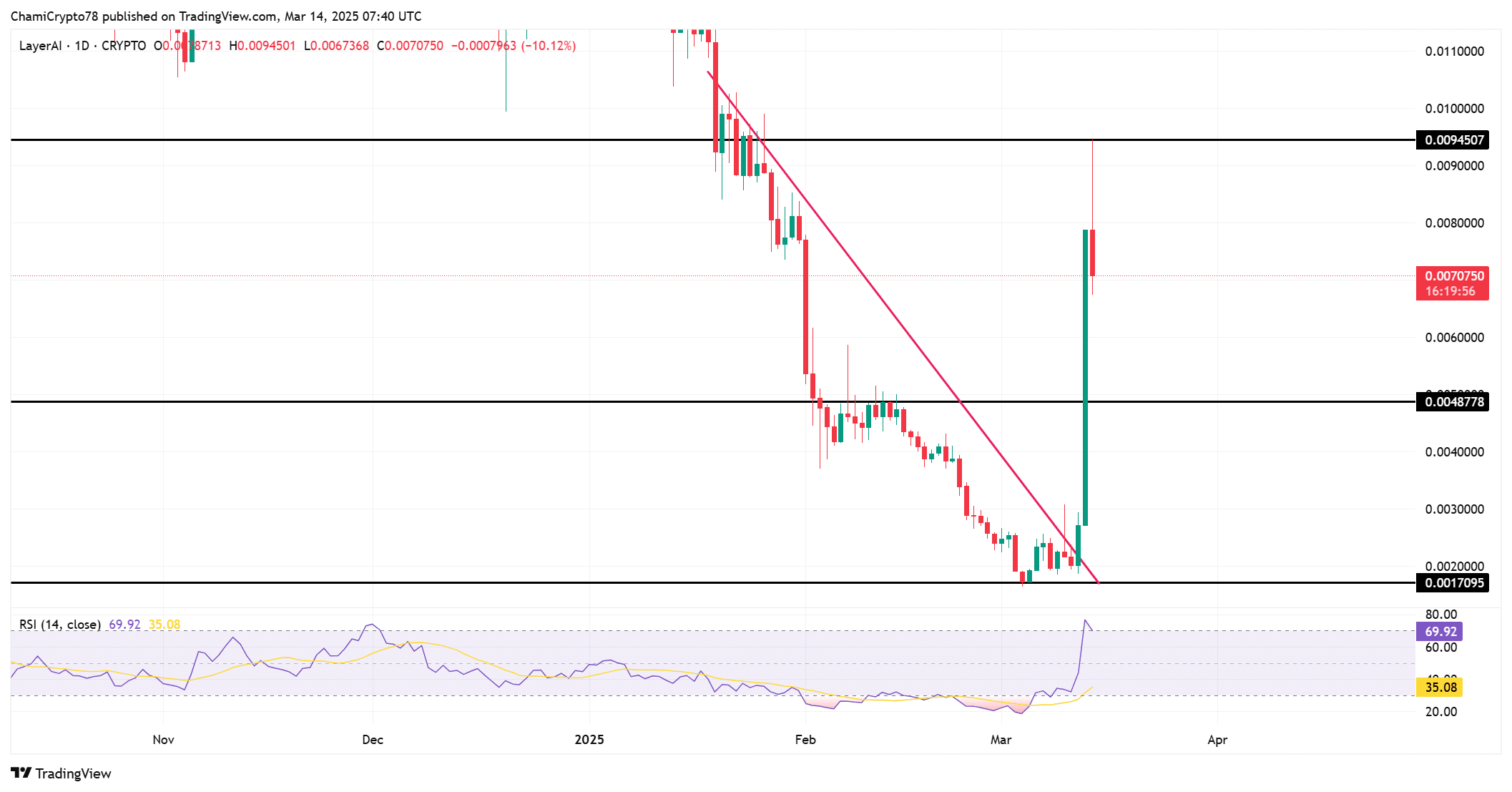

The price diagram of Layerai unveiled a dramatic peak in March 2025, where it broke through various resistance levels, pushing the price above the $ 0.007 market.

The RSI seemed to flash a bullish lecture of 69.92 – a sign that it was active in a strong momentum phase. The price correction that was seen after reaching the peak that was referred to potential consolidation before the next major movement.

The most important support levels to view are $ 0.0048778 and $ 0.006000, while the resistance is $ 0.0094507 near the region. If Layerai keeps holding up the support, this can focus on higher price levels in the coming weeks.

Source: TradingView

Open interest Surge – what does it tell us?

Layerai’s open interest rose with a stunning 143.39%and hit $ 6.42 million. This sharp walk indicated that more capital is tied up in the Futures of Lai, which indicates growing market confidence. It is a clear sign that investors bet on further price promotion.

However, the significant increase in open interest can also give a higher market risk, especially if the price registers a reversal. With this in mind, traders must keep a close eye on the open interest rate in order to measure the intensity of the market sentiment.

Moreover, Layerai’s on-chain statistics emphasized a considerable peak in daily active addresses and transaction volume. The number of daily active addresses jumped drastically and reached 54 addresses at the time of the press – which marks an increase in network activity.

Moreover, this increase is supported by a corresponding increase in transaction. Such a peak in the activity in the chain usually indicates that more users are involved in the network. This can indicate a growing acceptance and further demand for LAI.

Source: Santiment

Lai Long vs. Short Liquidations – Who wins?

