This article is available in Spanish.

Ethereum is flat at the time of writing, moving within a narrow range of $400 with highs of $2,300 at the bottom and $2,800 as the top. Although investors are optimistic and expect prices to rise in the coming sessions, uncertainty continues to engulf the market.

Ethereum finds support at $2,300: more than 52 million ETH purchased

The world’s second most valuable coin is bearish, down more than 50% from July highs and unable to break local resistance at $3,500. As traders keep a close eye on how price action develops, one analyst has picked out an interesting development from market data.

Related reading

Citing IntoTheBlock data from Oct. 11, the analyst said notes that more than 52 million ETH has been acquired by traders around the $2,300 level. Considering the amount of coins traders hold at this price, this zone is the immediate support.

If buyers have the upper hand and raise prices from this point, this level will anchor the uptrend. If sellers double down, as has been the case over the past few trading months, ETH is more likely to fall below the Q3 2024 low.

Currently, sentiment is bearish, as evidenced by the CoinMarketCap poll. More than 65% of ETH holders and traders to expect prices will struggle in the short term.

Therefore, how prices respond to local support will determine formation in the short to medium term. A surge that pushes ETH above $2,800 will be crucial in boosting demand, providing much-needed tailwinds for optimistic traders.

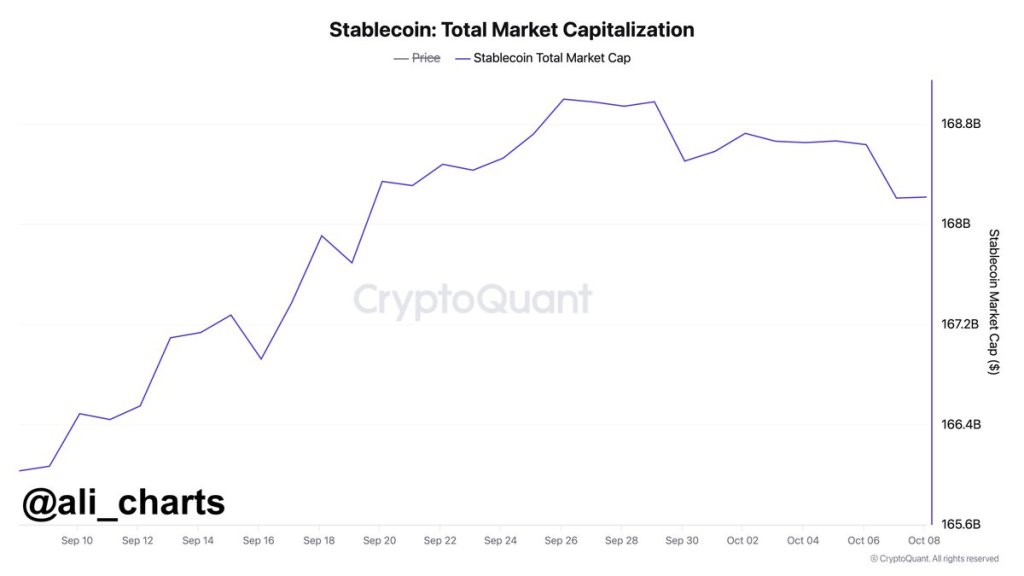

USDT, USDC and Stablecoin Market Capitalization Drops: Is Purchasing Power Declining?

While optimism is high, other related market data points to weakness. In recent trading weeks, the market capitalization of stablecoins such as USDT and USDC has fallen. From October 10, the analyst notes it fell $780 million from recent swing highs, indicating a possible decline in purchasing power.

Typically, when USDC, USDT, and even DAI move to centralized exchanges, more users are interested in purchasing crypto assets, including ETH and BTC. However, if there is an outflow or if the market capitalization declines, it could mean that more users are being cautious and closely monitoring events before committing.

Typically, more coins, including stablecoins, find their way to centralized exchanges when there are concerns about the market’s prospects. Such inflows often precede a market-wide correction.

Related reading

For now, the inflow of ETH to centralized exchanges has not been determined. What is happening, however, is that more holders have bet. As of mid-week, market data showed that over 34 million ETH remained locked, giving holders an APY of 3.3%.

Feature image of DALLE, chart from TradingView

Credit : www.newsbtc.com

Leave a Reply