Alderoty calls SEC again

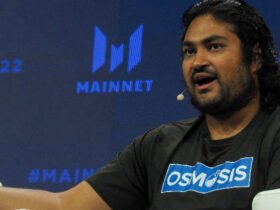

In a final X afterRipple CLO, Stuart Alderoty, has accused the SEC of causing massive and long-term artificial suppression of the crypto market. He noted the following in his

Previously, Alderoty had lambasted the SEC for bragging about the record fines it had collected, comparing it to a professor who boasted about the highest ever failure rate in his class and the most fraudulent scandals. He had emphasized that it was not a measure of success, but rather an indictment of supervision gone terribly wrong, driven by perverse incentives.

The SEC under Gensler has faced widespread criticism for its hostile approach to the crypto industry. The agency, led by Gensler, sued Ripple in December 2020, saying it broke the law by selling XRP without first registering it as a security. The agency subsequently filed lawsuits against several digital asset companies, including Coinbase Global and Binance Holdings.

Light at the end?

Analysts expect that the legal battle between crypto companies and the SEC could be “dismissed or settled” under the Trump administration. Recently, former CFTC Chairman Chris Giancarlo also urged regulators to drop several cases, including Ripple’s. In a recent Fox Business interview on Nov. 26, Giancarlo said, “It’s time for regulators to drop a lot of these things.” Asked whether the SEC should specifically drop the Ripple case, Giancarlo replied: “I think they should.”

Recently, amid the news of Gensler stepping down in January, this has contributed to the price increase of XRP. Digital assets that were flagged as “unregistered securities” in previous SEC lawsuits, such as ADA and SOL, have also benefited from this positive sentiment.

“XRP was in an accumulation phase for almost three years – about 900 days. The duration of such a phase often determines the strength of the subsequent rally, so it is no surprise that XRP is up around 404% as of November 4,” said Arthur Azizov, the CEO of crypto exchange and payment processor B2BinPay, according to a report . Forbes report.

The improving regulatory landscape and its massive potential could push the XRP price beyond its all-time high by 2025.

XRP will reach ATH soon

The comments from Ripple’s Chief Legal Officer come at a time when XRP is seeing a $100 billion increase. XRP rose to briefly become the third-largest cryptocurrency after a $100 billion rally. On Monday, the token rose as much as 20% to a nearly seven-year high of $2.50, last reached in January 2018. Remarkably, its market value rose to $139 billion, up from less than $30 billion on November 5. $2.68, up more than 40% in the last 24 hours.

Amid the US ETF opportunity, XRP had inflows of $95 million, the highest on record. Additionally, WisdomTree has formally filed an S-1 with the SEC for an XRP spot ETF, joining Bitwise, 21Shares, and Canary in the race.

Credit : coinpedia.org

Leave a Reply