- PEPE’s near-term trajectory will depend heavily on its ability to hold the $0.000018-$0.00002 support zone

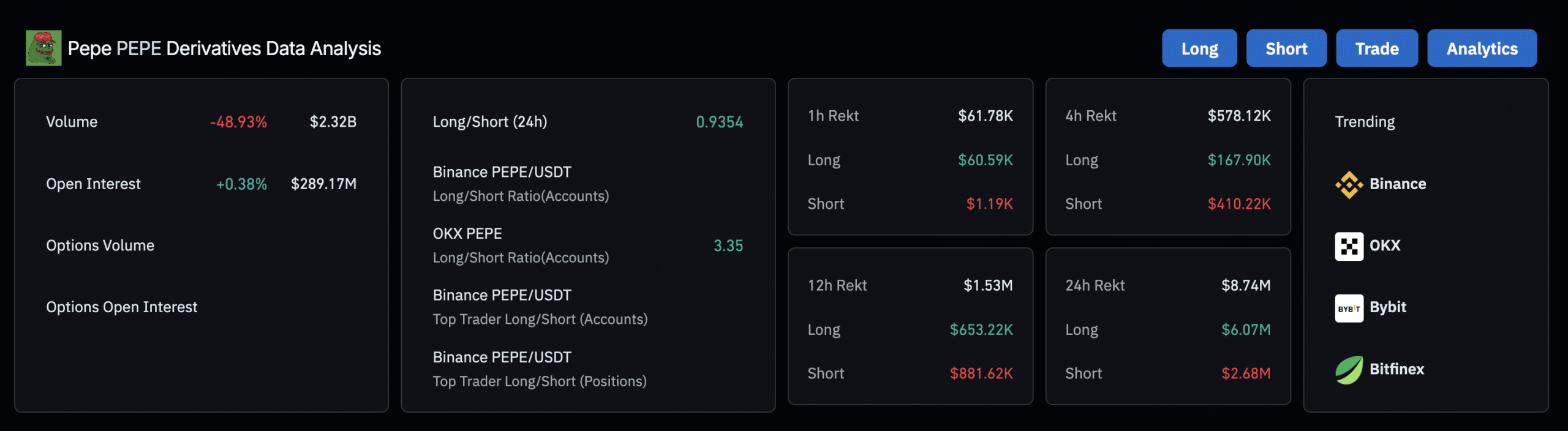

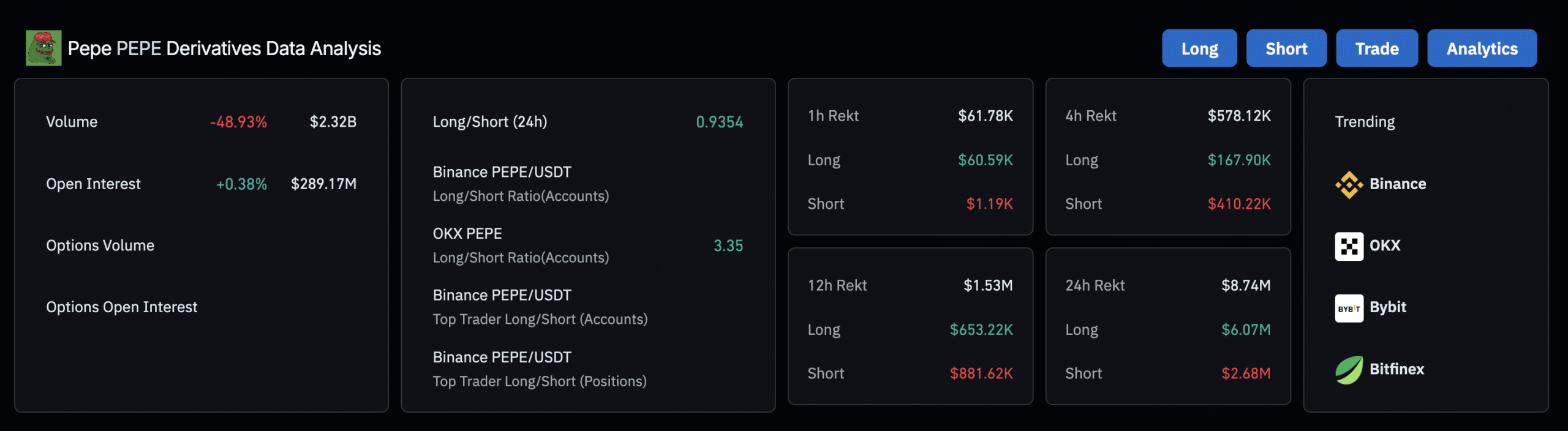

- The memecoin derivatives data highlighted mixed sentiment with a slight lead for bulls

