- WIF and POPCAT have both achieved important milestones in defending crucial support lines.

- However, only one can take charge in the next cycle. Which memecoin will it be?

dog hat [WIF] retained support at $2, rising 4% over the past 24 hours, defying volatility fueled by Bitcoin’s consolidation below $64,000.

In the meantime, POPCAT briefly reached a market cap of $1 billion, but returned to $968 million as bulls failed to defend the $1 level. While WIF leads the way, AMBCrypto notes that POPCAT is closing in.

As analysts watch ‘Uptober’, it will fuel Bitcoin’s bull run Solana memecoin will lead the next cycle?

A razor-thin margin between the two

After a rough patch without a bullish swing since late August, WIF recovered in mid-September and rose 45% to $2.15 on the daily time frame.

POPCAT, on the other hand, mirrored Bitcoin’s moves from early September, rising 102% to $1.0194 at the time of writing.

Notably, POPCAT showed greater resilience amid market declines, reaching a new ATH of $1.0768 on September 25.

Source: Coinalyse

However, POPCAT is now on a crucial line of support. If bulls fail to hold it, a retracement would be the memecoin decline near $0.38. Conversely, a new upward push could lead to a new ATH.

Similarly, WIF has shown remarkable growth, with bulls pushing the price up 20% in the last three days, which is evident from the long green candles on the daily price chart. Yet,

There’s a catch

According to AMBCrypto, WIF’s recovery is the result of a strategic course maneuvering by spot traders accumulating aggressively to squeeze out the significant influx of short positions.

While this is a bullish sign, it could backfire if these traders move into the distribution phase, which seems increasingly likely.

