This article is available in Spanish.

Solana (SOL) has reached a new record: today it has more than 75 million monthly active addresses. The increase speaks to the growing popularity of the network, especially in areas such as developer and user activities within the decentralized applications (dApps), DeFi and NFT sectors.

Related reading

With such an increase in Solana’s business, the platform stretches even further from others as it remains one of the most scalable and efficient blockchains available.

Despite this positive momentum, recent market activity has seen significant volatility SOL. As of September 18, Solana experienced $121,000 in short liquidations and nearly $3.20 million in long liquidations, with Binance seeing the majority of long positions liquidated. This heavy liquidation of long positions indicates that traders could be cautious about Solana’s near-term price movements.

Source: Artemis

Price prediction shows potential

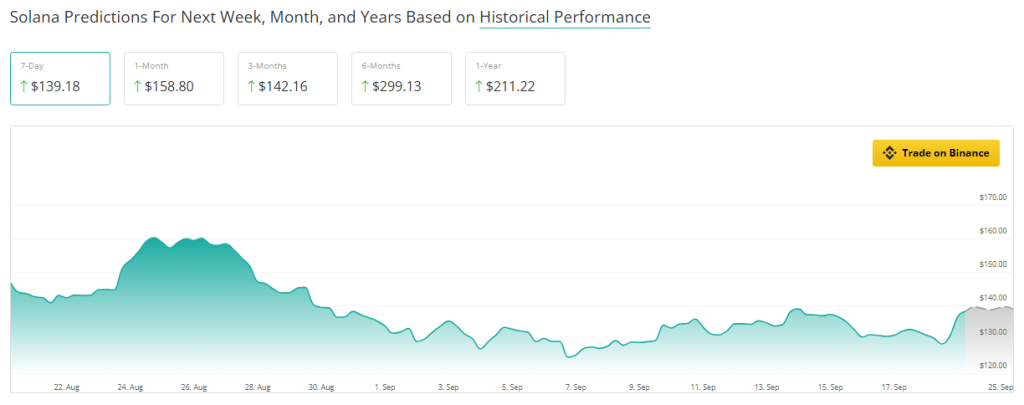

While short-term volatility is a concern, Solana’s price forecasts point to a brighter future. Currently, SOL is trading 14.59% below its estimate for next month, indicating near-term bearish pressure. However, the price is predicted to grow 2.59% over the next three months, even growing 2.59% stronger growth expected further down the road.

Within six months, Solana’s price could rise 115%, while a 52% increase is expected in the coming year. This indicates that while the short-term future is not that promising, Solana is a great investment prospect in the long term.

At the time of writing, SOL is trading at $141.21 up 10.1% and 4.1% in the daily and weekly time frames, Coingecko data shows.

Increase in user activity

One of the main factors why Solana has great potential is that it has an ever-growing user base. The active addresses on the network have increased exponentially from mid-2023, reaching 75.2 million in absolute terms to date.

This reflects that Solana scales well and can process large volumes of transactions while keeping costs low; more developers and users flocked to the platform and Solana’s ecosystem continues to grow.

This user growth is not just a short-term phenomenon. The launch of new features and updates in the coming months could further accelerate adoption, especially in the DeFi and NFT spaces where scalability is a key factor.

Related reading

A network for the future?

The growth in the number of active addresses and good price forecasts should put Solana on stable ground. While liquidations and sideways moves could cause some concern among investors in the short term, the long term looks promising.

For now, investors may need to be cautious about short-term volatility, but Solana’s long-term prospects remain solid. Those looking to invest in the future may find Solana’s current price a good entry point before the predicted growth becomes a reality.

Featured image of Protos, chart from TradingView

Credit : www.newsbtc.com

Leave a Reply