- Data showed a recent SHIB burn of 7.8 million tokens.

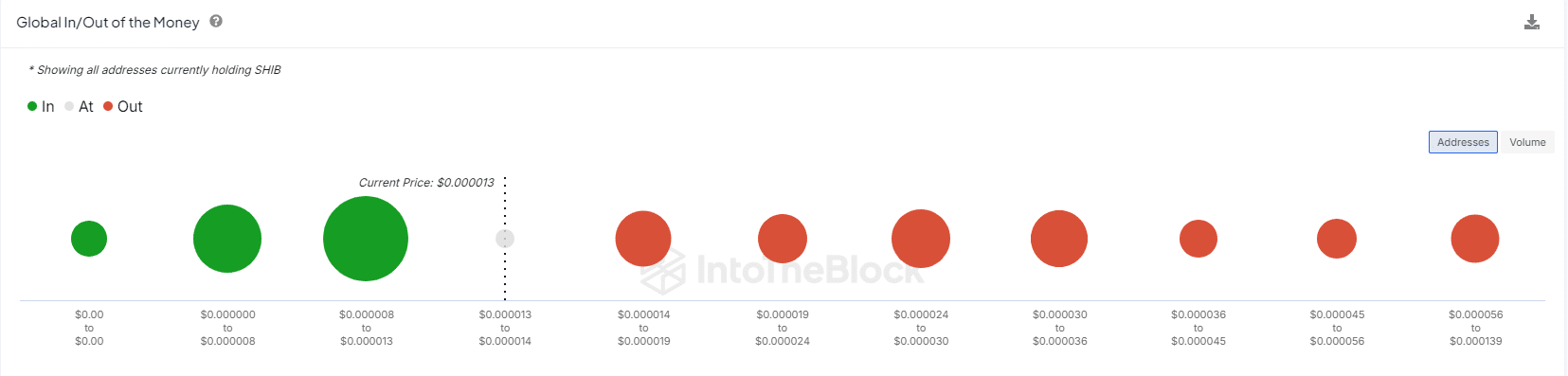

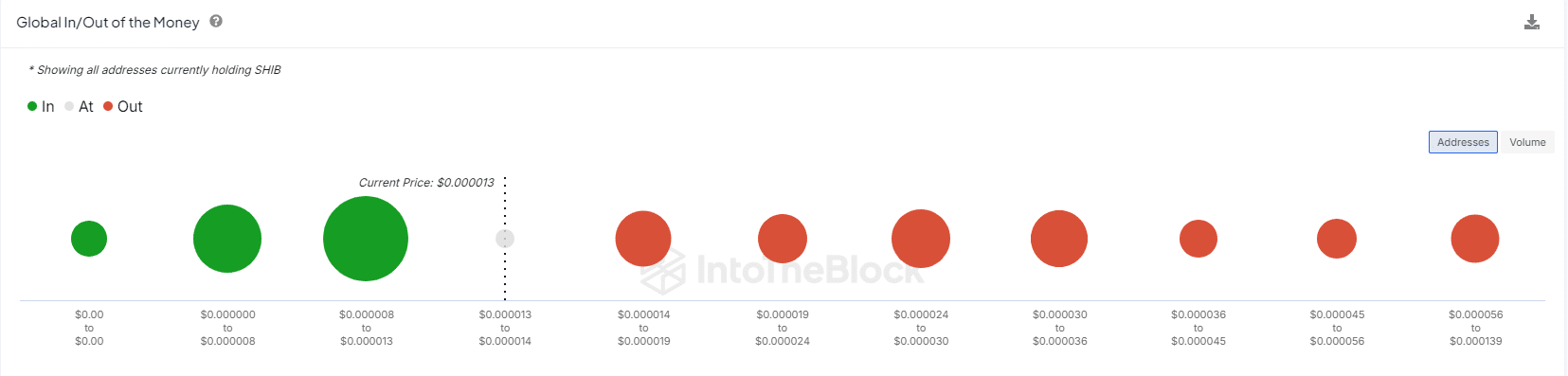

- The memecoin was at a crucial support level at $0.0000130 at the time of writing.

