- SOL’s extensive price consolidation could spark a massive rally.

- Several institutions plan to set up shop on the network.

Solana [SOL] emerged as one of the biggest outliers during this market cycle. It jumped from a low of $8 after the implosion of the FTX to a high of $210 in March 2024. That’s a gain of more than 2000%.

However, market headwinds in Q2/Q3 saw the altcoin consolidate above $120.

According to renowned technical chart analyst Peter Brandt, SOL’s six-month price consolidation was excellent preparation for upward progress. He noted,

“It looks like $SOL $SOLUSD held support at $120. This could be a rectangle that can make significant progress.”

Source:

If so, breaking out a rectangular channel tends to print gains comparable to the height of the channel. Theoretically, that would mean an increase to $280.

Will BreakPoint support the SOL price?

As expected, the Solana BreakPoint event saw major announcements and interest institutions in the alternative layer 1 blockchain.

From asset managers like Franklin Templeton to tokenization service providers like Securitize, they all have plans to target the Solana network.

Additionally, Citi, a leading bank, is reportedly exploring its tokenization and digital payment capabilities through Solana.

Additionally, Solana’s infrastructure is ready for a major overhaul as Firedancer, the second validator client, has reached testnet and could soon reach Mainnet.

Firedancer will offer Solana 1 million transactions per second, up from the current 3,000 transactions per second.

Apart from improved processing, this would make the network more decentralized by reducing the number of single point-of-failures based on a single validator client.

