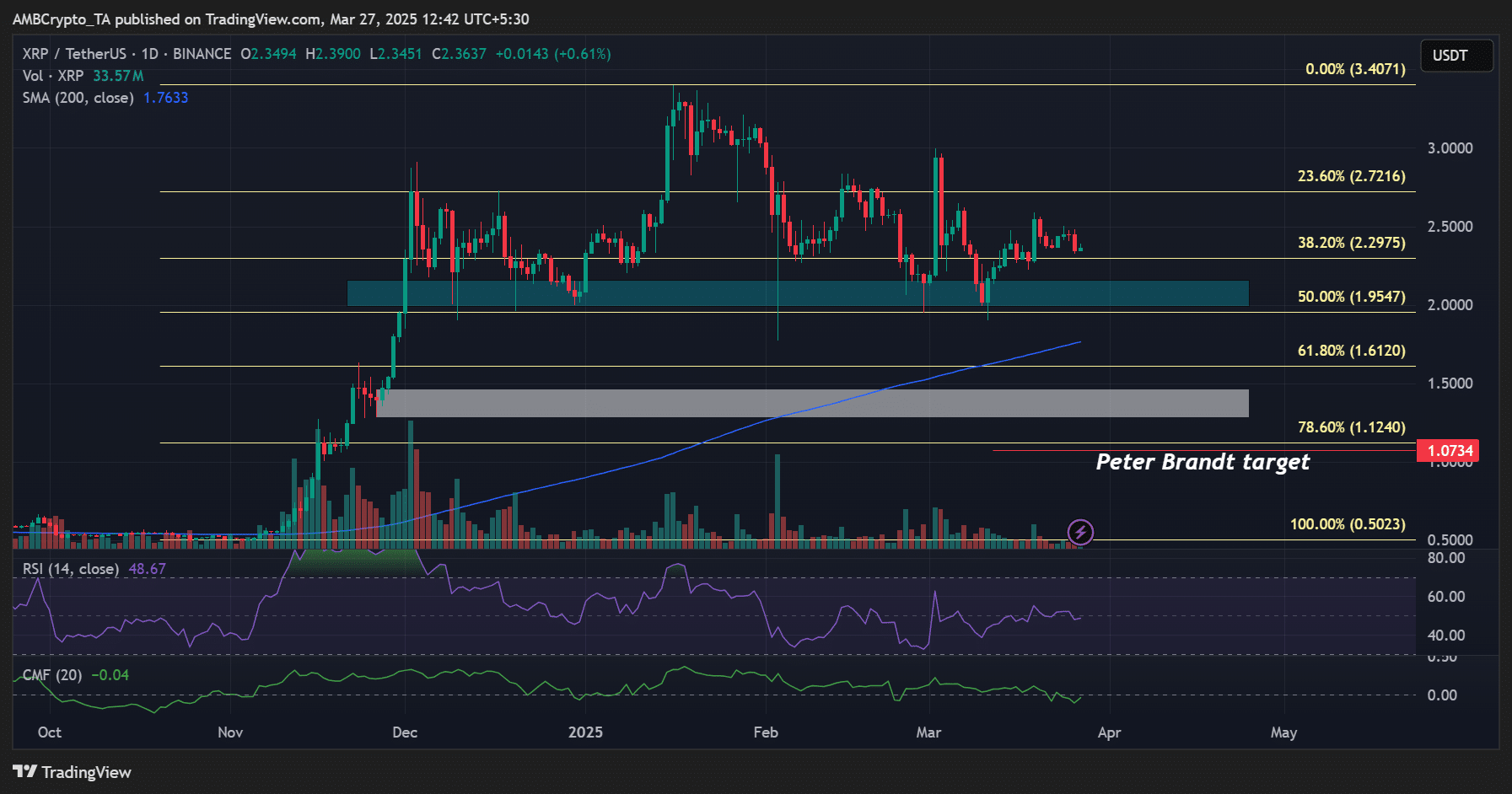

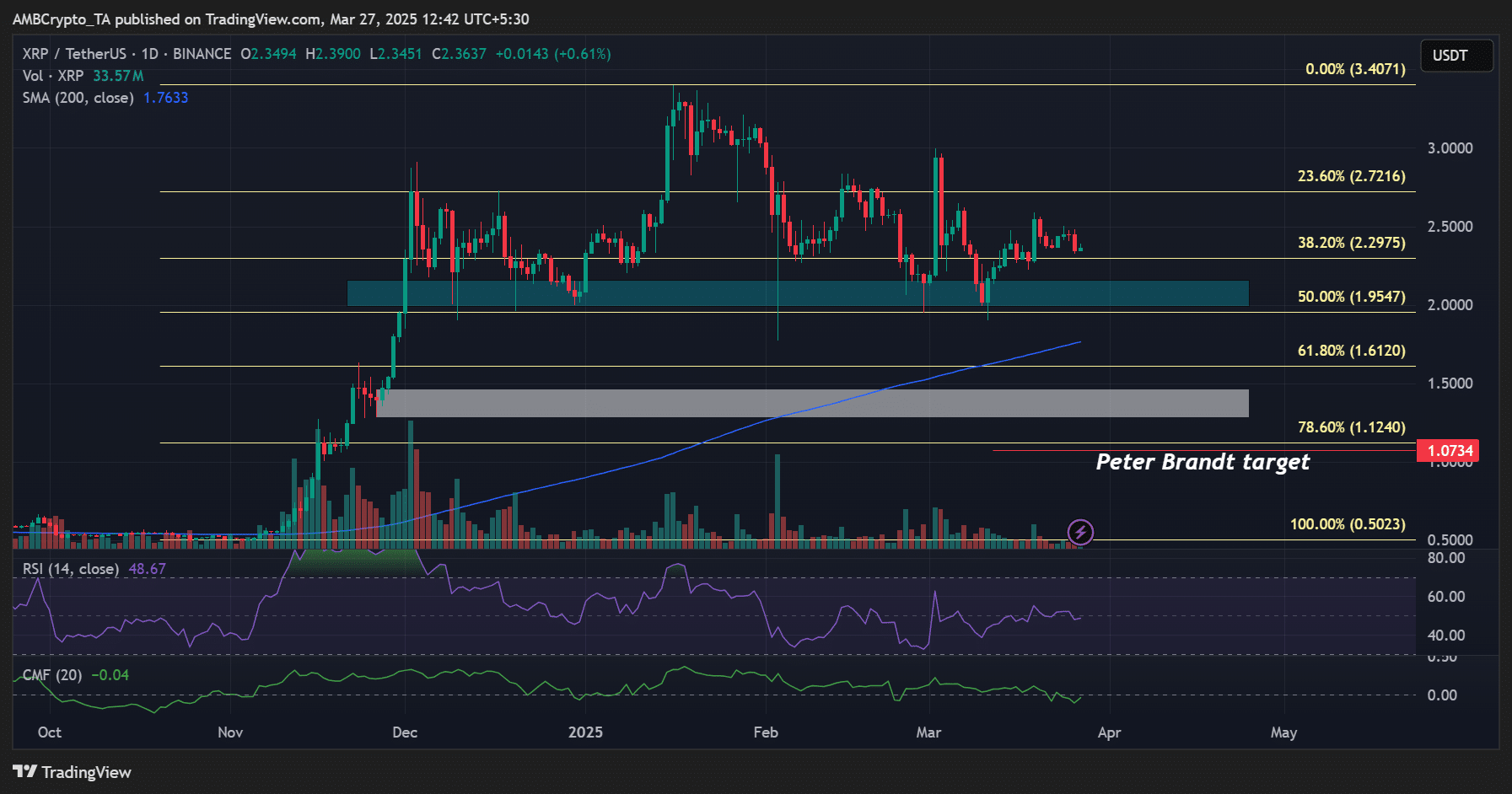

- Peter Brandt did a bearish XRP call, warning for a likely dip up to $ 1.

- XRP was relatively overvalued, but the bullish market structure was still intact from this writing.