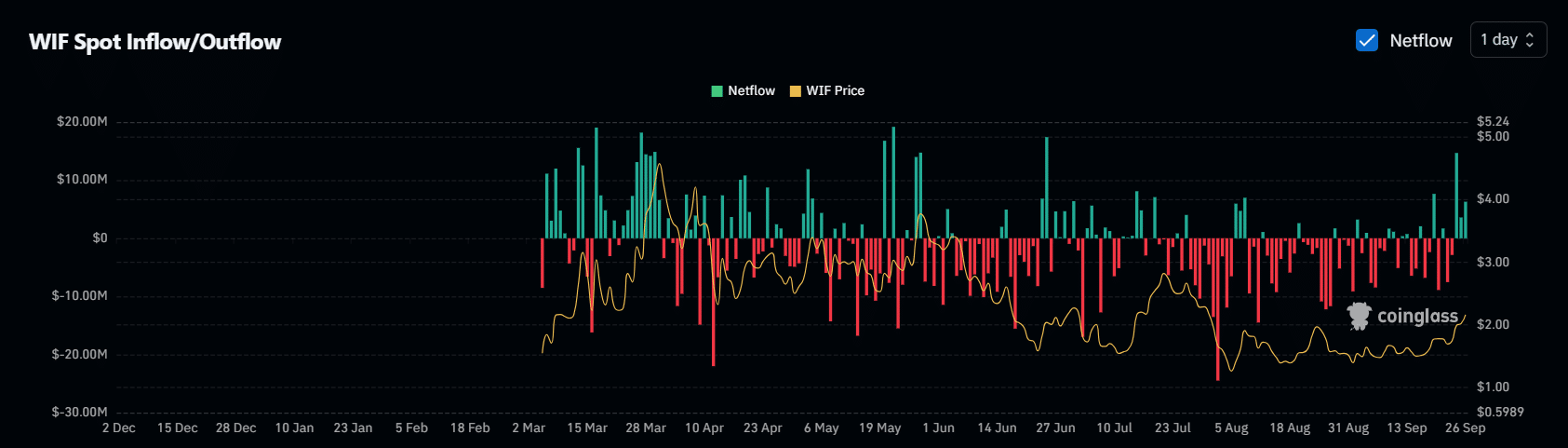

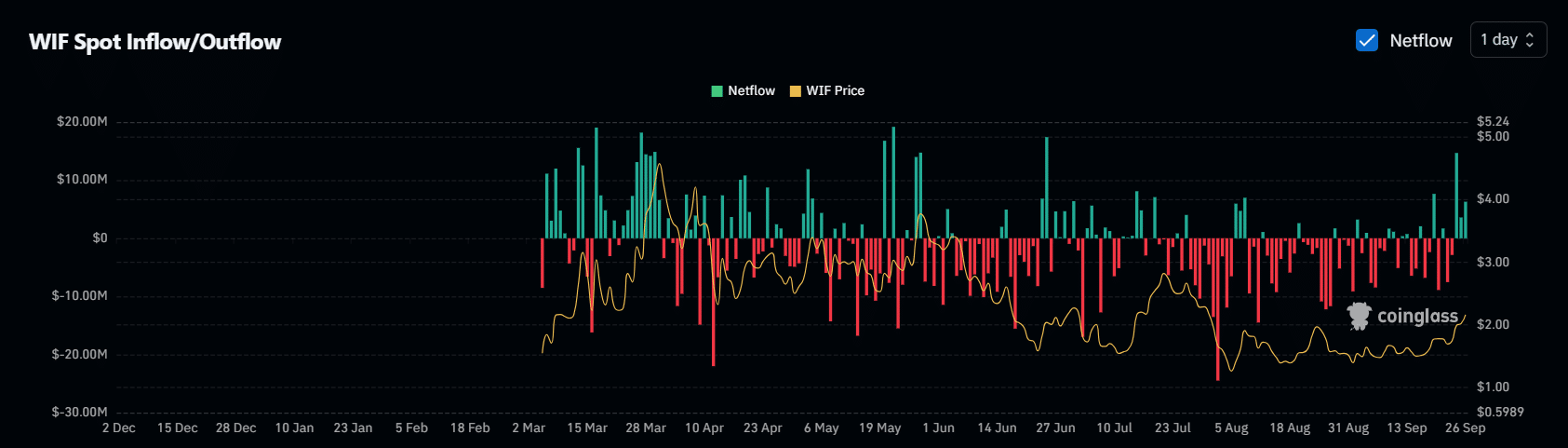

Source: Coinglass

Since WIF hit its market bottom of $1.26 in early August, net outflows from the exchanges have risen to $30 million, creating an ideal buy-the-dip opportunity.

Now at $2.16, most of these early withdrawals have turned into profits, leaving WIF on the brink of possible exhaustion. This is indicated by a new peak in net inflows, which has reached a three-month high of $15 million. If the trend continues, WIF could be poised for a reversal, shifting liquidity POPCAT.

