This article is available in Spanish.

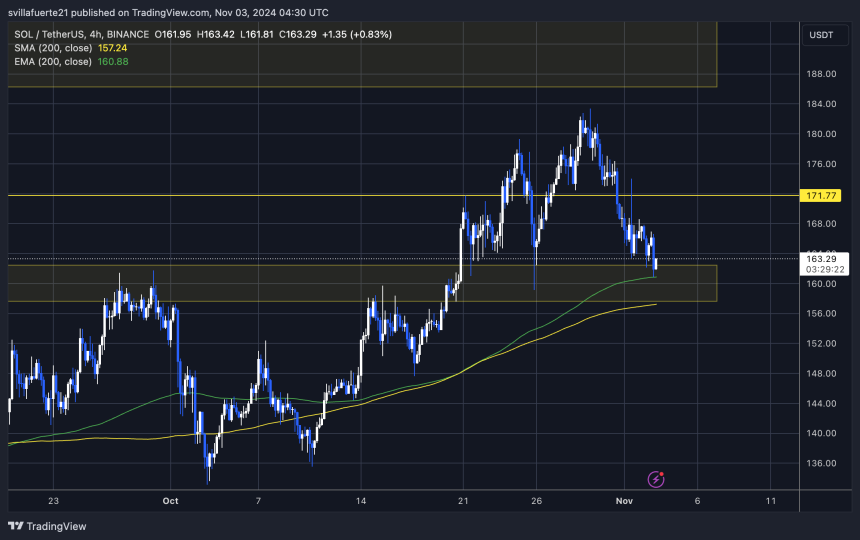

Solana (SOL) is currently trading at a crucial demand level around $163, after a return from local highs around $183. This price is a crucial support area that could determine the direction of SOL’s upcoming price action. Losing this level could signal a deeper correction, which would intensify selling pressure and potentially push SOL to retest the lower support levels.

However, top analyst Daan shared a technical analysis suggesting that if SOL can hold this “green zone” around $160, it could pave the way for a recovery. Daan notes that in the most optimistic scenario, SOL could hold this support and begin a gradual climb, with the ultimate goal of testing the downtrend line that has kept the price in check. This setup would keep SOL’s bullish structure intact, creating a potential entry point for investors looking for an upswing.

Related reading

With the broader crypto market showing volatility and Solana at this crucial level, the next few days will be crucial. Traders and investors are watching closely to see if this demand zone can support a reversal, potentially allowing the SOL to return to recent highs.

Solana remains strong despite uncertainty

Solana (SOL) has managed to stay above the key support level around $160 despite the recent market volatility and uncertainty. This level is crucial to SOL’s price structure as it is a strong demand zone that could serve as a basis for the next upward move.

Crypto analyst Daan recently shared his view on Xshowing that SOL’s “most bullish case” would be if it were to hold this “green zone” around $160, allowing it to gradually return to the descending trendline that has capped recent gains.

According to Daan, the next attempt at this trendline could likely result in a successful breakout, with the potential to push SOL’s price above $200. He suggests that waiting for confirmation of this breakout could be a good strategy for cautious investors, as there is still plenty of room for upside potential even after a confirmed reversal. His analysis highlights a confident view of SOL’s potential recovery, viewing this accumulation area as a promising buying opportunity.

However, Daan also acknowledges that there is still a certain downside risk. If SOL fails to hold above this $160 level, a deeper correction could follow, potentially pushing SOL to test lower support levels.

Related reading

For now, the market will keep a close eye on this support level as a critical indicator of SOL’s short-term trend. Staying above it would be a sign of strength and open the door for a potential rally, while a collapse could lead to an extended bearish phase. As overall market sentiment remains mixed, Solana’s next steps will be critical for traders and investors alike.

SOL price action

Solana is currently trading at $163 after noting the 4-hour 200 exponential moving average (EMA), a critical indicator of short-term strength. A position above this EMA indicates a bullish outlook for SOL, suggesting buyers are stepping in to support the price at this level. If SOL can maintain momentum above the 200 EMA, it could lay a foundation for a potential rally to new local highs, potentially challenging the recent peak around $183.

However, the USD 160 level remains a crucial support area. Losing this support would likely lead to significant selling pressure, potentially pushing the SOL down toward $150, where further demand could emerge. This zone would be closely watched by investors looking for potential accumulation opportunities, as a dip could provide favorable entry points for long-term holders.

Related reading

In contrast, a strong rise above current demand levels would confirm renewed bullish momentum, paving the way for SOL to target and potentially surpass recent highs. As SOL hovers around this key technical zone, traders will be on the lookout for any decisive move that could signal the next direction, whether it be a continued uptrend or a return to lower demand levels.

Featured image of Dall-E, chart from TradingView

Credit : www.newsbtc.com

Leave a Reply