Ripple [XRP] Can’t decisive above $ 2.5, despite recent bullish updates on the SEC right store front. It was still tied to his Q1 -Neerwaartse Trend and had bought 30% of record highs of $ 3.4.

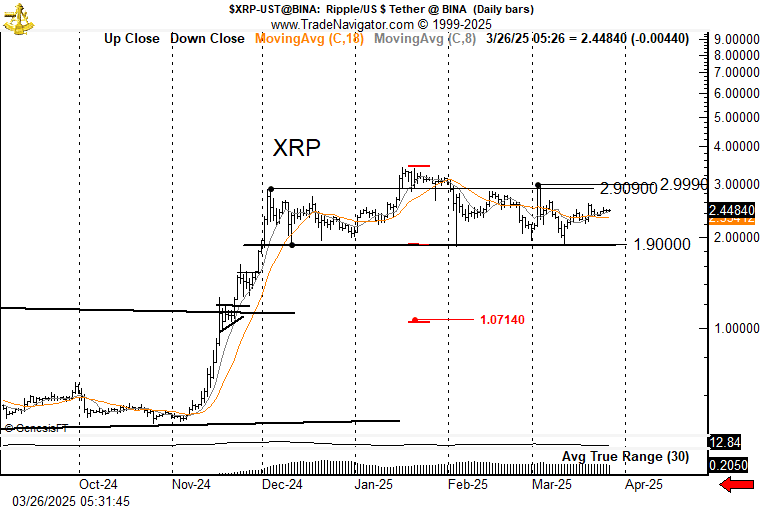

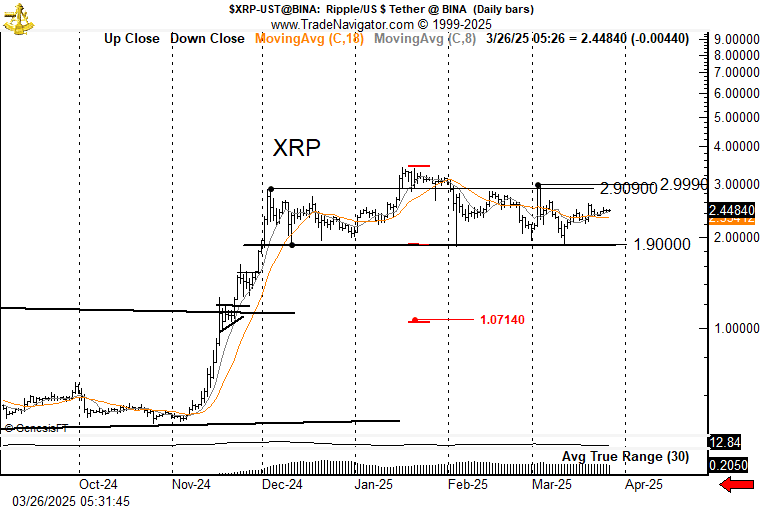

In fact, the famous price schedules Peter Brandt projected that the Altcoin could crash 43% if it fell below $ 1.9. He quoted The Bearish formation of an H&S (head and shoulder) pattern, which, if validated, focus on $ 1.07.

“$ XRP is an H&S pattern of the textbook. So we are now reached. I would not want to be short above 3,000. I would not want to possess it under 1.9. H&S projects to 1.07”

Source: X

Do XRP on-chain signals agree?

Some signals on the chain have also painted a similar weak prospect. At a weekly average addresses XRP Ledger Active addresses rejected With 62% of 74k users on the peak from December to 28k in March.