A crucial path for POPCAT

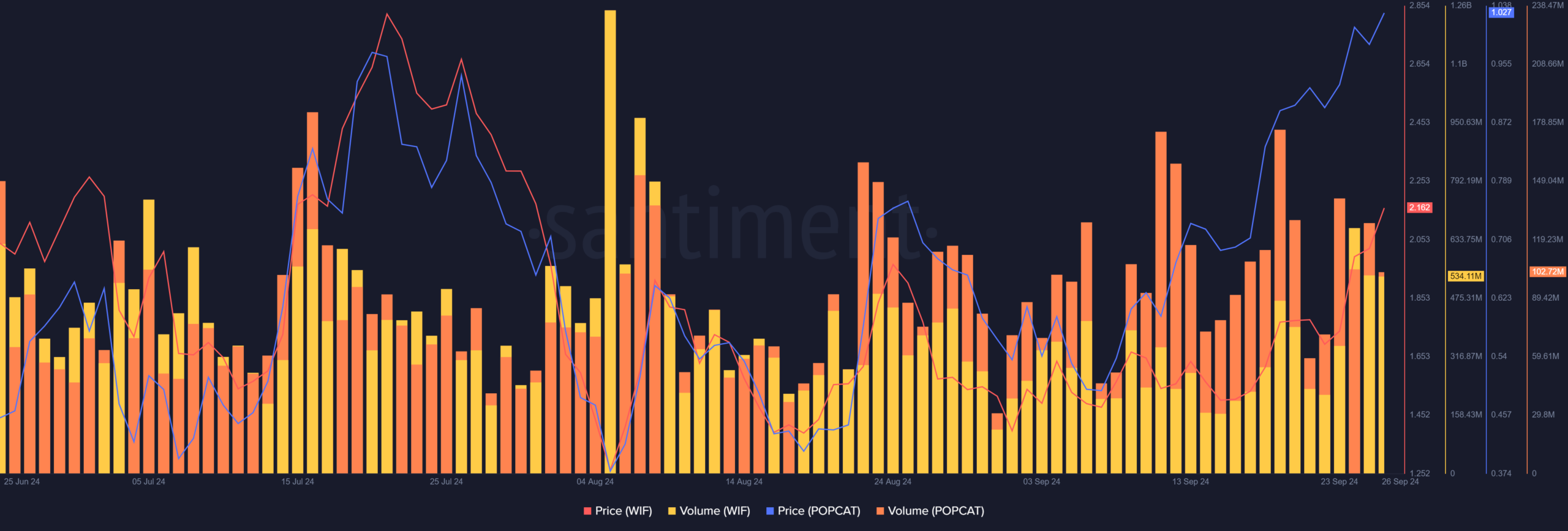

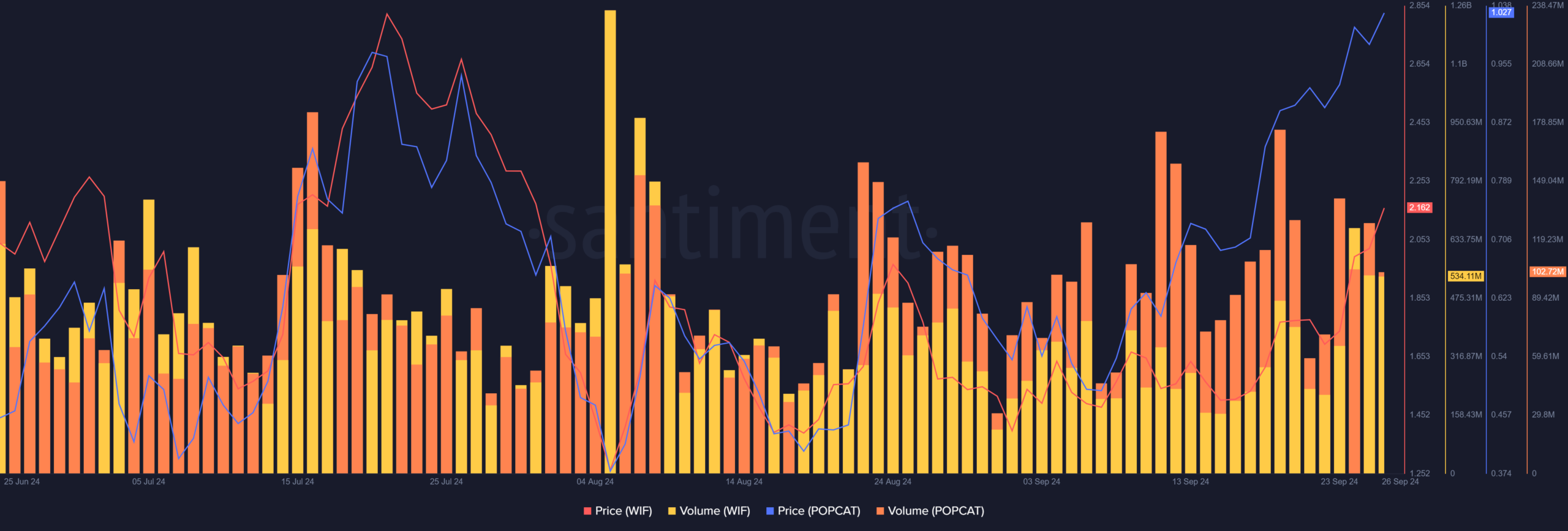

First, the price of POPCAT has largely moved in tandem with the price of WIF, except during the rally in early September, when POPCAT rose significantly, indicating growing interest in the memecoin.

Source: Santiment

Furthermore, WIF’s trading volume has halved since August, when it peaked at $1 billion. A closer look revealed that POPCAT volume increased from $104 million to $127 million the next day.

Is your portfolio green? Check out the POPCAT profit calculator

In short, POPCAT focuses on WIF’s lead. If WIF falters – which seems likely – POPCAT may have a better chance of a takeover.

This ambition could be further cemented if the bulls hold the $1 support while keeping a close eye on WIF’s trading activities.

Credit : ambcrypto.com

Leave a Reply