The cryptomarkt exists on a massive dogecoin (doge) transaction. Transferred a whale 100 million dogeOr about $ 25.42 million, against Binance. The move has asked questions about whether a sale is about to happen or whether this is just a different typical shift in companies.

Whale activity

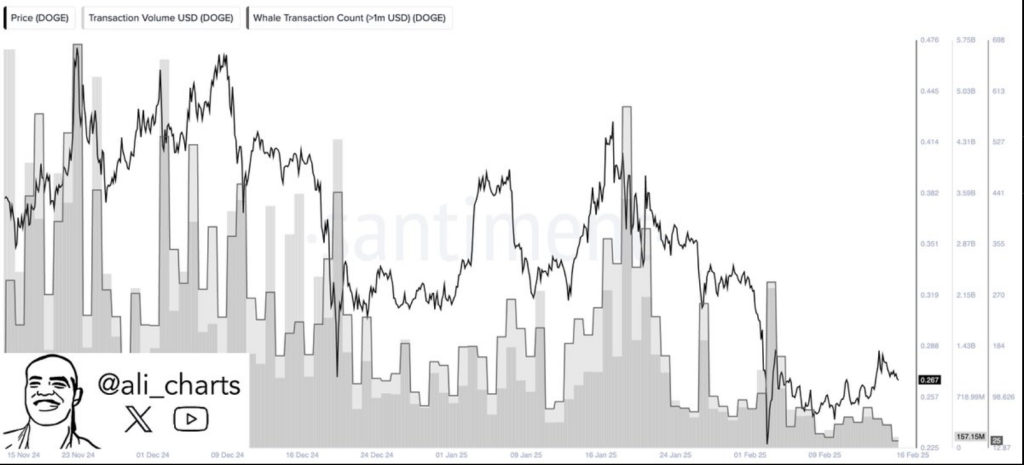

When a large cryptocurrency holder moves a considerable number of their possession to an exchange, this usually means that they want to sell. The price of Doge can therefore fall, so that smaller investors would respond. Cryptocurrency expert Ali Martinez, however, noted a decrease in whale activity, which suggests that large investors do not act aggressively for the time being.

Whale activity on the #Dogecoin $ Doge Network has fallen by almost 88% since mid -November! pic.twitter.com/6x4cih3mf8

– Ali (@ali_charts) February 17, 2025

Doge’s current market performance points on vagueness. From the moment of writing, the price is $ 0.255622; An intraday high is $ 0.257605 and a layer is $ 0.250725. These fluctuations imply a fairly limited trading range; But if more important holders decide to sell their shares, volatility can increase.

Market sentiment remains divided

According to certain traders, whale transfer is a bearish signal, while others believe that their influence can be negligible, unless there is an influx of extra coins. Dogecoin has a history of responding sharply Whale movements; However, the total sales pressure seems to be modest this time.

The constant discussion about a potential Doge Exchange Traded Fund (ETF) is another important factor that influences sentiment. If an ETF Momentum acquires, the institutional investors can attract, which may cause any sales pressure of whales. Nevertheless, the market is currently in a state of assumption, because no official approvals or timelines have been announced.

The road for Dogecoin

Despite the whale movement, the price of doge remains stable, but if the market sentiment shifts, there may be a further decrease. Further dumping can occur if the price of doge falls below $ 0.25, which can further lower the price. On the other hand, strong purchasing activity can work as a barrier to decrease further.

Investor options

The whale movement reminds us of the speed with which the market dynamics of the retail trade can shift. Some people can decide to keep their positions because they hope that possible catalysts such as the ETF will increase prices, while others take a more cautious approach, looking for signs of raised whale activity before they decide on what to do.

Featured image of medium, graph of TradingView

Credit : www.newsbtc.com

Leave a Reply