Shiba Inu [SHIB] is in a downtrend, with a notable pivot at $0.000020 in mid-July, while at the time of writing the price was trading at $0.0001329.

The current daily chart resembles pre-March action, which previously pushed SHIB towards resistance at $0.0000380.

With the recent one facts from Shibburn, which shows the burn of 7.8 million SHIBs, SHIB could rise to the $0.000020 range before testing the $0.00030 level.

If the aforementioned trend continues…

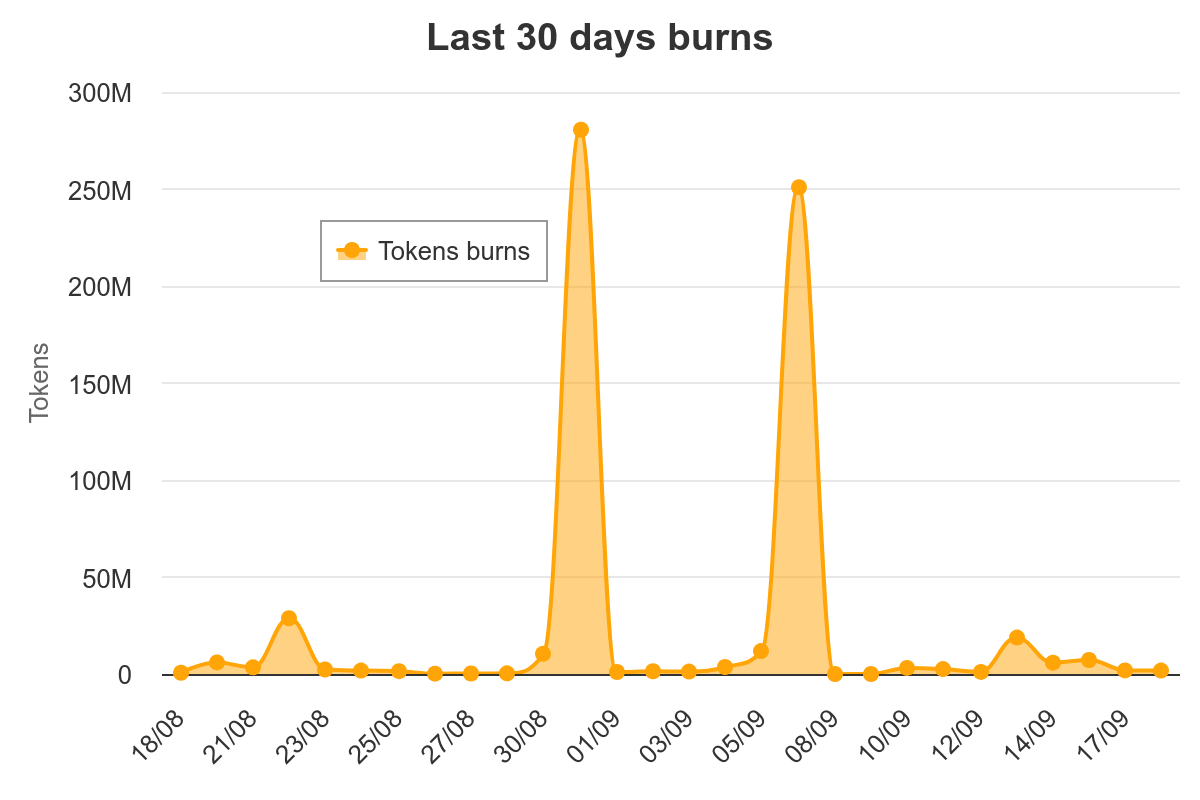

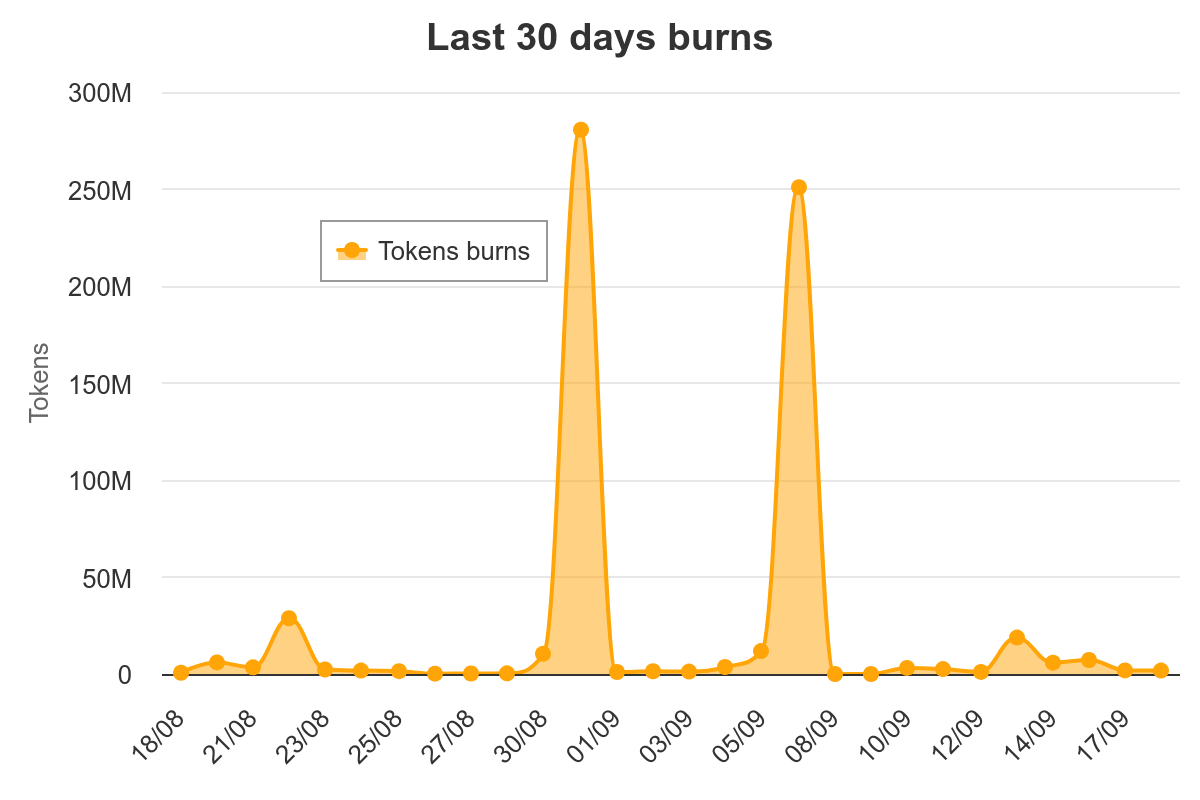

For context, SHIB burns are a strategy to manipulate value by making tokens scarce. Since launch, 41% of the total SHIB supply has been burned, out of the original 999 billion.

In a recent action, up to 280 million SHIB tokens were burned just before September, likely as a preventive measure ahead of expected volatility.

Source: Shiba BurnTracker

However, despite fire efforts, SHIB was unable to protect itself from Bitcoin [BTC] decline; September started off bearish.

This time, however, the timing is well in line with general market optimism. If the trend continues, it could propel the memecoin to its previous market highs. What are the chances?

A defining moment for SHIB

According to AMBCrypto, optimism could fade if the SHIB bulls fail to hold the $0.0000130 support.

A recent market rally led to a nearly 1% increase in SHIB’s value. Interestingly, developers took advantage of this by burning 7.8 million SHIB, increasing the burn rate by 3,348%.

However, this strategy may prove ineffective if the bears push SHIB below $0.0000130, leaving approximately 350,000 addresses in a losing position.

Source: IntoTheBlock

Conversely, if the strategy succeeds and SHIB approaches $0.000014, approximately 127,000 addresses would become profitable – favorable for bulls.

In short, SHIB is at a critical juncture. While the timing of the burnout was strategic, the outcome depends on how effectively the bulls leverage their positions.