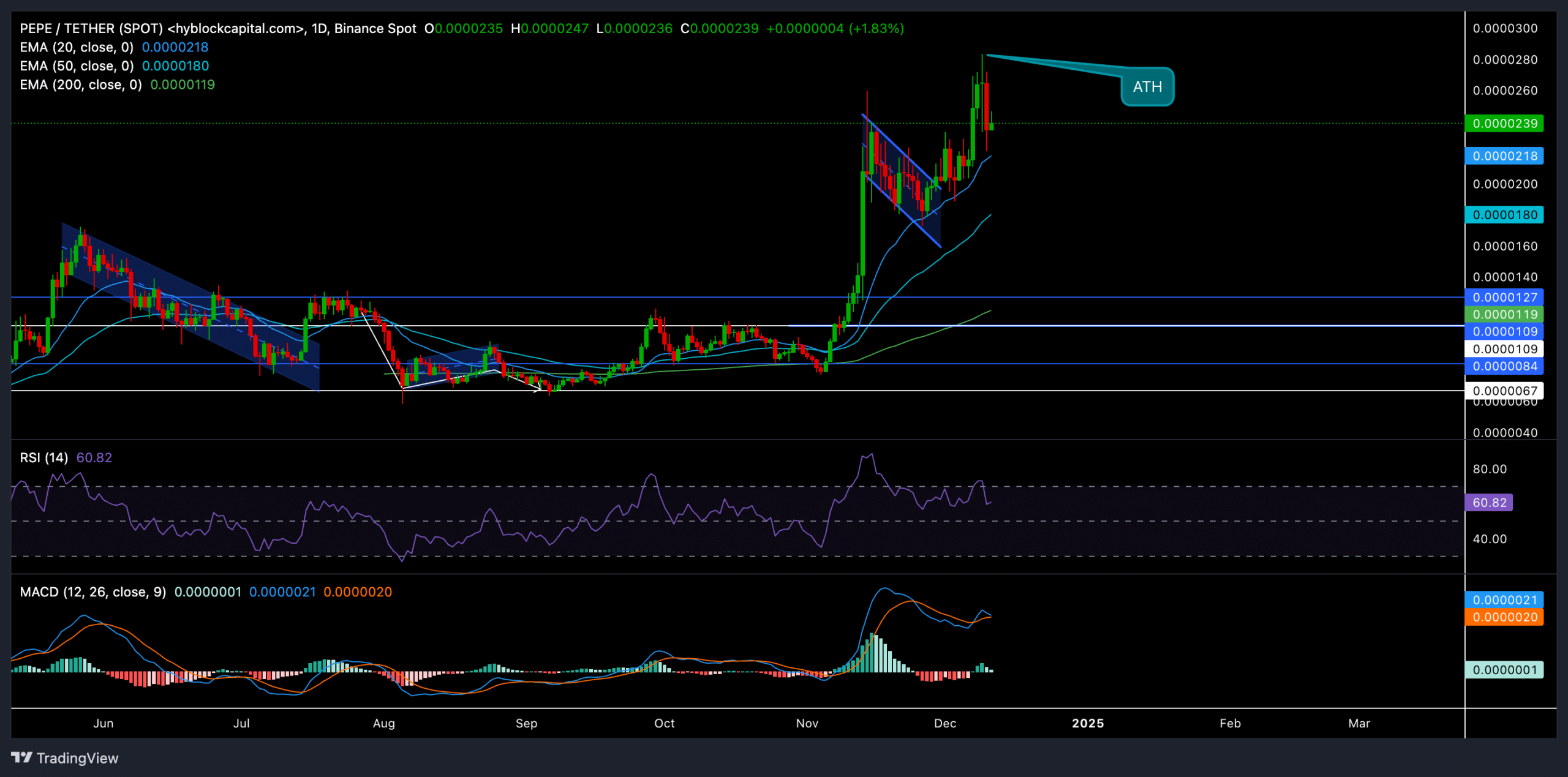

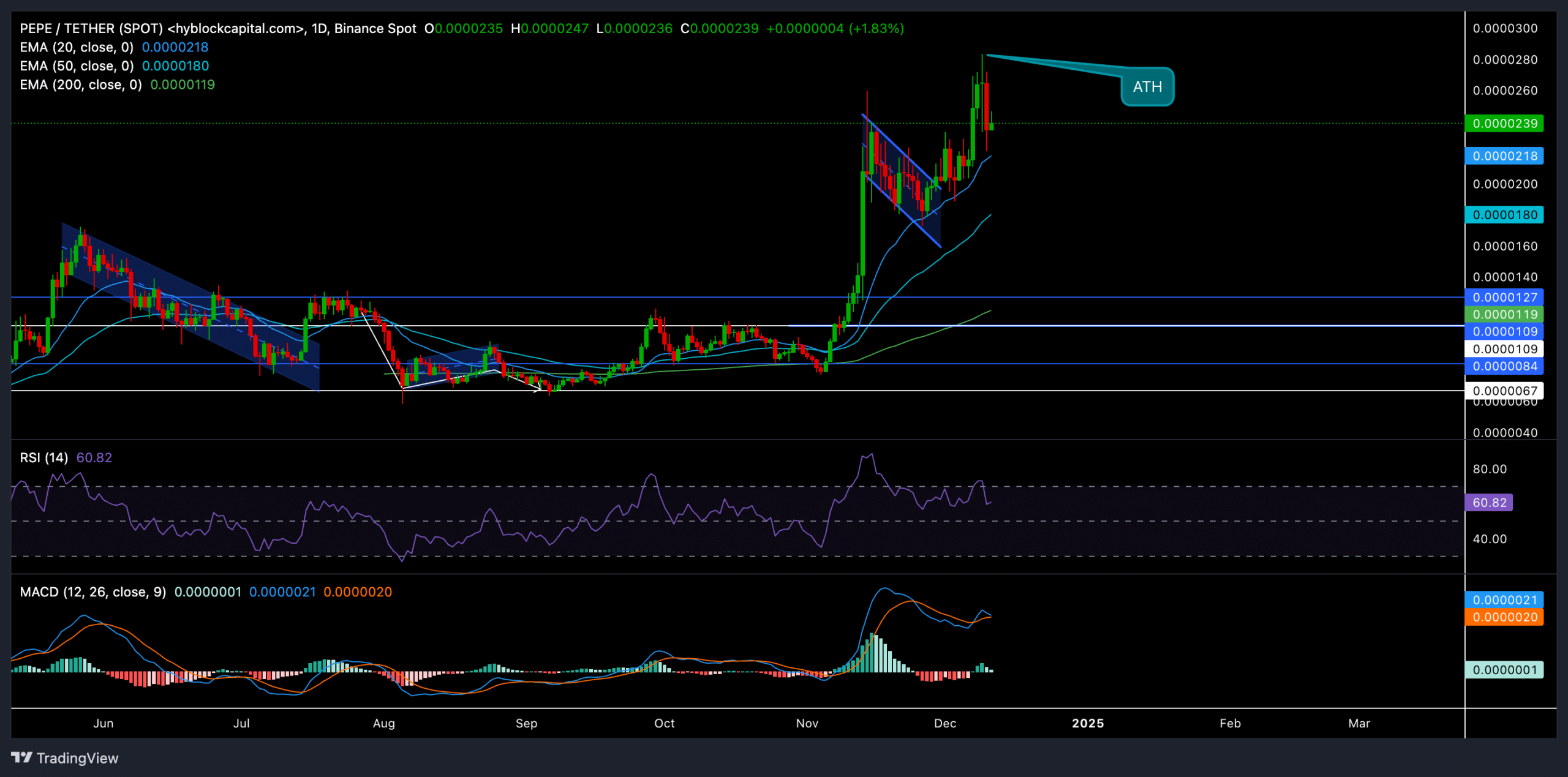

PEPE recently enjoyed an exponential rally of over 250%, reaching a new all-time high (ATH) of $0.0000284 on December 9. This explosive growth coincided with the broader memecoin supercycle and Bitcoin’s continued bullish sentiment on the charts.

At the time of writing, PEPE was trading at $0.0000239, with the 20-day EMA strongly supporting the recent correction. A consistent recovery from this level could put the price into a price discovery phase, potentially finding a newer ATH.

Critical levels to keep an eye on

Source: TradingView, PEPE/USDT

Since the ATH, PEPE has been fluctuating between $0.000018 and $0.0000247, indicating more indecision in the market.

The main levels to pay attention to are:

Support: The range of $0.000018-$0.00002, in line with the 20-day EMA, is a critical support zone for buyers. A dip below this range could negate the prevailing bullish trend, leaving the token exposed to downside risks towards $0.000015.

Resistance: A decisive close above the $0.000025 resistance could set the stage for buyers to head towards the $0.0000284 ATH. Crossing this level could open doors for an extended uptrend towards $0.00003.

Technical indicators pointed to cautious optimism. The RSI was hovering around 61 at the time of writing – a sign of moderate bullish momentum. While the country appeared far from overbought territory, the possibility of a consolidation phase near this press time level cannot be ruled out.

The MACD was also yet to see a full bearish crossover, indicating potential pressure on sellers in the near term. However, traders must wait for the signal line to stabilize before predicting a trend reversal.

Derivatives data revealed THIS

Source: Coinglass

Here it is worth noting that trading volume has fallen by around 48.93% over the past day, indicating reduced market activity after the most recent rally.

Open Interest showed a slight increase of 0.38%, indicating cautious trader participation. The overall long/short ratio was slightly below 1, reflecting a fairly neutral trend. However, the ratio on OKX confirmed a strong bullish edge as it was well above 3.

The 24-hour liquidations totaled $8.74 million, with $6.07 million in long liquidations and $2.68 million in shorts. The larger long liquidations suggested that the recent price correction caught over-indebted long traders off guard.

Bitcoin’s continued bullish momentum could further catalyze an ongoing rally for the memecoin. However, traders should remain cautious as PEPE’s high volatility could lead to sharp reversals.

Credit : ambcrypto.com

Leave a Reply