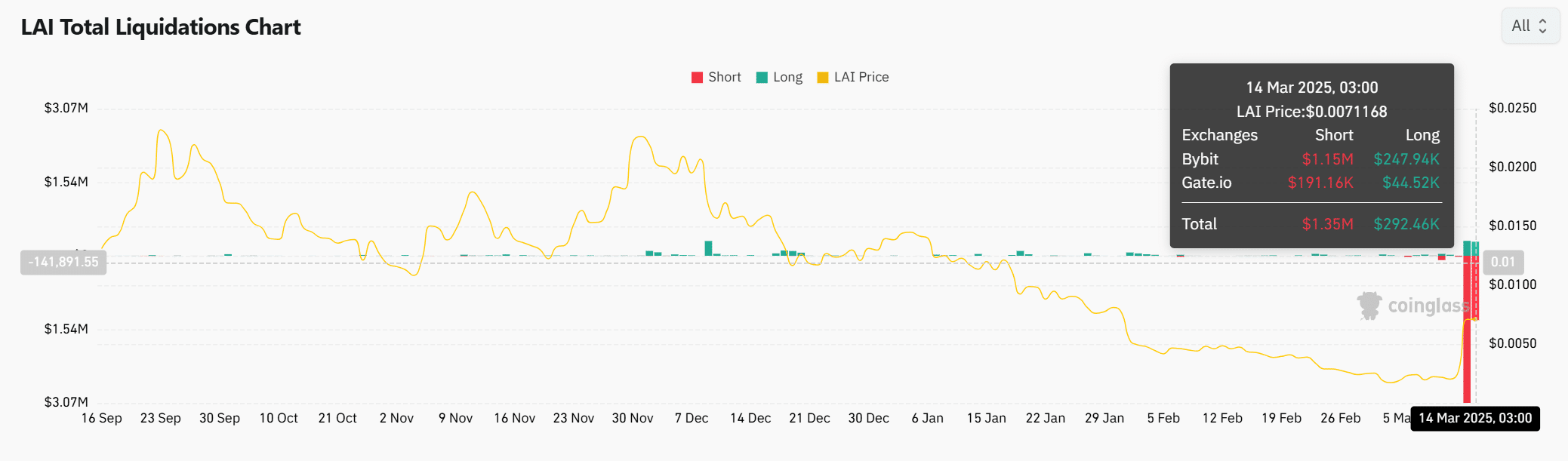

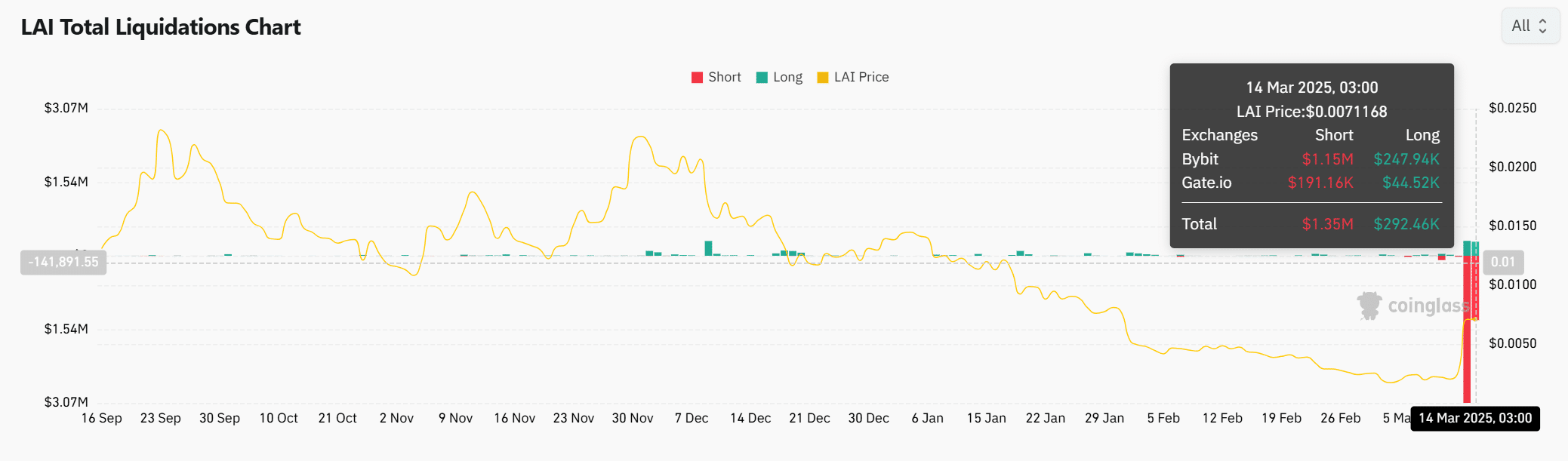

Layerai has seen remarkable liquidations on the market, with short positions that are confronted with considerable pressure. From March 14, short liquidations were $ 1.35 million for trade fairs such as Bybit and Gate.io.

The fast price stick ensured that many short sellers leave their positions, so that the rally was further fueled.

Now long positions were also confronted with some liquidations. However, the overwhelming short liquidations mean that the Bearish sentiment has been unpacked for the time being.

Source: Coinglass

Will Layerai continue to rise?

Layerai’s dramatic price action, reinforced by increased open interest, rising activities on the chain and the dominance of long liquidations, paints a bullish image. However, the market could see volatility in the short term. Especially since the RSI suggested that the token may be approaching conditions.

Although the Golf has been promising, traders must remain careful and look at signs of a correction. If Layerai succeeds in retaining the most important support levels, this can continue its Bullish process.

Credit : ambcrypto.com

Leave a Reply