- Ondo crypto bulls fought to defend the $2 mark, but the price could fall towards $1.9 in the coming days.

- At the higher futures, ONDO maintained a bullish outlook and could rise towards $3.

Ondo [ONDO] is down 5.44% in the last 24 hours and daily trading volume is down 32%. The lower time frame price action outlined the $1.9 zone as a key support zone.

The 1-day chart depicted a bullish structure and dips to $1.67-$1.8 were for buying.

Ondo crypto challenges psychological $2

Source: ONDO/USDT on TradingView

After the deep retracement to $1.3 on December 9, ONDO has quickly moved higher. The momentum and market structure were bullish, evidenced by the higher lows and the Awesome Oscillator well above zero.

A local high at $2,146 was formed and ONDO bulls have been pushed back over the past 48 hours. However, the CMF stood at +0.16, reflecting strong capital inflows into the market. This supported the idea that the bias in the higher time frame was bullish.

The weekly significant levels to watch are $0.5 and $1.48, both of which were relatively far from current market prices. In the coming days, the $1.72 area could be retested as a demand zone. The $1.3 recovery was used to draw a series of Fibonacci levels.

After $2.14, the $2.34 and $2.66 levels were the next bullish targets for Ondo crypto.

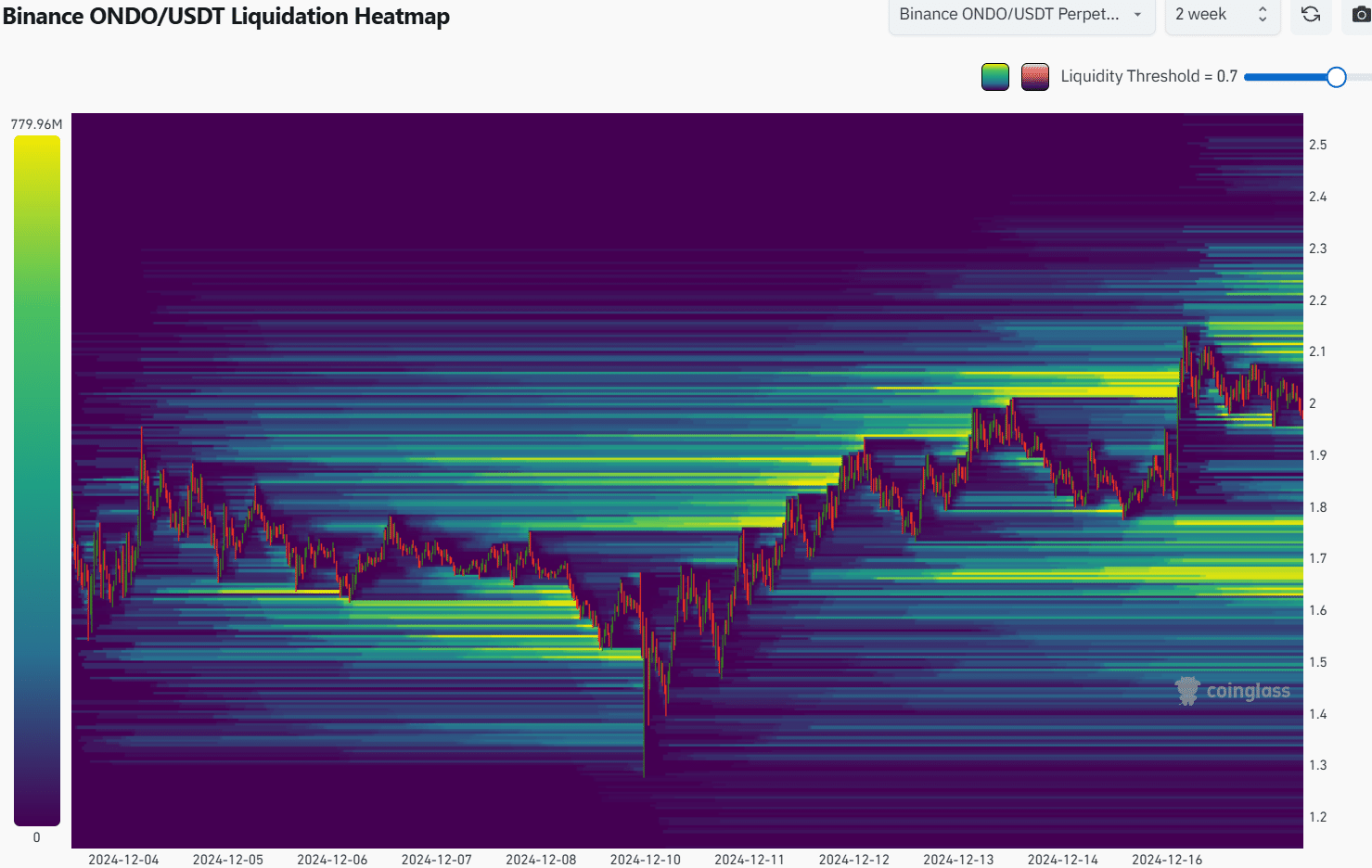

Will liquidity below $1.8 pull prices higher?

Source: Mint glass

The two-week look back period showed that there were three major liquidity clusters in the area. The first two were $1.67 and $1.77, and the third was $2.1. While the $2.11 pocket was much closer, the $1.67 region sees much more liquidation levels.

Is your portfolio green? Check the Ondo Profit Calculator

Being the stronger magnetic zone, there was a chance that Ondo crypto would drop to the $1.7 demand zone in the coming days. On the lower time frames, the $1.8 zone was also an interesting liquidity area where a price increase could occur.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer

Credit : ambcrypto.com

Leave a Reply