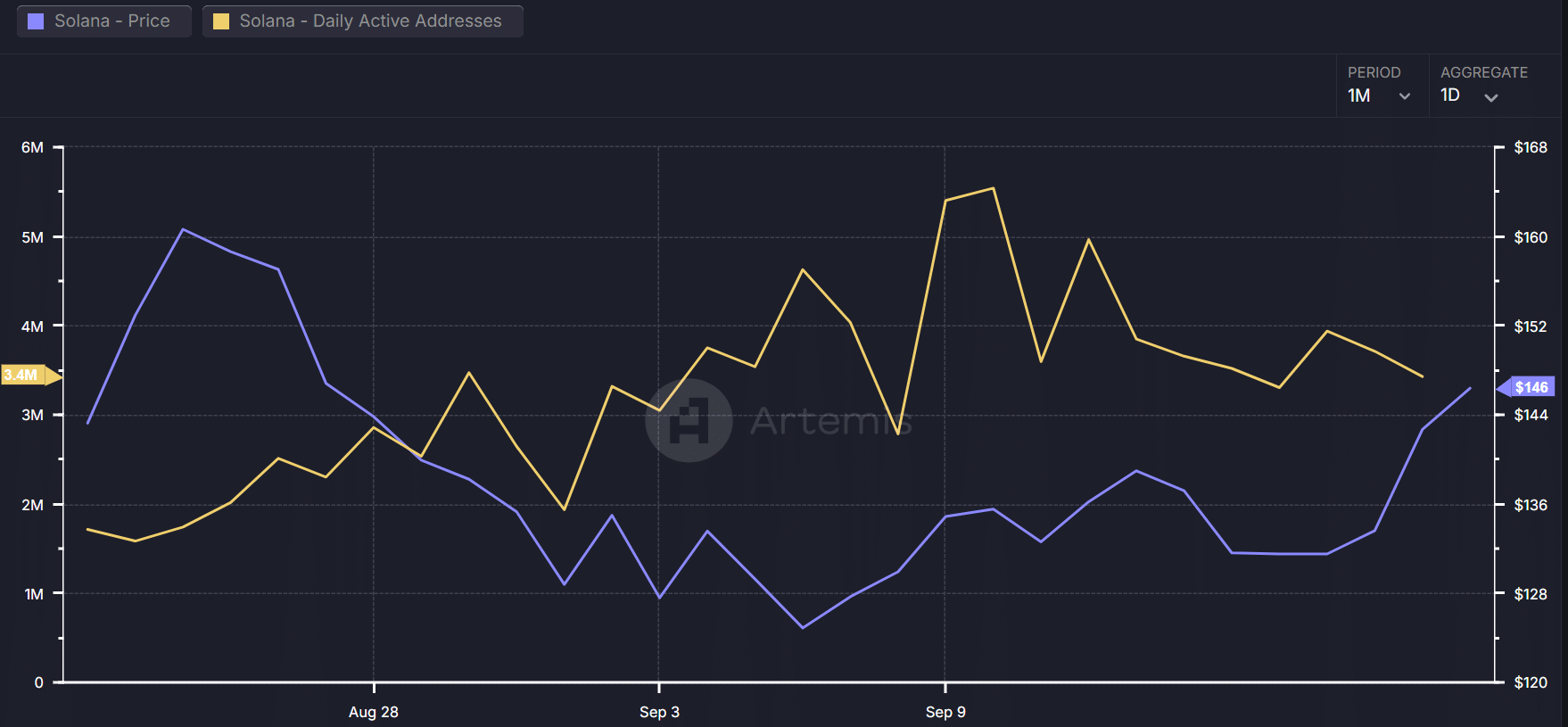

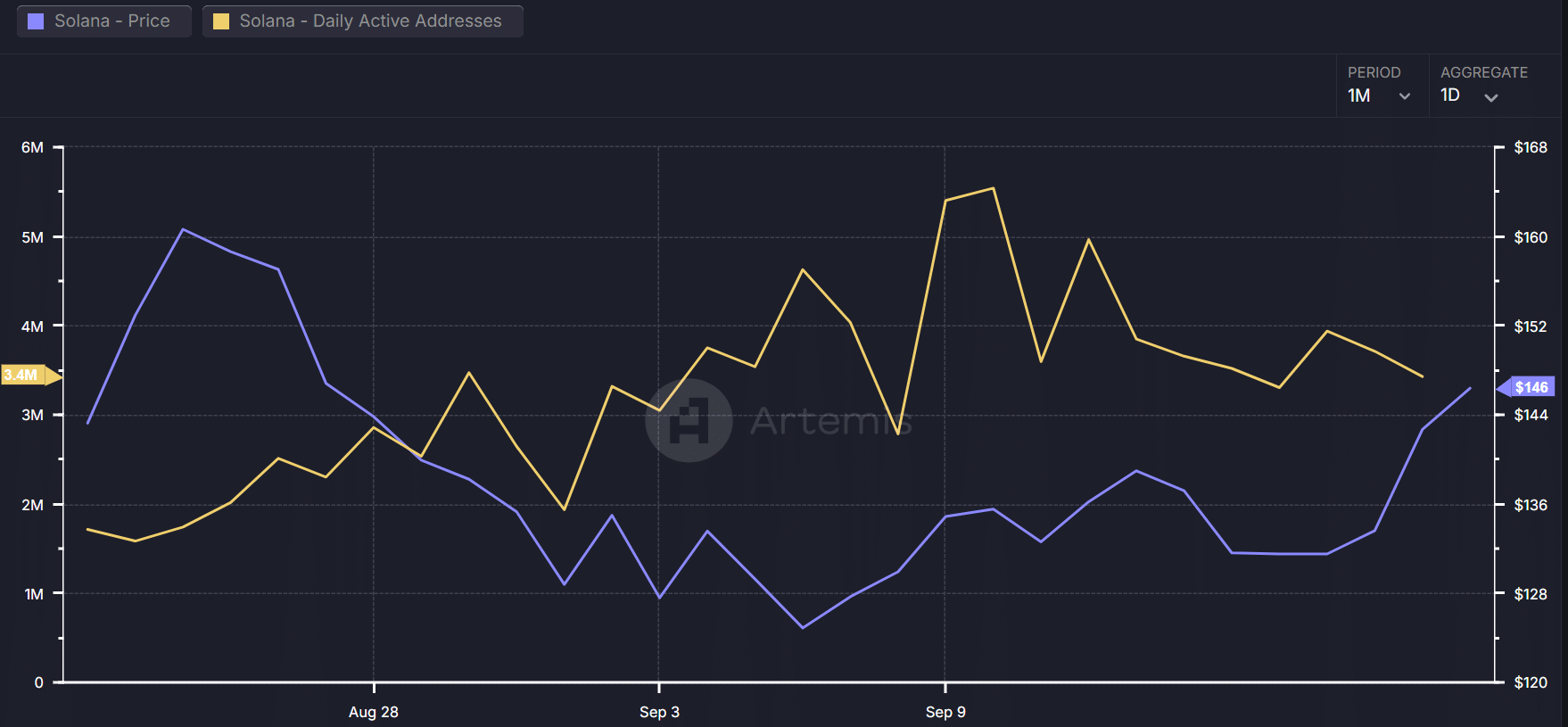

However, network growth stalled after a notable expansion in late August, as evidenced by daily active addresses.