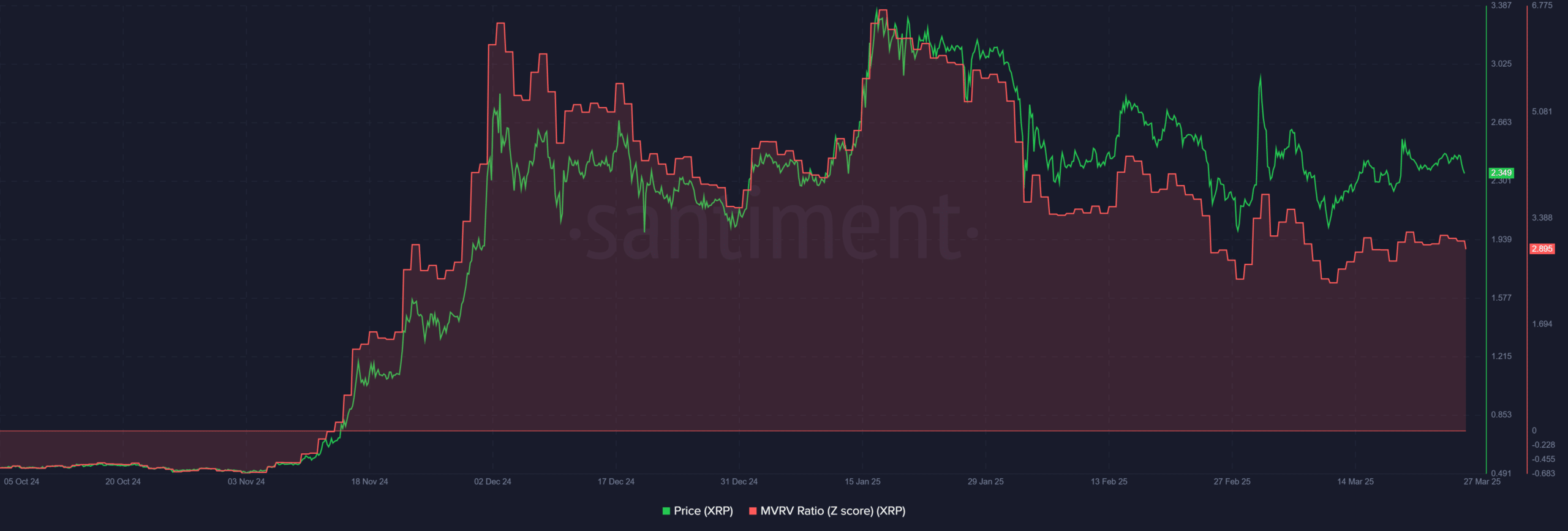

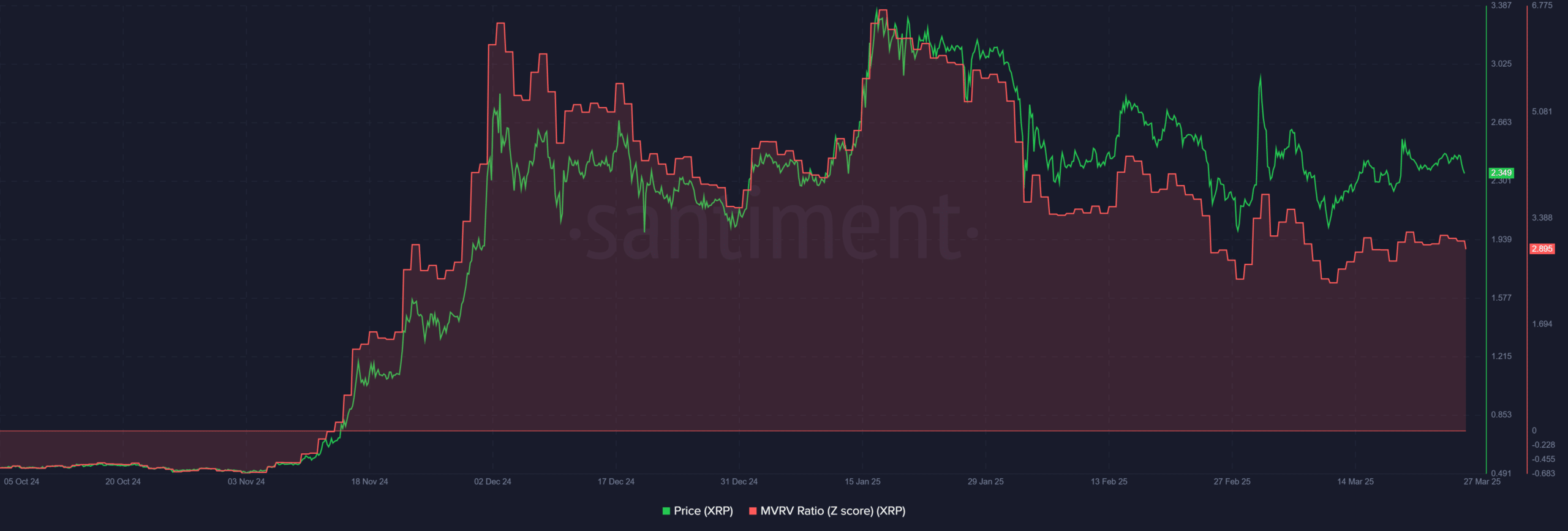

According to the MVRV Z score of Santiment, XRP was still relatively overvalued at current levels. The indicator follows whether an actively overvalued or undervalued in relation to its price.

A lecture above can be considered ‘too expensive’, because more holders have and can sell profit. On the contrary, MVRV Z score values under one are seen as ‘undervalued’.

Source: Santiment

For Ripple, the metric climbed above 6 in December and was 2.8 at the time of the press. Simply put, long-term holders had 2.8x-6x non-realized profit and could possibly make a profit and tank XRP.

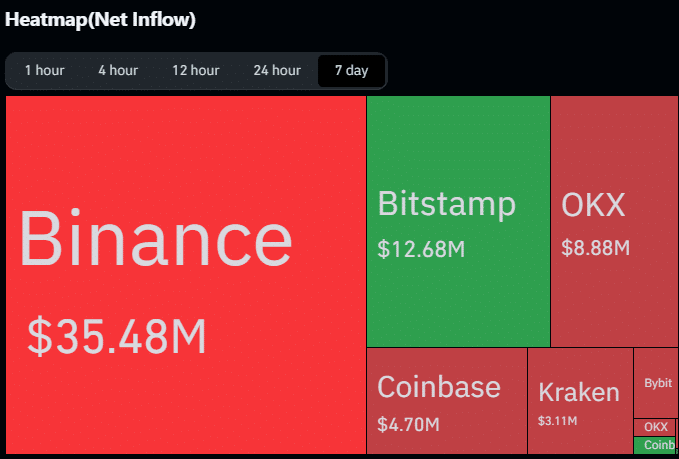

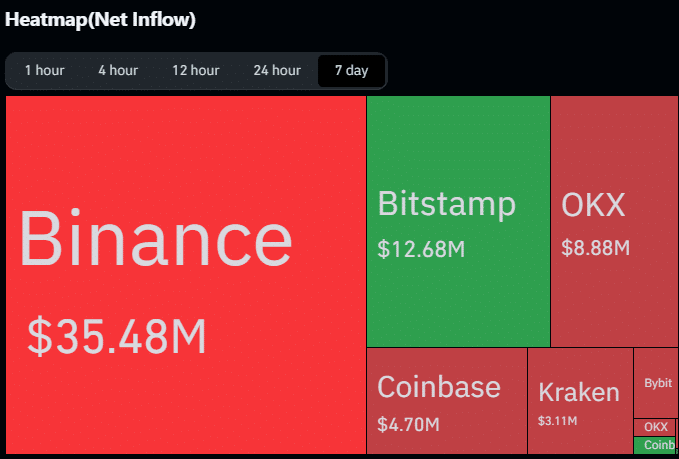

But the level of accumulation in the last seven trading days did not support the bearish tendency.

Source: Coinglass

This week $ 43 million was included in XRP from trade fairs per Coinglass data. In general, $ 290 million left out trade fairs in XRP in March, which suggests that some players expected an extra meeting. Will their long bet come true?

Source: XRP/USDT, TradingView

From a price diagram perspective, the $ 2 (cyan) and $ 1.4 (white) levels were important support to view for the goal of Brandt.

Moreover, the price promotion was still above the 200 daily progressive average (DMA) in blue, which meant that the bullish market structure of XRP was still intact, at least from this letter.

Credit : ambcrypto.com

Leave a Reply