- Optimism saw bullishness in the short term, but it was unclear whether the rally could continue by $ 0.74.

- The Bitcoin movement during the rest of the week could guide the price action of OP.

Optimism [OP] showed increased speculative activity. On June 6, at the support level of $ 0.59, tested. Since then it has 20%Gerally.

Despite the bullish structure break on the daily, a rally to the reach of the range was not guaranteed. Liquidity for $ 0.74 could play a crucial role in the coming hours.

Swing traders receive a buying option in case the mid-range resistance is reversed to support. Until then, risk -avoiding traders can wait for clarity.

Briefly, it may not be feasible because of the bullish structure.

Optimism Bulls Put siege on the resistance of $ 0.72

Source: Op/USDT on TradingView

The 1-day graph showed a range (white) between $ 0.59 and $ 0.84. Optimism saw a bullish structure break (cyan) on the daily graph, which encouraged a bullish bias among traders.

A movement that goes beyond the resistance of the middle range would offer a chance to buy swing that focuses on the reach high at $ 0.84. At the time of the press, however, the Bullish Momentum was underwhelming.

The MFI showed a lecture of only 44, but no differences yet.

The OBV also had difficulty trends. Since mid -May it has been moved sideways, which reflects a balance when buying and selling pressure. This helped to explain the range.

It also hinted that traders and investors should not expect outbreak than $ 0.84

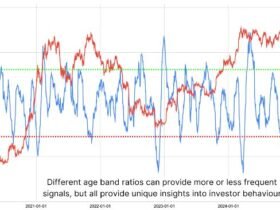

Source: Coinglass

The 1 -month liquidation heat showed that the structure of liquidity around $ 0.72, the medium -range level, had been swept. In recent days, a number of short liquidations have been built up just above $ 0.72.

This meant that a move to $ 0.74 was possible in the short term, before a bearish reversal.

As Bitcoin, however [BTC] Collected past $ 110k and continued higher, could race to the $ 0.85 magnetic zone then.

Data from Coinalyze showed that the rally was accompanied by an increase of $ 22 million in open interest. The financing figure, which had been negative in June, began to shift for the past 48 hours.

The financing figure did not show any overwhelming bullish sentiment, but it was a start. The spot CVD moved sideways in recent days, but the increasing OI promised heavy speculative activity.

This bullishness could help stimulate optimism outside the local resistance in the short term.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer

Credit : ambcrypto.com

Leave a Reply