The indicator rose from less than 2 million in August to more than 5 million on September 10, but then collapsed.

Source: Artemis

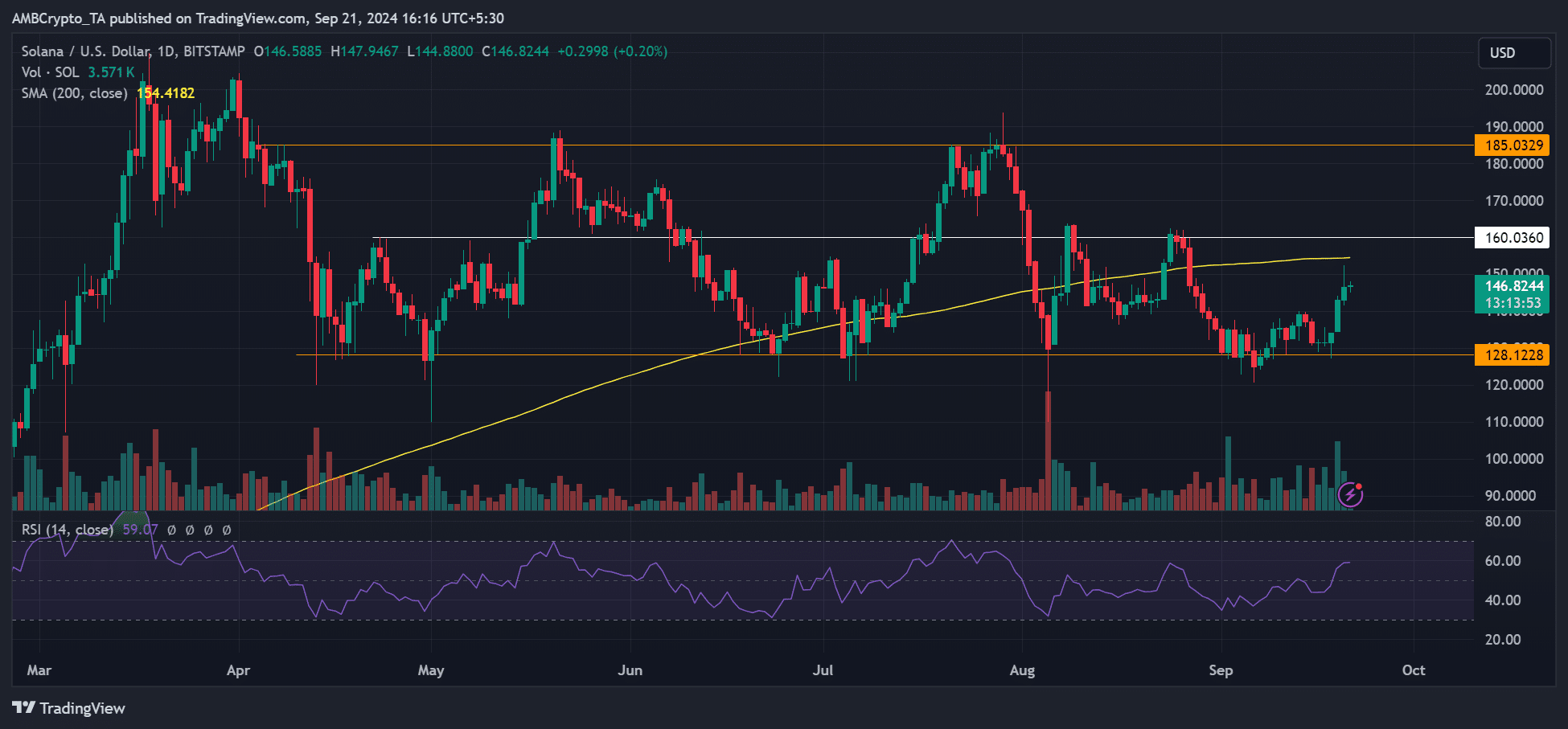

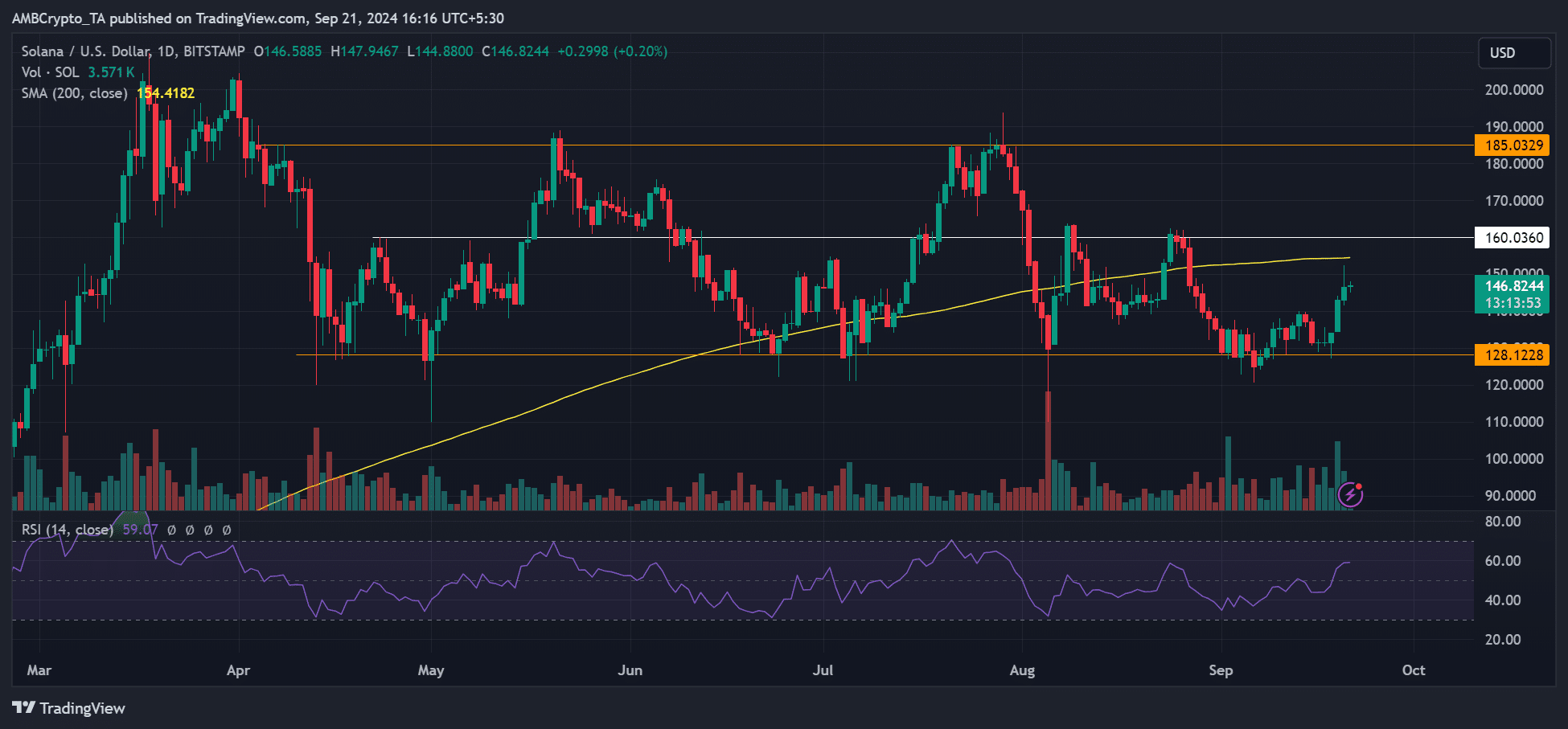

This could delay a strong move above $150 in the short term. The altcoin rose about 14% from the $128 support but remained stuck around the 200-day Moving Average (MA) above $154.

Should it regain the 200-day MA, $160 and $180 could be the next near-term bullish targets.

Source: SOLUSD, TradingView

Credit : ambcrypto.com

Leave a Reply