- RAY hits 2-year high as price has gone parabolic since September.

- Assessing the relationship between RAY’s price action and Raydium’s performance on key metrics.

RAY, the native token on the Raydium DEX on Solana [SOL]just hit a new two-year high.

Its performance so far, especially in the past two months, has delivered better gains than Bitcoin [BTC]which also reached a new high on November 6.

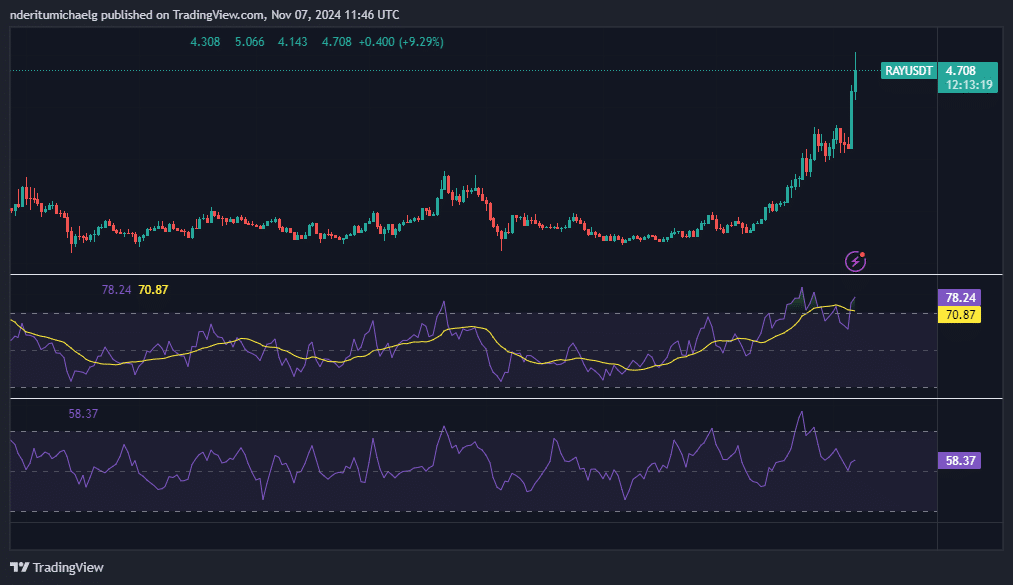

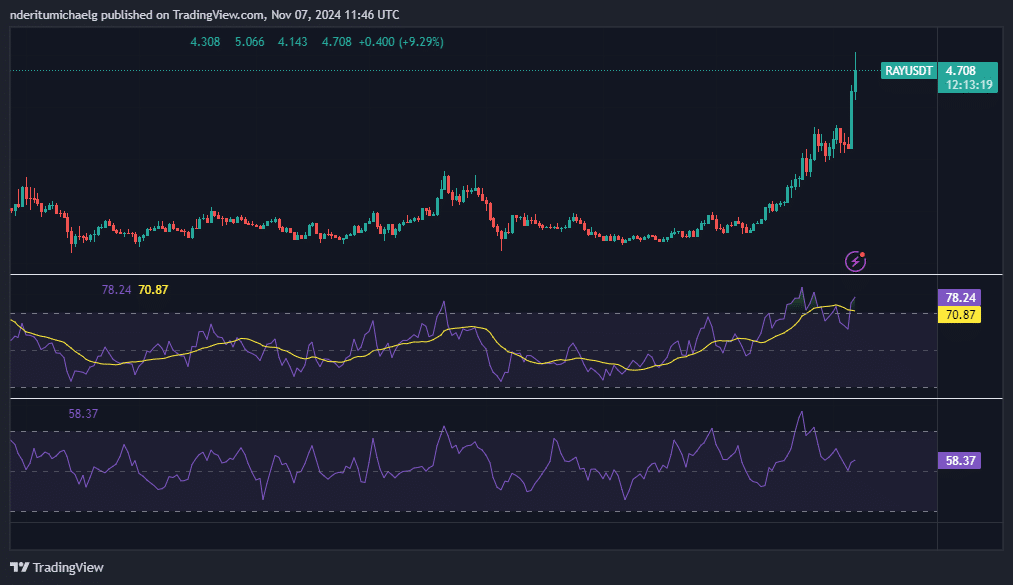

A look at RAY’s price action revealed a parabolic performance rooted in September accumulation. The token traded as low as $1.35 in September, but by October it was clear that the bulls were in full control.

RAY rose to $5.06 over the past 24 hours, marking a 276% rally from its September low.

For context, Bitcoin only gained 45% from its September low to its recent new local high.