Impact of SHIB Burning on HODLers

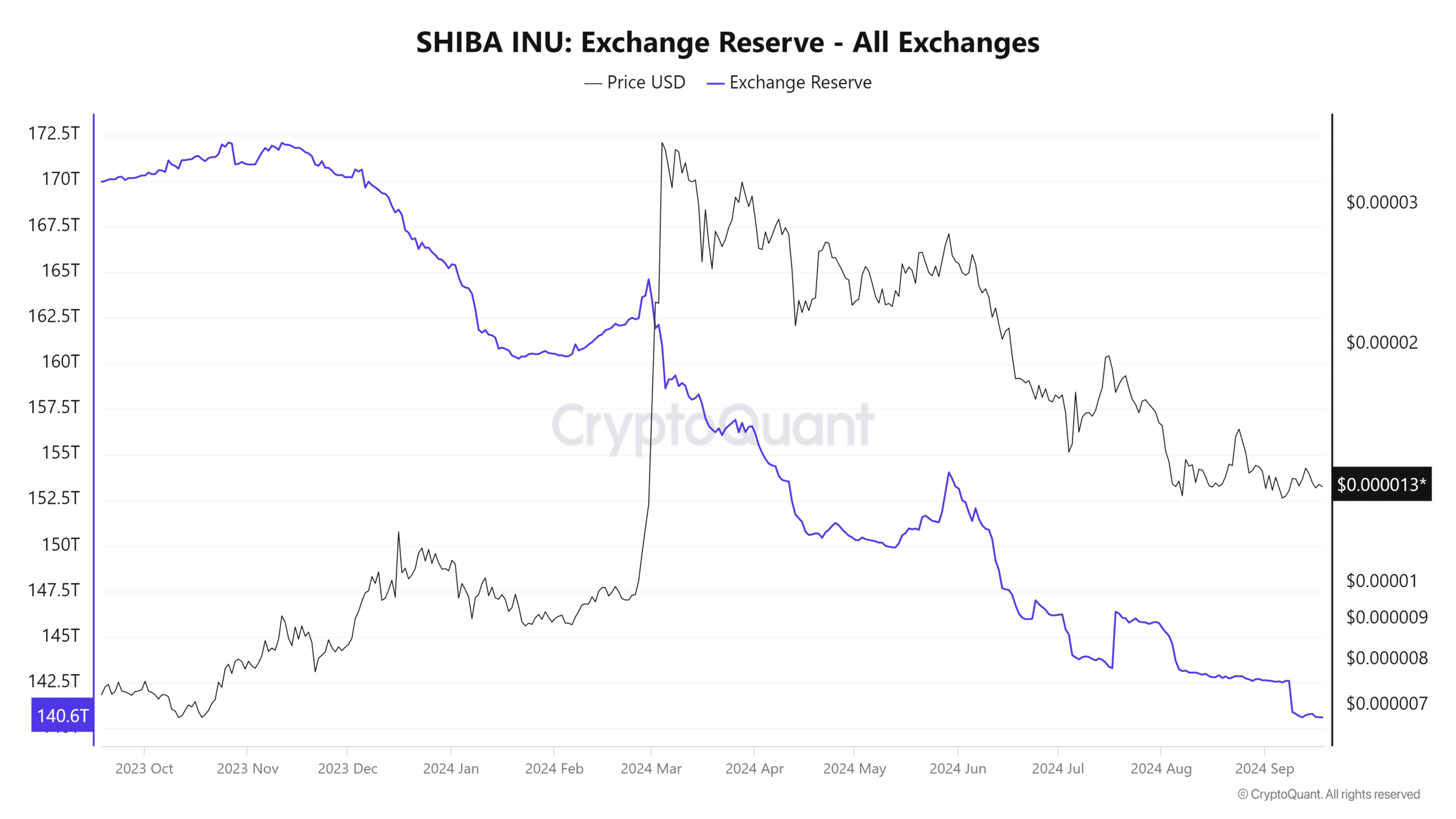

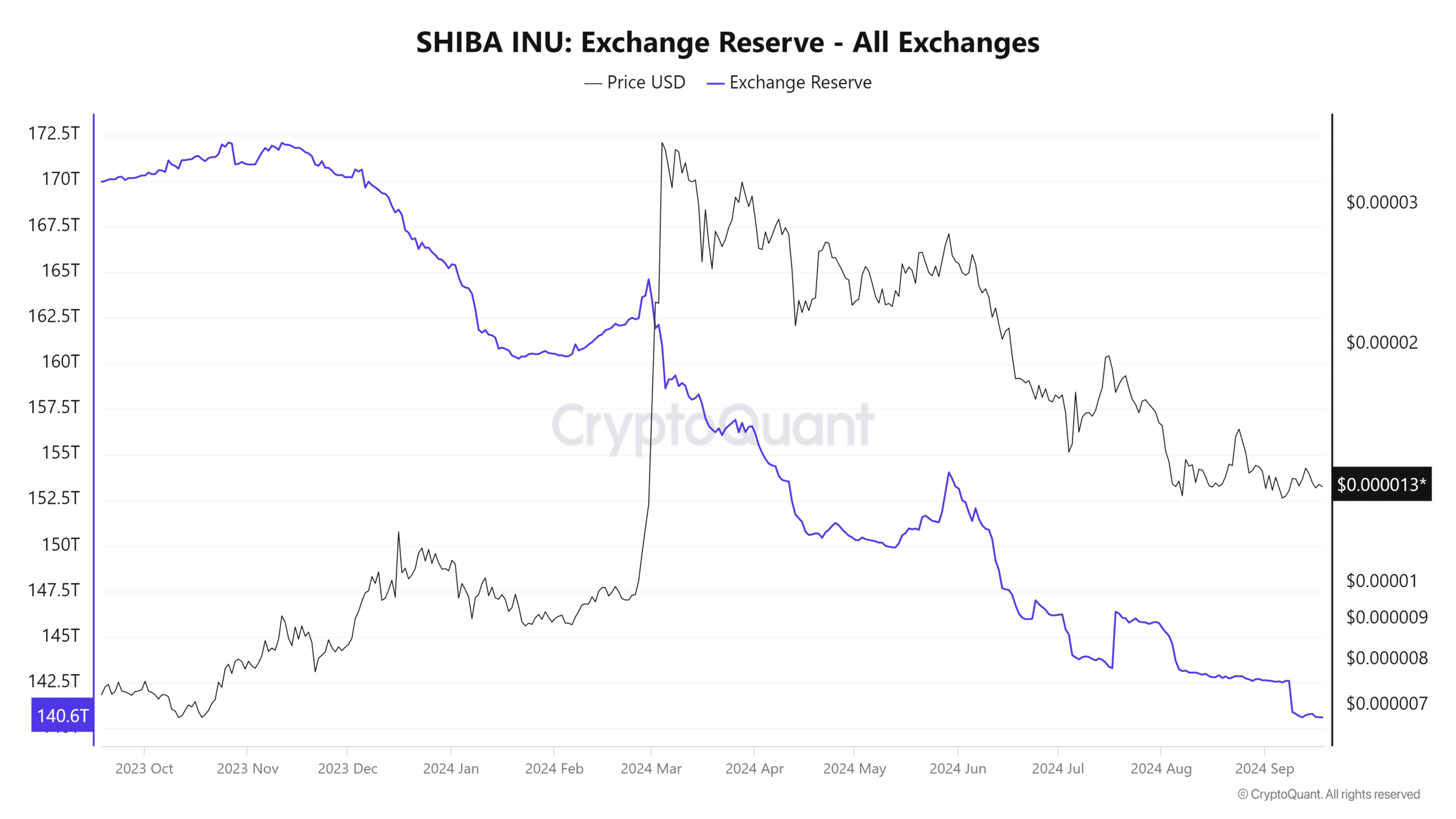

On the one-year lookback chart, SHIB’s foreign exchange reserves have plummeted significantly, indicating confidence in price recovery among HODLers.

Source: CryptoQuant

In fact, the total number of coins held on exchanges is at its lowest this year, marking a staggering 17.8% drop, from 171 tons to 140.6 tons at the time of writing.

Is your portfolio green? View the SHIB Profit Calculator

In summary, the strong support from stakeholders underlines confidence in SHIB’s long-term prospects. Bulls are positioning for a recovery, but this depends on holding crucial support levels against bearish pressure.

If bears intervene, reaching the resistance at $0.000020 could be challenging. While the burn strategy has captured the attention of stakeholders, maintaining the support of $0.0000130 is crucial for a potential market top.

Credit : ambcrypto.com

Leave a Reply