Source: TradingView

Despite these achievements, RAY still has a significant amount of room for growth before it reaches its all-time high. The token peaked at $17.80 in August 2021.

Nevertheless, a short-term pullback is likely with RAY extremely overbought.

The token showed a bearish divergence with the lower high of the RSI. The MFI has also fallen, which indicates that profit-taking has taken place.

Reflection of Raydium’s performance?

The Solana blockchain has had robust utility in 2024 and Raydium has benefited from this as one of the top DEXes.

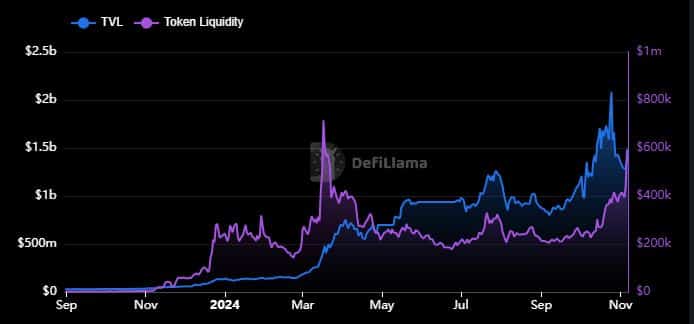

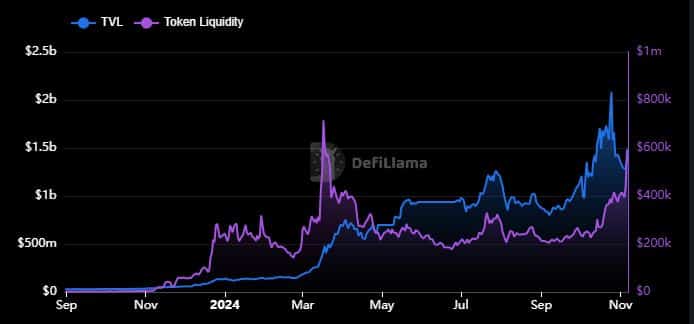

Raydium’s TVL had less than $40 million and less than $10,000 in token liquidity exactly 12 months ago.

Both measures recently showed impressive growth, with TVL peaking at $2.08 billion in October but has since fallen back to $1.50 billion. Meanwhile, RAY token liquidity has since increased to $597 million.

Source: DeFiLlama

This TVL and token liquidity growth underscore the Raydium DEX’s growing momentum through 2024, in line with Solana’s ecosystem growth.

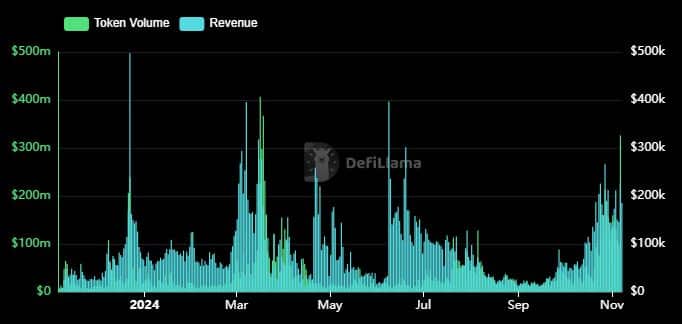

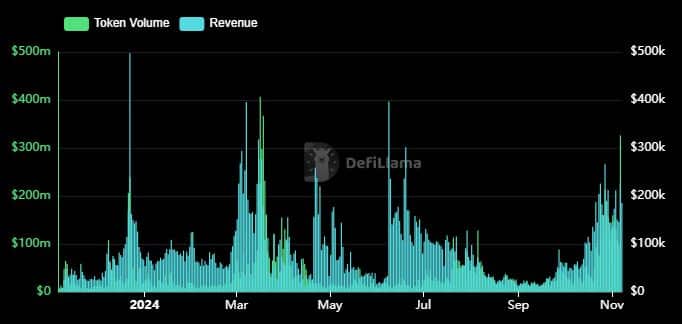

However, that growth and network activity was more visible in Raydium’s revenue and volume data.

Both volume and revenue recorded their highest peaks in March, June and October, followed by declines the rest of the time.

For example, the highest token volume since early 2024 was approximately $406 million in March. Meanwhile, the highest sales in March were $395,000.

Source: DeFiLlama

The latest data indicates that both token volume and revenue have been increasing since September. This reflects the peak in activity during bullish months.

Read Raydium’s [RAY] Price forecast 2024–2025

It is also consistent with the observation that the same numbers declined during slow or bearish months.

Based on the above observation, it was clear that DEX activity has had a notable impact on RAY demand. This trend is likely to continue as the bull market heats up.

Credit : ambcrypto.com

Leave a Reply